Market Overview

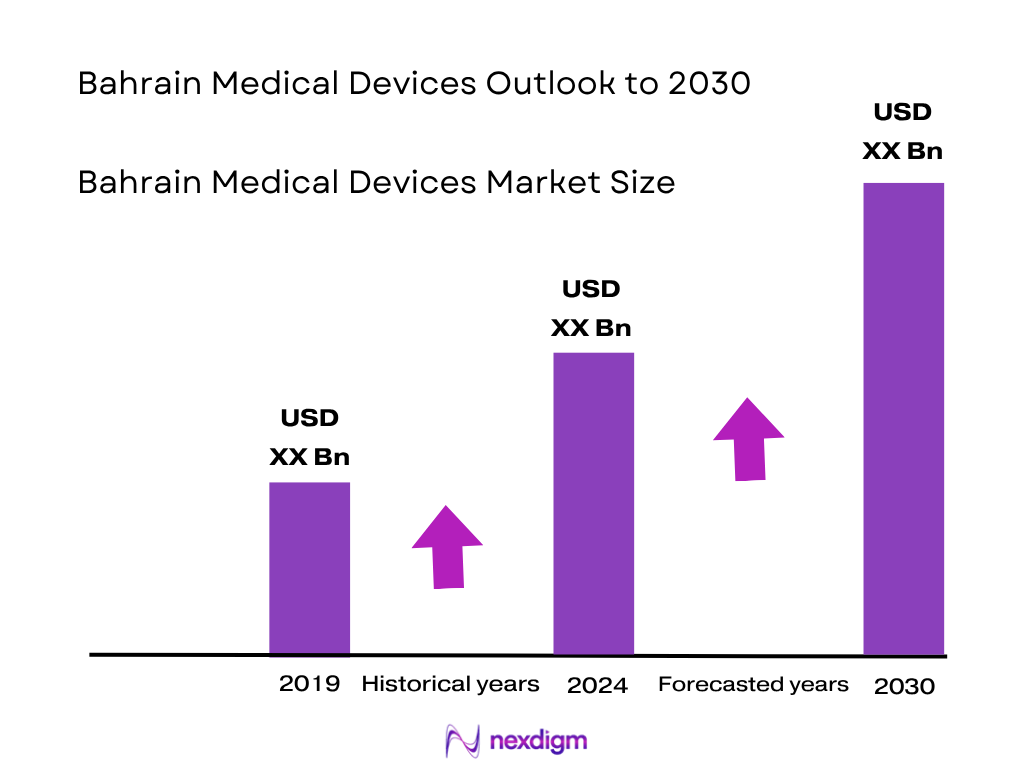

The Bahrain Medical Devices Market is valued at approximately USD 0.4 billion, derived from comprehensive industry reporting on in‑country sales and imports. This valuation reflects robust public and private healthcare investment, modernization of infrastructure under Vision 2031, and an expanding medical tourism segment. The market’s growth from 2023 to 2024 is anchored in rising demand for diagnostic imaging, patient monitoring, and surgical technologies, particularly in government hospitals and specialist private centers.

The market is concentrated in key urban centers such as Manama (Capital) and the Riffa area, driven by the presence of major tertiary hospitals including Salmaniya Medical Complex, King Hamad University Hospital, and several private hospital chains. These hubs dominate because they serve as primary care and referral centers, host the majority of tenders via the Tender Board and NHRA, and attract medical tourist inflows, thereby concentrating procurement volumes and device uptake.

Based on the Nexdigm analysis, the market is valued at USD 0.4 billion in 2025, implying a similar scope in 2024. It is forecast to grow at a CAGR of 9.2% from 2025 through 2031. For the period 2024–2030, you may approximate a consistent CAGR near 9.2%, recognizing slight year-on-year variation. This forecast reflects continued healthcare investment, device uptick across segments like imaging, monitoring, surgical instruments, and rising demand in homecare/telemedicine.

