Market Overview

The Bahrain e‑commerce market is valued at USD 412 million, based on comprehensive analysis of recent commerce‑tracking platforms reflecting 2024 performance. This market scale is driven by expanding internet penetration, rising smartphone adoption, and increasingly tech‑savvy consumer behavior in Bahrain. Additionally, growth in digital payments—including mobile wallets and BNPL schemes—has underpinned rising fashion purchases via online channels.

Within Bahrain, Manama and Muharraq dominate due to their dense urban populations, higher income levels, and well‑established logistics and delivery infrastructure. The presence of major malls and retail hubs also accelerates omnichannel fashion adoption. At the regional level, fashion e‑commerce from cross‑border players (e.g., from UAE and Saudi Arabia) is significant, facilitated by free‑trade logistics and familiarity with GCC sizing and styling, making these players strong contributors.

Market Segmentation

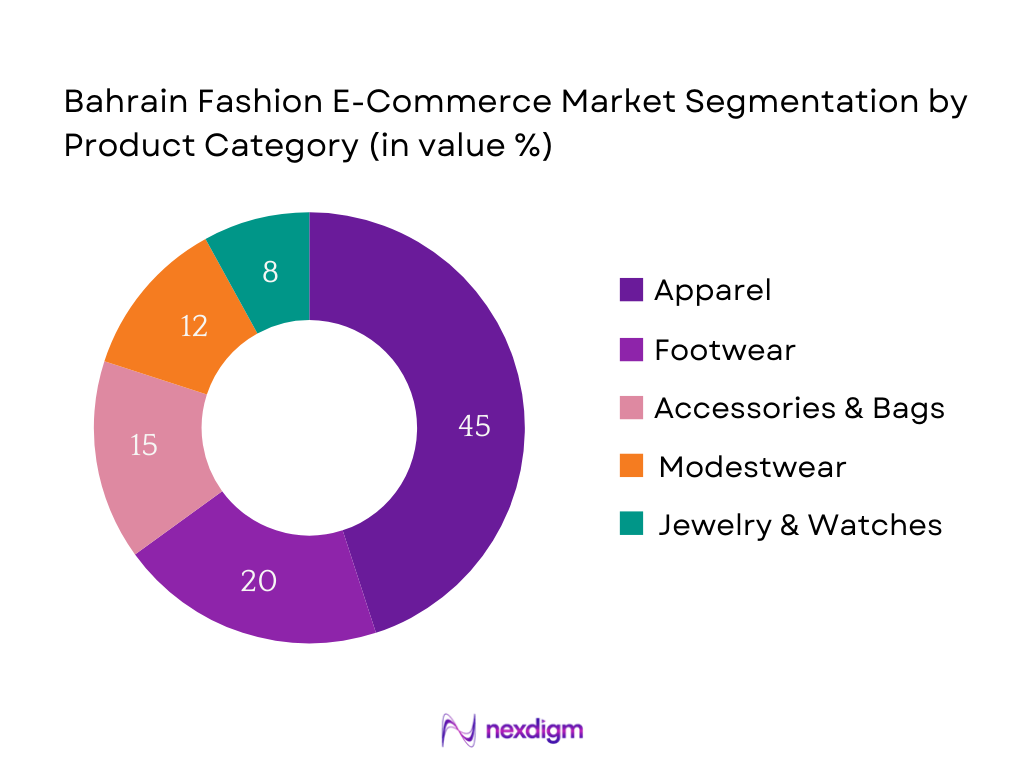

By Product Category

Bahrain’s fashion e‑commerce market is segmented into Apparel, Footwear, Accessories & Bags, Modestwear, and Jewelry & Watches. The Apparel sub‑segment dominates with around 45 % market share in 2024, attributed to its universal appeal and frequent repurchase cycle (e.g., everyday wear, seasonal trends). Apparel’s dominance is also reinforced by high visibility in promotions, broad size range, and strong offerings from major online retailers catering to both casual and formal styles.

