Market Overview

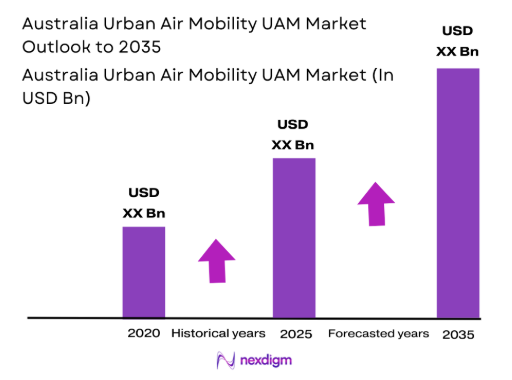

The Australia Urban Air Mobility UAM market current size stands at around USD ~ million and reflects early-stage commercialization supported by test flights and regulatory pilots. Activity levels increased during 2024 and 2025 as multiple eVTOL programs advanced certification readiness and urban trial operations. Fleet deployment volumes remained limited but demonstrated consistent growth across metropolitan corridors. Infrastructure development focused on vertiports, charging systems, and digital traffic management integration. Investment momentum remained stable, driven by public and private collaboration. Market momentum is shaped by technology validation, safety benchmarks, and regulatory alignment.

Urban air mobility development is primarily concentrated across Sydney, Melbourne, and Brisbane due to dense commuter flows and established aviation infrastructure. These regions benefit from advanced airspace management capabilities and early-stage vertiport planning initiatives. Demand concentration is reinforced by congestion levels, airport connectivity needs, and premium mobility demand. State-level transport agencies actively support pilot projects through regulatory sandboxes. The ecosystem is further strengthened by aerospace clusters, defense-linked R&D, and smart city programs. Regional cities are gradually entering planning stages based on intercity connectivity needs.

Market Segmentation

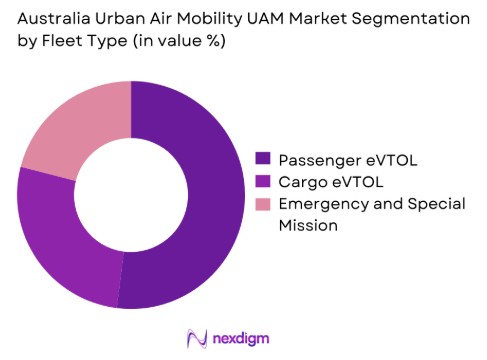

By Fleet Type

Passenger eVTOL aircraft dominate current deployment planning due to strong urban commuting demand and infrastructure compatibility. Cargo and logistics aircraft follow closely, driven by medical supply and express delivery requirements. Emergency and special mission platforms maintain limited but strategic adoption. Passenger-focused fleets benefit from greater investor backing and clearer certification pathways. Operational models emphasize short-range, high-frequency flights. Fleet standardization efforts are increasing to optimize maintenance and safety compliance.

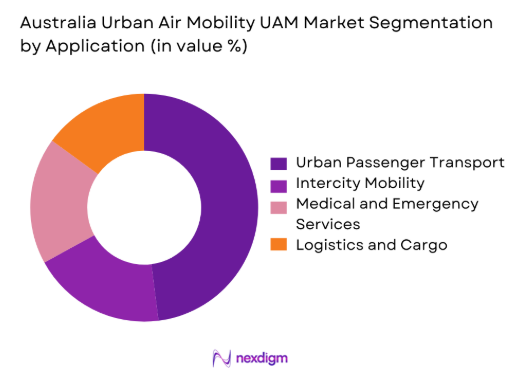

By Application

Urban passenger transport represents the most developed application segment due to traffic congestion and time efficiency advantages. Intercity mobility remains in pilot phases, supported by regional connectivity initiatives. Medical evacuation use cases are expanding, particularly for time-critical services. Logistics applications are gaining attention for high-value and urgent deliveries. Tourism-based aerial mobility is emerging in select metropolitan regions. Application diversification continues as regulatory clarity improves.

