Market Overview

The Australia Unmanned Marine Vehicles market current size stands at around USD ~ million, supported by expanding maritime surveillance programs, offshore monitoring demand, and defense modernization initiatives. Deployment volumes exceeded ~ units across multiple operational environments, with autonomous surface and underwater platforms forming a significant share of total systems deployed. Technology investments during the period emphasized endurance, navigation precision, and payload modularity. Operational utilization increased across naval patrols, seabed mapping, and offshore inspection activities, supported by gradual regulatory clarity and integration with maritime command systems.

Australia’s market activity is concentrated across Western Australia, New South Wales, and Queensland due to naval bases, offshore energy assets, and maritime trade density. Coastal infrastructure maturity, defense testing corridors, and port modernization initiatives support deployment concentration. Government-backed innovation zones and strong collaboration between defense agencies and technology developers reinforce ecosystem depth. Regional demand is further shaped by long coastline surveillance needs, environmental monitoring requirements, and growing autonomy adoption across commercial maritime operations.

Market Segmentation

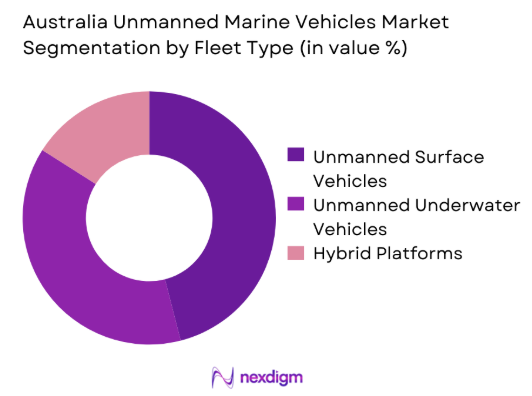

By Fleet Type

The market shows strong dominance of unmanned surface vehicles due to versatility in surveillance, mapping, and patrol missions. These platforms benefit from lower deployment complexity and broader regulatory acceptance. Unmanned underwater vehicles maintain steady demand driven by seabed mapping, mine countermeasure activities, and subsea inspections. Hybrid platforms are emerging gradually, supported by defense experimentation and multi-mission requirements. Fleet procurement decisions increasingly favor modular systems enabling payload interchangeability and endurance optimization. Growth momentum is influenced by mission flexibility, endurance capabilities, and integration compatibility with existing naval systems.

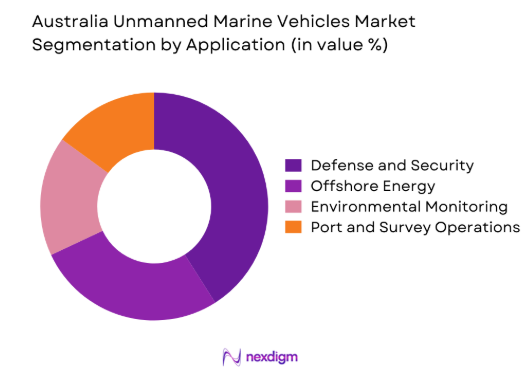

By Application

Defense and maritime security dominate application adoption due to surveillance, patrol, and threat detection requirements. Offshore energy inspection remains a key commercial application, driven by asset monitoring and reduced human intervention. Environmental monitoring adoption is increasing, supported by sustainability initiatives and marine research programs. Port management and hydrographic surveying continue to expand as automation improves efficiency. Application growth is influenced by operational risk reduction, regulatory acceptance, and mission endurance capabilities.

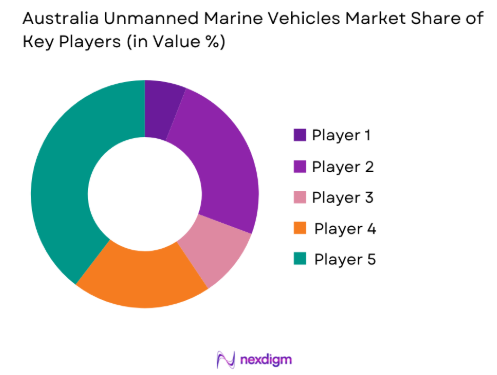

Competitive Landscape

The competitive environment is characterized by defense-focused manufacturers, marine robotics specialists, and system integrators with strong regional presence. Market participants differentiate through autonomy software, sensor integration depth, and long-term service capability. Partnerships with defense agencies and offshore operators remain critical for sustained positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Austal | 1988 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1994 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Defence | 1814 | Norway | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Unmanned Marine Vehicles Market Analysis

