Market Overview

The Australia Tactical Optics market current size stands at around USD ~ million, reflecting steady procurement activity across defense modernization and border security programs. Recent demand has been driven by infantry modernization, surveillance upgrades, and increasing operational readiness requirements across armed forces units. Deployment volumes increased steadily through 2024 and 2025 due to sustained procurement cycles. Technology refresh programs accelerated adoption of thermal and night vision optics. Operational emphasis on situational awareness continues influencing equipment upgrades. Demand patterns remain strongly linked to long-term defense capability planning.

Australia’s tactical optics demand is concentrated around defense hubs in New South Wales, Victoria, and Western Australia. These regions benefit from established defense infrastructure, training facilities, and procurement command centers. Strong integration with allied defense programs enhances equipment standardization. Local maintenance and support ecosystems further support adoption. Policy emphasis on defense self-reliance reinforces domestic participation. Strategic geographic positioning also supports surveillance and maritime monitoring requirements.

Market Segmentation

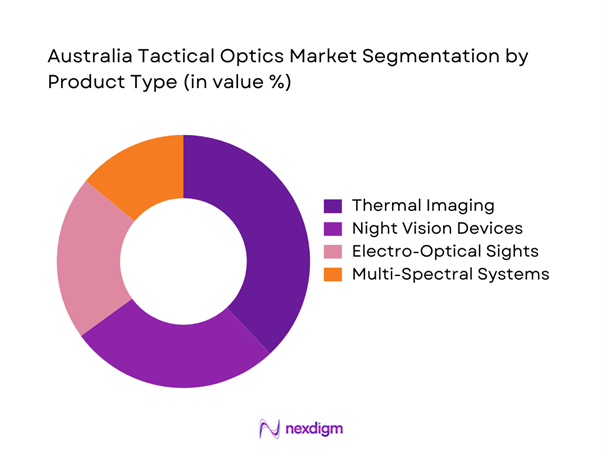

By Product Type

The product landscape is dominated by thermal imaging and night vision optics due to their battlefield relevance. Weapon-mounted optics maintain strong adoption due to infantry modernization initiatives. Electro-optical sights continue gaining preference for precision targeting and reconnaissance. Multi-spectral systems are emerging as integrated solutions supporting varied combat conditions. Procurement decisions increasingly favor modular systems supporting interoperability. Lifecycle performance and ruggedization remain central to purchasing priorities.

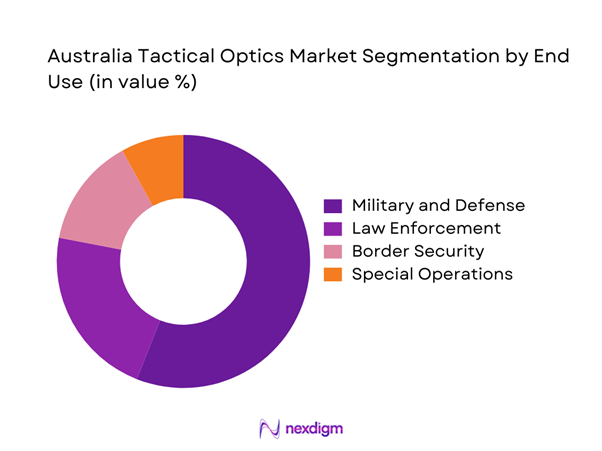

By End Use

Defense forces represent the dominant end-user segment, driven by modernization and tactical readiness programs. Law enforcement agencies increasingly adopt tactical optics for counterterrorism and surveillance operations. Border security units rely on optics for night monitoring and remote terrain coverage. Special operations forces demand high-performance systems with enhanced durability. Procurement decisions emphasize mission adaptability and long-term operational reliability.

