Market Overview

As of 2024, the Australia warehousing market is valued at USD ~ billion, with a growing CAGR of 7.7% from 2024 to 2030, showing significant growth since the previous year due to the surge in e-commerce activities and the increasing demand for efficient logistics solutions. The market is driven by various factors including the expansion of third-party logistics services and advancements in warehousing technologies. Established logistics companies are adapting to meet the evolving needs of businesses, thereby enhancing service levels and operational efficiencies, which are crucial for maintaining competitive advantage in the market.

Key cities dominating the Australia warehousing market include Sydney, Melbourne, and Brisbane. These metropolitan areas are critical due to their strategic locations, robust infrastructure, and high consumer density, which facilitate effective distribution and fulfilment of goods. Additionally, the presence of major transport hubs and continuous investments in logistics infrastructure bolster their prominence in the warehousing ecosystem, making them focal points for warehousing operations.

Market Segmentation

By Component

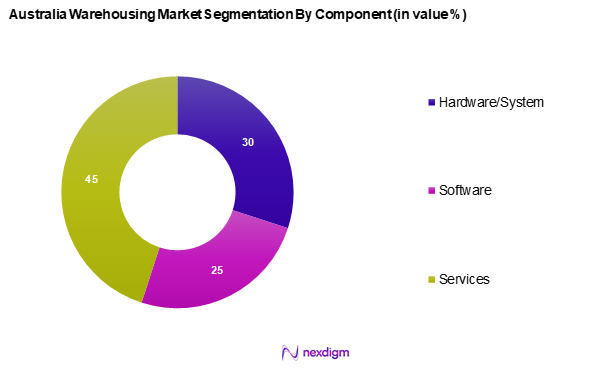

The Australia warehousing market is segmented into hardware/system, software, and services. The services segment dominates the market due to the increasing reliance on third-party logistics (3PL) providers, which offer comprehensive solutions including inventory management, order fulfilment, and transportation services. Companies recognize that outsourcing these functions enhances efficiency and reduces operational costs, leading to a preference for integrated service providers that can simplify logistics operations while ensuring quicker response times.

By Function

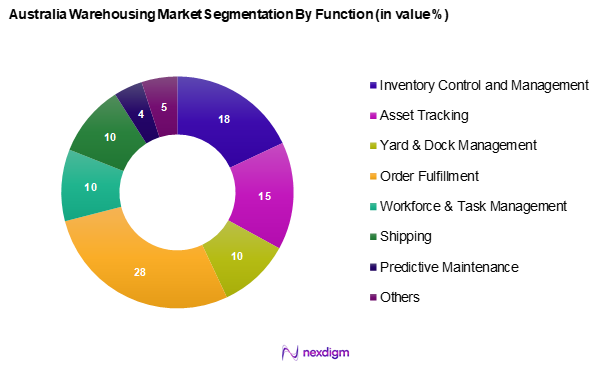

The Australia warehousing market is segmented into inventory control and management, asset tracking, yard & dock management, order fulfilment, workforce & task management, shipping, predictive maintenance, and others. Among these, order fulfilment has emerged as the leading segment, driven by the explosion of e-commerce, which demands efficient and quick order processing solutions. As online shopping becomes a norm, companies invest in advanced technologies to streamline this function, optimizing their supply chains to fulfil customer expectations for faster delivery times.

Competitive Landscape

The Australia warehousing market is characterized by a competitive landscape dominated by several key players, including G&S Logistics Sydney, Linfox, Race Couriers, Toll Holdings Limited, and eStore Logistics. These players leverage their extensive networks, advanced technologies, and strong customer relationships to maintain their market position. The consolidation of key players highlights their significant influence in shaping market trends and consumer behaviours.

| Company Name | Establishment Year | Headquarters | Market Share (%) | Number of Warehouses | Technological Capabilities | Service Offerings |

| G&S Logistics Sydney | 2014 | Sydney, Australia | – | – | – | – |

| Linfox | 1956 | Melbourne, Australia | – | – | – | – |

| Race Couriers | 2018 | Victoria, Australia | – | – | – | – |

| Toll Holdings Limited | 1888 | Melbourne, Australia | – | – | – | – |

| eStore Logistics | 2008 | Victoria, Australia | – | – | – | – |

Australia Warehousing Market Analysis

Growth Drivers

Increase in E-commerce Activity

The expansion of e-commerce in Australia has significantly increased the demand for warehousing solutions, driven by changing consumer shopping habits. As more customers prefer the convenience of online purchases and rapid delivery options, retailers are enhancing their logistics infrastructure to meet expectations. The demand for same-day and next-day delivery has accelerated the need for efficient warehousing strategies, leading to the expansion of fulfilment centres to manage inventory more effectively.