Growth Drivers

Rising maritime surveillance and border security requirements

Australia’s extensive coastline requires persistent monitoring to address illegal activities and maritime security threats. Government agencies increased deployment of autonomous patrol systems during 2024 and 2025. Unmanned platforms enable continuous operations with reduced personnel risk exposure. Surveillance efficiency improves through persistent sensor coverage and autonomous navigation. Integration with coastal command systems enhances situational awareness. Defense modernization programs continue allocating resources toward maritime autonomy. Platform reliability improvements support extended deployment durations. Interoperability advancements strengthen joint operations across agencies. Demand growth aligns with national security priorities and maritime domain awareness initiatives. Operational scalability remains a key factor accelerating procurement momentum.

Expansion of offshore energy exploration and inspection activity

Offshore energy projects require continuous monitoring of subsea assets and pipelines. Unmanned vehicles reduce inspection costs while improving data accuracy and safety. Deployment frequency increased across offshore basins during 2024 and 2025. Operators increasingly rely on autonomous platforms for deepwater inspection tasks. Improved sensor payloads enable real-time structural analysis. Regulatory compliance requirements further drive adoption of unmanned inspection solutions. Reduced human intervention enhances operational efficiency and safety performance. Integration with digital twin platforms supports predictive maintenance strategies. Offshore asset aging further reinforces inspection demand growth. Market momentum benefits from energy sector digitalization initiatives.

Challenges

High system acquisition and integration costs

Advanced unmanned marine systems require significant upfront investment. Integration with existing naval and commercial systems increases total ownership complexity. High specification sensors and navigation technologies raise procurement thresholds. Budget constraints limit adoption among smaller operators. Maintenance and lifecycle support add further cost pressure. Customization requirements increase engineering complexity. Certification and testing processes extend deployment timelines. Limited economies of scale affect unit pricing structures. Procurement cycles remain lengthy due to compliance obligations. Cost sensitivity impacts broader commercial market penetration.

Regulatory constraints on autonomous marine operations

Autonomous marine operations face evolving regulatory frameworks across jurisdictions. Certification processes remain inconsistent for unmanned deployment. Maritime safety authorities impose strict operational guidelines. Lack of harmonized standards restricts cross-border operations. Regulatory approvals often delay project timelines significantly. Liability frameworks remain under development for autonomous incidents. Data security and communication compliance requirements add complexity. Testing permissions vary across regional waters. Regulatory uncertainty slows commercial adoption rates. Policy evolution continues to influence deployment scalability.

Opportunities

Expansion of autonomous maritime patrol programs

Government agencies increasingly prioritize persistent maritime surveillance capabilities. Autonomous patrol platforms reduce manpower dependency and operational costs. Patrol coverage expansion supports border security objectives. Integration with aerial and satellite systems enhances detection capabilities. Multi-mission adaptability improves fleet utilization efficiency. Endurance improvements enable longer mission durations. Coastal monitoring programs create recurring procurement opportunities. Technology maturity increases confidence among defense stakeholders. Interagency collaboration accelerates deployment pipelines. Strategic investments support sustained program expansion.

Growing demand for persistent ocean monitoring solutions

Environmental monitoring requirements continue increasing across coastal regions. Autonomous systems provide continuous data collection capabilities. Climate observation programs rely on unmanned platforms for scalability. Research institutions adopt autonomous systems for long-duration missions. Data-driven ocean management benefits from high-frequency monitoring. Sensor advancements improve measurement accuracy and reliability. Long-term deployment reduces operational cost burdens. Integration with analytics platforms enhances decision-making. Government-backed monitoring initiatives drive adoption momentum. Sustainability policies further reinforce demand growth.

