Market Overview

The Australia Terrain Awareness and Warning System market current size stands at around USD ~ million and reflects steady integration across commercial, defense, and special mission aviation fleets. System deployments increased during 2024 and 2025 as regulatory oversight strengthened and avionics upgrades accelerated. Adoption is driven by safety compliance requirements, fleet modernization initiatives, and growing emphasis on controlled flight risk mitigation. The market demonstrates stable procurement activity supported by recurring retrofit demand and integration with advanced avionics platforms.

Demand concentration remains strongest across major aviation hubs with dense commercial operations and defense infrastructure. Eastern and western aviation corridors show higher installation activity due to fleet density and operational complexity. Strong maintenance ecosystems, established avionics integration capabilities, and supportive regulatory frameworks contribute to sustained adoption. Government oversight bodies and aviation operators continue prioritizing safety technology deployment, reinforcing long-term market stability and structured growth momentum.

Market Segmentation

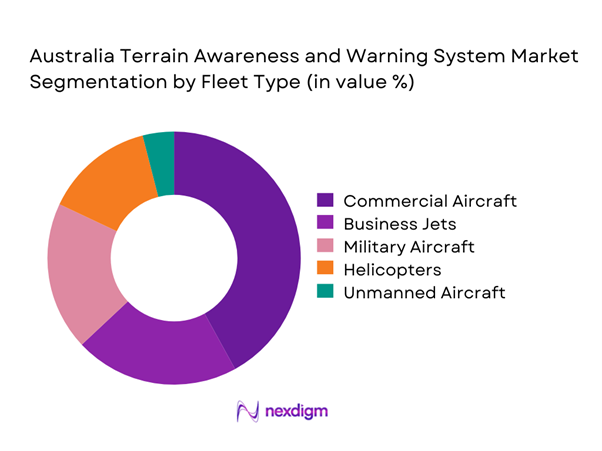

By Fleet Type

Commercial aircraft dominate adoption due to regulatory compliance obligations and higher flight frequencies requiring advanced safety systems. Business aviation follows with consistent retrofit demand driven by premium safety expectations and fleet upgrades. Military aviation maintains steady integration through modernization programs and mission safety requirements. Helicopter operations represent a growing segment supported by emergency services, offshore operations, and low-altitude flight risks. Unmanned platforms remain emerging, with limited but expanding adoption aligned with regulatory evolution and operational testing initiatives.

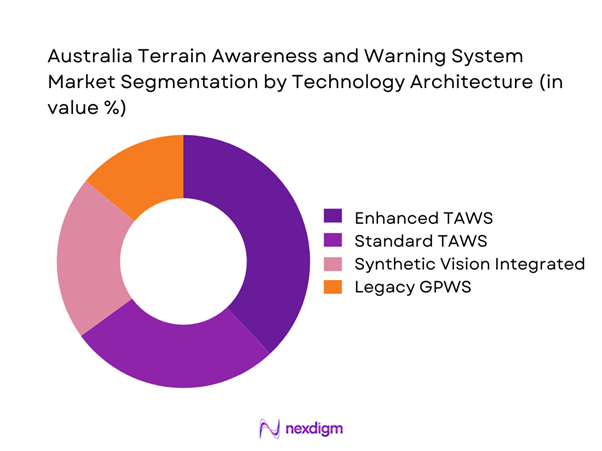

By Technology Architecture

Enhanced and integrated terrain awareness systems dominate due to compatibility with modern avionics suites and regulatory acceptance. Traditional systems maintain relevance in legacy aircraft, particularly within regional and utility aviation segments. Synthetic vision integration continues expanding as operators prioritize situational awareness and pilot decision support. Modular architectures gain preference for retrofit flexibility and lower integration complexity. System interoperability with navigation and flight management platforms increasingly influences purchasing decisions.

Competitive Landscape

The market features a consolidated competitive environment supported by established avionics manufacturers and specialized system providers. Competition is driven by certification readiness, integration capabilities, and long-term support offerings. Vendors differentiate through system reliability, software upgrade pathways, and compatibility with diverse aircraft platforms. Strategic partnerships with aircraft manufacturers and service providers strengthen market positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Garmin Ltd. | 1989 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Terrain Awareness and Warning System Market Analysis

