Market Overview

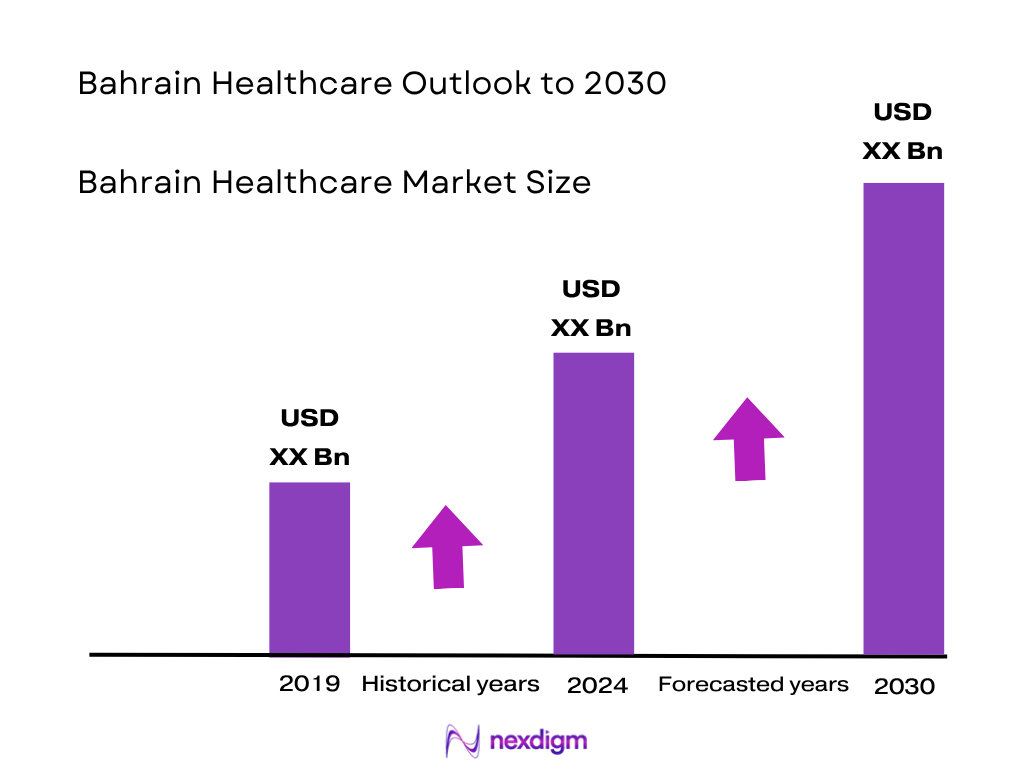

The Bahrain healthcare market is valued at USD 2.4 billion, according to estimates tracking healthcare expenditure from USD 1.8 billion in prior years to USD 2.4 billion as the most recent data point. This substantial increase is driven by public-sector dominance in service delivery, growing outpatient and inpatient care spending, expansion of medical goods and ancillary services, and ongoing infrastructure and workforce investment.

Healthcare delivery is concentrated in the Capital Region (Manama), particularly around Salmaniya Medical Complex, the largest tertiary hospital. The dominance stems from its large bed capacity (~1,200 beds), high daily patient throughput (900–1,000 admissions), and established residency and emergency services. Additionally, Muharraq benefits from proximity to Manama and contains major private hospitals and clinics, drawing patients due to ease of access and comprehensive specialty offerings.