Future Outlook

The market is expected to witness sustained growth driven by defense modernization and expanding offshore monitoring requirements. Technological maturity in autonomy and sensor integration will accelerate deployment scalability. Regulatory frameworks are likely to evolve toward greater acceptance of unmanned operations. Collaboration between government and industry will remain a key growth enabler. Demand diversification across commercial and environmental applications will strengthen long-term market resilience.

Major Players

- Austal

- BAE Systems Australia

- Saab Australia

- Kongsberg Defence

- Thales Australia

- Ocean Infinity

- L3Harris Technologies

- Teledyne Marine

- Atlas Elektronik

- Fugro

- Subsea 7

- ECA Group

- Liquid Robotics

- BlueZone Group

- RANMETRIC

Key Target Audience

- Australian Department of Defence

- Australian Border Force

- Royal Australian Navy

- Offshore energy operators

- Port authorities

- Marine research organizations

- Investments and venture capital firms

- Australian Maritime Safety Authority

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined through platform classification, application mapping, and deployment use cases. Key performance indicators included fleet type, autonomy level, and operational usage. Data parameters were aligned with regulatory and operational benchmarks.

Step 2: Market Analysis and Construction

Market structure was developed using bottom-up assessment of deployment trends and procurement activities. Application demand mapping was conducted across defense, energy, and research segments.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through interviews with industry participants, technology providers, and maritime operators. Operational assumptions were tested against deployment and procurement patterns.

Step 4: Research Synthesis and Final Output

Insights were consolidated through data triangulation and consistency checks. Final analysis integrated qualitative and quantitative findings to ensure accuracy and relevance.

- Executive Summary

- Research Methodology (Market Definitions and Scope Delineation for Unmanned Marine Platforms, Platform and Mission-Based Segmentation Framework Development, Bottom-Up Fleet and Deployment Level Market Sizing, Revenue Attribution Across Defense and Commercial Programs, Primary Validation with Naval Operators and OEMs, Data Triangulation Across Procurement, Trials, and Deployment Records)

- Definition and Scope

- Market evolution

- Usage and operational deployment pathways

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and maritime compliance environment

- Growth Drivers

Rising maritime surveillance and border security requirements

Expansion of offshore energy exploration and inspection activity

Increasing adoption of autonomous systems to reduce operational risk

Advancements in autonomy, navigation, and sensor fusion

Government-backed defense modernization programs - Challenges

High system acquisition and integration costs

Regulatory constraints on autonomous marine operations

Limited interoperability standards across platforms

Harsh marine operating environments affecting reliability

Shortage of skilled operators and system integrators - Opportunities

Expansion of autonomous maritime patrol programs

Growing demand for persistent ocean monitoring solutions

Integration of AI-based navigation and analytics

Commercialization of unmanned survey services

Public–private partnerships in maritime security - Trends

Increased deployment of long-endurance platforms

Rising adoption of hybrid propulsion systems

Growth in modular payload architectures

Emphasis on swarming and coordinated operations

Integration with satellite and ISR networks - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned Surface Vehicles

Unmanned Underwater Vehicles

Hybrid and Multi-Domain Platforms - By Application (in Value %)

Defense and Maritime Security

Hydrographic Survey and Mapping

Offshore Energy Inspection

Environmental Monitoring

Port and Harbor Management - By Technology Architecture (in Value %)

Remotely Operated Systems

Semi-Autonomous Systems

Fully Autonomous Systems - By End-Use Industry (in Value %)

Defense and Naval Forces

Offshore Oil and Gas

Marine Research Institutions

Port Authorities

Commercial Survey Operators - By Connectivity Type (in Value %)

Satellite Communication

Acoustic Communication

Line-of-Sight RF Communication

Hybrid Communication Systems - By Region (in Value %)

New South Wales

Western Australia

Queensland

Victoria

Rest of Australia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform Capability, Autonomy Level, Endurance, Payload Flexibility, Integration Capability, After-Sales Support, Regulatory Compliance, Cost Structure)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Austal

BAE Systems Australia

Saab Australia

Kongsberg Defence Australia

L3Harris Technologies

Thales Australia

Ocean Infinity

BlueZone Group

RANMETRIC

ECA Group

Liquid Robotics

Teledyne Marine

Atlas Elektronik

Fugro

Subsea 7

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035