Market Overview

The Australia Unmanned Surface Vehicle market current size stands at around USD ~ million, supported by increasing defense procurement activity and expanding offshore operational requirements. Deployment volumes increased steadily across coastal surveillance, hydrographic mapping, and autonomous patrol functions, with fleet utilization rates rising during the last two operational cycles. Technology adoption accelerated through platform upgrades, enhanced autonomy software, and sensor integration. Government-backed trials and maritime modernization programs further contributed to operational acceptance, enabling consistent demand across defense and commercial maritime operators.

Operational concentration remains highest along eastern and western coastlines, supported by naval infrastructure, port density, and offshore energy assets. Sydney, Perth, and Brisbane act as deployment and testing hubs due to access to naval bases, research centers, and industrial shipyards. Policy frameworks encouraging autonomous maritime systems and coastal security investments strengthen ecosystem maturity. Growing collaboration between defense agencies, technology providers, and port authorities continues to reinforce long-term deployment stability across regional waters.

Market Segmentation

By Fleet Type

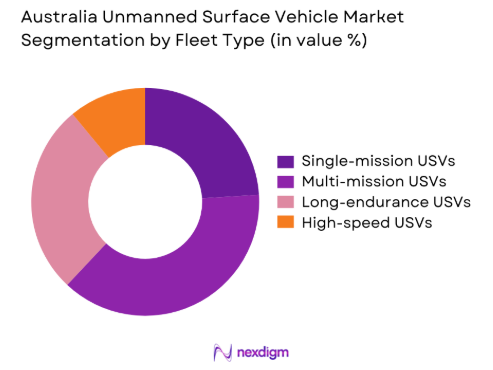

The fleet structure is dominated by multi-mission and long-endurance unmanned surface vehicles designed for extended surveillance and maritime monitoring. Defense agencies favor modular platforms capable of integrating multiple payloads, while commercial operators prioritize endurance and fuel efficiency. Single-mission units remain relevant for environmental monitoring and hydrographic surveys. Fleet composition is increasingly influenced by mission flexibility, autonomous endurance, and interoperability with naval command systems. Continuous upgrades in hull design and propulsion efficiency further shape procurement preferences across fleet categories.

By Application

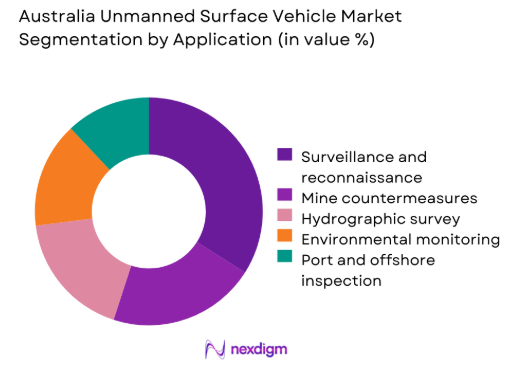

Surveillance and reconnaissance dominate application demand due to persistent maritime security requirements and extended coastline monitoring needs. Mine countermeasure operations and hydrographic surveying follow, driven by naval modernization and offshore infrastructure development. Environmental monitoring applications continue expanding with increased focus on marine ecosystem protection. Commercial inspection and port security applications are gaining relevance as automation reduces operational risks and improves efficiency. Application diversification is supported by improved sensor fusion and real-time communication systems.

Competitive Landscape

The competitive landscape reflects a mix of defense-focused manufacturers and specialized autonomous system developers. Market participation is shaped by platform reliability, integration capability, regulatory compliance, and service support depth. Strategic partnerships with naval agencies and technology integrators strengthen competitive positioning. Product differentiation increasingly depends on autonomy software maturity, endurance capability, and modular payload compatibility.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Austal | 1988 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 1895 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Kongsberg Maritime | 1814 | Norway | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Unmanned Surface Vehicle Market Analysis

Growth Drivers

Rising maritime surveillance requirements

Maritime security requirements expanded due to increased coastal monitoring needs and heightened awareness of unauthorized maritime activity. Naval forces prioritized unmanned systems to extend patrol coverage without increasing crew exposure. Autonomous surface vehicles enabled persistent operations across extended maritime zones. Enhanced sensor payloads improved detection accuracy under variable environmental conditions. Fleet operators increasingly relied on unmanned platforms for endurance missions. Deployment frequency increased steadily during recent operational cycles. Integration with command systems improved situational awareness across maritime domains. Budget allocations favored scalable autonomous assets over manned vessels. Operational efficiency gains supported continued adoption momentum. Strategic defense planning reinforced sustained surveillance investments.

Increasing naval modernization initiatives

Naval modernization programs emphasized fleet digitization and autonomous capability development across surface platforms. Unmanned systems were integrated to complement traditional naval assets. Modernization efforts focused on enhancing situational awareness and response speed. Autonomous platforms reduced operational strain on crewed vessels. Interoperability with legacy command systems remained a priority. Technology refresh cycles accelerated adoption of advanced navigation algorithms. Fleet planners emphasized modularity and upgradeability. Investment alignment supported long-term platform sustainability. Operational doctrines increasingly incorporated unmanned missions. Modernization roadmaps continued reinforcing demand consistency.

Challenges

High system integration and deployment costs

Integration complexity remains a challenge due to diverse mission requirements and platform configurations. System customization often requires specialized engineering resources. Deployment readiness depends on compatibility with existing naval infrastructure. Testing and certification cycles increase project timelines. Maintenance logistics add operational burden for fleet operators. Interoperability challenges persist across communication protocols. Training requirements increase operational overhead. Infrastructure readiness varies across deployment locations. Budget constraints limit rapid scaling potential. Cost management remains a persistent operational concern.