Competitive Landscape

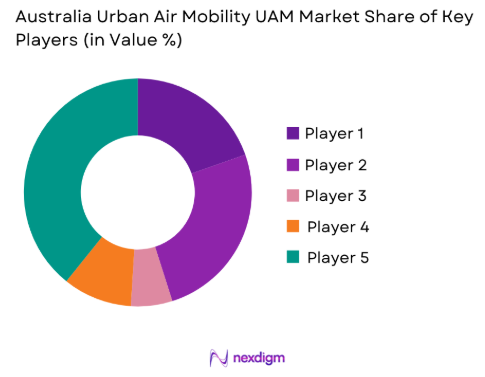

The Australia Urban Air Mobility market features a developing competitive structure characterized by technology partnerships and regulatory alignment strategies. Market participants focus on certification progress, local partnerships, and infrastructure collaboration. Competitive differentiation is driven by aircraft readiness, safety compliance, and integration capabilities rather than pricing. Strategic collaborations with airport authorities and state governments shape positioning. The ecosystem remains moderately concentrated with increasing foreign participation.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Joby Aviation | 2009 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Lilium | 2015 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Volocopter | 2011 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Archer Aviation | 2018 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Eve Air Mobility | 2020 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Urban Air Mobility UAM Market Analysis

Growth Drivers

Rising urban congestion and demand for rapid mobility

Urban congestion levels intensified across major Australian cities during 2024, increasing commuter demand for time-efficient mobility alternatives. Road-based transport systems experienced rising saturation, reducing reliability during peak hours. Urban populations continued expanding around metropolitan centers, elevating pressure on surface infrastructure. Travel time reduction emerged as a primary value proposition for air mobility solutions. Businesses increasingly prioritized productivity-linked mobility options for executives and essential travel. Consumer acceptance improved as demonstration flights increased visibility and confidence. Infrastructure planning aligned with congestion mitigation strategies at city levels. Urban mobility policies increasingly recognized aerial transit as complementary infrastructure. Municipal governments supported feasibility assessments and route planning initiatives. These factors collectively strengthened demand momentum across metropolitan regions.

Government support for advanced air mobility programs

Federal and state governments expanded aviation modernization frameworks during 2024 and 2025. Regulatory agencies increased engagement with manufacturers to streamline certification pathways. Funding programs supported airspace integration research and safety validation initiatives. Public sector backing reduced uncertainty for private investment decisions. Government-led pilot programs accelerated operational testing across urban corridors. Policy alignment with sustainability goals strengthened support for electric aircraft deployment. Collaboration between transport authorities and aviation regulators intensified. Regulatory sandboxes enabled controlled deployment of trial services. Long-term transport strategies increasingly incorporated air mobility considerations. These initiatives collectively enhanced market confidence and development pace.

Challenges

Regulatory and certification delays

Certification complexity remains a major barrier to commercial deployment across Australia. Safety validation processes require extensive testing and documentation. Regulatory harmonization with international aviation standards creates additional timelines. Approval processes for autonomous or semi-autonomous operations remain undefined. Airspace integration challenges slow route authorization approvals. Coordination between federal and state authorities adds procedural layers. Infrastructure certification also lags aircraft readiness. Public safety assurance requirements elevate compliance burdens. Delays increase capital exposure for developers. These factors constrain rapid commercialization timelines.

High capital and infrastructure costs

Development of vertiports requires significant upfront infrastructure investment. Charging and energy systems demand grid upgrades and planning approvals. Aircraft acquisition costs remain high due to limited production scale. Maintenance facilities require specialized tooling and trained personnel. Insurance and liability coverage costs add financial complexity. Urban land availability constraints increase development expenses. Financing challenges persist for early-stage operators. Return timelines remain uncertain during early deployment phases. Capital intensity restricts rapid market scaling. These barriers slow ecosystem maturation.

Opportunities

Commercialization of air taxi services

Urban air taxi services represent the most immediate commercial opportunity. High-income commuter segments demonstrate strong adoption potential. Business travel use cases support premium pricing structures. Tourism-based aerial transport enhances city connectivity offerings. Demonstration routes build consumer familiarity and acceptance. Operator partnerships with airports enable efficient integration. Fleet scalability improves as certification progresses. Public visibility strengthens brand trust in aerial mobility. Early mover advantages exist in route network establishment. Commercial services anchor broader ecosystem development.

Integration with multimodal transport networks

Air mobility integration with rail and road networks enhances overall transport efficiency. Seamless ticketing and scheduling improve user convenience. Urban planning increasingly considers intermodal connectivity. Data sharing platforms enable optimized passenger flows. Multimodal hubs support faster adoption of aerial services. Collaboration with transit authorities reduces operational friction. Integrated infrastructure increases utilization rates. Connectivity improves last-mile accessibility for commuters. Smart city initiatives support such integration models. These synergies expand long-term adoption potential.