Market Segmentation

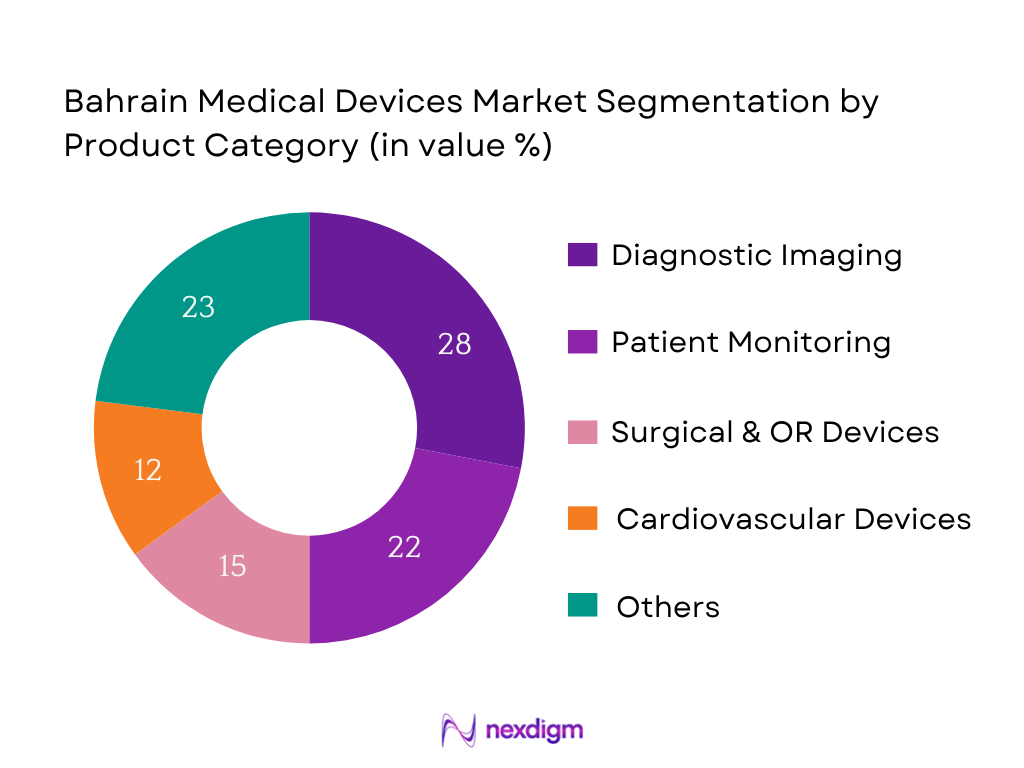

By Product Type

The Diagnostic Imaging segment leads the market due to heavy investments in MRI, CT, ultrasound, and X-ray systems by both public and private institutions, as part of infrastructure modernization efforts. This includes upgrading existing imaging suites and flow-through demand from research and medical tourism sectors, reinforcing strong volumetric and value contributions.

