Market Overview

The Australia vehicle intercom system market current size stands at around USD ~ million, reflecting stable deployment across defense, mining, and emergency vehicle fleets nationwide. During 2024 and 2025, system installations increased across ~ vehicles, driven by platform upgrades, retrofit programs, and communication digitization initiatives. Installed base expansion is supported by longer vehicle lifecycles, increasing crew sizes, and operational safety mandates. Average system configurations continue evolving toward modular digital architectures supporting multi-channel voice and data communication.

Demand concentration is strongest in Western Australia and Queensland due to mining operations, while defense-driven adoption centers around New South Wales, Victoria, and South Australia. These regions benefit from mature defense infrastructure, vehicle integration facilities, and policy-backed modernization programs. Emergency services adoption remains urban-centric, supported by state-level safety investments. Ecosystem maturity is reinforced by local system integrators, maintenance hubs, and long-term service contracts aligned with regulatory compliance frameworks.

Market Segmentation

By Fleet Type

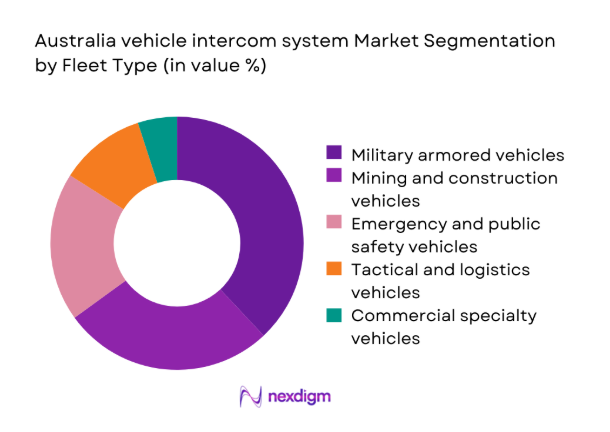

Military armored and tactical vehicles dominate adoption due to mission-critical communication requirements, extended deployment cycles, and continuous modernization initiatives. Mining and construction fleets follow closely, driven by hazardous operating environments demanding reliable crew coordination. Emergency and public safety vehicles maintain steady uptake through state procurement programs emphasizing interoperability and resilience. Commercial specialty vehicles contribute limited volumes, primarily through customized applications. Fleet dominance is shaped by vehicle density, operational risk profiles, and long-term maintenance expectations.

By Technology Architecture

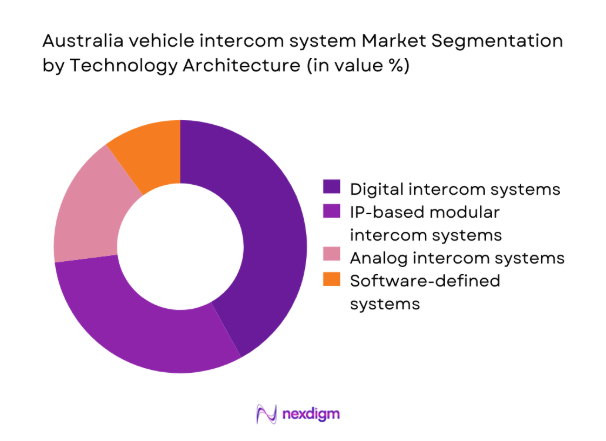

Digital intercom systems lead adoption due to enhanced audio clarity, scalability, and compatibility with modern vehicle electronics. IP-based modular systems are gaining momentum as fleets prioritize software-defined upgrades and system interoperability. Analog systems persist mainly within legacy platforms where replacement cycles remain extended. Technology selection reflects lifecycle cost considerations, integration complexity, and future-proofing priorities across fleet operators seeking adaptable communication frameworks.

