Market Overview

The Australia Target Acquisition Systems market current size stands at around USD ~ million, reflecting sustained procurement across land, naval, and airborne defense platforms. Demand levels remained stable with ~ units deployed across operational forces, supported by modernization programs and sensor upgrades. Active system installations increased steadily, while replacement cycles continued for legacy optics. Platform integration intensity expanded, supported by domestic defense manufacturing programs. Investment flows focused on multi-sensor solutions, while acquisition volumes aligned with operational readiness objectives. Technology refresh cycles continued without major disruption across defense branches.

Australia’s market is primarily concentrated around defense hubs in New South Wales, Victoria, and South Australia, supported by strong industrial infrastructure. Demand is driven by military bases, naval shipyards, and aerospace facilities with high integration capabilities. The ecosystem benefits from long-term defense procurement planning and structured acquisition frameworks. Policy alignment with allied defense standards supports system interoperability. Strong supplier presence and system integration expertise reinforce market maturity across regions.

Market Segmentation

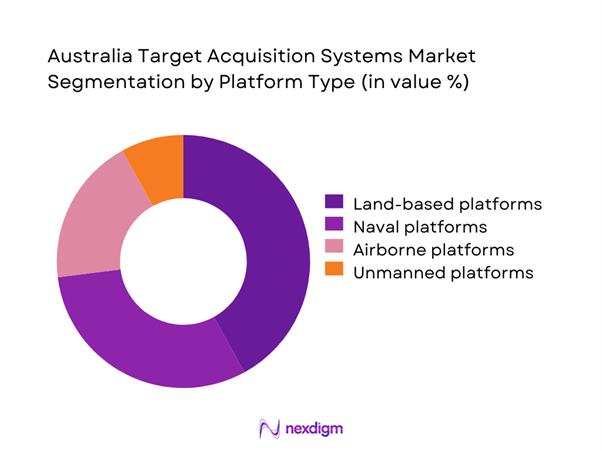

By Platform Type

The market is dominated by land-based and naval platforms due to ongoing modernization of armored vehicles, artillery systems, and maritime surveillance assets. Land platforms account for the highest adoption due to border security requirements and tactical mobility needs. Naval systems follow closely, supported by surface combatant upgrades and coastal monitoring programs. Airborne platforms contribute steadily, driven by ISR aircraft and unmanned systems integration. Platform diversification continues as multi-domain operations gain importance, with increasing emphasis on interoperability and real-time data fusion across environments.

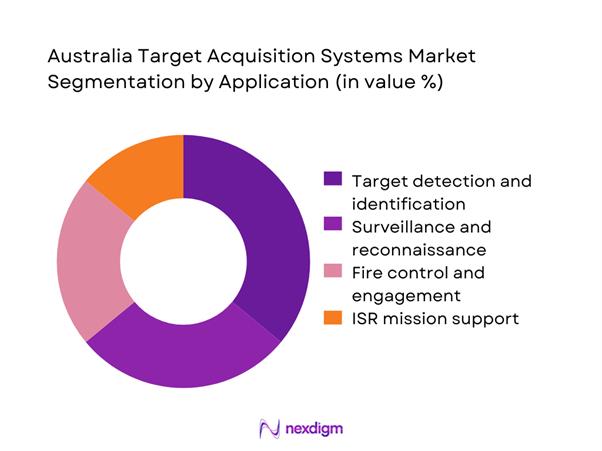

By Application

Target detection and identification represent the largest application segment due to operational reliance on accurate threat recognition. Surveillance and reconnaissance follow closely, supported by border protection and maritime domain awareness needs. Fire control applications maintain consistent demand through artillery and naval systems. ISR mission support continues to expand with integration of multi-sensor architectures. Application diversification is driven by evolving threat environments and increasing demand for precision targeting capabilities across defense operations.

