Market Overview

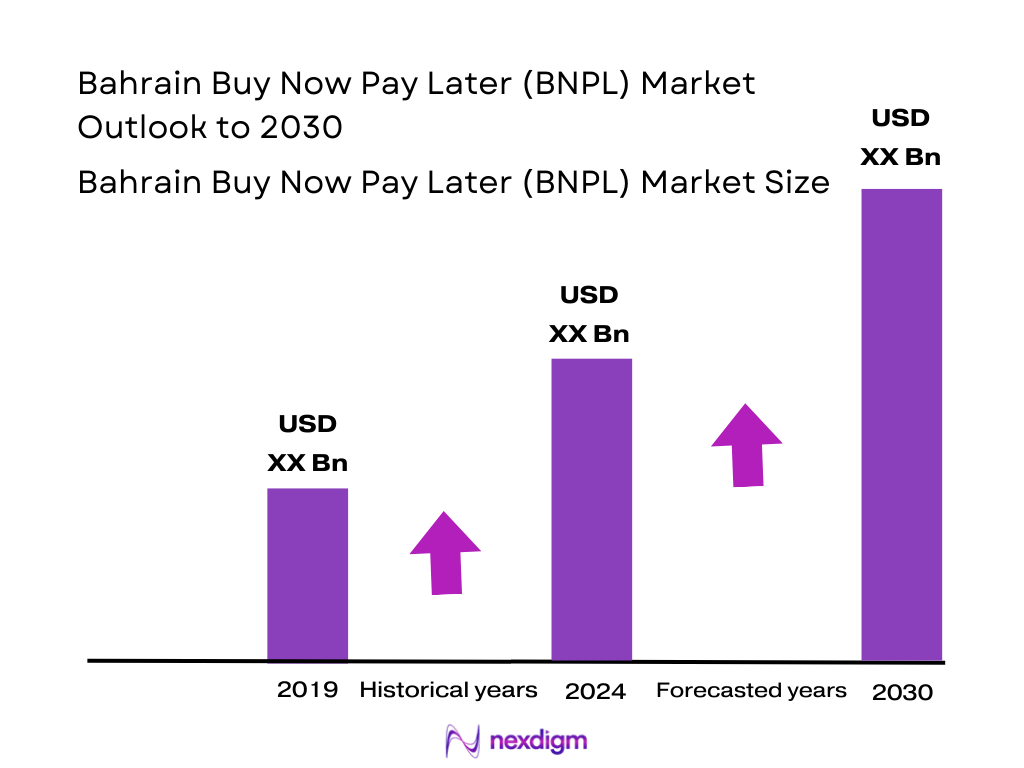

The Bahrain BNPL market is valued at USD 412 million, representing the total e‑commerce landscape from which BNPL services increasingly derive. Growth is being fueled by rising digital commerce activities across both B2C and B2B segments, bolstered by robust smartphone penetration, enhanced fintech infrastructure (like open banking and e‑cheques), and strategic digital investments—creating fertile conditions for BNPL adoption.

Key hubs like Manama, Bahrain’s capital, dominate the BNPL scene due to concentrated merchant networks, superior digital payment infrastructure, and higher consumer purchasing power. Additionally, Saudi Arabia and the UAE, as regional leaders in BNPL, indirectly shape the Bahrain market—driven by regulatory clarity and early fintech adoption, which serve as models Bahrain’s players increasingly emulate.

