Market Overview

The Brazil agrochemical market is valued at USD 10.4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 5.6% from 2024-2030, which is primarily driven by the country’s robust agricultural sector and continuous innovation in agri-input technologies. The increasing need for high-yield crops amid expanding farmland and a growing population has led to a significant demand for agrochemicals, particularly fertilizers and pesticides. Consequently, the market is set to follow the upward trajectory, supported by government policies advocating for agricultural modernization and efficiency improvements.

Brazil has emerged as a global leader in agrochemical consumption, with dominant regions such as the Southeast, particularly São Paulo and Minas Gerais, and the Central-Western states, including Mato Grosso and Goiás. These regions account for a significant share of the country’s agricultural output due to conducive climatic conditions and large-scale farming practices. Such geographical advantages encourage higher utilization of agrochemicals, solidifying Brazil’s status as a major market player within South America.

Technological advancements are revolutionizing the agrochemical industry in Brazil, with investments in R&D reaching USD 1.5 billion in recent years. These innovations include precision agriculture tools that enhance the efficient application of agrochemicals, significantly minimizing waste and maximizing effectiveness. Brazil’s adoption of digital agriculture technologies further supports this development, helping farmers optimize their use of pesticides and fertilizers.

Market Segmentation

By Product Type

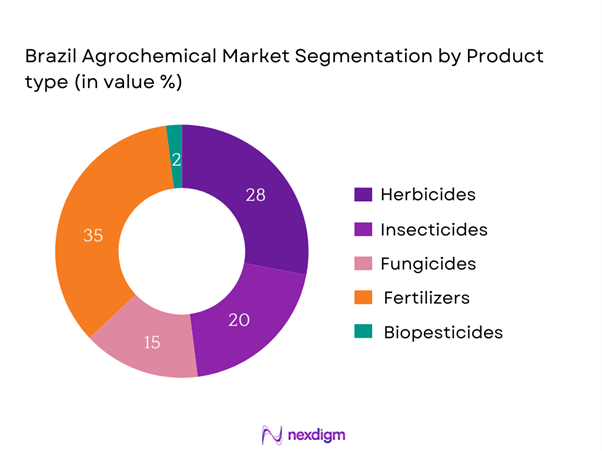

The Brazil agrochemical market is segmented by product type into herbicides, insecticides, fungicides, fertilizers, and biopesticides. Recently, fertilizers have captured the largest market share driven by the consistent demand for soil enrichment to boost crop productivity. Fertilizers, specifically nitrogenous, phosphatic, and potassic types, provide essential nutrients required for healthy crop development. Moreover, the increasing adoption of high-yield plant varieties necessitates enhanced soil fertility, making fertilizers indispensable. Additionally, local agricultural practices have evolved to include advanced fertilization techniques, highlighting Brazil’s importance in the international fertilizer market.

By Application

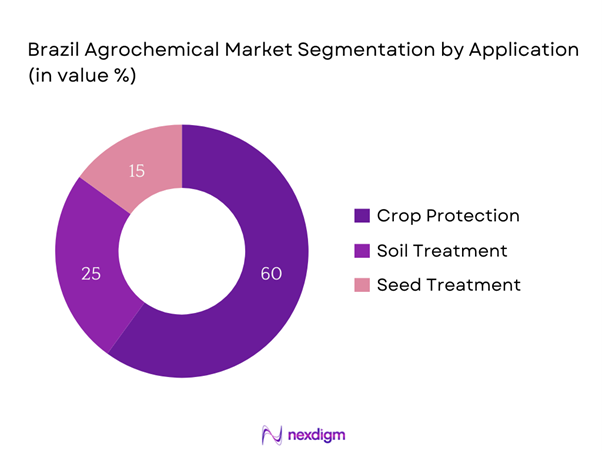

The market is also segmented by application, including crop protection, soil treatment, and seed treatment. Among these, crop protection is the dominant segment due to the increasing need to safeguard crops from pests and diseases, which has become paramount as agricultural productivity demands heighten. Crop protection products help mitigate yield losses caused by harmful organisms and are an integral component of modern agriculture. Moreover, Brazil’s diverse agricultural landscape, which includes grains, fruits, and vegetables, necessitates a broad array of pest management solutions, solidifying its critical role in ensuring optimum crop yields.

