Market Overview

The Australia Targeting Pods market current size stands at around USD ~ million, reflecting active procurement cycles and modernization initiatives across combat aviation platforms. Recent operational deployments have accelerated adoption of advanced electro-optical systems, supported by increasing integration of precision targeting technologies. Fleet modernization programs and interoperability requirements have sustained procurement momentum, while replacement demand from aging systems remains consistent. Increased defense readiness initiatives and expanding aerial surveillance needs continue influencing procurement patterns. The market demonstrates steady technological refresh cycles aligned with evolving mission requirements. Procurement volumes remain aligned with fleet expansion and upgrade timelines.

The market is primarily concentrated around major air force operational hubs, supported by advanced aerospace infrastructure and established defense manufacturing ecosystems. Regions hosting key airbases and maintenance facilities account for the highest deployment density. Strong government procurement frameworks and long-term defense capability planning support sustained demand. Local industry participation enhances supply chain reliability and integration efficiency. Policy-driven defense modernization initiatives further reinforce adoption. Close collaboration between defense agencies and system integrators shapes regional market development.

Market Segmentation

By Platform Type

The market is dominated by fixed-wing combat aircraft due to their extensive deployment across air superiority, strike, and reconnaissance missions. Multirole fighters account for a significant share as they increasingly rely on integrated targeting systems for mission flexibility. Trainer and light combat aircraft contribute moderately, primarily for operational readiness and training environments. Unmanned aerial platforms are gaining traction as force multipliers, particularly for surveillance missions. Rotary-wing platforms represent a smaller yet specialized segment, driven by close air support requirements. Platform selection is closely tied to mission complexity, interoperability, and upgrade cycles.

By Application

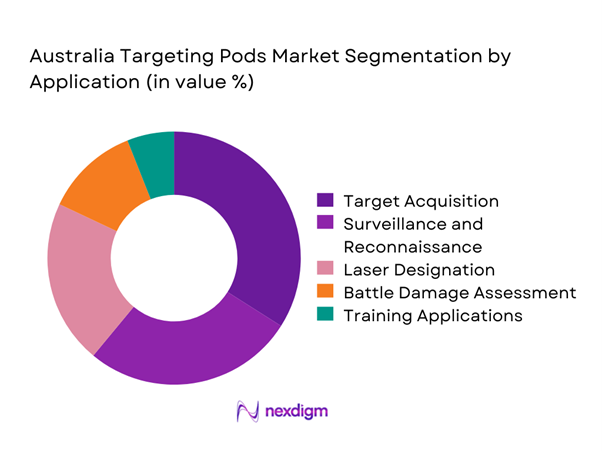

Target acquisition and tracking dominate usage due to their critical role in precision strike missions. Surveillance and reconnaissance applications follow closely, driven by increased border security and situational awareness requirements. Laser designation remains essential for guided munitions deployment across air operations. Battle damage assessment usage continues to grow with modern combat doctrines emphasizing real-time feedback. Training and simulation applications form a smaller but stable segment. Application demand is shaped by operational doctrine and mission adaptability.

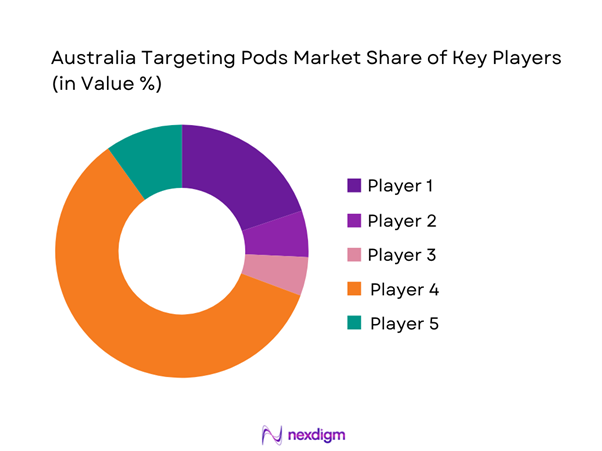

Competitive Landscape

The competitive landscape is characterized by established defense technology providers with strong integration capabilities and long-term defense relationships. Market participants focus on platform compatibility, system reliability, and lifecycle support. Competitive differentiation is driven by sensor performance, software integration, and support infrastructure. Entry barriers remain high due to certification requirements and defense procurement complexity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1994 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1948 | Israel | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Targeting Pods Market Analysis