Competitive Landscape

The competitive landscape is characterized by a mix of global defense communication specialists and regionally embedded system integrators. Market participation emphasizes ruggedization expertise, long-term service capability, and compliance readiness for defense and industrial deployments.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Australia vehicle intercom system Market Analysis

Growth Drivers

Rising defense modernization and armored vehicle upgrades

Defense modernization programs continue prioritizing secure onboard communication systems across armored fleets supporting complex operational coordination requirements. Platform upgrades during 2024 and 2025 accelerated replacement of legacy analog systems with digitally integrated intercom architectures. Intercom systems increasingly align with broader C4ISR integration objectives across land vehicle platforms. Extended vehicle service lives amplify demand for communication upgrades rather than full vehicle replacement. Interoperability with radios headsets and situational awareness tools remains a core procurement driver. Defense standardization initiatives reinforce consistent adoption across multiple vehicle classes. Increased joint operations require standardized crew communication interfaces across platforms. Training efficiency improves through consistent communication layouts across fleets. System reliability expectations intensify due to operational risk exposure. These factors collectively reinforce sustained defense-led demand momentum.

Expansion of mining operations requiring rugged communication

Mining fleet expansion increases demand for rugged intercom systems capable of operating under extreme noise and environmental stress. Vehicle utilization intensity across mining sites necessitates continuous crew coordination to reduce safety incidents. During 2024 and 2025, new project developments expanded heavy vehicle deployment density. Communication systems support productivity by minimizing downtime and operational errors. Mining operators prioritize systems with high durability and simplified maintenance requirements. Integration with vehicle telemetry improves incident response coordination. Remote site operations require dependable internal communication independent of external networks. Regulatory safety expectations reinforce communication reliability mandates. Fleet standardization across sites supports scalable intercom deployment strategies. Mining-driven demand remains structurally resilient.

Challenges

High system integration and customization costs

System integration costs remain elevated due to vehicle-specific customization and interface compatibility requirements. Each platform demands tailored harnesses mounts and software configurations. During 2024 and 2025, customization complexity increased alongside digital system adoption. Integration timelines extend vehicle downtime during retrofit cycles. Budget constraints delay full-fleet upgrades across non-defense operators. Engineering validation requirements further increase deployment costs. Smaller fleet operators face disproportionate cost burdens. Limited standardization across vehicle OEMs compounds integration challenges. Long approval cycles delay procurement decisions. Cost pressures remain a key adoption restraint.

Interoperability issues across legacy and new platforms

Legacy vehicle platforms often lack standardized interfaces compatible with modern digital intercom architectures. Mixed fleet compositions complicate system harmonization across operational units. During 2024 and 2025, interoperability gaps slowed upgrade programs. Adapter solutions introduce additional points of failure. Training complexity increases when multiple system types coexist. Software updates require careful configuration management. Cross-platform communication limitations impact coordinated operations. Testing requirements expand when integrating new systems with legacy electronics. Documentation inconsistencies hinder maintenance efficiency. Interoperability remains a persistent technical barrier.

Opportunities

Retrofit demand across aging military and mining fleets

Aging fleets present significant retrofit opportunities as replacement cycles remain extended across defense and mining sectors. Communication systems represent cost-effective capability upgrades compared to new vehicle acquisition. During 2024 and 2025, retrofit programs expanded across multiple fleet categories. Modular designs enable phased upgrades minimizing operational disruption. Retrofit demand supports aftermarket service revenues. Fleet audits increasingly prioritize communication performance. Standardized retrofit kits improve deployment efficiency. Local integration partners benefit from sustained retrofit pipelines. Retrofit strategies align with lifecycle extension policies. This opportunity supports long-term market stability.

Adoption of IP-based and software-defined intercoms

IP-based intercom architectures enable scalable upgrades through software rather than hardware replacement. Fleet operators value flexibility to add channels devices and functionalities. During 2024 and 2025, software-defined adoption accelerated across digitally enabled platforms. Centralized configuration simplifies fleet-wide updates. Cybersecurity features enhance communication integrity. Integration with vehicle networks improves data sharing. Future capability expansion becomes more cost efficient. Training requirements reduce through unified interfaces. Vendor ecosystems expand through open architecture designs. IP-based systems represent a transformative growth pathway.

Future Outlook

The market outlook through 2035 reflects steady expansion supported by defense modernization continuity and sustained mining investment cycles. Increasing digitization and software-defined architectures will reshape system design priorities. Regional integration capabilities and lifecycle service models will gain importance. Regulatory emphasis on safety and interoperability will further reinforce structured adoption pathways.

