Market Overview

The Australia Thrust Vector Control market current size stands at around USD ~ million, supported by increasing defense propulsion programs and advanced flight control requirements. Recent activity shows steady system integration volumes, with unit deployments exceeding ~ units annually across military and space platforms. Development intensity has risen alongside testing activity, particularly for missile and launch vehicle applications. Adoption is driven by modernization initiatives and platform upgrades rather than replacement cycles. Technology readiness levels continue improving through domestic manufacturing and collaborative development programs.

Australia’s thrust vector control ecosystem is concentrated around defense and aerospace clusters in New South Wales, South Australia, and Queensland. These regions benefit from established test ranges, propulsion laboratories, and government-backed innovation corridors. Demand concentration aligns with missile development, space launch activities, and defense research facilities. The ecosystem is supported by localized supply chains, increasing public-private collaboration, and regulatory frameworks encouraging sovereign capability development and controlled technology transfer.

Market Segmentation

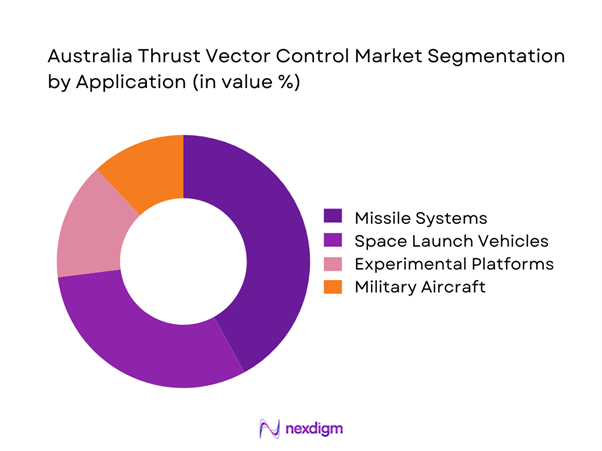

By Application

The application-based segmentation is dominated by missile systems and launch vehicle programs, driven by increased defense readiness and sovereign capability initiatives. Missile guidance and stabilization account for the highest adoption due to their reliance on precise thrust modulation. Space launch applications are expanding steadily, supported by growing domestic launch activities and small satellite missions. Experimental platforms and research programs contribute to steady baseline demand, while aircraft-based applications remain limited but technologically significant. Continuous testing, qualification cycles, and mission-critical performance requirements sustain long-term demand across application segments.

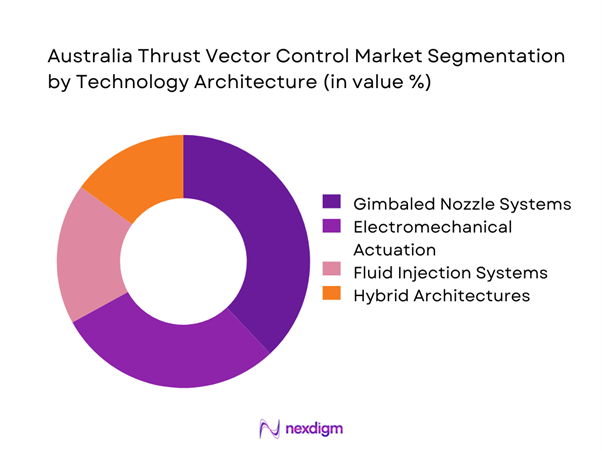

By Technology Architecture

Technology architecture segmentation is led by gimbaled nozzle systems due to their proven reliability and high thrust vector accuracy. Electromechanical actuation systems are gaining traction because of lower maintenance complexity and improved digital control compatibility. Fluid injection systems maintain niche usage in high-speed applications, while hybrid architectures are emerging through defense research programs. Advancements in materials and control electronics continue to influence architecture selection, with emphasis on precision, response time, and system redundancy across mission profiles.