Market Segmentation

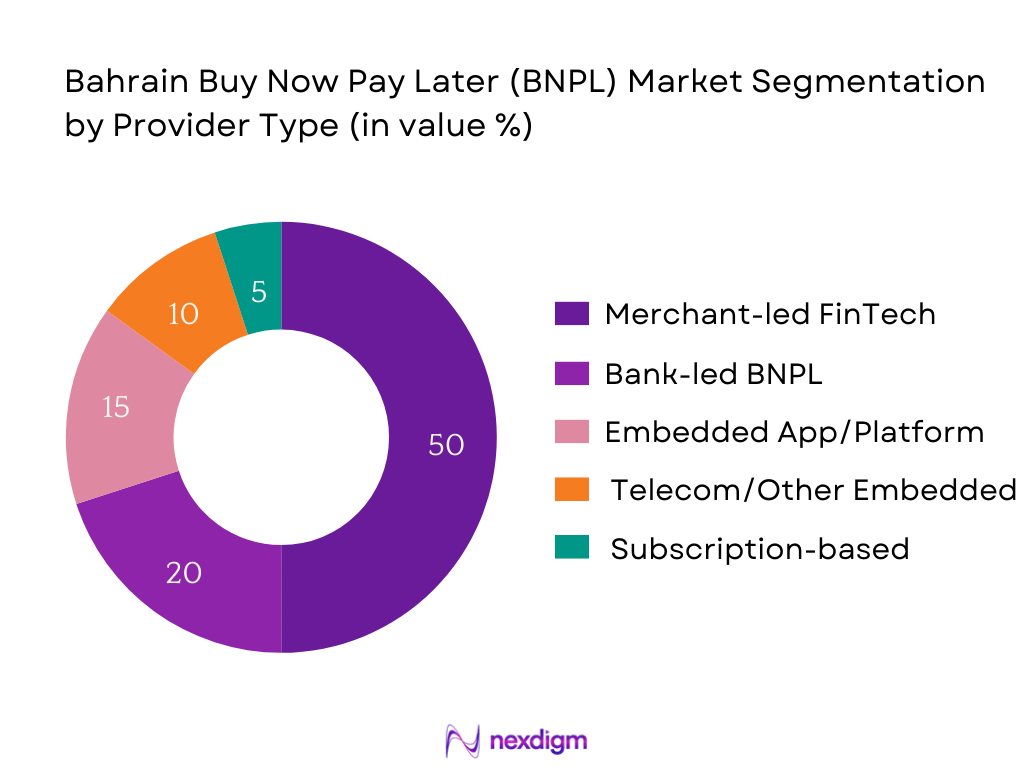

By Provider Type

Among these, Merchant‑led FinTech providers dominate due to their nimble product innovation, direct integration with e‑commerce checkouts, and agile risk assessment models. In markets like Bahrain, players such as Tamara offer interest‑free instalments and seamless UX, appealing strongly to millennial and Gen Z shoppers. Their readiness to onboard merchants quickly, often supported by aggressive promotion and partnerships, further cements their leading position. Bank-led models, while trusted, are slower to launch new features, and embedded app BNPLs have yet to match visibility and merchant presence.