Growth Drivers

Modernization of Royal Australian Air Force combat fleet

Modernization initiatives have accelerated replacement of legacy systems with advanced targeting pods across frontline aircraft platforms. Fleet upgrades in recent years have increased integration of precision targeting capabilities into multirole combat aircraft. Modernization programs prioritize interoperability, sensor fusion, and real-time targeting accuracy for mission effectiveness. Increased operational complexity has necessitated improved situational awareness through advanced pod technologies. Defense capability plans emphasize technology refresh cycles aligned with evolving threat environments. Procurement timelines reflect long-term force structure modernization objectives. Integration of advanced avionics has expanded compatibility requirements for targeting systems. Enhanced mission readiness standards continue driving adoption across operational squadrons. Fleet standardization programs support consistent targeting performance across aircraft types. These modernization efforts collectively sustain long-term market demand.

Rising emphasis on precision-guided munitions

Increased reliance on precision-guided munitions has intensified demand for high-accuracy targeting pods across platforms. Modern combat doctrines prioritize precision engagement to minimize collateral damage and mission risk. Targeting pods enable real-time laser designation essential for guided weapon deployment. Operational data from recent exercises has reinforced the effectiveness of advanced targeting systems. Precision strike capabilities remain central to air combat readiness strategies. Enhanced sensor resolution supports improved target discrimination in complex environments. Integration with digital command systems improves mission coordination and effectiveness. Air forces increasingly require multi-sensor targeting solutions for diverse mission profiles. Training programs emphasize pod-enabled targeting proficiency. These trends continue reinforcing sustained market growth.

Challenges

High procurement and lifecycle costs

High acquisition costs create budgetary pressures for defense procurement agencies managing multiple modernization priorities. Lifecycle expenses associated with maintenance and upgrades further increase ownership costs. Advanced sensor technologies require specialized maintenance infrastructure and skilled personnel. Budget allocation constraints may delay procurement timelines across platforms. Long-term sustainment contracts add complexity to procurement planning. Cost escalation risks arise from customization and integration requirements. Defense budgets must balance competing capability investments. Financial constraints can limit adoption of next-generation targeting solutions. Cost control remains a critical concern for program managers. These factors collectively restrain rapid market expansion.

Platform integration complexity

Integration of targeting pods with diverse aircraft platforms presents significant technical challenges. Compatibility issues arise due to varying avionics architectures and mission systems. Extensive testing and certification are required to ensure operational safety. Integration timelines often extend beyond initial projections. Software compatibility issues can delay deployment schedules. Customization requirements increase development complexity for suppliers. Interoperability with existing mission systems remains critical. Integration risks can impact program costs and delivery schedules. Technical validation processes are resource intensive. These challenges affect adoption speed across fleets.

Opportunities

Fleet upgrade programs for legacy aircraft

Legacy aircraft modernization programs present strong opportunities for targeting pod upgrades. Many operational fleets require sensor enhancements to meet current mission standards. Retrofit programs extend platform service life while improving combat effectiveness. Upgrading existing aircraft is cost-effective compared to fleet replacement. Defense planners increasingly prioritize incremental capability enhancements. Retrofit demand supports sustained aftermarket opportunities. Integration of modern targeting pods enhances operational relevance. Upgrade cycles align with scheduled maintenance intervals. These programs create steady procurement pipelines. Market participants benefit from long-term upgrade contracts.

Rising demand for network-centric warfare systems

Network-centric operations drive demand for connected targeting solutions across platforms. Targeting pods increasingly require data-sharing capabilities with command networks. Enhanced connectivity improves situational awareness and coordinated mission execution. Integration with battlefield management systems is becoming standard. Demand is rising for pods supporting real-time data exchange. Networked operations enhance multi-domain combat effectiveness. Interoperability requirements are shaping product development strategies. Future platforms emphasize seamless data fusion capabilities. These trends expand functional expectations of targeting systems. Market opportunities align with digital warfare transformation.