Complex regulatory and certification requirements

Regulatory frameworks governing autonomous maritime operations continue evolving. Certification processes require extensive validation and compliance documentation. Cross-jurisdictional operations introduce additional regulatory complexity. Safety standards mandate rigorous testing protocols. Approval timelines affect deployment schedules. Policy alignment between civil and defense authorities remains inconsistent. Data security compliance introduces operational constraints. Environmental regulations impact deployment planning. Regulatory uncertainty slows commercialization efforts. Compliance costs influence procurement decisions.

Opportunities

Expansion of autonomous port operations

Port authorities increasingly adopt unmanned platforms for monitoring and inspection tasks. Automation reduces operational risks in congested harbor environments. Demand for continuous surveillance supports deployment growth. Integration with port management systems enhances efficiency. Autonomous inspection reduces downtime and labor dependency. Ports benefit from real-time data acquisition. Expansion aligns with smart port initiatives. Operational scalability improves asset utilization. Technology maturity supports broader adoption. Long-term infrastructure modernization creates sustained opportunity.

Increased defense procurement programs

Defense agencies continue expanding unmanned system acquisition programs. Strategic emphasis on maritime domain awareness supports sustained demand. Procurement frameworks increasingly include autonomous surface platforms. Capability gaps addressed through rapid technology deployment. Collaborative development programs accelerate innovation cycles. Domestic manufacturing participation strengthens supply chains. Program funding stability enhances market confidence. Operational trials validate system effectiveness. Multi-year procurement plans support vendor planning. Defense modernization remains a key growth catalyst.

Future Outlook

The Australia unmanned surface vehicle market is expected to experience sustained expansion driven by defense modernization, port automation, and autonomous technology maturity. Continued regulatory alignment and infrastructure investment will support broader adoption. Advancements in artificial intelligence and sensor integration will enhance operational capability. Cross-sector collaboration will further strengthen ecosystem resilience through the forecast period.

Major Players

- Austal

- L3Harris Technologies

- BAE Systems

- Thales Group

- Kongsberg Maritime

- Saab Group

- Elbit Systems

- Rheinmetall Defence

- Northrop Grumman

- QinetiQ

- Teledyne Marine

- Atlas Elektronik

- Fugro

- Ocean Infinity

- Lockheed Martin

Key Target Audience

- Australian Department of Defence

- Royal Australian Navy

- Australian Maritime Safety Authority

- Port authorities and harbor operators

- Offshore energy operators

- Maritime security agencies

- Investments and venture capital firms

- State and federal regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key operational, technological, and regulatory variables were identified through analysis of maritime programs and deployment models. Emphasis was placed on platform capabilities, mission types, and adoption drivers.

Step 2: Market Analysis and Construction

Market structure was developed using segmentation analysis, deployment trends, and technology maturity evaluation across operational use cases.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with maritime specialists, defense planners, and autonomous system engineers to ensure practical alignment.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a cohesive framework, ensuring consistency, accuracy, and relevance for strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and Scope Alignment, Platform and Mission Taxonomy Development, Bottom-Up Fleet and Deployment Estimation, Revenue Attribution by Program and Procurement Cycle, Primary Interviews with Naval and Autonomous Systems Experts, Data Triangulation Across Defense, Commercial, and R&D Sources, Assumption Validation Based on Maritime Regulatory Frameworks)

- Definition and Scope

- Market evolution

- Usage and mission deployment landscape

- Ecosystem structure

- Supply chain and system integration flow

- Regulatory and maritime compliance environment

- Growth Drivers

Rising maritime surveillance requirements

Increasing naval modernization initiatives

Growing offshore energy exploration activities

Advancements in autonomous navigation technologies

Demand for cost-efficient unmanned operations - Challenges

High system integration and deployment costs

Complex regulatory and certification requirements

Limited interoperability standards

Cybersecurity and data integrity concerns

Harsh maritime operating conditions - Opportunities

Expansion of autonomous port operations

Increased defense procurement programs

Commercial adoption for offshore inspection

Advancements in AI-enabled navigation

Export potential to Asia-Pacific naval markets - Trends

Shift toward multi-mission platforms

Integration of AI-based navigation systems

Increased endurance and hybrid propulsion adoption

Growing use of swarm-based operations

Rising collaboration between defense and private industry - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Single-mission USVs

Multi-mission USVs

Long-endurance USVs

High-speed interceptor USVs - By Application (in Value %)

Intelligence, surveillance, and reconnaissance

Mine countermeasures

Maritime security and patrol

Hydrographic survey

Environmental monitoring - By Technology Architecture (in Value %)

Remote-operated

Semi-autonomous

Fully autonomous - By End-Use Industry (in Value %)

Defense and naval forces

Offshore energy

Port and harbor authorities

Marine research organizations

Commercial maritime operators - By Connectivity Type (in Value %)

Line-of-sight communication

Satellite communication

Hybrid connectivity systems - By Region (in Value %)

New South Wales

Victoria

Western Australia

Queensland

Rest of Australia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Fleet scalability, Mission versatility, Autonomy level, Integration capability, Regulatory compliance, Cost competitiveness, After-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces

- Detailed Profiles of Major Companies

Austal Limited

L3Harris Technologies

BAE Systems

Thales Group

Kongsberg Maritime

Elbit Systems

Saab Group

Rheinmetall Defence

Northrop Grumman

Ocean Infinity

QinetiQ

Teledyne Marine

Atlas Elektronik

Fugro

Lockheed Martin

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035