Market Overview

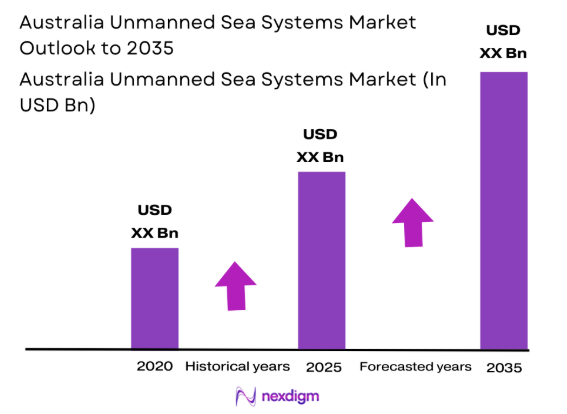

The Australia Unmanned Sea Systems market current size stands at around USD ~ million and reflects steady adoption across defense and offshore sectors. Activity levels increased during 2024 and 2025 due to expanding maritime surveillance programs and autonomous trials. Fleet deployments rose as coastal monitoring requirements intensified. System integration accelerated through defense modernization initiatives. Technology readiness improved with expanded testing programs. Domestic manufacturing participation increased through industrial partnerships. Capability upgrades focused on endurance and autonomous navigation. Procurement cycles lengthened due to regulatory evaluation requirements.

Western Australia and New South Wales dominate deployments due to naval infrastructure and offshore operations concentration. South Australia supports system testing and platform integration activities. Queensland contributes through port security and environmental monitoring programs. Coastal surveillance demand drives regional clustering of operations. Policy support for maritime autonomy strengthens regional ecosystems. Research institutions support trials and technology validation. Industrial hubs align with defense logistics corridors. Infrastructure maturity influences adoption intensity across regions.

Market Segmentation

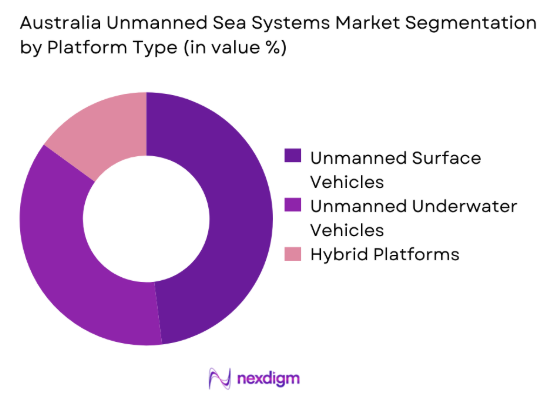

By Platform Type

The platform landscape is dominated by unmanned surface vehicles supporting surveillance and patrol missions across extensive maritime zones. Underwater systems are increasingly adopted for seabed mapping and mine countermeasure activities. Hybrid platforms combining surface and subsurface capabilities are emerging within defense programs. Operational flexibility and endurance determine platform selection preferences. Government agencies prioritize modular systems supporting rapid reconfiguration. Commercial operators focus on reliability and payload compatibility. Technological advancements have improved autonomy levels and mission persistence. Platform demand aligns strongly with maritime security and offshore energy applications. Lifecycle support capability influences procurement decisions significantly. Platform diversification continues as mission complexity increases.

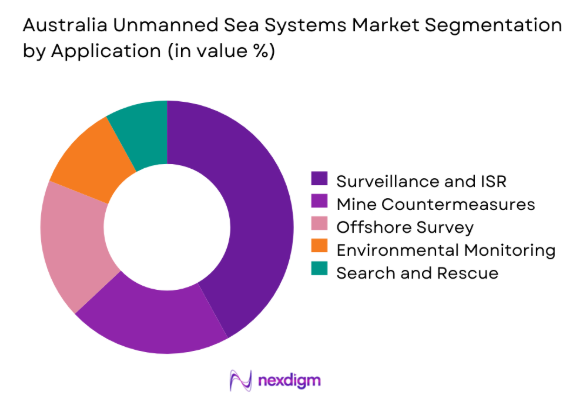

By Application

Surveillance and intelligence applications represent the largest demand segment driven by border security and maritime domain awareness requirements. Mine countermeasure operations continue expanding through naval modernization initiatives. Offshore inspection and hydrographic survey applications show consistent growth. Environmental monitoring supports regulatory compliance and ecosystem management. Search and rescue support applications are gaining operational relevance. Defense agencies emphasize multi-mission adaptability across applications. Commercial utilization focuses on data acquisition efficiency. Application diversification enhances platform utilization rates. Integration with command systems improves operational effectiveness. Demand patterns reflect evolving maritime risk profiles.