Major Players

- Thales Group

- Rheinmetall Defence

- Saab AB

- Elbit Systems

- L3Harris Technologies

- Leonardo S.p.A.

- Cobham

- David Clark Company

- 3M Peltor

- Zenitel

- Clear-Com

- Motorola Solutions

- Becker Mining Systems

- Cattron Group

- TE Connectivity

Key Target Audience

- Defense vehicle procurement agencies

- Mining fleet operators and asset owners

- Emergency services departments

- Vehicle OEMs and integrators

- System integration and maintenance providers

- Government and regulatory bodies including Department of Defence Australia

- State transport and safety authorities

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

The research identifies platform types, fleet composition, deployment environments, and communication architecture variables influencing system adoption patterns. Emphasis is placed on operational requirements and lifecycle dynamics.

Step 2: Market Analysis and Construction

Segmentation frameworks are constructed using fleet type and technology architecture lenses aligned with real-world procurement structures. Deployment intensity and integration complexity guide market modeling.

Step 3: Hypothesis Validation and Expert Consultation

Industry specialists validate assumptions related to system integration, retrofit demand, and digital transition trajectories. Feedback refines adoption drivers and constraint assessments.

Step 4: Research Synthesis and Final Output

Findings are consolidated into coherent market narratives supported by triangulated data and scenario-based evaluation. Outputs emphasize decision-relevant insights.

- Executive Summary

- Research Methodology (Market Definitions and vehicle intercom system scope alignment, Platform and fleet-based segmentation taxonomy development, Bottom-up market sizing using vehicle parc and retrofit rates, Revenue attribution by OEM fitment and aftermarket integration, Primary interviews with defense integrators fleet operators and mining OEMs, Data triangulation across contracts imports and deployment data, Assumptions on lifecycle replacement ruggedization and interoperability constraints)

- Definition and Scope

- Market evolution

- Usage and operational communication pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory and standards environment

- Growth Drivers

Rising defense modernization and armored vehicle upgrades

Expansion of mining operations requiring rugged communication

Increased focus on crew safety and operational coordination

Integration of advanced C4ISR and vehicle electronics

Growth in emergency response and disaster management fleets - Challenges

High system integration and customization costs

Interoperability issues across legacy and new platforms

Procurement delays in defense and public sector contracts

Harsh operating environments impacting system reliability

Limited local manufacturing and dependence on imports - Opportunities

Retrofit demand across aging military and mining fleets

Adoption of IP-based and software-defined intercoms

Integration with vehicle telematics and situational awareness systems

Local partnerships for assembly and lifecycle support

Growth in autonomous and semi-autonomous vehicle programs - Trends

Shift from analog to digital and IP-based architectures

Increased demand for modular and scalable systems

Focus on cybersecurity and encrypted communications

Convergence of intercom and radio communication platforms

Lifecycle service contracts and long-term support models - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Military armored vehicles

Tactical and logistics vehicles

Mining and construction vehicles

Emergency and public safety vehicles

Commercial and specialty vehicles - By Application (in Value %)

Crew communication

Command and control coordination

Vehicle-to-vehicle communication interface

Vehicle-to-base communication interface

Situational awareness and sensor integration - By Technology Architecture (in Value %)

Analog intercom systems

Digital intercom systems

IP-based modular intercom systems

Software-defined communication systems - By End-Use Industry (in Value %)

Defense and homeland security

Mining and resources

Construction and infrastructure

Emergency services

Industrial and utilities - By Connectivity Type (in Value %)

Wired intercom systems

Wireless intercom systems

Hybrid wired-wireless systems - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Rest of Australia

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (Product ruggedization level, Platform interoperability, Technology architecture, Customization capability, Local support presence, Pricing model, Contract lifecycle support, Compliance and certification) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Thales Group

Rheinmetall Defence

Saab AB

Elbit Systems

L3Harris Technologies

Leonardo S.p.A.

Cobham

David Clark Company

3M Peltor

Zenitel

Clear-Com

Motorola Solutions

Becker Mining Systems

Cattron Group

TE Connectivity

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035