Market Overview

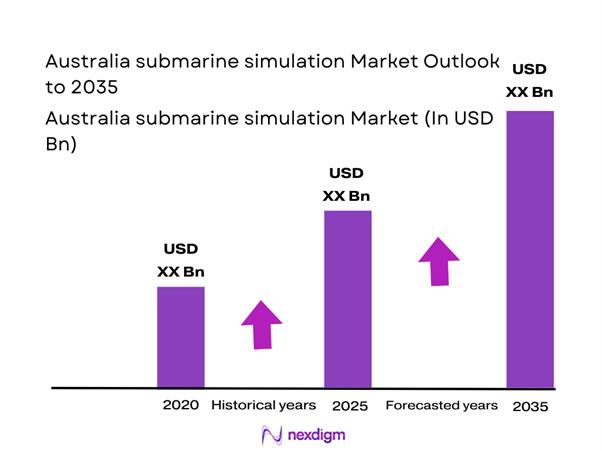

The Australia submarine simulation market current size stands at around USD ~ million, reflecting steady procurement and training investments during recent defense modernization cycles. Demand is supported by fleet sustainment programs, increasing training complexity, and integration of digital simulation platforms across naval forces. Adoption accelerated during 2024 and 2025 as simulation replaced live exercises for cost efficiency and safety optimization. The market reflects growing emphasis on crew readiness, system interoperability, and scenario-based mission preparation within controlled environments.

Activity is concentrated around major naval bases in Western Australia and South Australia, supported by defense industry clusters and shipbuilding infrastructure. Strong institutional demand, long-term defense planning, and localized industrial participation drive sustained deployment. The ecosystem benefits from government-backed programs, long procurement cycles, and deep collaboration between defense agencies and technology providers. Regulatory alignment, secure data handling, and sovereign capability development further shape regional market structure and adoption patterns.

Market Segmentation

By Application

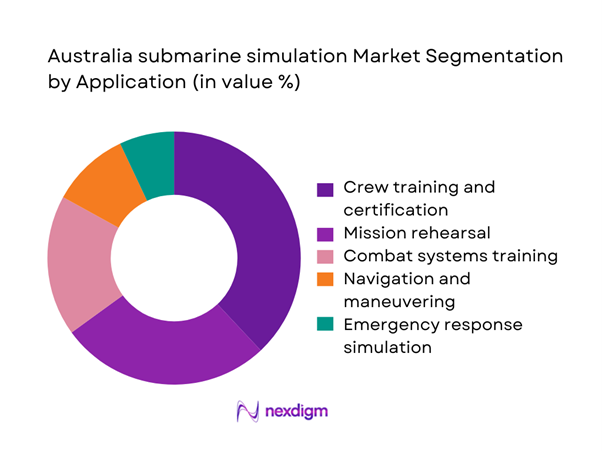

Training and mission rehearsal dominate usage due to increasing operational complexity and multi-domain coordination requirements. Simulation systems are primarily deployed for crew certification, combat readiness, and tactical planning, reducing reliance on costly live exercises. Maintenance and emergency response simulation is gaining relevance as fleets modernize and operational safety standards tighten. Adoption is further supported by integration with digital twins and real-time scenario modeling. The segment benefits from continuous upgrade cycles driven by evolving threat environments and procedural standardization across naval operations.

By Technology Architecture

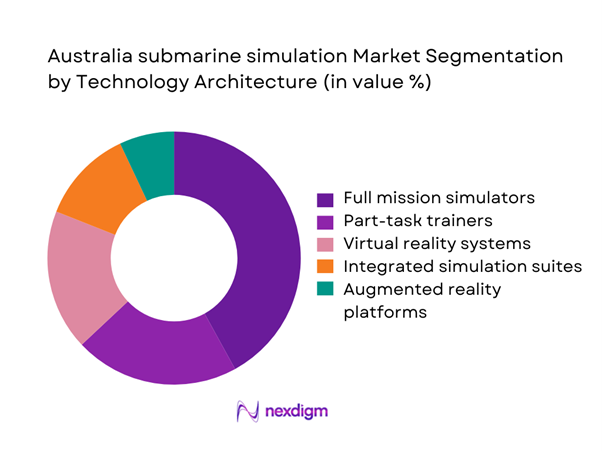

Full mission simulators dominate deployments due to their ability to replicate operational environments with high fidelity. Virtual and augmented reality systems are increasingly adopted to enhance immersion and reduce physical infrastructure dependency. Integrated simulation suites are favored for joint-force exercises and interoperability testing. Modular architectures enable scalability and cost efficiency, supporting phased upgrades. Demand growth is influenced by advances in computing, sensor emulation, and networked simulation environments supporting collaborative training.

