Market Overview

The Australia Vetronics market current size stands at around USD ~ million, reflecting steady platform upgrades, integration programs, and fleet digitization momentum across armored vehicles. System deployments increased across ~ units in recent operational fleets, while installed active systems exceeded ~ units, driven by modernization initiatives. Procurement cycles accelerated, subsystem integration density rose, and software-defined architectures gained prominence. Indigenous manufacturing participation expanded, and interoperability requirements influenced system configurations across multiple vehicle classes, reinforcing sustained demand patterns.

Demand concentration remains strongest in New South Wales, Victoria, and South Australia, supported by defense industrial clusters, testing facilities, and integration hubs. Western Australia contributes through sustainment and naval-ground interface programs, while Queensland supports training and maintenance ecosystems. Policy emphasis on sovereign capability, local supply chain resilience, and long-term sustainment frameworks reinforces regional dominance. Mature infrastructure, skilled labor pools, and proximity to defense stakeholders collectively shape regional vetronics adoption intensity.

Market Segmentation

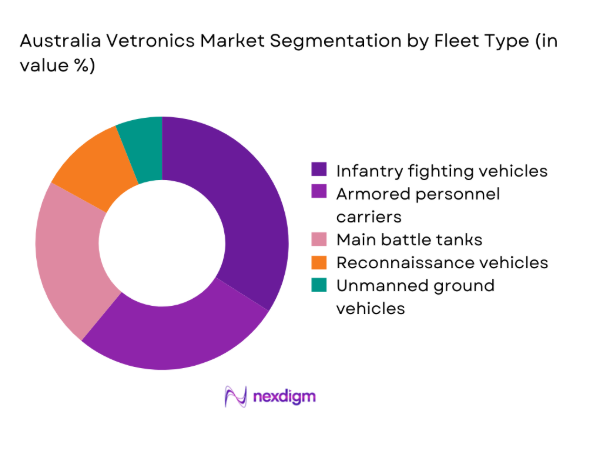

By Fleet Type

Tracked and wheeled combat vehicles dominate the Australia Vetronics market segmentation due to ongoing fleet replacement and upgrade programs emphasizing digitized battlefield integration. Infantry fighting vehicles and armored personnel carriers account for the largest adoption volumes, reflecting higher operational deployment frequency and electronics density. Main battle tanks follow closely, driven by fire control, sensor fusion, and command system upgrades. Reconnaissance vehicles increasingly adopt lightweight vetronics suites optimized for situational awareness. Unmanned ground vehicles remain limited but demonstrate accelerating integration interests.

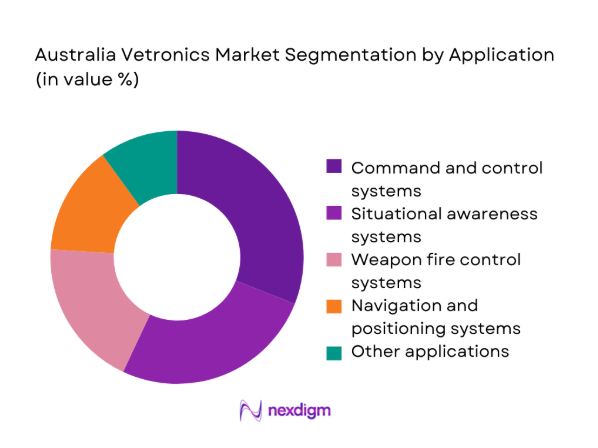

By Application

Command and control applications dominate vetronics demand, reflecting the Australian Defence Force emphasis on network-centric operations and real-time decision support. Situational awareness systems, including driver vision and surveillance modules, follow closely due to safety and mission effectiveness requirements. Weapon fire control adoption remains strong within armored platforms, while navigation and positioning systems benefit from integration with multi-domain command networks. Application diversification is driven by modular architectures enabling scalable subsystem integration across fleet types.