Growth Drivers

Increasing aviation safety mandates by CASA

Stricter aviation safety mandates from national authorities continue elevating mandatory installation requirements across commercial and specialized aircraft fleets. Regulatory updates during 2024 reinforced compliance expectations for terrain awareness capabilities within certified avionics suites across diverse operational categories. Authorities increasingly emphasize controlled flight into terrain mitigation as a critical airworthiness evaluation parameter for commercial and government operators. Audit frameworks implemented in 2025 strengthened enforcement mechanisms across scheduled, charter, and rotary aviation segments nationwide under updated compliance programs. These mandates accelerate adoption cycles as operators prioritize certification continuity and operational risk reduction within regulated flight environments. Mandatory compliance drives avionics upgrade planning across fleets operating in challenging terrain conditions and variable weather profiles nationally. Safety oversight agencies increasingly link operational approvals with validated terrain awareness system performance metrics during routine audits annually. This regulatory pressure sustains consistent demand for compliant systems across newly inducted aircraft within commercial fleets and charter operators. Operators prioritize certified solutions to avoid penalties, grounding risks, and operational disruptions under evolving regulatory oversight frameworks nationally. Overall, regulatory stringency remains a primary catalyst shaping procurement behavior and upgrade timelines across Australian aviation sectors consistently.

Rising commercial and regional air traffic

Growth in domestic air travel continues increasing aircraft utilization rates across regional and metropolitan airspace networks. Passenger movement expansion during 2024 intensified operational frequencies for short haul and regional routes nationwide. Higher traffic density elevates safety risk exposure, strengthening reliance on advanced terrain awareness systems. Regional carriers expanded route networks connecting remote locations with limited navigational infrastructure. Increased flight cycles accelerate avionics wear, prompting proactive system upgrades across operational fleets. Aviation operators prioritize situational awareness technologies to manage terrain risks in congested air corridors. Growth in tourism and intercity connectivity sustains consistent aircraft deployment across varied terrain profiles. Higher utilization rates support faster replacement cycles for legacy safety equipment. Operators increasingly integrate terrain systems during scheduled avionics modernization programs. Rising air traffic therefore directly supports long-term demand stability for compliant warning technologies.

Challenges

High system integration and certification costs

High integration complexity creates financial and technical barriers for operators seeking system upgrades. Certification processes require extensive testing, documentation, and regulatory approvals, extending project timelines. Integration with existing avionics often requires customization, increasing engineering effort and associated expenses. Smaller operators face constraints aligning budgets with mandatory compliance expectations. Certification delays can disrupt aircraft availability and operational scheduling. Costs associated with software validation and hardware compatibility remain significant across fleet categories. Integration challenges intensify for mixed or aging fleet compositions. Limited in-house technical expertise further complicates implementation planning for smaller operators. These factors collectively slow adoption rates despite regulatory pressures. Cost sensitivity therefore remains a persistent challenge affecting broader market penetration.

Limited retrofit feasibility in older aircraft

Aging aircraft fleets present structural and technical constraints limiting system retrofitting feasibility. Legacy avionics architectures often lack compatibility with modern terrain awareness technologies. Retrofitting requires extensive rewiring, display upgrades, and system recalibration processes. Downtime associated with retrofit activities impacts fleet availability and operational scheduling. Economic viability becomes uncertain when retrofit costs approach aircraft residual values. Operators may defer upgrades in favor of fleet replacement strategies. Certification complexity increases when modifying older airframes with limited documentation support. Maintenance burdens rise due to hybrid system configurations. These limitations reduce addressable demand within aging aircraft segments. Retrofit feasibility therefore remains a structural constraint on overall market expansion.

Opportunities

Fleet modernization programs across Australia

Ongoing fleet renewal initiatives create significant opportunities for advanced avionics integration. Airlines increasingly replace aging aircraft with models supporting modern safety systems. New deliveries incorporate terrain awareness capabilities as standard or optional equipment. Modernization programs initiated during 2024 emphasize digital cockpit architectures. Fleet renewal reduces integration complexity and accelerates system adoption timelines. Operators align procurement strategies with long-term safety compliance objectives. Enhanced avionics compatibility supports seamless deployment of terrain warning solutions. Financing availability supports capital investments in newer aircraft platforms. Modern fleets enable higher operational efficiency and regulatory compliance. Fleet modernization therefore presents a sustained growth pathway for system providers.

Expansion of defense aviation investments

Defense aviation programs continue prioritizing flight safety and mission reliability enhancements. Government investment in rotary and fixed wing platforms supports avionics upgrades. Military training operations require advanced terrain awareness for low altitude missions. Procurement programs emphasize interoperability and mission safety performance. Defense modernization initiatives during 2025 included avionics capability enhancements. Tactical operations increase demand for reliable situational awareness technologies. Integration of terrain systems improves mission planning and execution safety. Defense procurement cycles offer long term contract stability for suppliers. Increased defense aviation activity strengthens overall market demand. Military investment therefore represents a significant opportunity segment.