Market Segmentation

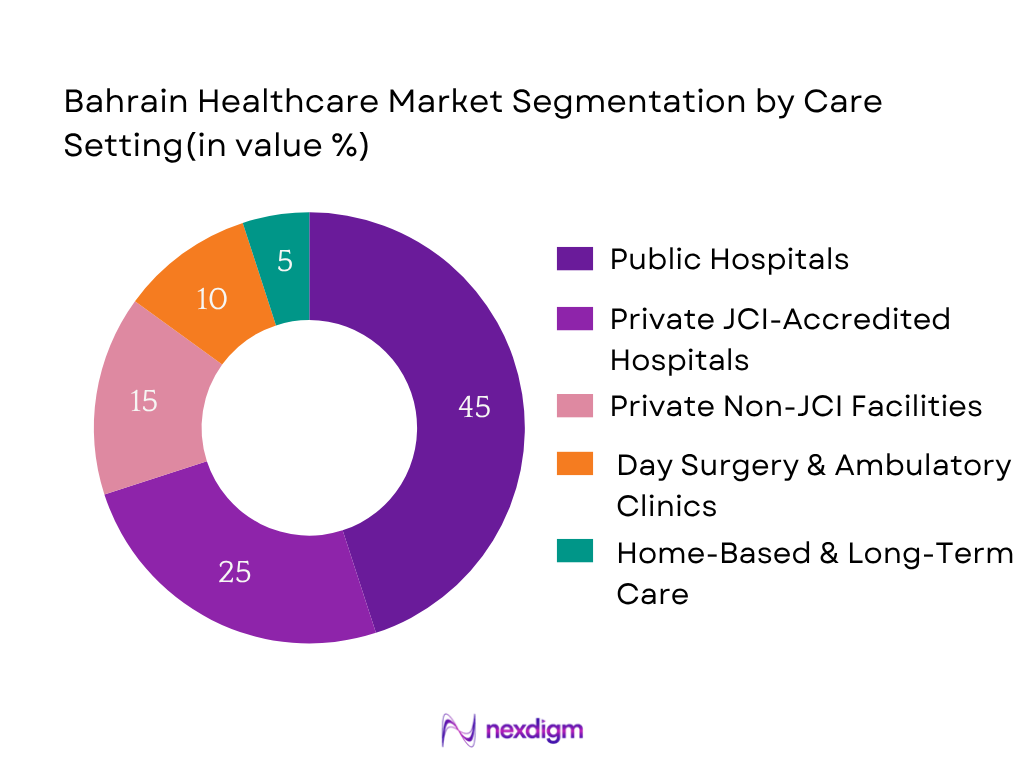

By Care Setting

The Bahrain healthcare market by Care Setting is segmented into Public Hospitals (MoH, BDF, University), Private JCI-Accredited Hospitals, Private Non-JCI Facilities, Day Surgery & Ambulatory Clinics, and Home-Based & Long-Term Care. Public hospitals dominate with 45% market share due to extensive government funding, universal coverage for nationals, and integrated system infrastructure. They handle the bulk of inpatient and emergency care. Private JCI-accredited hospitals follow at 25%, favored for specialized care, quality accreditation, and attention to expatriates and medical tourists. Non-JCI private facilities hold 15%, catering to general outpatient demand. Day surgery and ambulatory clinics (10%) are rising due to efficiency and convenience, and home-based/long-term care (5%) remains nascent but growing with aging population needs.

By Payer Type

Under Payer Type, Bahrain’s healthcare market segments into Public Schemes (MoH, BDF, University Fund), Employer-Sponsored Plans, Private Health Insurance, Self-Pay, and International/Medical Tourism. Public schemes hold 50%, driven by universal subsidies for nationals, government employee coverage, and institutional funding. Employer-sponsored plans account for 20%, given mandatory insurance for expatriates and large corporate groups. Private health insurance contributes 15%, as middle-income and self-employed individuals opt for private plans. Self-pay (10%) covers those seeking services outside insurance, often for convenience or choice. International and medical tourism (5%) is small yet strategic, supported by quality private hospitals and location within the GCC.

Competitive Landscape

The Bahrain healthcare market shows a strong presence of a handful of major institutions across public and private sectors. This consolidation underscores the influence of these large providers in shaping healthcare delivery.

| Major Player | Est. Year | Headquarters | Bed Capacity Installed | Accreditation Status | Primary Specialty Focus | Digital Health Adoption | Service Footprint |

| Salmaniya Medical Complex | 1957 | Manama (Capital) | – | – | – | – | – |

| King Hamad University Hospital | – | West of Manama | – | – | – | – | – |

| BDF Royal Medical Services Hospital | – | Riffa (BDF campus) | – | – | – | – | – |

| American Mission Hospital | 1893 | Manama | – | – | – | – | – |

| Bahrain Specialist Hospital | – | Manama area | – | – | – | – | – |

Bahrain Healthcare Market Analysis

Growth Drivers

Demographics, Expat Base & NCD Burden

Bahrain’s demand pool is anchored by a resident population of 1,588,670 (link). Non-Bahrainis form 848,934 of residents (link), creating sustained utilization across public and private facilities. Population ageing and survivorship underpin chronic-care needs, with life expectancy at birth at 81.284 years (link). The NCD burden is material: non-communicable diseases cause “around 2,000” deaths among citizens each year (link). Service access is broad via 26 public primary health centers and 1 clinic operated by the Ministry of Health (link). Together, these fixed demographic volumes and NCD mortality profiles create predictable throughput for acute, specialty, and longitudinal care pathways in the Kingdom.

