Market Overview

The Australia Tactical Communication market current size stands at around USD ~ million, reflecting steady defense modernization and secure communication investments. Demand during recent years has been supported by increased procurement of interoperable systems, networked battlefield solutions, and encrypted communication platforms across defense units. Adoption levels have risen due to modernization of legacy systems and alignment with allied operational standards. Ongoing upgrades in command-and-control infrastructure and tactical data networks continue to drive consistent procurement activity. System upgrades, replacement cycles, and capability enhancement programs remain key demand enablers. Technology refresh cycles are influencing procurement frequency and system architecture choices.

Australia’s tactical communication deployment is concentrated around major defense bases, joint command centers, and operational hubs supporting land, naval, and air forces. Eastern and northern regions exhibit higher activity due to strategic positioning and training infrastructure. Strong domestic defense manufacturing participation supports system integration and lifecycle servicing. Government-backed defense initiatives reinforce adoption across services. Policy alignment with allied forces strengthens interoperability requirements. The ecosystem benefits from established defense procurement processes and long-term capability development planning.

Market Segmentation

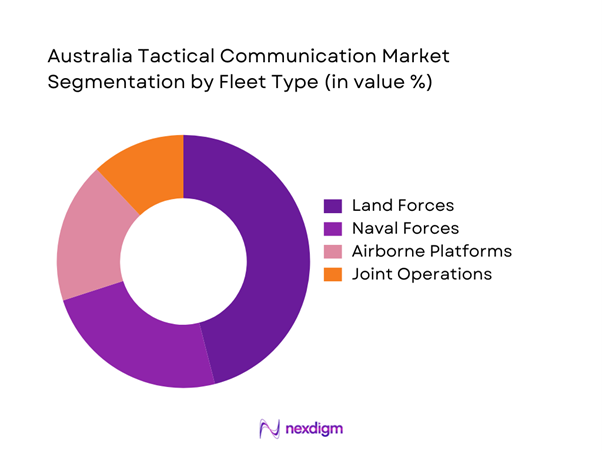

By Fleet Type

Land-based platforms dominate deployment due to extensive use in mobility, command, and battlefield coordination operations. Ground forces require continuous communication coverage across diverse terrains, driving sustained adoption of portable and vehicle-mounted systems. Naval fleets contribute steadily through shipborne communication upgrades, while airborne platforms focus on secure airborne networking. Joint operations further strengthen demand for interoperable multi-domain systems. Increasing emphasis on integrated battlefield awareness supports balanced adoption across all fleet types.

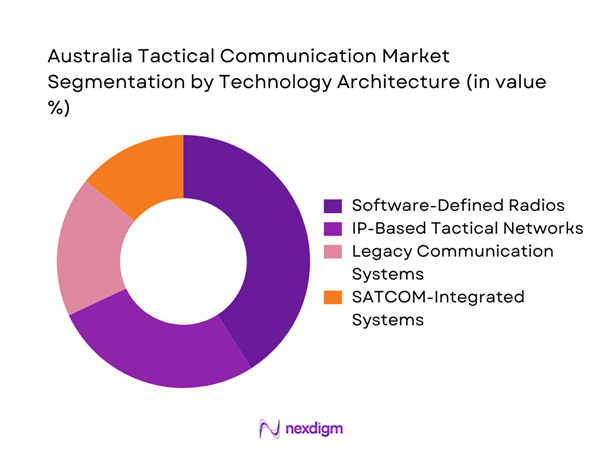

By Technology Architecture

Software-defined radio systems lead adoption due to flexibility, upgradeability, and interoperability advantages. IP-based tactical networks are gaining traction for enhanced data transmission and situational awareness. Legacy systems continue limited use in secondary operations, while satellite-integrated systems expand coverage in remote environments. Emphasis on network resilience and electronic warfare resistance is shaping architecture selection. Modular communication frameworks are increasingly favored for scalability.

Competitive Landscape

The competitive environment is characterized by long-term defense contracts, high entry barriers, and stringent certification requirements. Market participants compete on system reliability, interoperability, lifecycle support, and compliance with defense standards. Local integration capability and sustained support services significantly influence vendor selection.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Tactical Communication Market Analysis

Growth Drivers

Rising defense modernization and digitization programs

Defense modernization initiatives continue expanding network-centric warfare capabilities across operational domains. Communication systems upgrades support improved command coordination and battlefield visibility. Integration of digital technologies enhances real-time information exchange between units. Increased focus on interoperability strengthens tactical communication investments. Secure data transmission remains critical for mission success. Defense planners prioritize scalable communication infrastructure. Procurement cycles increasingly favor modular solutions. Tactical communication upgrades align with long-term defense capability roadmaps. Training and simulation requirements further reinforce system adoption. Continuous modernization sustains stable demand momentum.

Expansion of network-centric warfare capabilities

Network-centric doctrines emphasize rapid information sharing across defense units. Tactical communication systems enable real-time situational awareness during operations. Interconnected platforms improve decision-making accuracy and responsiveness. Digital battlefield concepts rely heavily on resilient communication links. Multi-domain operations increase communication complexity. Secure connectivity becomes a strategic enabler. Enhanced bandwidth supports advanced surveillance systems. Interoperability with allied forces drives system upgrades. Network resilience remains a core operational priority. These factors collectively drive sustained market expansion.

Challenges

High procurement and lifecycle costs

Tactical communication systems require substantial upfront investment and long-term maintenance. Budget allocation constraints affect procurement timelines. Complex system integration increases deployment expenses. Upgrades require specialized technical expertise. Lifecycle support adds ongoing financial pressure. Cost-intensive testing and certification delay adoption. Budget prioritization impacts replacement cycles. High customization needs elevate program complexity. Maintenance infrastructure demands continuous funding. Financial constraints remain a key limiting factor.