Future Outlook

The market is expected to maintain stable growth through continued regulatory enforcement and fleet modernization initiatives. Technological integration with advanced avionics and synthetic vision platforms will enhance system adoption. Increasing defense and regional aviation activity will further support demand. Long-term outlook remains positive as safety compliance remains a core operational priority.

Major Players

- Honeywell Aerospace

- Collins Aerospace

- Thales Group

- Garmin Ltd.

- L3Harris Technologies

- Leonardo S.p.A.

- Safran Electronics and Defense

- BAE Systems

- Cobham Aerospace Communications

- Avidyne Corporation

- Aspen Avionics

- Universal Avionics

- Dynon Avionics

- Trig Avionics

- Skytrac Systems

Key Target Audience

- Commercial airline operators

- Regional and charter aviation companies

- Defense aviation procurement agencies

- Emergency medical service operators

- Offshore energy aviation operators

- Aircraft maintenance and overhaul providers

- Investments and venture capital firms

- Civil Aviation Safety Authority and Department of Defence

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, system definitions, regulatory scope, and application categories were identified through structured industry mapping. Demand drivers and adoption constraints were defined based on operational and regulatory frameworks.

Step 2: Market Analysis and Construction

Segmentation logic was developed using fleet composition, application usage, and technology deployment patterns. Market behavior was analyzed across commercial, defense, and special mission aviation sectors.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through discussions with aviation professionals, maintenance specialists, and regulatory experts. Assumptions were refined based on operational feasibility and compliance realities.

Step 4: Research Synthesis and Final Output

Data insights were consolidated through triangulation techniques. Final outputs were structured to reflect market dynamics, risks, and opportunity pathways accurately.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of terrain awareness and warning systems, Platform and fleet-based segmentation framework, Bottom-up and top-down market sizing using aircraft fleet and retrofit data, Revenue attribution across OEM, retrofit, and upgrade cycles, Primary interviews with avionics OEMs, airlines, and defense operators, Data triangulation using regulatory filings and fleet databases, Assumptions based on certification timelines and avionics upgrade cycles)

- Definition and Scope

- Market evolution

- Usage and operational deployment across aviation segments

- Ecosystem structure and stakeholder roles

- Supply chain and system integration flow

- Regulatory and certification environment

- Growth Drivers

Increasing aviation safety mandates by CASA

Rising commercial and regional air traffic

Modernization of aging aircraft fleets

Growth in offshore and EMS aviation operations

Rising adoption of advanced avionics suites - Challenges

High system integration and certification costs

Limited retrofit feasibility in older aircraft

Complex regulatory compliance processes

Dependency on accurate terrain databases

Budget constraints in regional aviation operators - Opportunities

Fleet modernization programs across Australia

Expansion of defense aviation investments

Integration with synthetic vision and flight management systems

Growth in helicopter emergency services

Upgrades driven by ICAO safety mandates - Trends

Shift toward integrated avionics platforms

Increased use of digital terrain databases

Adoption of predictive and AI-enabled warning systems

Rising demand for lightweight and modular systems

Growing focus on pilot situational awareness - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Commercial fixed-wing aircraft

Business jets

Helicopters

Military aircraft

Unmanned aerial systems - By Application (in Value %)

Commercial aviation safety compliance

Military flight safety and mission assurance

Search and rescue operations

Offshore and EMS operations

Training and simulation - By Technology Architecture (in Value %)

Ground Proximity Warning System (GPWS)

Enhanced Ground Proximity Warning System (EGPWS)

Terrain Awareness and Warning System (TAWS Class A/B/C)

Synthetic vision integrated TAWS - By End-Use Industry (in Value %)

Commercial aviation

Defense and homeland security

Emergency medical services

Offshore energy aviation

Flight training organizations - By Connectivity Type (in Value %)

Standalone onboard systems

Integrated avionics suites

Satellite-enabled terrain databases

Cloud-assisted update systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio breadth, Certification and compliance coverage, Integration capability, Pricing strategy, Aftermarket support strength, Technology maturity, Geographic presence, Customer base diversity)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Honeywell Aerospace

Collins Aerospace

Thales Group

Garmin Ltd.

L3Harris Technologies

Leonardo S.p.A.

Safran Electronics & Defense

BAE Systems

Cobham Aerospace Communications

Avidyne Corporation

Aspen Avionics

Universal Avionics

Dynon Avionics

Trig Avionics

Skytrac Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035