Employer Insurance & Private Investment

Employer-funded coverage is a structural demand catalyst. Active foreign-worker permits reached 631,763 by end-Q2, indicating the insured expatriate base administered through LMRA systems (link). In the same quarter, 33,740 new employment permits were issued, feeding insured inflows to providers (link). The Health Insurance Law mandates employers to provide health insurance to non-Bahraini workers for residence or work permit issuance, codifying coverage at the point of immigration processing (link). Parallel provider capacity is deepening: NHRA’s latest reporting cites 924 licensed healthcare facilities overall, with 877 licensed private facilities forming the competitive backbone for insured care delivery (link). This confluence—large expatriate employment rolls, mandatory insurance triggers, and a dense private provider base—translates directly into higher insured outpatient and inpatient encounters.

Market Challenges

Specialist & Nursing Shortages

Sectoral workforce signals point to tightness in critical roles. Government-linked analysis drawing on NHRA data notes 10,500+ Bahraini medical professionals in clinical roles—about half of the clinical workforce—highlighting reliance on expatriate clinicians to fill gaps in specialist and nursing cadres. Historic benchmark ratios also suggest capacity pressures: earlier World Bank-sourced series showed physicians at 0.842 per 1,000 while registered nurses and midwives were 2.346 per 1,000, underscoring the need for recruitment, training, and retention to meet rising chronic-care and specialty demand. These workforce realities push providers to adopt task-shifting, teleconsults, and targeted international hiring.

Import Dependency (Devices, Drugs)

Bahrain’s supply chain is import-heavy for pharmaceuticals and devices, exposing providers to cross-border logistics and regulatory complexity. UN Comtrade shows, for example, imports of adhesive medical dressings (HS 3005) at 2,264,458 USD with 64,062 kg volume in the latest published year, reflecting reliance on external suppliers for essential consumables. Medical oxygen imports totaled 172,056 m³ with a corresponding value of 54,720 USD, signaling cross-border dependence even for critical gases in clinical pathways. NHRA’s registry breadth—4,211 registered medicines—illustrates the scale of regulated imports that must be continuously maintained to prevent stock-outs.

Opportunities

PPP Models & Brownfield Upgrades

The asset base offers ample scope for PPPs and upgrades. NHRA tracks 924 licensed facilities, with 877 in the private segment—an investable landscape for concession-based diagnostics, imaging, and procedural suites within existing shells. Public primary care’s 26 centers and 1 clinic provide defined brownfield nodes for expansion of chronic-care rooms, infusion bays, and telehealth pods through performance-linked PPPs. Demographically, 1,588,670 residents, including 848,934 non-nationals, ensure sustained case-mix throughput to justify refurbishment CAPEX and equipment leases across imaging, endoscopy, and day surgery lines.

Home-Based Chronic Care & RPM

Chronic-care management at home is primed by age-structure and NCD realities. Bahrain counts 61,218 persons aged 65+—a concrete cohort for post-discharge monitoring and RPM-supported disease control. NCDs cause roughly 2,000 citizen deaths per year, emphasizing the payoff from continuity models that reduce exacerbations and readmissions. Public service design already includes mobile units and home visits for elderly patients, establishing an operational base for scale-up of chronic-care bundles supported by remote monitoring and virtual review. Life expectancy of 81.284 years adds to the chronic-care arc requiring home-based follow-up and device-enabled monitoring to maintain functional status and reduce acute utilization

Future Outlook

Over the coming years, the Bahrain healthcare market is poised for sustained growth, underpinned by ongoing infrastructure investments, enhancements in universal coverage, and increasing prevalence of non-communicable diseases. Continued modernization of facilities and adoption of digital health tools will further propel service sophistication and efficiency, particularly in ambulatory and specialty care segments.