Growth in Third-Party Logistics Demand

The reliance on third-party logistics (3PL) providers has grown as businesses seek to optimize their supply chain operations. Companies are increasingly outsourcing logistics management to specialized providers to improve efficiency, reduce operational costs, and focus on their core business activities. The increasing complexity of supply chain operations has further reinforced the role of 3PL services in streamlining logistics and enhancing overall market performance.

Market Challenges

High Operational Costs

The warehousing sector in Australia faces significant cost pressures, primarily due to rising labour expenses and high real estate prices in key metropolitan areas. Warehouses, particularly in major cities, experience increasing rental rates for instance Sydney’s warehouse rents averaging AUD 271 (USD 165.5) per square meter this creates a challenge for companies.

Regulatory Compliance Issues

Warehousing operations are subject to stringent regulatory requirements that vary across states and territories. Compliance with safety, environmental, and labor regulations demands continuous monitoring and investment in training and reporting. Businesses that fail to meet these regulatory standards risk financial penalties and operational setbacks, making compliance a critical challenge in the sector. The complexity of these regulations also presents entry barriers for smaller players looking to establish warehousing operations.

Opportunities

Adoption of Advanced Technologies

The integration of automation, artificial intelligence, and the Internet of Things (IoT) is transforming warehousing operations by improving efficiency and accuracy. The adoption of robotics and smart inventory management systems is helping businesses reduce costs and enhance productivity. A growing number of warehouses are planning to implement these advanced solutions, positioning themselves for increased competitiveness in the evolving logistics landscape.

Expansion of Green Warehousing Practices

Sustainability is emerging as a key focus in the warehousing market, with companies increasingly investing in eco-friendly solutions. The adoption of energy-efficient infrastructure, renewable energy sources, and sustainable materials is helping businesses lower their environmental impact while also reducing long-term operational costs. As consumer preferences shift towards sustainability, businesses that prioritize green practices gain a competitive edge, aligning with market trends favouring responsible and environmentally conscious operations.

Future Outlook

Over the next five years, the Australia warehousing market is expected to witness remarkable growth driven by ongoing advancements in logistics technology, increased adoption of automation, and continuous expansion of e-commerce services. As businesses seek to improve operational efficiencies and reduce costs, investments in smart warehousing solutions will become more prevalent. Furthermore, the shift toward sustainable practices and green warehousing initiatives will play a crucial role in shaping the future landscape of the market.

Major Players in the Market

- G&S Logistics Sydney

- Linfox

- Race Couriers

- eStore Logistics

- Freight People

- GMK Logistics

- Toll Holdings Limited

- AirRoad

- Black Bear Fulfillment

- Direct Courier Solution

- Silk Contract Logistics

- Gold Coast 3PL

- Carrabba’s Group

- Ridge Logistics

- Others

Key Target Audience

- E-commerce companies

- Retail chains

- Logistics service providers

- Manufacturers requiring warehousing solutions

- Investments and venture capitalist firms

- Government and regulatory bodies (Australian Competition and Consumer Commission, Department of Infrastructure, Transport, Regional Development and Communications)

- Distribution and supply chain managers

- Technology providers for warehouse solutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia warehousing market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Australia warehousing market. This includes assessing market penetration, the ratio of warehouses to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple warehousing service providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction aims to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Australia warehousing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Data Sources, Consolidated Research Approach, Understanding Market Dynamics Through Expert Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increase in E-commerce Activity

Growth in Third-Party Logistics Demand - Market Challenges

High Operational Costs

Regulatory Compliance Issues - Opportunities

Adoption of Advanced Technologies

Expansion of Green Warehousing Practices - Trends

Rise of Automated Warehousing Solutions

Focus on Sustainability - Government Regulation

Zoning Laws

Environmental Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Component, (In Value %)

Hardware/System

Software

Services - By Function, (In Value %)

Inventory Control and Management

Asset Tracking

Yard & Dock Management

Order Fulfilment

Workforce & Task (Process) Management

Shipping

Predictive Maintenance

Others - By Type, (In Value %)

Insource Warehousing

Outsource Warehousing - By Size, (In Value %)

Small

Medium

Large - By Ownership, (In Value %)

Public Warehouses

Private Warehouses

Bonded Warehouses

Consolidated Warehouse - By Warehousing Storage Nature, (In Value %)

Ambient Warehousing (Around 80°F)

Air Conditioned (56°F and 75°F)

Refrigerated (33°F and 55°F)

Cold/Frozen (Of or Below 32°F)

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Component Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Revenue Analysis, Operational Efficiency, Technology Utilization, Geographic Reach, Client Base)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

G&S Logistics Sydney

Linfox

Race Couriers

eStore Logistics

Freight People

GMK Logistics

Toll Holdings Limited

AirRoad

Black Bear Fulfillment

Direct Courier Solution

Silk Contract Logistics

Gold Coast 3PL

Carrabba’s Group

Ridge Logistics

Silk Contract Logistics

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030