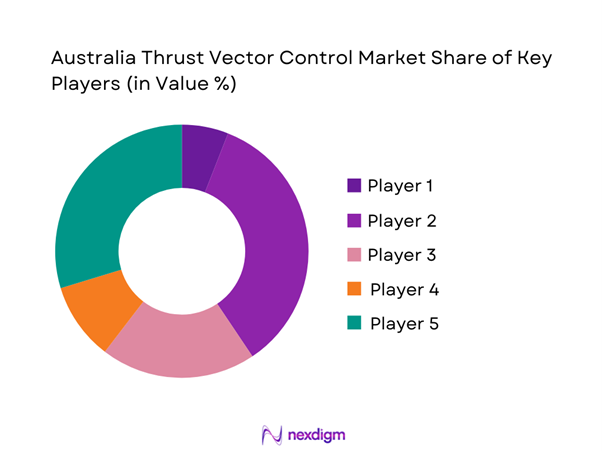

Competitive Landscape

The competitive environment is characterized by a limited number of specialized aerospace and defense suppliers with strong system integration capabilities. Market participation is shaped by long qualification cycles, stringent regulatory compliance, and close collaboration with government agencies. Competitive differentiation is primarily driven by technological depth, reliability, and alignment with national defense programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Moog Inc. | 1951 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX Corporation | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Thrust Vector Control Market Analysis

Growth Drivers

Rising defense modernization and missile programs

Defense modernization initiatives are expanding rapidly as strategic priorities emphasize missile capability and deterrence readiness nationwide. Increased allocation toward guided weapons development has elevated demand for precision thrust control technologies. Platform upgrades across land, air, and naval forces are driving integration of advanced vectoring systems. Indigenous development programs encourage localized production and system customization for operational needs. Testing intensity has increased due to higher system performance requirements and qualification standards. Cross-domain integration between sensors and propulsion is becoming standard practice. Government-backed research initiatives continue accelerating prototype development cycles. Increased defense collaboration with allied nations supports knowledge transfer and technical validation. Program continuity ensures stable demand pipelines for thrust vector control suppliers. Overall momentum reflects long-term strategic alignment with advanced propulsion capabilities.

Expansion of sovereign space launch capabilities

Australia’s growing space launch ambitions are accelerating demand for thrust vector control technologies. Launch vehicle programs increasingly rely on precise thrust modulation for trajectory optimization. Domestic spaceports and test facilities support frequent experimental launches. Government policies emphasize sovereign access to space and payload deployment independence. Private launch startups are integrating vector control to enhance flight stability. Technological collaboration between defense and space sectors strengthens innovation flow. Increasing satellite deployment drives repeated launch requirements. Research institutions contribute to propulsion testing and control algorithm development. Commercial and government missions collectively expand application breadth. This momentum reinforces sustained adoption of thrust vector control systems.

Challenges

High development and qualification costs

Development of thrust vector control systems involves extensive testing, simulation, and certification requirements. Engineering complexity increases costs across design, materials, and validation stages. Qualification cycles extend due to stringent safety and reliability thresholds. Limited production volumes restrict economies of scale for manufacturers. Specialized testing infrastructure adds to capital intensity for suppliers. Compliance with defense standards increases documentation and verification burdens. Iterative testing often leads to prolonged development timelines. Budget constraints can delay program execution and system upgrades. Smaller suppliers face barriers entering high-cost development environments. These factors collectively restrain rapid market expansion.

Stringent defense certification requirements

Defense certification processes require extensive validation across environmental and operational conditions. Compliance timelines are lengthy due to multilayered approval frameworks. Documentation standards impose administrative and engineering burdens on suppliers. Certification failures can significantly delay deployment schedules. System redesigns often become necessary after qualification testing. Regulatory oversight limits flexibility in component sourcing and design changes. Cross-platform certification complexity further extends approval cycles. Integration testing requires alignment with multiple defense stakeholders. Export control regulations add additional compliance layers. These requirements increase entry barriers and operational complexity.

Opportunities

Growth of commercial space launches in Australia

Commercial launch activity is increasing as domestic providers expand orbital and suborbital missions. Demand for reliable thrust vectoring grows with higher launch frequency. Small satellite deployment drives repeat launch requirements. Private investment supports innovation in propulsion control systems. Launch providers seek cost-efficient and modular control solutions. Technology validation through commercial missions accelerates adoption cycles. Local manufacturing reduces dependency on imports. Collaboration with research agencies enhances system testing. Infrastructure development supports sustained launch operations. These factors collectively create strong growth potential.

Indigenous missile and rocket development programs

National defense strategies emphasize indigenous missile and rocket development capabilities. Localized production increases demand for domestically developed control systems. Government funding supports long-term propulsion research initiatives. Indigenous programs reduce reliance on foreign technology providers. Testing programs drive continuous refinement of thrust vector technologies. Collaboration between defense agencies and manufacturers strengthens system integration. Skill development enhances technical workforce capabilities. Program continuity ensures predictable demand visibility. Export potential improves with proven domestic systems. These developments position the market for sustained expansion.