Competitive Landscape

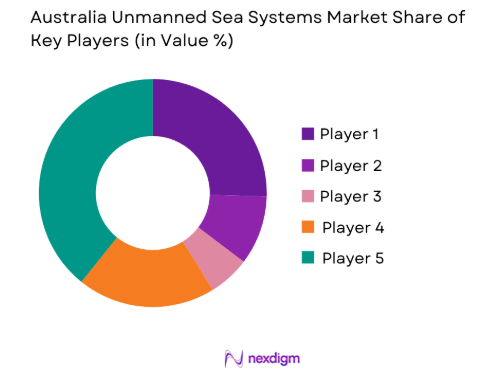

The competitive environment is characterized by a mix of domestic defense contractors and international technology providers. Companies compete on platform reliability, autonomy capabilities, and integration readiness. Strategic partnerships support local manufacturing and sustainment objectives.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Austal | 1988 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1994 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2000 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Unmanned Sea Systems Market Analysis

Growth Drivers

Fleet modernization programs support replacement of legacy manned platforms.

Rising maritime border surveillance requirements continue to drive procurement of autonomous sea platforms across Australian defense agencies. Increased operational tempo in coastal monitoring activities has expanded deployment frequency across multiple maritime zones. Government emphasis on persistent intelligence collection strengthens demand for unmanned maritime solutions. Autonomous systems reduce personnel exposure in high risk maritime environments. Technological maturity has improved mission reliability and endurance. Integration with naval command systems enhances operational effectiveness. Demand aligns with expanding maritime security mandates. Operational cost efficiency supports long term adoption. Defense budgets prioritize unmanned capabilities for future readiness.

Increasing naval modernization and autonomy programs

Defense modernization initiatives emphasize autonomous capability development across surface and subsurface platforms. Naval force structure reviews prioritize unmanned integration for force multiplication. Technology trials demonstrate improved mission persistence and reduced logistical burden. Investment focus supports autonomous navigation and sensor fusion systems. Capability roadmaps include multi-domain interoperability objectives. Operational doctrine increasingly incorporates unmanned assets for surveillance roles. Fleet planners emphasize scalability and modular deployment options. Program timelines reflect accelerated acquisition cycles. Indigenous capability development remains a strategic priority. Autonomy adoption aligns with regional maritime security needs.

Challenges

High development and integration costs

System development requires significant engineering investment for maritime certification and endurance validation. Integration with existing naval platforms increases complexity and program timelines. Specialized sensors elevate acquisition and lifecycle management costs. Testing requirements extend deployment schedules. Customization demands increase engineering resource allocation. Software validation imposes additional compliance burdens. Infrastructure upgrades are necessary for autonomous operations. Budget limitations constrain rapid fleet expansion. Cost control remains a key procurement consideration.

Limited interoperability standards

Lack of unified standards restricts seamless integration across platforms and command systems. Proprietary architectures limit cross-platform communication effectiveness. Interoperability challenges complicate joint operations with allied forces. Standardization gaps increase system integration timelines. Data exchange protocols require harmonization. Regulatory alignment remains inconsistent across jurisdictions. Testing interoperability requires extended validation cycles. Operational inefficiencies arise from fragmented system architectures. Integration costs escalate due to customization requirements. Standard development remains an ongoing industry challenge.

Opportunities

Expansion of unmanned naval fleets under defense modernization

Defense modernization programs create sustained demand for autonomous maritime platforms. Fleet expansion strategies prioritize unmanned asset integration. Long term capability planning supports continuous procurement cycles. Operational doctrine increasingly favors unmanned systems for surveillance missions. Indigenous manufacturing capabilities strengthen domestic supply chains. Technology transfer agreements enhance platform development capacity. Multi-year programs provide procurement stability. Fleet expansion improves maritime domain awareness coverage. Training frameworks evolve to support unmanned operations. Strategic alignment supports sustained market growth.

Growing use in offshore renewable energy monitoring

Offshore energy infrastructure expansion increases demand for autonomous inspection solutions. Unmanned systems improve inspection efficiency and safety performance. Continuous monitoring supports asset integrity management. Data collection requirements drive sensor integration innovation. Renewable projects require persistent maritime surveillance. Autonomous platforms reduce operational downtime. Environmental compliance monitoring supports regulatory adherence. Offshore deployment capabilities enhance system utilization rates. Energy sector partnerships expand commercial applications. Market diversification strengthens long term growth prospects.