Competitive Landscape

The competitive landscape is characterized by a mix of global defense electronics providers and locally established integrators supporting sovereign capability objectives. Companies differentiate through platform integration depth, compliance readiness, and long-term sustainment offerings aligned with defense procurement frameworks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Thales Australia | 1990 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1959 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence Australia | 2015 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Elbit Systems of Australia | 2000 | Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Vetronics Market Analysis

Growth Drivers

Modernization of Australian Defence Force land platforms

Australian Defence Force land modernization programs expanded system digitization across ~ platforms, emphasizing integrated vetronics for operational coordination and survivability improvements. Vehicle upgrade roadmaps prioritized electronics refresh cycles, increasing demand for command, sensor fusion, and mission computing solutions. Procurement frameworks encouraged modular integration, enabling scalable adoption across varied vehicle classes. Modernization timelines aligned with capability replacement objectives, reinforcing sustained integration activity. Interoperability mandates required compatibility with allied systems, accelerating adoption. Platform lifecycle extensions necessitated electronics upgrades rather than replacements. Training effectiveness improved through digital interfaces. Maintenance efficiency benefited from embedded diagnostics. Indigenous industry participation increased system customization. Overall modernization momentum structurally reinforced vetronics demand.

Increasing emphasis on network-centric warfare

Network-centric operational doctrine expanded adoption of integrated vetronics supporting real-time data exchange across ~ connected platforms. Command hierarchies increasingly relied on onboard computing and secure communications integration. Battlefield transparency requirements elevated sensor fusion importance. Tactical decision cycles shortened through digital interfaces. Interoperable data standards influenced architecture selection. Secure connectivity drove encryption and cyber-hardened designs. Mission effectiveness improved through shared situational awareness. Cross-domain integration linked land platforms with air and maritime assets. Software-defined systems enabled rapid upgrades. Network-centric emphasis sustained long-term vetronics relevance.

Challenges

High integration complexity with legacy platforms

Legacy vehicle architectures created integration complexity, requiring customized vetronics interfaces across ~ platforms with varied electrical and spatial constraints. Retrofit programs demanded extensive validation testing. Compatibility risks increased engineering timelines. Legacy power management limited subsystem scalability. Software interoperability issues required middleware solutions. Certification requirements extended integration cycles. Training requirements rose for mixed-generation fleets. Cost predictability remained constrained. Maintenance complexity increased post-integration. Legacy constraints slowed deployment velocity.

Stringent defense certification and security requirements

Defense certification processes imposed rigorous compliance checks across vetronics subsystems deployed on ~ platforms. Cybersecurity accreditation extended development timelines. Documentation requirements increased administrative workload. Testing protocols required multiple validation stages. Secure supply chain verification constrained component sourcing. Export control compliance limited design flexibility. Classified integration restricted external collaboration. Certification delays affected deployment schedules. Ongoing audits increased lifecycle overhead. Security rigor remained unavoidable but demanding.

Opportunities

LAND 400 and future armored vehicle programs

LAND 400 programs created opportunities for integrated vetronics deployment across ~ vehicles, emphasizing modular open architectures and local integration. Program scale enabled standardization benefits. Early design-phase involvement increased solution depth. Indigenous manufacturing alignment improved bid competitiveness. Long-term sustainment contracts supported recurring demand. Digital backbone requirements expanded computing needs. Platform commonality reduced integration costs. Upgrade pathways extended revenue visibility. Training simulators leveraged shared architectures. Program continuity strengthened market outlook.

Adoption of open architecture vetronics standards

Open architecture adoption enabled scalable vetronics integration across ~ platforms, reducing vendor lock-in and lifecycle upgrade barriers. Standard interfaces accelerated subsystem replacement. Software portability improved system longevity. Competition increased innovation pace. Integration timelines shortened through reusable modules. Maintenance efficiency improved via standardized diagnostics. Training complexity reduced for operators. Cyber updates deployed more rapidly. Open standards aligned with allied interoperability goals. Adoption momentum supported sustained opportunity creation.

Future Outlook

The Australia Vetronics Market outlook through 2035 reflects sustained modernization spending, deeper digital integration, and growing emphasis on interoperability. Open architectures, cyber resilience, and indigenous capability development will shape system design priorities. Long-term defense programs and upgrade cycles are expected to provide stable demand, while emerging autonomous and AI-enabled functionalities gradually expand application scope.

Major Players

- Thales Australia

- BAE Systems Australia

- Rheinmetall Defence Australia

- Saab Australia

- Elbit Systems of Australia

- Lockheed Martin Australia

- Northrop Grumman Australia

- Leonardo DRS

- L3Harris Technologies

- Kongsberg Defence & Aerospace

- Curtiss-Wright Defense Solutions

- EOS Defence Systems

- Hanwha Defense Australia

- Ultra Electronics Australia

- Boeing Defence Australia

Key Target Audience

- Australian Department of Defence procurement divisions

- Australian Army land systems commands

- Defence Capability Acquisition and Sustainment Group

- Armored vehicle OEMs and integrators

- Defense electronics subsystem suppliers

- Systems integration and sustainment contractors

- Investments and venture capital firms

- Government and regulatory bodies including Defence Export Controls

Research Methodology

Step 1: Identification of Key Variables

Involved identification of key variables across vehicle fleets, subsystem categories, and integration pathways relevant to vetronics deployment. Operational use cases and procurement structures were mapped.