Competitive Landscape

The competitive landscape is characterized by a limited number of specialized defense technology providers with deep naval simulation expertise. Market participants compete on system fidelity, integration capability, long-term support, and alignment with defense procurement frameworks. Strategic partnerships with government agencies and shipbuilders influence contract awards. Barriers to entry remain high due to security clearances, certification requirements, and long development cycles.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Saab Australia | 1987 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1997 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1950 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia submarine simulation Market Analysis

Growth Drivers

Modernization of Australian submarine fleet

Fleet modernization programs are driving increased demand for advanced simulation platforms supporting complex operational readiness requirements. New submarine classes require extensive crew training before deployment, increasing simulator utilization rates across training facilities. Modern vessels incorporate advanced sensors and combat systems requiring realistic digital replication environments. Simulation allows safe rehearsal of mission-critical scenarios without operational risk. Training cycles have expanded as crews transition between legacy and next-generation platforms. Defense agencies increasingly mandate simulation hours for certification compliance. Integration with digital twins improves learning efficiency and operational accuracy. Modernization programs encourage long-term investment in scalable simulation infrastructure. Training throughput requirements continue rising with fleet expansion. These factors collectively sustain consistent demand growth across the simulation ecosystem.

Increasing complexity of undersea warfare

Undersea warfare complexity has increased due to advanced detection systems and multi-domain operational requirements. Simulation enables realistic exposure to acoustic, electronic, and tactical challenges in controlled environments. Crews require frequent scenario-based training to maintain readiness against evolving threats. Multi-platform coordination demands interoperable simulation environments for joint operations. Digital environments allow testing of tactics without compromising classified data. Simulation supports rapid adaptation to new warfare doctrines. Increasing mission complexity raises reliance on high-fidelity modeling systems. Training programs now emphasize decision-making under pressure. These factors collectively reinforce simulation adoption across naval training structures. Operational realism remains a core driver of continued simulator investment.

Challenges

High capital investment requirements

Simulation systems require substantial upfront capital for hardware, software, and infrastructure integration. Procurement cycles involve extensive testing, certification, and customization processes. Budget allocation competition with other defense programs can delay implementation timelines. Long system lifecycles reduce flexibility for rapid technology upgrades. Specialized facilities increase installation and maintenance costs. Limited vendor competition restricts pricing flexibility. Training personnel for system operation adds further expenditure. Financial constraints impact adoption among smaller defense units. Lifecycle cost management remains a persistent challenge. These factors collectively constrain rapid market expansion.

Integration complexity with legacy systems

Legacy naval platforms often lack compatibility with modern simulation architectures. Data standardization challenges hinder seamless integration across training environments. Retrofitting older systems increases technical complexity and implementation timelines. Interoperability testing requires extensive validation procedures. Software updates must align with classified system protocols. Integration delays can disrupt training schedules and readiness goals. Technical customization increases dependency on specialized vendors. Limited interoperability reduces scalability of simulation networks. These issues elevate operational risk and deployment timelines. Integration complexity remains a significant adoption barrier.

Opportunities

AUKUS-driven training infrastructure expansion

AUKUS collaboration is accelerating demand for interoperable training and simulation systems. Shared operational frameworks require standardized simulation environments across allied forces. Joint training initiatives expand requirements for advanced modeling capabilities. Investment in nuclear submarine programs increases long-term training needs. Simulation supports safe familiarization with complex propulsion and combat systems. Collaborative development encourages technology transfer and capability enhancement. Regional training hubs are likely to emerge under alliance frameworks. Increased funding allocation supports advanced simulator deployment. Long-term defense cooperation sustains demand growth. This environment creates significant expansion opportunities.

Adoption of AI-enabled simulation

Artificial intelligence enhances realism through adaptive scenario generation and behavior modeling. AI-driven analytics improve trainee performance assessment and feedback mechanisms. Automation reduces instructor workload and training cycle duration. Predictive modeling supports mission rehearsal accuracy. AI integration enables continuous system learning and improvement. Enhanced data analytics improve operational readiness outcomes. AI-supported simulations reduce human error during training. Advanced algorithms enable complex threat replication. These capabilities increase simulator value proposition. AI adoption is expected to accelerate across training programs.

Future Outlook

The market is expected to expand steadily through the forecast period, supported by long-term defense modernization initiatives and allied cooperation frameworks. Increasing reliance on digital training environments will continue to reshape operational preparedness strategies. Technological advancements in simulation fidelity, artificial intelligence, and system interoperability will further enhance adoption. Policy stability and sustained defense investment are expected to maintain favorable market conditions.