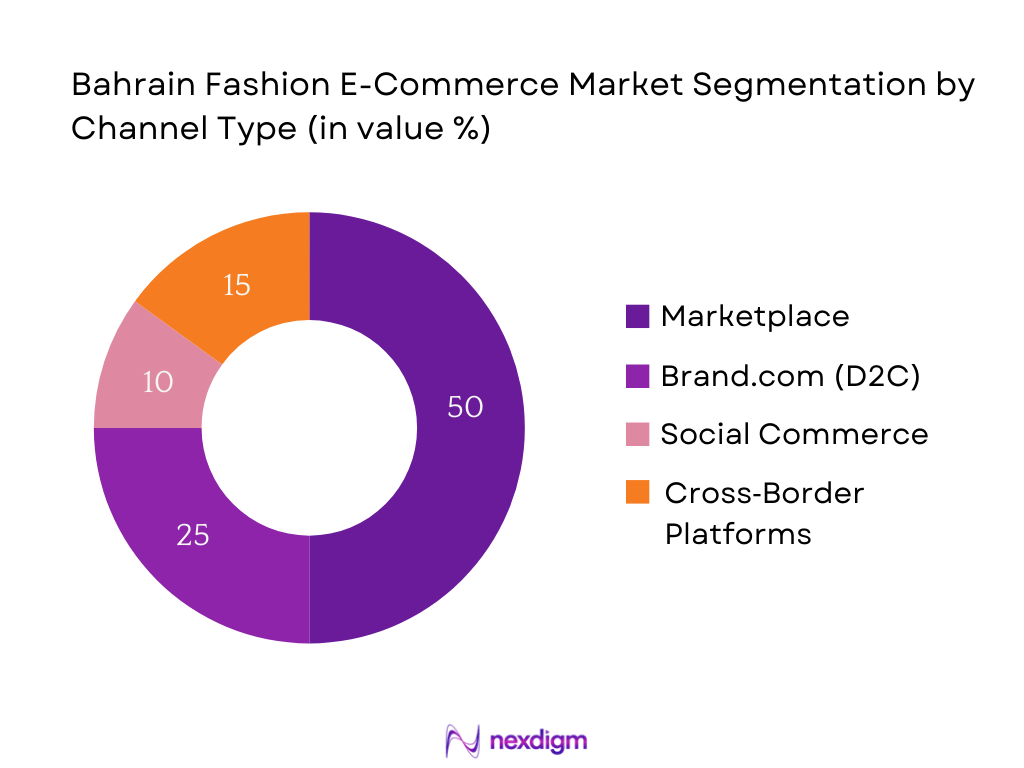

By Channel Type

The Bahrain fashion e‑commerce market is segmented into Marketplace, Brand.com (D2C), Social Commerce, and Cross‑Border Platforms. Marketplaces hold the largest share—approximately 50 %—driven by their aggregation of multiple brands, frequent discount campaigns, trusted logistics, and strong local brand recognition. They deliver convenience and variety, drawing consumers who prefer one‑stop shopping with reliable delivery.

Competitive Landscape

The Bahrain fashion e‑commerce arena is shaped by a handful of large players spanning marketplaces, international fast‑fashion brands, and cross‑border platforms. This consolidation reflects the influence of those companies in shaping consumer options, logistics reliability, payment flexibility, and brand loyalty. Below is a table of five major players, listing their establishment year, headquarters, and six market‑specific parameters:

| Company | Est. Year | HQ | AOV (USD) | BNPL Available | Same‑Day Delivery | Click‑&‑Collect | Mobile App Rating (BH) | Return Window |

| Noon | 2017 | UAE | – | – | – | – | – | – |

| Namshi | 2011 | UAE | – | – | – | – | – | – |

| Max Fashion | 2004 | UAE | – | – | – | – | – | – |

| Centrepoint | 2003 | UAE | – | – | – | – | – | – |

| Ounass | 2009 | UAE | – | – | – | – | – | – |

Bahrain Fashion E-Commerce Market Analysis

Growth Drivers

Smartphone and Internet Penetration

Bahrain exhibits almost universal internet connectivity, with 1.48 million internet users in January 2024, representing 99.0 percent of the population. In addition, mobile connections exceed the country’s population, clocking at 156.6 percent of total population in early 2024. This widespread access underpins fashion e‑commerce growth by providing ubiquitous digital touchpoints. Consumers are able to browse, compare, and purchase fashion products seamlessly via mobile‑first platforms. The dense smartphone and mobile data usage (e.g., 41.6 GB per person per month, among the highest in the GCC) further facilitates rich media engagement—videos, imagery—that enhances product discovery and conversion.