Competitive Landscape

The competitive environment is characterized by a mix of global defense primes and specialized system integrators operating through long-term defense contracts. Market competition is shaped by technological capability, platform compatibility, and compliance with national defense procurement standards. Local manufacturing partnerships and system integration expertise play a critical role in supplier selection.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1912 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2000 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Target Acquisition Systems Market Analysis

Growth Drivers

Modernization of Australian Defence Force combat systems

Modernization programs have accelerated integration of advanced targeting technologies across multiple operational domains. Defense planners continue prioritizing sensor upgrades to enhance battlefield situational awareness and engagement accuracy. Platform renewal programs emphasize compatibility with modern targeting architectures and digital command networks. Increased focus on joint operations drives demand for interoperable targeting solutions across services. Equipment upgrades are aligned with evolving operational doctrines and threat environments. Modernization initiatives also encourage replacement of aging optical systems with advanced electro-optical alternatives. Training and readiness requirements further support continuous system upgrades across operational units. Enhanced lethality and survivability goals reinforce sustained investment in targeting technologies. Integration with command systems improves decision-making efficiency and response time. These modernization efforts collectively sustain long-term demand growth across defense segments.

Rising investment in ISR and situational awareness

ISR investments continue to rise as operational awareness becomes a central defense priority. Target acquisition systems play a critical role in enhancing real-time intelligence accuracy. Surveillance expansion programs require advanced sensors capable of operating across diverse environments. Improved data fusion capabilities support faster threat identification and response coordination. Situational awareness initiatives increasingly depend on multi-sensor integration across platforms. Defense planners prioritize persistent monitoring capabilities to address evolving regional security dynamics. Enhanced ISR capabilities improve mission effectiveness across land, sea, and air operations. Continuous technology upgrades support high-resolution detection and tracking performance. Integration with digital command networks increases system value across operational theaters. These factors collectively strengthen demand for advanced target acquisition solutions.

Challenges

High system procurement and integration costs

Target acquisition systems require significant capital investment due to advanced sensor technologies. Integration with existing platforms often involves complex engineering and customization efforts. Procurement cycles can be extended due to technical validation and compliance requirements. Budget constraints sometimes limit the pace of system replacement programs. Maintenance and lifecycle support further increase overall ownership costs. High-performance components contribute to elevated unit pricing levels. Integration challenges arise when retrofitting legacy platforms with modern systems. Cost overruns may occur due to evolving operational specifications. Training and support requirements add to total deployment expenses. These financial constraints can delay procurement decisions across defense programs.

Dependence on foreign technology suppliers

Australia relies heavily on imported technologies for advanced targeting systems and components. Supply chain dependencies expose programs to geopolitical and logistical risks. Limited domestic production capability restricts full technology sovereignty. Export controls and licensing requirements can delay system delivery schedules. Dependence on foreign upgrades impacts system customization flexibility. Technology transfer restrictions affect local manufacturing participation levels. Maintenance and spare parts availability may be influenced by external suppliers. Long-term support agreements increase reliance on overseas vendors. Strategic autonomy objectives face challenges under current dependency levels. These factors collectively impact procurement resilience and operational continuity.

Opportunities

Indigenous defense manufacturing and technology transfer

Local manufacturing initiatives present significant growth potential for target acquisition systems. Technology transfer agreements enhance domestic production capabilities and technical expertise. Government policies increasingly support local defense industry participation. Indigenous manufacturing improves supply chain resilience and system customization potential. Collaboration with global partners accelerates capability development. Domestic production enables faster maintenance and lifecycle support services. Skilled workforce development strengthens long-term industry sustainability. Local testing and validation improve system adaptation to operational conditions. Increased domestic content aligns with national defense industrial strategies. These factors create strong opportunities for market expansion.

Integration of AI and autonomous targeting systems

Artificial intelligence enables faster and more accurate target recognition capabilities. Autonomous processing reduces operator workload and decision latency. AI-based analytics enhance threat classification and prioritization accuracy. Integration with sensor fusion platforms improves real-time situational awareness. Autonomous features support operations in complex and contested environments. Continuous learning algorithms improve system performance over time. Adoption of AI enhances interoperability across command networks. Defense agencies increasingly prioritize autonomy-enabled targeting solutions. AI integration supports predictive threat assessment and response planning. These advancements create substantial growth potential for next-generation systems.