Competitive Landscape

The competitive environment is moderately consolidated with global defense technology providers dominating high-end segments. Competition is influenced by technological sophistication, compliance readiness, and long-term service capabilities. Local integration partnerships play a critical role in procurement success. Vendors differentiate through innovation, lifecycle support, and system interoperability. Contract awards favor proven reliability and compliance with defense standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems | 1966 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran Group | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Tactical Optics Market Analysis

Growth Drivers

Modernization of Australian Defence Force infantry systems

Modernization programs emphasize replacing legacy equipment with advanced tactical optics across infantry formations nationwide. Procurement cycles in 2024 reflected increased allocations toward integrated sighting systems. Operational readiness requirements continue pushing adoption of advanced targeting solutions. Infantry digitization initiatives require optics compatible with networked battlefield architectures. Training standardization further accelerates uniform equipment upgrades. Equipment interoperability requirements influence procurement frameworks significantly. Modular system compatibility is increasingly prioritized across platforms. Defense modernization strategies emphasize survivability, accuracy, and operational effectiveness. Tactical optics remain central to achieving modernization objectives. Budget planning cycles continue reinforcing consistent procurement momentum.

Rising demand for night-fighting capabilities

Night operations have become central to modern military doctrines emphasizing continuous operational readiness. Tactical advantages gained through night visibility drive sustained demand for imaging systems. Increasing low-light operations necessitate reliable night vision solutions. Surveillance missions depend heavily on thermal and infrared technologies. Training exercises emphasize night maneuverability and target acquisition. Operational doctrines increasingly prioritize darkness dominance. Enhanced situational awareness reduces mission risk significantly. Tactical optics support improved identification accuracy during nighttime operations. Demand continues rising with expanded night training programs. Night-fighting capability remains a core operational requirement.

Challenges

High procurement and lifecycle costs

Advanced tactical optics involve substantial acquisition and maintenance investments. Long lifecycle requirements increase total ownership costs for defense agencies. Budget constraints influence procurement scheduling and volume decisions. Maintenance and calibration add recurring operational expenditures. Spare parts availability impacts system uptime and effectiveness. Training costs further increase lifecycle expenditure considerations. Budget prioritization often delays replacement cycles. Cost management remains a persistent procurement challenge. Financial planning complexity affects multi-year acquisition programs. Cost efficiency remains a critical evaluation parameter.

Export control and ITAR restrictions

Export regulations significantly influence sourcing and technology transfer decisions. Compliance requirements affect procurement timelines and supplier selection processes. Restrictions limit access to certain advanced technologies. Licensing approvals introduce delays in acquisition cycles. International collaboration often requires regulatory alignment. ITAR compliance increases administrative burden for suppliers. Restrictions can limit system customization flexibility. Cross-border integration efforts face procedural challenges. Regulatory complexity influences long-term procurement strategies. Policy adherence remains essential for market participation.

Opportunities

Indigenous manufacturing and localization initiatives

Government initiatives encourage local production and technology transfer partnerships. Domestic manufacturing strengthens supply chain resilience and responsiveness. Localization policies support long-term capability development. Indigenous production enhances maintenance and lifecycle support capabilities. Local partnerships improve compliance with national security objectives. Investment incentives encourage domestic assembly and integration. Skill development programs support workforce expansion. Local manufacturing reduces dependency on foreign suppliers. Strategic autonomy remains a national priority. Localization initiatives create sustained market opportunities.

Growing demand for thermal and fused optics

Thermal and fused systems provide superior detection capabilities across environments. Demand is driven by multi-domain operational requirements. Integration of thermal imaging enhances situational awareness. Fused optics combine multiple sensing capabilities efficiently. Technological advancements improve accuracy and reliability. Defense modernization programs increasingly specify multi-spectral systems. Operational flexibility benefits from combined sensor outputs. Training adoption supports broader system deployment. Thermal optics improve performance in low-visibility conditions. Demand continues expanding across defense applications.