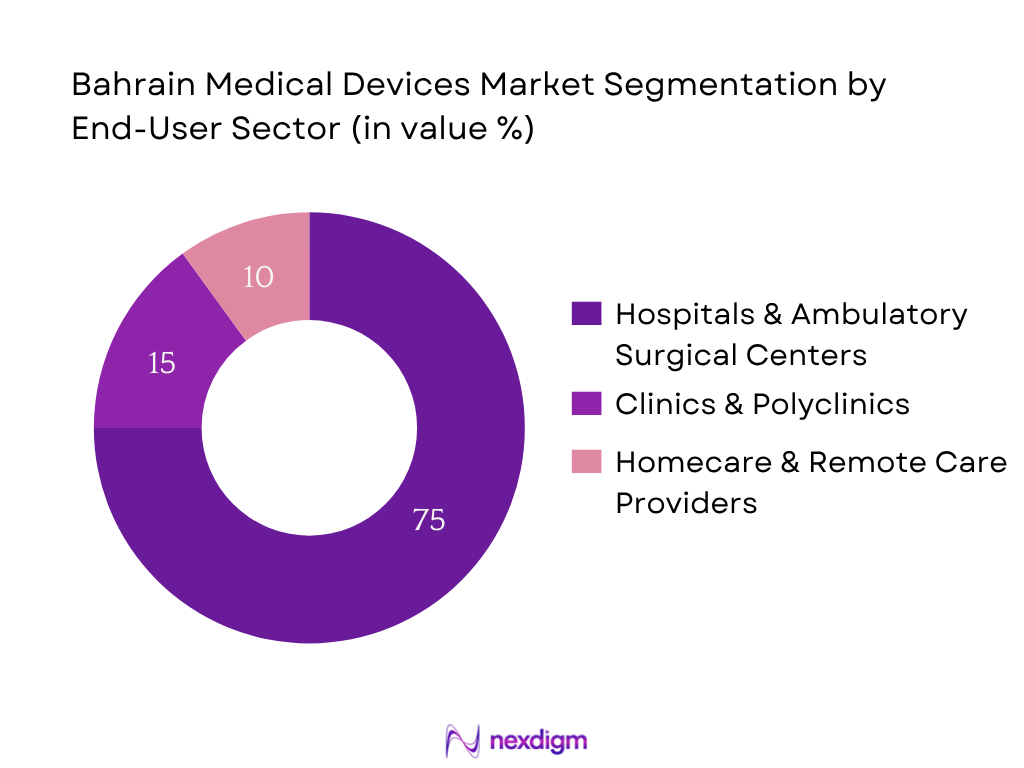

By End-User / Application

Hospitals and Ambulatory Surgical Centers dominate, accounting for the bulk of demand. This is due to their infrastructure scale, capital expenditure budgets, and clinical demand across tertiary departments like imaging, ICU, OR, cardiology, and dialysis. Clinics and homecare segments, while growing, still trail due to smaller procurement budgets and longer adoption cycles.

Competitive Landscape

The Bahrain Medical Devices Market features a mix of global OEMs and regional distributors. This consolidation underscores the influence of key long-standing players who have local presence and service capabilities. The market is consolidated around major players such as GE HealthCare, Siemens Healthineers, Philips, Medtronic, and Stryker, supported by regional distributors like Al Jishi and Gulf House. Their dominance stems from comprehensive portfolios, NHRA registrations, servicing networks, and strategic partnerships with healthcare institutions.

| Company | Establishment Year | Headquarters | NHRA-registered SKUs | Local Service Engineers | OFOQ Import Approvals | Tender Awards | Warranty SLA (uptime) |

| GE HealthCare | — | USA | – | – | – | – | – |

| Siemens Healthineers | — | Germany | – | – | – | – | – |

| Philips | — | Netherlands | – | – | – | – | – |

| Medtronic | — | USA | – | – | – | – | – |

| Stryker | — | USA | – | – | – | – | – |

Bahrain Medical Devices Market Analysis

Growth Drivers

Aging cohort & homecare

World Bank data show 61,218 people aged 65+ alongside 1,588,670 total residents, with the 65+ share trending up since 2022; this shifts utilization toward home oxygen, infusion pumps, and ambulatory monitoring. WHO’s Bahrain health brief counts 6,102 deaths, with 74% attributable to NCDs—a profile that drives continuous demand for cardiac, renal, and metabolic devices in clinic and home settings. Dense urbanization accelerates access to services and same-day device logistics around Manama and Muharraq, improving adherence to device protocols.

Insurance penetration

Central Bank datasets indicate medical insurance gross premiums at BD 74,406 thousand with claims BD 51,581 thousand in 2022, rising from BD 69,708 thousand premiums and BD 48,093 thousand claims the year prior, making medical the largest non-life class and ratifying a paying pathway for hospital-driven device utilization. The CBB maintains the dinar at 0.376081 per USD, stabilizing import settlement for USD-priced devices and consumables purchased by insurers and providers. These financing and monetary anchors support predictable procurement and contract servicing for high-acuity modalities.

Market Challenges

FX and freight exposure

Device imports settle predominantly in USD/EUR; the Bahraini dinar parity at 0.376081 per USD anchors invoice translations but ties landed cost to global logistics. Bahrain International Airport recorded 128,690 tonnes of import air cargo and 156,562 tonnes in trans-shipment during 2023, while KBSP maintains 1,100,000 TEU container capacity—data that reflect strong throughput yet exposure to global cargo cycles. Freight timing, aircraft belly capacity, and port schedules thus remain critical to commissioning timelines for imaging, OR, and ICU equipment.