Competitive Landscape

The Brazilian agrochemical market is dominated by several major players, including BASF, Bayer Crop Science, Syngenta, Corteva Agriscience, and FMC Corporation. These companies leverage extensive research and development capabilities, significant distribution networks, and strong brand loyalty to maintain their industry positions. The consolidation in the market emphasizes the influence of these key companies in shaping trends and driving innovation within the agrochemical landscape.

| Company | Establishment Year | Headquarters | Revenue (USD) | Product Focus | Market Presence | R&D Investment |

| BASF | 1865 | Ludwigshafen, Germany | – | – | – | – |

| Bayer Crop Science | 1863 | Leverkusen, Germany | – | – | – | – |

| Syngenta | 2000 | Basel, Switzerland | – | – | – | – |

| Corteva Agriscience | 2019 | Wilmington, USA | – | – | – | – |

| FMC Corporation | 1884 | Philadelphia, USA | – | – | – | – |

Brazil Agrochemical Market Analysis

Growth Drivers

Accelerated Agricultural Production

Brazil’s agricultural output has surged, reaching 259 million tons of grain in 2023, reflecting the sector’s rapid expansion fueled by increasing domestic and global food demand. The use of agrochemicals plays a pivotal role in achieving such high levels of productivity, particularly in key states like Mato Grosso and Paraná, which lead in soybean and corn production. As a result, Brazil ranks among the top global producers of essential crops. Government initiatives have supported this growth by investing in research and infrastructure to strengthen the agricultural backbone of the nation.

Increasing Export Demand

Brazil’s agricultural exports reached USD 131.9 billion in 2023, marking it as a global leader in food exports, with soybeans, corn, and beef as the primary contributors. This demand is driven by consumer markets in Asia and Europe, creating immense opportunities for agrochemical companies to supply the necessary input to maintain and increase production levels. The competitive edge in export markets is sustained by adopting high-quality agrochemicals, essential for cultivating export-grade crops. The robust demand for agricultural exports underlines the significant economic role of the agrochemical sector in supporting Brazil’s trade surplus.

Market Challenges

Environmental Regulations

Brazil’s stringent environmental regulations pose challenges to the agrochemical market as the government seeks to balance agricultural growth with ecological protection. Compliance with these regulations is mandatory, enhancing the need for eco-friendly formulations and sustainable practices. Policies like the Forest Code, which mandates that rural properties maintain a specified percentage of native vegetation, influence the agrochemical industry’s operational frameworks. Companies must invest in research to develop products that meet regulatory standards without compromising productivity. This challenge also presents an opportunity for innovation in creating more sustainable agrochemical solutions.

Resistance Development in Pests

Resistance development among pests is a significant challenge for Brazil’s agrochemical sector, as witnessed by increased cases of resistant crop pests reported by the Brazilian Ministry of Agriculture. This phenomenon threatens agricultural productivity and necessitates the ongoing adaptation and enhancement of agrochemical products. Farmers and agrochemical companies work collaboratively to develop integrated pest management strategies, combining chemical and non-chemical methods to mitigate resistance issues. Ongoing research aims to introduce advanced formulations that address these resistance challenges, ensuring the continued effectiveness of agrochemical applications in safeguarding crop yields.

Opportunities

Sustainable Agricultural Practices

With approximately 30 million hectares dedicated to organic agriculture in Brazil, the shift toward sustainable farming practices offers significant opportunities for the agrochemical market. This movement is supported by government policies promoting sustainable agriculture and eco-friendly product development. The demand for organic and less environmentally impactful agrochemical products is rising. Companies are incentivized to innovate and develop sustainable solutions that enhance crop resilience and soil health, aligning with the national goal of reducing the agricultural sector’s environmental footprint while maintaining high productivity levels.

Innovative Agrochemical Formulations

Brazil’s focus on innovation within the agrochemical market caters to the evolving needs of farmers who face heightened demands for crop protection under challenging conditions. The development of bio-based agrochemicals, which recorded increasing investment, indicates a significant trend toward more sustainable and innovative solutions. Such formulations provide targeted pest control while reducing chemical residue, appealing to both domestic and international consumers concerned with sustainability. As these innovations gain traction, agrochemical companies can capitalize on the growing market for environmentally friendly products that align with Brazil’s agricultural advancement.

Future Outlook

Over the next five years, the Brazil agrochemical market is projected to demonstrate a significant growth trajectory driven by various factors including advancements in agricultural technology, increasing export demand, and the rising adoption of sustainable farming practices. Additionally, government support and regulatory frameworks aimed at boosting the agricultural sector will further enhance market dynamics. With the increasing emphasis on food security, the industry is expected to become more innovative, looking towards environmentally friendly agrochemical solutions.