Major Players

- Salmaniya Medical Complex

- King Hamad University Hospital

- BDF Royal Medical Services Hospital

- American Mission Hospital

- Bahrain Specialist Hospital

- Royal Bahrain Hospital – KIMSHEALTH

- Ibn Al-Nafees Hospital

- Al Hilal Healthcare Group

- Al Kindi Specialised Hospital

- Middle East Hospital

- Awali Hospital

- Al Salam Specialist Hospital

- Haifa Eye Hospital

- Noor Specialist Hospital

- King Abdullah bin Abdulaziz Medical City (University Medical City)

Key Target Audience

- Ministry of Health, Bahrain (government and regulatory bodies)

- National Health Regulatory Authority (NHRA) (government and regulatory bodies)

- Bahrain Health Insurance Fund — Sehati (government and regulatory bodies)

- Major Hospital Groups — Strategic Planning Leads

- Medical Equipment & Device Vendors – Regional Country Heads

- Investors and Venture Capitalist Firms interested in healthcare infrastructure

- HR & Operations Heads at private hospital chains

- Telehealth and Health Tech Platform Providers

Research Methodology

Step 1: Identification of Key Variables

We begin by mapping all stakeholders within the Bahrain healthcare ecosystem—including public hospitals, private facilities, payers, regulators, and medical device suppliers—relying on authoritative sources such as the Ministry of Health, NHRA, and facility registries to define market dimensions and segmentation.

Step 2: Market Analysis and Construction

This phase involves compiling historical data for utilization, spending, revenues, and payer mix. Government expenditure records, NHRA facility licensing data, and insurer/payer reporting are analyzed to triangulate sector revenue and quantity metrics reliably.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses regarding market growth drivers and segment dominance are validated via structured interviews with executives from major hospitals, health insurance entities, and NHRA officials—supplemented with insights from local industry forums.

Step 4: Research Synthesis and Final Output

The final stage integrates quantitative findings with qualitative stakeholder feedback. We consolidate data using a bottom-up method—summing service-line revenues across the ecosystem—and verify outputs through comparisons with published benchmarks, ensuring robustness and actionable insights.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Demographics, Expat Base & NCD Burden

Employer Insurance & Private Investment

Ambulatory Shift & Day-Care Expansion - Market Challenges

Specialist & Nursing Shortages

Import Dependency (Devices, Drugs)

Reimbursement Timelines & Denials - Opportunities

PPP Models & Brownfield Upgrades

Home-Based Chronic Care & RPM

Diagnostic Hubs & Centers of Excellence - Trends

Digital Front Door & Telehealth

AI-Enabled Imaging/Labs & RCM Automation - Government Regulation

NHRA Licensing & Quality Standards

Device/Drug Registration & Pricing Reference - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Care Setting (In Value %)

Primary Care Clinics

Secondary Care Hospitals

Tertiary & Quaternary Hospitals

Day Surgery Centers

Rehabilitation & Long-Term Care

Home Health & Community Care - By Payer Type (In Value %)

Public Schemes (MoH/BDF/University)

Employer-Sponsored Plans

Private Health Insurance

Self-Pay (Out-of-Pocket)

International/Medical Tourism - By Clinical Service Line (In Value %)

Cardiometabolic (Cardiology, Endocrinology)

Women & Child Health (Obstetrics, Neonatology, Pediatrics)

Oncology (Medical, Surgical, Radiation)

Orthopedics & Spine

Ophthalmology

Renal Care & Dialysis

Gastroenterology & Endoscopy

ENT & Dental

Mental & Behavioral Health - By Facility Ownership (In Value %)

Public MoH Facilities

BDF Royal Medical Services

University/Teaching Hospitals

Private (JCI-Accredited)

Private (Non-JCI) - By Geography (In Value %)

Capital

Muharraq

Northern

Southern

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Care Setting, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Care Setting/Service Line, Number of Touchpoints, Network Coverage (Insurer Panels), Number of Beds & ICU Bays, Theatre Count & Utilization, Diagnostic Suite (MRI/CT/Angio), Average Length of Stay, Occupancy, Claims Settlement TAT, Digital Maturity, Accreditation Status, Biomedical Uptime, Unique Value Offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players in Bahrain Healthcare Market

- Detailed Profiles of Major Companies

Salmaniya Medical Complex

King Hamad University Hospital

BDF Royal Medical Services Hospital

American Mission Hospital

Bahrain Specialist Hospital

Royal Bahrain Hospital – KIMSHEALTH

Ibn Al-Nafees Hospital

Al Hilal Healthcare Group (Hospitals & Clinics)

Al Kindi Specialised Hospital

Middle East Medical Center / Middle East Hospital

Awali Hospital

Al Salam Specialist Hospital

Dr. Haifa Eye Hospital

Noor Specialist Hospital

King Abdullah bin Abdulaziz Medical City (University Medical City)

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030