Cybersecurity for SaMD

Connected care raises cyber-assurance needs across PACS/RIS and RPM links. Bahrain’s National Cyber Security Centre provides the national incident response framework and oversees execution under the National Cyber Security Strategy; MoH digital services show 63,482 appointment transactions within a recent panel, and Sehati exposes medical results for SMC and KHUH—illustrating real patient-data flows that must align with medical-grade cybersecurity controls. With regulated telemedicine under SCH and NHRA technical standards, SaMD and connected devices must evidence secure deployment within this national posture.

Opportunities

Managed equipment services (MES) & lifecycle contracts

The delivery network’s scale—924 licensed facilities, 22,060 active licensed professionals, and a compact population of 1,588,670—creates ideal conditions for outcome-linked MES covering imaging, monitoring, and CSSD estates across multi-site public and private operators. Active procurement (e.g., PHC equipment replacement tender 968/2024) indicates structured refresh waves that can be bundled into uptime-guaranteed agreements with on-island parts pools and technician SLAs. Stable monetary conditions (BHD parity 0.376081 per USD) support multi-year service payments without FX drift, improving feasibility of availability-based contracts for high-acuity fleets.

PACS/VNA consolidation & imaging informatics

Ministry platforms already expose medical results for SMC and KHUH through Sehati, while eService logs show tens of thousands of appointment transactions in active use—data flows that justify centralized PACS/VNA architectures and enterprise imaging governance across hospitals and primary care. Formal telemedicine enablement under SCH Decision No. 2 of 2019 and NHRA technical standards sets the regulatory base for interoperable imaging exchange, audit trails, and cybersecurity hardening. Consolidating archives reduces duplicate studies and supports AI triage overlays for radiology workloads in Manama/Muharraq hubs.

Future Outlook

Over the next several years, the Bahrain Medical Devices Market is expected to maintain strong growth momentum propelled by continued government-led healthcare infrastructure investment, private sector expansion, and rising medical tourism. Technological adoption in imaging and remote monitoring, along with increasing healthcare insurance coverage and value-based procurement models, will further fuel market development. Additionally, the trend toward outpatient diagnostics, home monitoring, and PC-based telehealth is poised to create new growth niches beyond traditional hospital procurement.

Major Players

- Al Jishi Corporation

- Gulf House Medical System WLL

- AMICO (Al Amin Medical & Instrument Co)

- Cigalah Gulf Medical – Bahrain

- Behzad Medical Establishment

- Al Jazeera Scientific Corporation

- Mercury Marketing WLL

- GE HealthCare

- Siemens Healthineers

- Philips

- Medtronic

- Johnson & Johnson (Ethicon/DePuy Synthes)

- Stryker

- BD (Becton, Dickinson and Company)

- Abbott

Key Target Audience

- Heads of rocurement – Ministry of Health (MoH)

- Heads of Procurement – Supreme Council of Health (SCH)

- Heads of Procurement – Royal Medical Services (BDF)

- Heads of Procurement – Private Hospital Chains (e.g., American Mission, Royal Bahrain)

- Heads of Biomedical Engineering – Major Public Hospitals (e.g., Salmaniya Medical Complex)

- Heads of Biomedical Engineering – Private Hospital Groups

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., National Health Regulatory Authority – NHRA)

Research Methodology

Step 1: Identification of Key Variables

This phase involved mapping stakeholders across Bahrain’s medical device ecosystem—hospitals, tender authorities, distributors, OEMs, and regulatory bodies. It involved desk research from secondary databases, NHRA documentation, and public hospital data to capture device categories, procurement flows, and market drivers.

Step 2: Market Analysis and Construction

Here, historical data on device imports, tender volumes, and hospital infrastructure investments were compiled. Modeling included installed base estimates, expenditure patterns by device category, and pricing benchmarks, followed by validation through cross-comparison of public (MoH) and private (chain) procurement data to triangulate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Draft hypotheses regarding growth drivers—such as imaging demand, private sector expansion, and medical tourism—were tested via interviews with biomedical heads at public hospitals, procurement officers, and distributor sales leads. These discussions refined assumptions around adoption timelines, service expectations, and supply chain bottlenecks.