Future Outlook

The Australia thrust vector control market is expected to experience steady advancement driven by defense modernization and expanding space activity. Continued investment in sovereign capabilities will support technology maturation and domestic production. Increasing collaboration between public and private stakeholders will enhance system innovation. Long-term growth will depend on sustained policy support, infrastructure expansion, and successful commercialization of propulsion technologies.

Major Players

- Moog Inc.

- Honeywell Aerospace

- RTX Corporation

- Northrop Grumman

- Thales Australia

- BAE Systems

- Lockheed Martin

- L3Harris Technologies

- Safran Group

- Boeing Defense

- Kongsberg Defence & Aerospace

- MBDA

- IHI Aerospace

- Gilmour Space Technologies

- Aerojet Rocketdyne

Key Target Audience

- Defense procurement agencies

- Space agency program offices

- Missile system manufacturers

- Launch vehicle developers

- Aerospace component suppliers

- Government and regulatory bodies including the Department of Defence Australia

- Private space technology firms

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through propulsion system classification, application mapping, and technology boundaries. Key demand indicators and operational parameters were identified through industry interaction.

Step 2: Market Analysis and Construction

Data was structured using platform-level adoption trends, technology penetration, and system integration patterns. Segmentation logic was applied to ensure accurate representation of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through discussions with aerospace engineers, defense specialists, and propulsion system experts. Assumptions were refined based on operational insights.

Step 4: Research Synthesis and Final Output

All insights were consolidated, cross-validated, and structured into a coherent analytical framework. Outputs were reviewed for consistency, relevance, and industry alignment.

- Executive Summary

- Research Methodology (Market Definitions and system boundary mapping for thrust vector control, platform and propulsion-based segmentation framework, bottom-up estimation of actuator and control system revenues, OEM and defense contract value attribution modeling, primary interviews with propulsion engineers and defense procurement experts, triangulation using launch vehicle and missile program data, market assumptions based on Australia’s defense and space roadmap)

- Definition and Scope

- Market evolution

- Usage across missile, launch vehicle, and aerospace platforms

- Industry and ecosystem structure

- Supply chain and component integration

- Regulatory and defense compliance environment

- Growth Drivers

Rising defense modernization and missile programs

Expansion of sovereign space launch capabilities

Increased investment in hypersonic research

Growing demand for precision-guided munitions

Government-backed aerospace manufacturing initiatives - Challenges

High development and qualification costs

Stringent defense certification requirements

Limited domestic manufacturing scale

Dependence on imported propulsion subsystems

Long development and testing cycles - Opportunities

Growth of commercial space launches in Australia

Indigenous missile and rocket development programs

Collaborations with global aerospace OEMs

Advancements in electric actuation technologies

Defense export potential within Indo-Pacific region - Trends

Shift toward electrically actuated vector control

Integration of AI-assisted flight control systems

Lightweight and high-temperature material adoption

Modular thrust vectoring architectures

Increased use of digital twins in propulsion design - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Missile systems

Space launch vehicles

Unmanned aerial systems

Manned military aircraft

Experimental and test platforms - By Application (in Value %)

Flight stabilization

Trajectory control

Maneuvering and guidance

Attitude control

Launch phase vectoring - By Technology Architecture (in Value %)

Gimbaled nozzle systems

Jet vane systems

Fluid injection thrust vectoring

Electromechanical actuation

Hybrid thrust vectoring systems - By End-Use Industry (in Value %)

Defense and missile systems

Space and launch services

Aerospace R&D

Government research agencies

Commercial space operators - By Connectivity Type (in Value %)

Analog control systems

Digital control systems

Fly-by-wire integration

Autonomous guidance integration - By Region (in Value %)

New South Wales

Victoria

Queensland

South Australia

Western Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (technology maturity, product portfolio depth, defense contract presence, local manufacturing capability, R&D intensity, system integration capability, pricing competitiveness, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Moog Inc.

Woodward Inc.

Honeywell Aerospace

RTX Corporation

Northrop Grumman

Lockheed Martin

L3Harris Technologies

Safran Group

BAE Systems

Thales Australia

Boeing Defense, Space & Security

MBDA

Kongsberg Defence & Aerospace

IHI Aerospace

Gilmour Space Technologies

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035