Future Outlook

The Australia Urban Air Mobility market is expected to progress steadily through phased commercialization toward 2035. Regulatory clarity, infrastructure readiness, and public acceptance will shape deployment speed. Urban passenger services are likely to dominate early adoption. Technology maturation and policy support will enable broader integration. Long-term growth depends on cost optimization and scalable operational models.

Major Players

- Joby Aviation

- Lilium

- Volocopter

- Archer Aviation

- Eve Air Mobility

- Airbus Urban Mobility

- Boeing NeXt

- Wisk Aero

- EHang

- AMSL Aero

- Skyports Infrastructure

- Ferrovial Vertiports

- Urban Aeronautics

- Swoop Aero

- Embraer

Key Target Audience

- Urban air mobility service operators

- Aircraft and eVTOL manufacturers

- Airport authorities and infrastructure developers

- State transport departments

- Civil aviation regulatory authorities

- Smart city development agencies

- Investments and venture capital firms

- Government and regulatory bodies including CASA and state transport ministries

Research Methodology

Step 1: Identification of Key Variables

Market boundaries, operational definitions, technology categories, and application scope were defined through industry mapping. Regulatory frameworks and infrastructure readiness factors were incorporated to ensure relevance. Key demand drivers and adoption barriers were identified.

Step 2: Market Analysis and Construction

Market structure was developed using operational data, deployment trends, and ecosystem relationships. Segmentation logic was aligned with fleet usage, application, and regional activity. Assumptions were validated against deployment timelines.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, aviation planners, and regulatory stakeholders provided validation inputs. Assumptions were refined through iterative feedback loops. Scenario consistency was checked against policy and infrastructure developments.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework. Data consistency and logical coherence were verified. Outputs were aligned with market dynamics and future development trajectories.

- Executive Summary

- Research Methodology (Market Definitions and UAM operational scope mapping, aircraft and service taxonomy development for urban air mobility, bottom-up fleet and revenue estimation using vertiport and route modeling, pricing and cost structure validation through OEM and operator inputs, primary interviews with eVTOL developers and aviation regulators, data triangulation using flight testing data and infrastructure rollout plans, market assumptions aligned to Australian airspace and certification timelines)

- Definition and scope

- Market evolution and maturity pathway

- Urban air mobility ecosystem structure

- Value chain and infrastructure framework

- Regulatory and certification environment

- Integration with urban transport systems

- Growth Drivers

Rising urban congestion and demand for rapid mobility

Government support for advanced air mobility programs

Advancements in electric propulsion and battery systems

Growing investment in smart city infrastructure

Increasing focus on low-emission transportation - Challenges

Regulatory and certification delays

High capital and infrastructure costs

Airspace integration and traffic management complexity

Public acceptance and safety concerns

Limited charging and vertiport infrastructure - Opportunities

Commercialization of air taxi services

Integration with multimodal transport networks

Defense and emergency response applications

Public-private partnerships for vertiport development

Advancements in autonomous flight systems - Trends

Acceleration of eVTOL prototype testing

Partnerships between OEMs and infrastructure developers

Development of dedicated UAM corridors

Adoption of digital air traffic management systems

Focus on noise reduction and sustainability - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Passenger eVTOL aircraft

Cargo and logistics eVTOL

Air ambulance and emergency response aircraft

Surveillance and special mission platforms - By Application (in Value %)

Urban passenger transport

Intercity and regional mobility

Medical evacuation and emergency services

Cargo and last-mile logistics

Tourism and charter services - By Technology Architecture (in Value %)

Electric vertical takeoff and landing (eVTOL)

Hybrid-electric VTOL

Autonomous and semi-autonomous platforms - By End-Use Industry (in Value %)

Commercial mobility operators

Logistics and e-commerce providers

Healthcare and emergency services

Government and defense agencies

Tourism and aviation service providers - By Connectivity Type (in Value %)

5G-enabled flight management

Satellite-based navigation and communication

Integrated UTM and ATM systems

Edge and cloud-based command platforms - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

Rest of Australia

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (fleet size, technology readiness level, certification progress, pricing strategy, geographic presence, partnership ecosystem, operational readiness, product portfolio breadth)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Porter’s Five Forces Analysis

- Detailed Profiles of Major Companies

Joby Aviation

Lilium GmbH

Volocopter

Archer Aviation

EHang

Wisk Aero

Airbus Urban Mobility

Boeing NeXt

Eve Air Mobility

Embraer

AMSL Aero

Swoop Aero

Skyports Infrastructure

Ferrovial Vertiports

Urban Aeronautics

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035