Future Outlook

The Australia tactical optics market is expected to maintain steady momentum through 2035 driven by modernization programs and capability upgrades. Continued emphasis on indigenous manufacturing will shape procurement strategies. Technological advancements in multi-spectral systems will redefine operational standards. Policy alignment with allied defense frameworks will influence acquisitions. Long-term demand will remain supported by security and surveillance priorities.

Major Players

- Thales Group

- Elbit Systems

- L3Harris Technologies

- Safran Group

- Leonardo S.p.A.

- Rheinmetall Defence

- BAE Systems

- Vortex Optics

- EOTech

- Trijicon

- Aimpoint AB

- Nightforce Optics

- Steiner Optics

- ATN Corp

- Bushnell Corporation

Key Target Audience

- Australian Department of Defence

- Australian Border Force

- State and Federal Law Enforcement Agencies

- Defence Procurement and Acquisition Authorities

- Special Operations Command

- Homeland Security Agencies

- Defense Equipment Integrators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables were defined based on defense procurement patterns, technology classifications, and application segments. Product categories and end-user applications were mapped using operational relevance criteria. Regulatory frameworks and procurement cycles were incorporated into variable selection.

Step 2: Market Analysis and Construction

Data was structured using bottom-up analysis of deployments, contracts, and modernization programs. Segment-wise evaluation was conducted using capability requirements and adoption trends. Cross-validation ensured alignment with defense planning frameworks.

Step 3: Hypothesis Validation and Expert Consultation

Industry insights were validated through consultations with defense analysts and procurement specialists. Assumptions were tested against operational requirements and modernization roadmaps. Feedback loops refined market assumptions and directional trends.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative inputs. Market narratives were structured to reflect operational realities. Final outputs emphasize strategic relevance and decision-making applicability.

- Executive Summary

- Research Methodology (Market Definitions and tactical optics scope alignment, Defense and law enforcement segmentation framework development, Bottom-up market sizing using shipment and contract value mapping, Revenue attribution by platform and optical class, Primary interviews with defense procurement officials and OEM executives, Triangulation using import-export data and tender databases, Assumptions and limitations based on classified procurement cycles)

- Definition and scope

- Market evolution and modernization trends

- Operational usage across defense and law enforcement

- Industry ecosystem and value chain structure

- Distribution and supply chain dynamics

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Australian Defence Force infantry systems

Rising demand for night-fighting capabilities

Increased border security and surveillance spending

Integration of optics with digital battlefield systems

Rising defense budgets and regional security concerns - Challenges

High procurement and lifecycle costs

Export control and ITAR restrictions

Long defense procurement cycles

Technological obsolescence risks

Dependence on foreign suppliers - Opportunities

Indigenous manufacturing and localization initiatives

Growing demand for thermal and fused optics

Upgrades of legacy weapon systems

Expansion of special operations capabilities

Partnerships under AUKUS framework - Trends

Shift toward lightweight and ruggedized optics

Integration with soldier modernization programs

Adoption of AI-enabled targeting systems

Increased use of clip-on and modular optics

Rising preference for multi-spectral devices - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land forces

Naval forces

Airborne platforms

Special forces units - By Application (in Value %)

Target acquisition and aiming

Surveillance and reconnaissance

Night vision operations

Thermal imaging and detection - By Technology Architecture (in Value %)

Electro-optical systems

Thermal imaging systems

Image intensification systems

Multispectral and fused optics - By End-Use Industry (in Value %)

Military and defense

Law enforcement agencies

Border security forces

Special operations units - By Connectivity Type (in Value %)

Standalone optics

Digitally networked optics

Weapon-mounted integrated systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, Technology readiness level, Local manufacturing presence, Defense certifications, Pricing competitiveness, Contract win history, After-sales support capability, R&D investment intensity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Thales Group

Elbit Systems

L3Harris Technologies

Safran Group

Leonardo S.p.A.

Rheinmetall Defence

BAE Systems

Vortex Optics

EOTech

Trijicon

Aimpoint AB

Nightforce Optics

Steiner Optics

ATN Corp

Bushnell Corporation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035