Surge in BNPL and Wallet Payments

In Bahrain, 86 percent of retailers report that accepting digital payments—including cards and mobile wallets—is essential to their business growth. While detailed BNPL-specific user counts are unavailable in open-source macroeconomic data, the strong merchant sentiment toward mobile wallet and digital payment integration indicates a favorable environment for Buy‑Now‑Pay‑Later growth. This readiness among merchants to support mobile-based financial instruments reduces friction in checkout, increasing fashion cart completion rates. The widespread merchant acceptance sets a firm foundation for BNPL services to expand in the fashion space, especially given consumer affinity for flexible payment.

Market Challenges

Logistics Costs and Last‑Mile Delivery Issues

In 2024, the broader GCC last-mile delivery market was valued at USD 14,623.10 million, a reflection of growing demand and cost structures across the region. This aggregated number underscores rising logistical complexity that likely impacts Bahrain’s e‑commerce operators—particularly fashion retailers dealing with high volume, low-weight fulfillment. Moreover, Bahrain’s postal services are undergoing digitalization upgrades to meet e‑commerce demands, signalling system stress and need for infrastructure investment. The evolution toward express delivery, tracking systems, and digital solutions is essential—but highlights existing strain in traditional logistics models and the need for cost optimization and reliability improvements.

Market Opportunities

Launch of Local Designer Marketplaces

The overall digital retail environment in Bahrain is increasingly supportive. For instance, e‑commerce and POS transactions grew by 9.0 percent year-on-year in Q1 2024, indicating elevated consumer engagement with digital purchasing channels. Additionally, mobile subscriptions reached 142.1 percent of the population in early 2023, translating into strong smartphone penetration and likely continued growth into 2024–2025. These foundations—digital readiness, high mobile usage, and rising retail transaction volume—create a fertile environment for niche segments. Local designer marketplaces can leverage these trends, offering curated collections of homegrown fashion and craftsmanship. Their online presence, facilitated by payments infrastructure and omnipresent mobile access, allows them to reach digitally empowered consumers seeking authenticity and cultural connection—an opportunity firmly grounded in strong macroeconomic fundamentals.

Growth in Sustainable and Ethical Fashion

Though macroeconomic sources don’t provide direct statistics for sustainable fashion uptake, the context suggests a viable growth environment. Bahrain’s digital economy is expanding: e‑commerce-related payments and POS activity rose by 9.0 percent year-on-year in Q1 2024. Meanwhile, mobile connections remained high—with 142.1 percent mobile subscriptions relative to population. With internet penetration near universal levels (over 99 percent) and expanding digital consumption, an increasing segment of online shoppers is likely motivated by value-based purchases. Consumers with access to wide product arrays online are more likely to explore brands that espouse sustainable and ethical values—especially when these brands are promoted via digital-first channels. Thus, while direct figures on ethical fashion sales are unavailable, the underlying digital infrastructure and consumer readiness represent a compelling foundation for growth in this segment.

Future Outlook

Over the coming years, the Bahrain fashion e‑commerce market is projected to grow robustly—driven by evolving consumer preferences, improved digital infrastructure, and expanding payment and fulfilment services. Greater adoption of same‑day delivery, mobile app loyalty programs, and BNPL financing will further unlock usage, especially among millennials and Gen Z shoppers. Additionally, increasing offerings from local designers and modestwear segments, alongside sustainability initiatives, are expected to enhance diversity and longevity in the market. Forecasting the broader Bahrain e‑commerce market suggests a CAGR of approximately 14.48%, as reported by market intelligence sources. While this refers to overall e‑commerce, the fashion segment is expected to align with this pace or outperform given its high visibility and discretionary nature.

Major Players

- Noon

- Namshi

- com

- H&M Bahrain

- ZARA (Inditex)

- Ounass

- Max Fashion

- Centrepoint

- American Eagle (Alshaya)

- SHEIN

- Ubuy Bahrain

- Next Direct

- Brands For Less

- Foot Locker

- Trendyol (cross‑border to Bahrain)

Key Target Audience

- Major Fashion Retail Investors

- Fashion‑Focused Venture Capitalist Firms

- Bahrain Economic Development Board

- Ministry of Industry and Commerce (Bahrain)

- Central Bank of Bahrain (for fintech/payments alignment)

- Bahrain Tourism and Exhibitions Authority (for cross‑border shoppers)

- Mall Operators / Retail Real Estate Developers

- National Payments Corporation / BenefitPay Authority

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a thorough ecosystem map of Bahrain fashion e‑commerce—encompassing marketplaces, brand.com players, payment methods, logistics, and customer segments. This is built using desk research from secondary data sources including government portals, payment gateways, and market trackers.