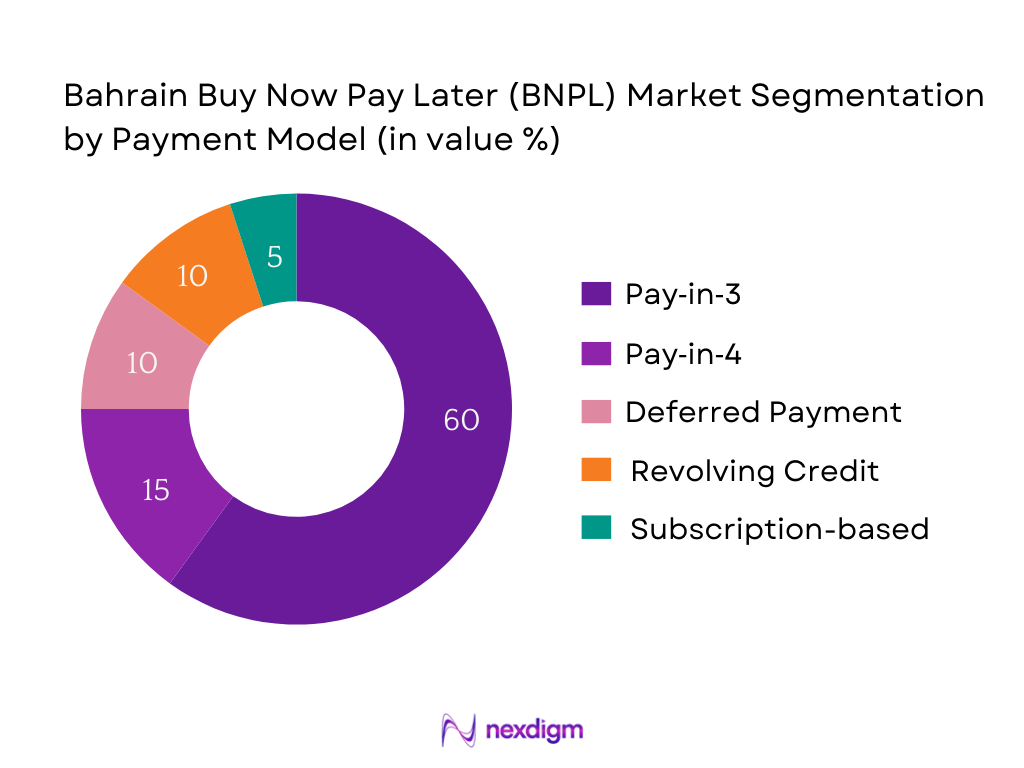

By Payment Model

The Pay‑in‑3 installments model leads the Bahrain BNPL market due to its simplicity, zero interest, and alignment with consumer preferences for short-term budgeting. Retailers promote it to minimize cart abandonment, and providers emphasize its appeal in promotional messaging. This model strikes a balance between affordability for consumers and ease of operations for providers, unlike revolving credit—which may trigger regulatory scrutiny—or deferred payment, which can increase default risk.

Competitive Landscape

The Bahrain BNPL scene is concentrated among a handful of agile FinTechs, emerging bank-led players, and a few embedded apps—reflecting a consolidating ecosystem. Merchant-led fintechs like Tamara enjoy substantial traction due to their digital-first approach, while banks and telco-backed apps seek to carve share by leveraging trust and existing customer bases.

| Company | Establishment Year | Headquarters | CBB License Status | Sharia-compliance | Merchant Network | Avg. Ticket Size (BHD) | Risk Model Integration | Default Rate Estimate |

| Tamara Bahrain B.S.C. | 2023 | Manama, Bahrain | – | – | – | – | – | – |

| ONE App (Developer & BNPL) | 2022 | Manama, Bahrain | – | – | – | – | – | – |

| EazyPay (with Tamara) | 2020 | Manama, Bahrain | – | – | – | – | – | – |

| National Bank of Bahrain | 1957 | Manama, Bahrain | – | – | – | – | – | – |

| Bahrain Financing Company | 1990 | Manama, Bahrain | – | – | – | – | – | – |

Bahrain BNPL Market Analysis

Key Growth Drivers

CBB Licensing Push & FinTech Sandbox Enablement

Bahrain’s regulatory framework is being reinforced by the Central Bank of Bahrain (CBB) through FinTech sandbox initiatives and licensing schemes, bolstering confidence in digital financial services. The IMF noted that recent Article IV assessments emphasize Bahrain’s “considerable strides in payment service digitalization and FinTech” as of mid‑2023. Meanwhile, Bahrain’s economy achieved a real GDP growth of 3.0 percent in 2023, driven by a 3.4 percent expansion in the non-oil sector. These macroeconomic improvements support the licensing environment, suggesting a financially stable backdrop for BNPL’s expansion through improved trust and digital infrastructure readiness.

Surge in E‑Commerce and Young Urban Consumers

Bahrain features 1.46 million internet users as of early 2023, with internet penetration at 99.0 percent of the population, and 2.10 million mobile connections, equating to 142.1 percent of total population. Additionally, urban residency is at approximately 89.8 percent of the population, indicating a concentrated consumer base with access to digital platforms. This broad connectivity and urban density signal strong e‑commerce potential, directly aligned with BNPL adoption, especially among digitally savvy younger demographics.