Step 4: Research Synthesis and Final Output

The final draft incorporated insights from OEMs and distributor leadership on portfolio performance, market segmentation dynamics, and future demand. These insights were used to validate the bottom-up sizing and segment forecasts, ensuring a robust and market-accurate analysis of Bahrain’s medical devices landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions [NHRA device classes, SaMD scope, installed base vs. shipments], Abbreviations [NHRA, SCH, BDF/RMS, KHUH, SMC, OFOQ, UDI/GS1], Market Sizing Approach [import dossiers, Tender Board awards, hospital capex mapping], Consolidated Research Approach [primary KOLs, OEM/distributor triangulation], Understanding Market Potential Through In-Depth Industry Interviews [MoH/SCH, private chains, biomedical heads], Primary Research Approach [RFP/tender debriefs, vendor scorecards], Limitations and Future Conclusions [recall actions, Class III approvals])

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

NCD burden & tertiary care expansions

Private hospital investments

Imaging & cath-lab upgrades

Digital health & RPM adoption

Aging cohort & homecare

Insurance penetration - Market Challenges

Small-lot demand & SKU complexity

NHRA registration lead times

Price compression in tenders

Biomedical service depth

FX/freight volatility

Cybersecurity for SaMD - Opportunities

Managed equipment services & lifecycle contracts

PACS/VNA consolidation

OR integration & navigation

CSSD compliance upgrades

Home dialysis & remote monitoring

AI decision support - Trends

AI-enabled imaging

Low-dose protocols

Point-of-care diagnostics

GS1/UDI traceability

Sustainability in OR/CSSD

Battery-backed critical devices - Government Regulation

NHRA classification

AR/importer obligations

OFOQ import pre-approval

Vigilance & FSN/recalls

Labeling/IFU Arabic-English

UDI/GS1 adoption roadmap - SWOT Analysis

- Stake Ecosystem (NHRA, MoH, SCH, BDF/RMS, KHUH, SMC, Tender Board, private chains, group purchasing)

- Porter’s Five Forces (public/private buyer power, specialty supplier power, substitutes, entry barriers via AR/QMS, rivalry by line cards)

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Diagnostic Imaging

Patient Monitoring

Surgical & OR

Cardiovascular

Orthopedics & Spine

Wound & Infection Control

Consumables & Disposables

Dental Devices

Homecare & RPM - By Device Risk Class (In Value %)

Class I

Class II

Class III

Active Implantable

Software as a Medical Device - By Clinical Department (In Value %)

Emergency & Trauma

ICU/CCU

Operating Room & CSSD

Cardiology & Cath Lab

Radiology

Oncology

Nephrology & Dialysis

OB/Gyn & NICU

Endoscopy

Dental

Ophthalmology - By End User (In Value %)

Ministry of Health facilities

Supreme Council of Health programs

BDF/Royal Medical Services

King Hamad University Hospital

Salmaniya Medical Complex

Private hospital chains

Specialty centers

Polyclinics

Diagnostic laboratories

Homecare providers - By Distribution Model (In Value %)

Direct OEM

Authorized Representative

Multi-line distributor

E-procurement/marketplace

- Market Share of Major Players on the Basis of Value/Volume (current cycle)

Market Share of Major Players by Device Segment (imaging, monitoring, OR, cardio, ortho, dental, homecare) - Cross Comparison Parameters (NHRA registration status & validity; count of NHRA-approved SKUs in Bahrain; Tender Board awards (number/value); installed base at SMC/BDF/KHUH/private; field-service footprint (engineers, response time); OFOQ import lead-time adherence; warranty & uptime SLAs; UDI/GS1 & bilingual IFU compliance)

- SWOT Analysis of Major Players (Bahrain-specific)

- Pricing Analysis Basis SKUs for Major Players in Bahrain Medical Devices Market

- Detailed Profiles of Major Companies

Al Jishi Corporation

Gulf House Medical System WLL

AMICO (Al Amin Medical & Instrument Co)

Cigalah Gulf Medical – Bahrain

Behzad Medical Establishment

Al Jazeera Scientific Corporation

Mercury Marketing WLL

GE HealthCare

Siemens Healthineers

Philips

Medtronic

Johnson & Johnson (Ethicon/DePuy Synthes)

Stryker

BD (Becton, Dickinson and Company)

Abbott

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030