Future Outlook

The Australia unmanned sea systems market is expected to maintain steady expansion driven by defense modernization and offshore activity growth. Continued investment in autonomous technologies will enhance operational capabilities. Policy support for indigenous manufacturing will strengthen domestic participation. Integration of artificial intelligence will improve mission efficiency. Collaboration between defense and commercial sectors will accelerate technology adoption.

Major Players

- Austal

- BAE Systems Australia

- Saab Australia

- Thales Australia

- L3Harris Technologies

- Kongsberg Maritime

- QinetiQ

- Teledyne Marine

- Atlas Elektronik

- Anduril Australia

- Elbit Systems

- Ocean Infinity

- Fugro

- BlueZone Group

- Boeing Defence Australia

Key Target Audience

- Australian Department of Defence

- Royal Australian Navy

- Australian Border Force

- Offshore energy operators

- Maritime security agencies

- Port authorities

- Investments and venture capital firms

- Australian Maritime Safety Authority

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined using platform classifications, application areas, and deployment environments. Data inputs included operational usage patterns and procurement frameworks. Variables were aligned with defense and commercial adoption metrics.

Step 2: Market Analysis and Construction

Segment-level assessment was conducted using deployment trends and technology maturity indicators. Demand drivers were evaluated across defense and commercial sectors. Assumptions were validated against operational benchmarks.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists provided insights on technology adoption and regulatory dynamics. Validation focused on operational feasibility and deployment scalability. Feedback refined segmentation and growth assumptions.

Step 4: Research Synthesis and Final Output

Findings were consolidated through cross-verification of qualitative and quantitative inputs. Analytical consistency was maintained across all sections. Final outputs reflect structured interpretation of market dynamics

- Executive Summary

- Research Methodology (Market Definitions and platform scope mapping, Unmanned maritime system taxonomy development, Program-wise and platform-wise market sizing logic, Defence and commercial revenue attribution modeling, Expert interviews with naval integrators and operators, Data triangulation using procurement data and fleet disclosures, Assumptions based on regulatory and mission profiles)

- Definition and Scope

- Market evolution

- Usage and operational deployment landscape

- Ecosystem structure

- Supply chain and integration framework

- Regulatory and defense procurement environment

- Growth Drivers

Rising maritime border surveillance requirements

Increasing naval modernization and autonomy programs

Expansion of offshore energy and seabed mapping activities

Technological advances in autonomous navigation and AI

Growing defense-industry partnerships and local manufacturing - Challenges

High development and integration costs

Limited interoperability standards

Regulatory constraints on autonomous operations

Cybersecurity and data integrity risks

Complex maintenance and lifecycle management - Opportunities

Expansion of unmanned naval fleets under defense modernization

Growing use in offshore renewable energy monitoring

Development of indigenous autonomous technologies

Increased export potential to Indo-Pacific nations

Advancements in swarm and AI-enabled operations - Trends

Shift toward multi-mission unmanned platforms

Rising adoption of autonomous underwater vehicles

Integration of AI-based navigation and analytics

Growing collaboration between defense and private sector

Emphasis on modular and scalable system designs - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Unmanned Surface Vehicles

Unmanned Underwater Vehicles

Hybrid Autonomous Platforms - By Application (in Value %)

ISR and Surveillance

Mine Countermeasures

Anti-Submarine Warfare Support

Hydrographic and Oceanographic Survey

Maritime Security and Patrol - By Technology Architecture (in Value %)

Remotely Operated Systems

Semi-Autonomous Systems

Fully Autonomous Systems - By End-Use Industry (in Value %)

Defense and Naval Forces

Homeland Security

Offshore Energy

Marine Research Institutions

Commercial Survey Operators - By Connectivity Type (in Value %)

Line of Sight Communication

Satellite Communication

Hybrid Communication Networks - By Region (in Value %)

New South Wales

Western Australia

Queensland

South Australia

Other Regions

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Platform capability, Autonomy level, Integration readiness, Defense certification, Geographic presence, Technology maturity, Service support, Pricing flexibility)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Austal

Anduril Australia

BAE Systems Australia

Boeing Defence Australia

Saab Australia

Thales Australia

L3Harris Technologies

Kongsberg Maritime

Atlas Elektronik

QinetiQ

Teledyne Marine

Ocean Infinity

Fugro

Elbit Systems

BlueZone Group

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035