Key Market Challenges

Lack of Consumer Credit Scoring Integration

Although Bahrain has made fintech strides, formal integration of consumer credit scoring infrastructure into digital lending remains underdeveloped. While banking sector resilience was affirmed in IMF’s 2023 Article IV mission, structural data on credit bureau penetration or digital credit history accessibility weren’t highlighted. This gap limits BNPL providers’ ability to assess risk accurately, potentially increasing default exposure.

Regulatory Limitations and Risk Profiling

Despite progressive fintech licensing, regulatory clarity on credit risk governance for BNPL remains limited. Bahrain’s strong digital payments backdrop has not yet been matched with equally granular regulations defining risk thresholds or consumer protection specifics around postdated payments. The IMF’s recognition of Bahrain’s fintech payments development does not extend to regulatory standards for consumer credit risk profiling. This uncertainty may hinder aggressive BNPL rollout plans.

Emerging Opportunities

BNPL Integration in Healthcare and Education

Bahrain’s non-oil sector expansion of 3.4 percent in 2023 underscores growing private consumption in services like healthcare and education, both of which involve discretionary and recurring payments. With populations digitally adept (99 percent internet penetration, 142 percent mobile connections), BNPL could be extended to cash-strapped yet digitally enabled consumers for such essential services. This untapped vertical offers a strategic growth path for BNPL beyond retail.

Telecom and BNPL Cross‑Integration Potential

With mobile penetration at 137 percent and robust telco infrastructure, telecom operators are well-positioned to embed BNPL in mobile payment ecosystems and billing services. Partnerships between telecom providers and BNPL platforms can leverage telco customer bases to drive adoption, especially given widespread connectivity and mobile data usage. This convergence offers an unexplored growth vector without dependence on existing e-commerce merchants.

Future Outlook

Over the next few years, the Bahrain BNPL market is poised for strong growth, driven by expanding e‑commerce penetration, ongoing digital infrastructure improvements, and increased consumer acceptance of fintech payment options. Banks and fintech players will likely deepen partnerships, while regulatory clarity and potential Sharia‑compliant innovations may further accelerate adoption. Mobile app integrations and omnichannel BNPL experiences are expected to grow in importance.

Major Players

- Tamara Bahrain B.S.C.

- ONE App BNPL

- EazyPay

- National Bank of Bahrain

- Bahrain Financing Company

- Bank-led BNPL initiatives (e.g., BKB)

- Subscription-based BNPL entrants

- Telecom-embedded BNPL (e.g., stc ecosystem)

- PayLater regional fintechs entering Bahrain

- Spotii / OCTA via Zip

- BenefitPay BNPL tie-ups

- ValU

Key Target Audience

- Retail & e‑commerce merchants in Bahrain

- Investments and venture capitalist firms (e.g., regional fintech funds)

- Payment infrastructure providers

- Government and regulatory bodies (e.g., Central Bank of Bahrain, Economic Development Board of Bahrain)

- Consumer credit rating agencies

- Digital payment aggregators

- Mobile wallet operators

- Large Bahraini retailers evaluating BNPL partnerships

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the BNPL ecosystem in Bahrain—covering fintechs, banks, merchants, regulators—using desk research of secondary data, local fintech announcements, and CBB sources to define essential market parameters, such as transaction volumes, provider types, and regulatory measures.

Step 2: Market Analysis and Construction

We compile historical revenue and transaction data where available, triangulated from industry reports and provider disclosures. Key metrics like average ticket size, payment models, and market segmentation are analyzed to construct a bottom‑up revenue model and validate via cross‑sector comparisons.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses—for example, the predominance of merchant-led fintech—are validated through targeted interviews with BNPL providers, merchants, and banking partners via virtual interviews, gathering insights on consumer behavior, merchant onboarding, and risk performance.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing quantitative findings with qualitative insights, ensuring all data are grounded in reliable sources. The report is cross-verified with provider case studies and industry benchmarks to ensure accuracy and strategic relevance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution and Market Genesis