Interoperability issues across legacy systems

Legacy communication platforms often lack compatibility with modern digital networks. Integration challenges delay operational readiness. System fragmentation increases maintenance complexity. Interoperability gaps reduce mission efficiency. Upgrading older platforms requires extensive reconfiguration. Software compatibility issues persist across generations. Training requirements increase due to system diversity. Data exchange limitations hinder real-time coordination. Standardization remains difficult across services. These issues slow modernization efforts.

Opportunities

Modernization of legacy radio systems

Aging communication infrastructure creates strong replacement demand. Modern radios offer enhanced encryption and flexibility. Upgrading legacy systems improves interoperability across units. Modular designs allow phased upgrades. Improved spectrum efficiency enhances performance. Digital transformation initiatives support replacement cycles. Defense modernization budgets prioritize communication upgrades. Lifecycle cost optimization encourages system refresh. Advanced radios improve operational resilience. Modernization programs provide long-term growth opportunities.

Integration of AI-enabled communication management

Artificial intelligence enhances network optimization and threat detection. AI-driven routing improves communication reliability. Automated spectrum management reduces interference risks. Predictive analytics support maintenance planning. Intelligent systems improve operational efficiency. AI integration enhances situational awareness. Adaptive networks respond dynamically to battlefield conditions. Decision support systems benefit from real-time data. AI adoption strengthens communication resilience. This creates significant technological advancement potential.

Future Outlook

The Australia tactical communication market is expected to advance steadily through 2035, driven by modernization priorities and evolving defense doctrines. Continued investment in secure, interoperable systems will remain central to capability development. Integration of digital and AI-enabled technologies will shape next-generation deployments. Policy alignment with allied forces will further influence system specifications and procurement strategies.

Major Players

- L3Harris Technologies

- Thales Group

- BAE Systems

- Leonardo

- Saab

- Collins Aerospace

- Northrop Grumman

- General Dynamics

- Airbus Defence and Space

- Elbit Systems

- Rohde & Schwarz

- Boeing Defence Australia

- Codan

- CEA Technologies

- Silvus Technologies

Key Target Audience

- Australian Department of Defence

- Royal Australian Army procurement divisions

- Royal Australian Navy communication units

- Royal Australian Air Force systems divisions

- Defense system integrators

- Tactical communication equipment manufacturers

- Defense technology investors and venture capital firms

- Government defense acquisition agencies

Research Methodology

Step 1: Identification of Key Variables

Market scope, technology categories, and application areas were defined through structured defense capability mapping. Key performance indicators were identified based on operational relevance. System classifications were aligned with defense procurement frameworks.

Step 2: Market Analysis and Construction

Demand patterns were evaluated using defense spending trends and program-level analysis. Segmentation was developed based on platform, application, and technology architecture. Data consistency was maintained across analytical layers.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultation with defense communication specialists and industry professionals. Assumptions were refined using operational feedback and system deployment patterns. Cross-validation ensured analytical robustness.

Step 4: Research Synthesis and Final Output

Findings were consolidated into structured insights. Market dynamics were aligned with strategic defense objectives. Outputs were reviewed for consistency, relevance, and analytical accuracy.

- Executive Summary

- Research Methodology (Market Definitions and operational scope for tactical communications in Australia, Platform and application-level segmentation framework, Bottom-up and top-down market sizing using defense procurement data, Revenue attribution across programs and lifecycle phases, Primary validation through defense contractors and military communication experts, Data triangulation using budget documents and program disclosures, Assumptions and limitations linked to classified procurement cycles)

- Definition and scope

- Market evolution

- Operational and mission usage landscape

- Ecosystem and value chain structure

- Supply chain and system integration framework

- Regulatory and defense procurement environment

- Growth Drivers

Rising defense modernization and digitization programs

Expansion of network-centric warfare capabilities

Increased investment in secure battlefield communications

Growing joint and coalition operations

Rising demand for interoperable communication systems - Challenges

High procurement and lifecycle costs

Interoperability issues across legacy systems

Cybersecurity and electronic warfare threats

Lengthy defense procurement cycles

Dependence on foreign technology providers - Opportunities

Modernization of legacy radio systems

Integration of AI-enabled communication management

Growth in software-defined and IP-based radios

Expansion of SATCOM-based tactical networks

Increased defense spending under long-term capability plans - Trends

Shift toward software-defined and cognitive radios

Integration of tactical communications with C4ISR

Adoption of secure IP-based architectures

Growing focus on electronic warfare resilience

Increased use of multi-domain communication platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces

Naval forces

Airborne platforms

Joint and coalition operations - By Application (in Value %)

Command and control communications

ISR and situational awareness

Soldier and squad communications

Platform-to-platform communications

Emergency and disaster response - By Technology Architecture (in Value %)

Software-defined radio systems

Legacy analog communication systems

IP-based tactical networks

SATCOM-integrated communication systems - By End-Use Industry (in Value %)

Australian Army

Royal Australian Navy

Royal Australian Air Force

Joint operations and special forces

Homeland security and border protection - By Connectivity Type (in Value %)

VHF/UHF communications

HF communications

SATCOM

Tactical LTE and 5G

Mobile ad-hoc and mesh networks

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (product portfolio, technology maturity, platform compatibility, defense certifications, local manufacturing presence, contract footprint, pricing strategy, lifecycle support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

L3Harris Technologies

Thales Group

BAE Systems

Elbit Systems

Rohde & Schwarz

Leonardo

Saab

Collins Aerospace

Boeing Defence Australia

Northrop Grumman

General Dynamics Mission Systems

Codan

CEA Technologies

Silvus Technologies

Airbus Defence and Space

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035