Step 2: Market Analysis and Construction

Historical data on market value, order volume, AOV, and channel contributions are compiled and triangulated from sources such as ECDB, payment platforms, and fashion platforms. Data reliability is ensured via cross‑validation across multiple datasets.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses—such as the dominance of marketplaces or BNPL uptake—are validated via interviews with industry experts including logistics heads, marketplace managers, and payment providers in Bahrain to add operational insights.

Step 4: Research Synthesis and Final Output

Findings are consolidated through interaction with representatives from leading retailers and platforms (e.g., Noon, Namshi). This ensures alignment, accuracy, and completeness of the market sizing and segmentation analysis in the final report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of Fashion E-Commerce in Bahrain

- Digital Retail Penetration vs Traditional Retail

- Value Chain and Ecosystem Mapping

- Online-Offline Integration (Omnichannel Landscape)

- Growth Drivers

Smartphone and Internet Penetration

Surge in BNPL and Wallet Payments

Rise in Female Workforce Participation

Cross-border E-Commerce Accessibility

Digital Initiatives under Economic Vision 2030 - Market Challenges

High Return-to-Origin (RTO) Rates

Address System Limitations

Customer Trust in Quality & Delivery

Logistics Costs and Last-Mile Delivery Issues - Market Opportunities

Launch of Local Designer Marketplaces

Growth in Sustainable and Ethical Fashion

Integration of Loyalty & BNPL Ecosystems

Potential for Omnichannel Pickup Points - Fashion E-Commerce Consumer Journey Mapping

- Stakeholder Ecosystem Analysis

- Regulatory & Taxation Landscape

- SWOT Analysis

- Porter’s Five Forces Analysis

- Value Chain Optimization & Cost Analysis

- By Gross Merchandise Value (GMV) [BHD], 2019-2024

- By Order Volume [Million Orders], 2019-2024

- By Average Order Value [BHD], 2019-2024

- By Number of Active Users [Million], 2019-2024

- By Product Category [GMV Contribution]

Apparel

Footwear

Accessories & Bags

Modestwear (Abayas, Hijabs)

Jewelry & Watches - By Business Model [Order Volume Share]

Marketplace

Brand.com (D2C)

Social Commerce

Cross-Border Platforms - By Customer Type [Average Order Value]

Bahraini Nationals

Expatriates

Tourists & Visitors

Loyalty Program Users - By Payment Method [Transaction Share]

Credit/Debit Cards

BenefitPay

BNPL (Tabby, Tamara)

Cash on Delivery - By Region (Governorate) [Order Fulfillment Density]

Capital

Muharraq

Northern

Southern

- Market Share of Major Players by GMV and Orders

- Brand & Marketplace Presence by Governorate

- Delivery Options, Payment Methods, and Returns Policy

- Cross Comparison Parameters (Gross Merchandise Value (GMV) [BHD], Average Order Value [BHD], Number of App Downloads (Bahrain), Delivery Time Commitment (Next-Day, Same-Day), BenefitPay & BNPL Integration, Return Window Policy, Order Fulfillment Coverage (Across Governorates), Loyalty Program Tie-ups)

- Pricing and Promotion Analysis

- Marketing Strategies and Influencer Collaborations

- Profiles of Key Competitors (15 Players)

Noon

Namshi

6thStreet.com

H&M Bahrain

ZARA (Inditex)

Ounass

Max Fashion

Centrepoint

American Eagle (Alshaya)

SHEIN

Ubuy Bahrain

Next Direct

Brands For Less

Foot Locker

Trendyol

- Digital Shopper Demographics

- Purchase Behavior & Category Preferences

- Loyalty Program Influence (Shukran, Amber, etc.)

- Spending Power and Purchase Frequency

- Customer Journey Breakdown and Touchpoints

- By Gross Merchandise Value (GMV) [BHD], 2025-2030

- By Order Volume [Million Orders], 2025-2030

- By Average Order Value [BHD], 2025-2030

- By Number of Active Users [Million], 2025-2030