Major Players

- Saab Australia

- CAE

- Thales Australia

- Lockheed Martin Australia

- BAE Systems Australia

- Kongsberg Defence

- L3Harris Technologies

- Raytheon Australia

- Naval Group Australia

- Rheinmetall Defence Australia

- Ultra Maritime

- Cubic Defense

- Elbit Systems Australia

- Atlas Elektronik

- ASC Pty Ltd

Key Target Audience

- Royal Australian Navy procurement divisions

- Australian Department of Defence

- Defence acquisition and sustainment agencies

- Naval shipbuilding and integration firms

- Simulation and training system integrators

- Defense technology investors

- Venture capital firms focused on defense innovation

- Government regulatory and compliance authorities

Research Methodology

Step 1: Identification of Key Variables

Market boundaries were defined through analysis of naval training systems, simulation technologies, and defense procurement structures. Key demand drivers, technology categories, and application areas were identified. Data points were aligned with defense modernization priorities. Scope refinement ensured relevance to submarine-focused simulation solutions.

Step 2: Market Analysis and Construction

Qualitative and quantitative inputs were synthesized to assess adoption trends and usage patterns. Market behavior was evaluated across training, operations, and maintenance domains. Segmentation was developed based on application and technology deployment. Regional dynamics were mapped using infrastructure and policy indicators.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through engagement with defense professionals and simulation specialists. Feedback was incorporated to refine growth drivers and constraint assessments. Cross-verification ensured consistency across operational and procurement perspectives. Iterative validation improved analytical accuracy.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a structured framework emphasizing clarity and relevance. Data consistency checks ensured logical alignment across sections. Insights were contextualized within defense modernization trends. Final outputs were reviewed to maintain analytical rigor and coherence.

- Executive Summary

- Research Methodology (Market Definitions and naval training scope mapping, Submarine simulation taxonomy and platform classification, Bottom-up market sizing using defense contract and program data, Revenue attribution across hardware software and services, Primary interviews with naval trainers and defense integrators, Validation through defense budget analysis and fleet modernization roadmaps, Data triangulation using procurement records and OEM disclosures)

- Definition and Scope

- Market evolution

- Usage and training integration pathways

- Ecosystem structure

- Supply chain and system integration landscape

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Australian submarine fleet

Increasing complexity of undersea warfare

Rising emphasis on synthetic training environments

Expansion of AUKUS-driven capability development

Cost efficiency compared to live-sea training

Growing focus on crew readiness and safety - Challenges

High capital investment requirements

Long procurement and approval cycles

Integration complexity with legacy systems

Cybersecurity and data protection concerns

Limited domestic supplier base

High customization and maintenance costs - Opportunities

AUKUS-driven training infrastructure expansion

Adoption of AI-enabled simulation

Export opportunities for simulation software

Public-private collaboration in defense training

Lifecycle service and upgrade contracts

Interoperability with allied naval forces - Trends

Shift toward immersive virtual training

Increased use of digital twins

Integration of AI-based scenario generation

Networked joint-force training environments

Greater focus on cyber and electronic warfare simulation

Modular and scalable simulator architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Conventional submarines

Nuclear-powered submarines

Training and research submarines - By Application (in Value %)

Crew training and certification

Mission rehearsal and tactics development

Combat systems training

Navigation and maneuvering simulation

Maintenance and emergency response training - By Technology Architecture (in Value %)

Full mission simulators

Part-task trainers

Virtual reality based simulators

Augmented and mixed reality systems

Integrated simulation suites - By End-Use Industry (in Value %)

Royal Australian Navy

Defense training academies

Shipbuilders and integrators

Defense research institutions - By Connectivity Type (in Value %)

Standalone simulators

Networked multi-simulator systems

Cloud-enabled simulation platforms - By Region (in Value %)

New South Wales

Western Australia

South Australia

Victoria

Rest of Australia

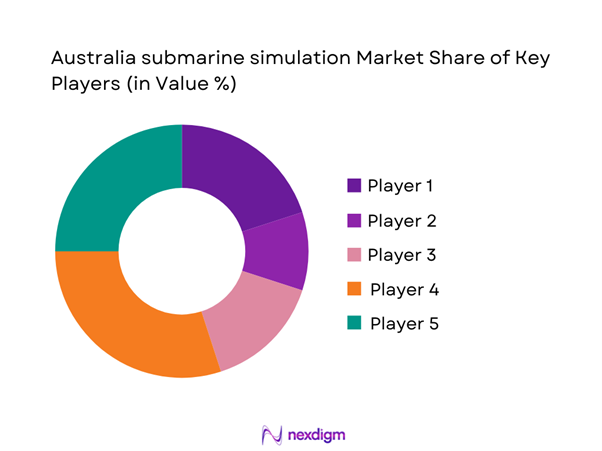

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (simulation fidelity, technology integration, contract value, delivery capability, lifecycle support, cybersecurity compliance, interoperability, pricing structure)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Saab Australia

CAE

Thales Australia

Lockheed Martin Australia

BAE Systems Australia

Kongsberg Defence Australia

L3Harris Technologies

Raytheon Australia

Naval Group Australia

Rheinmetall Defence Australia

Ultra Maritime

Cubic Defense

Elbit Systems Australia

Atlas Elektronik

ASC Pty Ltd

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035