- Regulatory Framework (CBB Guidelines for BNPL Licensing)

- Market Structure and Operating Models

- Value Chain Analysis (BNPL Lifecycle in Bahrain)

- Digital Infrastructure Readiness (Internet Penetration, Smartphone Usage)

- Key Growth Drivers

CBB Licensing Push & FinTech Sandbox Enablement

Surge in E-Commerce and Young Urban Consumers

Growing Demand for Sharia-Compliant Flexible Payments

Smartphone and Internet Penetration as Key Enablers - Key Market Challenges

Lack of Consumer Credit Scoring Integration

Regulatory Limitations and Risk Profiling

Low Consumer Awareness Beyond Urban Manama

Merchant Skepticism Due to Settlement Timelines - Emerging Opportunities

BNPL Integration in Healthcare and Education

Telecom and BNPL Cross-Integration Potential

Offline BNPL at Physical Retail Touchpoints

BNPL for Micro-Merchant Aggregation Platforms - Market Trends

Cross-border BNPL Integration with GCC FinTechs

Mobile App-Based BNPL (e.g., ONE App Rollouts)

Merchant Loyalty Programs Linked with BNPL

Gamification and Rewards via BNPL Repayment - Government & Regulatory Landscape [Central Bank Guidelines]

Central Bank of Bahrain BNPL Licensing Norms

Consumer Protection Regulations (Installment Duration, Fees)

Open Banking & FinTech Sandbox Updates - SWOT Analysis

Stake Ecosystem [FinTechs, CBB, Merchants, Aggregators, Banks]

Porter’s Five Forces Analysis

- By Value (BHD Million), 2019-2024

- By Volume (No. of BNPL Transactions), 2019-2024

- By Average Ticket Size (BHD), 2019-2024

- By Type of Provider (In Value %)

FinTech BNPL (e.g., Tamara, Tabby)

Bank-Led BNPL (e.g., NBB, BFC)

Telecom/Other Embedded BNPL (e.g., StcPay)

Marketplace-Led BNPL

POS-Financing Solutions - By Payment Model (In Value %)

Pay-in-3

Pay-in-4

Deferred Payment

Revolving Credit

Subscription-Based BNPL - By End-Use Industry (In Value %)

Electronics & Appliances

Fashion & Footwear

Travel & Booking

Healthcare & Dental Services

Food & Grocery Delivery - By Distribution Channel (In Value %)

Online E-Commerce Platforms

Mobile App Integration (e.g., ONE App)

In-Store POS Integration

Retail Aggregators

Embedded Finance Platforms - By Ticket Size (In Value %)

BHD 0–50

BHD 51–150

BHD 151–300

BHD 301–500

Above BHD 500

- Market Share of Major Players (by Value, Volume) [Competitor Share]

- Cross Comparison Parameters [Sharia Compliance, Risk Modeling, UI/UX, Approval Time, Customer Base, Merchant Network, Integration APIs, Default Rate]

- SWOT Analysis of Top Players

- Pricing, Fees & Interest Structure Benchmarking [BHD/Transaction Fee, Merchant Charges]

- Detailed Company Profiles

Tamara Bahrain B.S.C.

ONE App

EazyPay

Tabby

National Bank of Bahrain

Bahrain Financing Company

PayLater

StcPay Bahrain

ValU (Exploring Entry)

Fawry BNPL (Regional Expansion)

Spotii (Via Zip – possible re-entry)

BenefitPay (BNPL tie-up possibilities)

Postpay

TelyPay

Credimax (Card-to-BNPL Hybrid Model)

- End User Demographics and Digital Behavior [Urban vs Rural Adoption]

- Consumer Decision-Making Journey

- Affordability & Spending Patterns [Income Level vs BNPL Use]

- Preferences by Payment Model [Pay-in-3 vs Pay-in-4]

- End User Pain Point Mapping and Product Gaps

- By Value [Projected Market Value], 2025-2030

- By Volume [Future Transaction Growth], 2025-2030

- By Ticket Size, 2025-2030