Future Outlook

The market is expected to evolve steadily through increased digitalization and multi-domain integration initiatives. Emphasis on indigenous capability development will strengthen domestic supply chains. Continued modernization programs and technology upgrades will support sustained demand. Integration of advanced analytics and autonomous functions will shape future system architectures. Strategic defense priorities will continue influencing long-term procurement patterns.

Major Players

- Lockheed Martin

- BAE Systems

- Raytheon Australia

- Thales Australia

- Saab

- Northrop Grumman

- L3Harris Technologies

- Leonardo

- Rheinmetall Defence

- Elbit Systems

- Kongsberg Defence

- Hensoldt

- EOS Defence Systems

- CEA Technologies

- Rafael Advanced Defense Systems

Key Target Audience

- Australian Department of Defence

- Australian Army procurement divisions

- Royal Australian Navy acquisition units

- Royal Australian Air Force capability planners

- Defense system integrators

- Homeland security agencies

- Border protection authorities

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope definition included system types, applications, and deployment environments. Key performance and adoption indicators were identified across operational segments. Data points were structured around platform usage and capability requirements.

Step 2: Market Analysis and Construction

Quantitative and qualitative inputs were analyzed to assess demand patterns and technology penetration. Market structure was developed using platform-based and application-based segmentation logic.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense professionals and industry specialists. Insights were refined based on operational relevance and procurement practices.

Step 4: Research Synthesis and Final Output

Data triangulation ensured consistency across segments. Final insights were structured to reflect market dynamics, challenges, and growth opportunities accurately.

- Executive Summary

- Research Methodology (Market Definitions and system scope mapping for target acquisition solutions, segmentation framework based on platform and mission profiles, bottom-up market sizing using defense procurement and contract data, revenue attribution by system type and integration level, primary validation through defense OEMs and military procurement experts, triangulation using defense budgets and program disclosures, assumptions and limitations linked to classified program transparency)

- Definition and Scope

- Market evolution

- Operational and mission usage landscape

- Ecosystem structure

- Supply chain and system integration framework

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Australian Defence Force combat systems

Rising investment in ISR and situational awareness

Growing focus on network-centric warfare

Expansion of border surveillance and maritime security

Integration of advanced sensors in land and naval platforms - Challenges

High system procurement and integration costs

Dependence on foreign technology suppliers

Complex regulatory and export control requirements

Long defense procurement cycles

Interoperability challenges across platforms - Opportunities

Indigenous defense manufacturing and technology transfer

Integration of AI and autonomous targeting systems

Upgrades of legacy platforms with advanced sensors

Increased defense spending under regional security programs

Export opportunities to allied defense markets - Trends

Shift toward multi-sensor fused targeting systems

Increased adoption of AI-based target recognition

Rising demand for portable and vehicle-mounted systems

Integration with battlefield management systems

Emphasis on cyber-secure and resilient architectures - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Land-based platforms

Naval platforms

Airborne platforms

Unmanned platforms - By Application (in Value %)

Surveillance and reconnaissance

Target detection and identification

Fire control and engagement support

Border and coastal monitoring

ISR mission support - By Technology Architecture (in Value %)

Electro-optical and infrared systems

Laser rangefinders and designators

Multi-sensor fusion systems

Radar-assisted targeting systems

AI-enabled target recognition systems - By End-Use Industry (in Value %)

Army

Navy

Air Force

Homeland security and border protection

Defense research and testing agencies - By Connectivity Type (in Value %)

Standalone systems

Networked and C4ISR-integrated systems

Satellite-linked systems

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology capability, platform compatibility, system accuracy, integration flexibility, pricing strategy, local manufacturing presence, lifecycle support, contract footprint)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Raytheon Australia

Northrop Grumman

BAE Systems Australia

Thales Australia

Elbit Systems

L3Harris Technologies

Saab Australia

Leonardo

Rheinmetall Defence Australia

EOS Defence Systems

CEA Technologies

Rafael Advanced Defense Systems

Hensoldt

Kongsberg Defence & Aerospace

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035