Step 2: Market Analysis and Construction

Focused on constructing the market framework through platform-level analysis, application mapping, and lifecycle assessment. Integration density and upgrade cycles were evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Included hypothesis validation through expert consultation with defense engineers, program managers, and integration specialists. Assumptions were refined iteratively.

Step 4: Research Synthesis and Final Output

Synthesized insights into a coherent analytical narrative, aligning segmentation, competitive dynamics, and outlook assessments into a final deliverable.

- Executive Summary

- Research Methodology (Market Definitions and Australian land and naval vetronics scope alignment, Platform-level segmentation across tracked wheeled and amphibious fleets, Bottom-up market sizing using defense procurement and retrofit programs, Revenue attribution by subsystem integration and lifecycle phase, Primary interviews with ADF program managers and Tier-1 defense integrators, Triangulation using contract disclosures offset data and delivery schedules, Assumptions on classified upgrades and indigenous content constraints)

- Definition and Scope

- Market evolution

- Usage and mission integration pathways

- Defense electronics ecosystem structure

- Supply chain and local manufacturing footprint

- Regulatory and defense acquisition environment

- Growth Drivers

Modernization of Australian Defence Force land platforms

Increasing emphasis on network-centric warfare

Indigenous defense manufacturing and sovereign capability push

Rising investments in situational awareness and C4ISR

Fleet life extension and mid-life upgrade programs - Challenges

High integration complexity with legacy platforms

Stringent defense certification and security requirements

Budget prioritization across multi-domain programs

Supply chain dependence on imported electronic components

Long procurement cycles and program delays - Opportunities

LAND 400 and future armored vehicle programs

Adoption of open architecture vetronics standards

Integration of AI-enabled decision support systems

Export opportunities through allied interoperability programs

Retrofit demand for existing armored fleets - Trends

Shift toward modular open systems architecture

Increased use of software-defined vetronics

Cyber-hardened onboard electronics

Integration of autonomous and semi-autonomous functions

Enhanced human-machine interface solutions - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Installed Base of Active Systems, 2020–2025

- By Average Selling Price per Platform, 2020–2025

- By Fleet Type (in Value %)

Main battle tanks

Infantry fighting vehicles

Armored personnel carriers

Reconnaissance and patrol vehicles

Unmanned ground vehicles - By Application (in Value %)

Command and control systems

Navigation and positioning systems

Surveillance and reconnaissance

Weapon fire control systems

Driver vision and situational awareness - By Technology Architecture (in Value %)

Centralized vetronics architecture

Distributed vetronics architecture

Open systems and modular architecture

Legacy proprietary architectures - By End-Use Industry (in Value %)

Army land combat units

Naval ground support and amphibious forces

Border security and homeland defense

Defense research and test establishments - By Connectivity Type (in Value %)

Wired communication systems

Wireless tactical data links

Hybrid connectivity architectures - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Platform coverage, Technology maturity, Local manufacturing footprint, Systems integration capability, Compliance with ADF standards, Pricing competitiveness, Lifecycle support capability, Strategic partnerships)

- SWOT Analysis of Key Players

Pricing and Commercial Model Benchmarking

Detailed Profiles of Major Companies

Elbit Systems

Thales Australia

BAE Systems Australia

Saab Australia

Rheinmetall Defence Australia

Lockheed Martin Australia

Northrop Grumman Australia

Leonardo DRS

Curtiss-Wright Defense Solutions

L3Harris Technologies

Kongsberg Defence & Aerospace

Elbit Systems of Australia

EOS Defence Systems

Hanwha Defense Australia

Ultra Electronics Australia

- Demand and utilization drivers

- Defense procurement and tender dynamics

- Buying criteria and vendor selection priorities

- Budget allocation and multi-year funding patterns

- Integration risks and implementation barriers

- Post-deployment support and upgrade expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Installed Base of Active Systems, 2026–2035

- By Average Selling Price per Platform, 2026–2035