Future Outlook

The Australia targeting pods market is expected to maintain steady growth through 2035, supported by defense modernization programs and evolving combat requirements. Continued investment in advanced aerial capabilities and sensor technologies will sustain demand. Increasing focus on interoperability and digital warfare integration will influence future product development. Long-term procurement planning and fleet upgrades will remain key growth enablers.

Major Players

- Lockheed Martin

- Northrop Grumman

- Rafael Advanced Defense Systems

- Thales Group

- Leonardo

- Elbit Systems

- L3Harris Technologies

- BAE Systems

- Collins Aerospace

- Saab

- ASELSAN

- HENSOLDT

- Teledyne FLIR

- Safran Electronics & Defense

- Ultra Electronics

Key Target Audience

- Ministry of Defence Australia

- Royal Australian Air Force

- Defense procurement agencies

- Aircraft OEMs and integrators

- Defense system integrators

- Maintenance, repair, and overhaul providers

- Investments and venture capital firms

- Australian Department of Defence Capability Acquisition and Sustainment Group

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of platform types, mission requirements, and defense procurement frameworks. Emphasis was placed on understanding operational usage and system integration factors.

Step 2: Market Analysis and Construction

Market structure was developed using platform-level assessment and application mapping. Segmentation logic was aligned with defense acquisition and deployment patterns.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through expert consultations across defense operations and system integration domains. Cross-verification ensured alignment with operational realities.

Step 4: Research Synthesis and Final Output

Findings were consolidated through triangulation of qualitative and quantitative insights. Final outputs were refined to ensure accuracy and consistency.

- Executive Summary

- Research Methodology (Market Definitions and platform scope alignment, Australia-specific fleet and mission taxonomy mapping, bottom-up and top-down market sizing using defense procurement data, revenue attribution by platform integration and retrofit cycles, primary validation through defense contractors and MoD stakeholders, triangulation using program budgets and delivery schedules, assumptions linked to force structure and upgrade timelines)

- Definition and Scope

- Market evolution

- Usage and mission deployment framework

- Ecosystem structure

- Supply chain and procurement flow

- Regulatory and defense acquisition environment

- Growth Drivers

Modernization of Royal Australian Air Force combat fleet

Rising emphasis on precision-guided munitions

Integration of advanced ISR capabilities

Interoperability requirements with allied forces

Upgrades under long-term defense capability plans - Challenges

High procurement and lifecycle costs

Platform integration complexity

Export control and ITAR constraints

Limited domestic manufacturing base

Long certification and testing cycles - Opportunities

Fleet upgrade programs for legacy aircraft

Rising demand for network-centric warfare systems

Local industry participation and offset programs

Growth in unmanned combat platforms

Technology refresh driven by sensor miniaturization - Trends

Shift toward multi-sensor fused targeting pods

Integration with digital battlefield management systems

Enhanced imaging resolution and tracking accuracy

Growing demand for pod interoperability

Increased focus on lifecycle support and sustainment - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fighter aircraft

Multirole combat aircraft

Attack aircraft

Trainer and light combat aircraft

Unmanned aerial platforms - By Application (in Value %)

Target acquisition and tracking

Laser designation

Surveillance and reconnaissance

Battle damage assessment

Precision strike support - By Technology Architecture (in Value %)

Electro-optical targeting pods

Infrared targeting pods

Multi-sensor fused pods

Laser designator integrated pods - By End-Use Industry (in Value %)

Air force

Naval aviation

Joint and allied operations - By Connectivity Type (in Value %)

Standalone pod systems

Network-enabled pods

Data-linked multi-platform pods - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (platform compatibility, sensor resolution, targeting accuracy, network integration capability, upgrade flexibility, lifecycle cost, combat proven record, local support presence)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Northrop Grumman

Rafael Advanced Defense Systems

Thales Group

Leonardo

Elbit Systems

L3Harris Technologies

BAE Systems

Collins Aerospace

SAAB

ASELSAN

HENSOLDT

Teledyne FLIR

Safran Electronics & Defense

Ultra Electronics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

By Value, 2026–2035

By Volume, 2026–2035

By Installed Base, 2026–2035

By Average Selling Price, 2026–2035