Major Players

- BASF

- Bayer Crop Science

- Syngenta

- Corteva Agriscience

- FMC Corporation

- ADAMA Agricultural Solutions

- UPL Limited

- Nutrien

- Yara International

- Nufarm

- Sumitomo Chemical

- Bioceres Crop Solutions

- Inari Agriculture

- Evonik Industries

Key Target Audience

- Farmers and Agriculture Producers

- Agrochemical Distributors and Retailers

- Agricultural Equipment Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Ministry of Agriculture, Livestock and Supply)

- Environmental NGOs and Advocacy Groups

- Crop Research Institutions

- Food Processing Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the agrochemical ecosystem, identifying all key stakeholders within the Brazil Agrochemical Market. This process is underpinned by detailed desk research, utilizing both secondary sources and proprietary databases to compile comprehensive industry-level information. The objective of this step is to recognize and define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Brazil Agrochemical Market is compiled and analyzed. This includes evaluating market penetration, the relationship between various product offerings, and resulting revenue generation across the sector. A rigorous assessment of statistics related to service quality ensures the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

This phase involves developing market hypotheses that are subsequently validated through consultations using computer-assisted telephone interviews (CATI) with industry experts. These professionals represent a diverse range of companies within the agrochemical sector, providing invaluable operational insights and financial data to refine and corroborate the market analysis.

Step 4: Research Synthesis and Final Output

The final stage encompasses direct engagement with multiple agrochemical manufacturers to gather detailed insights regarding product segments, sales performance, consumer preferences, and pertinent market factors. This interaction serves to verify and complement the statistics derived from earlier research phases, ensuring a thorough and validated analysis of the Brazil Agrochemical Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview of Market Evolution

- Major Players Timeline

- Business Cycle and Trends

- Supply Chain and Value Chain Analysis

- Growth Drivers

Accelerated Agricultural Production

Increasing Export Demand

Technological Advancements in Agrochemicals - Market Challenges

Environmental Regulations

Resistance Development in Pests - Opportunities

Sustainable Agricultural Practices

Innovative Agrochemical Formulations - Market Trends

Shift Towards Organic Farming

Digital Agriculture Solutions - Government Regulation

Registration and Compliance

Trade Tariffs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Herbicides

– Glyphosate-based Herbicides

– Selective Herbicides

– Non-selective Herbicides

Insecticides

– Organophosphates

– Pyrethroids

– Neonicotinoids

Fungicides

– Triazoles

– Strobilurins

– Biofungicides

Fertilizers

– Nitrogenous

– Phosphatic

– Potassic

Biopesticides

– Microbial Pesticides

– Botanical Pesticides

– Biochemical Pesticides - By Application (In Value %)

Crop Protection

– Foliar Sprays

– Systemic Treatments

Soil Treatment

– Soil Conditioners

– Nutrient Enrichment Agents

Seed Treatment

– Insecticidal Seed Coatings

– Fungicidal Seed Coatings - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Farmer

– Corporate Farming Contracts

Distributors

– Regional Agro-dealers

– Agricultural Cooperatives

Online Platforms

– E-commerce Agro Portals

– B2B Agrochemical Marketplaces - By Crop Type (In Value %)

Cereals and Grains

– Corn

– Wheat

– Rice

Oilseeds

– Soybean

– Sunflower

Fruits and Vegetables

– Citrus Fruits

– Tomatoes

– Leafy Greens - By Region (In Value %)

São Paulo

Minas Gerais

Paraná

Rio Grande do Sul

Mato Grosso

Goiás

Bahia

Pernambuco

Pará

Amazonas

- Market Share of Key Players by Value/Volume, 2024

- Product Type Share Analysis, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Distribution Channels, Number of Dealers and Distributors, Product Portfolio, R&D Investment, Manufacturing Capacity, Regulatory Compliance, Geographic Presence, Sustainability Initiatives, Margins, Farmer Outreach Programs, Technological Innovations, Strategic Partnerships, Unique Value Offering, and others)

- SWOT Analysis of Major Companies

- Pricing Strategy Analysis for Major Players

- Detailed Profiles of Leading Companies

BASF

Bayer Crop Science

Syngenta

DuPont

Corteva Agriscience

FMC Corporation

ADAMA Agricultural Solutions

UPL Limited

Nufarm

Sumitomo Chemical

Inari Agriculture

Evonik Industries

Bioceres Crop Solutions

Nutrien

RICETEC

- Market Demand Dynamics

- Budget Allocation and Spending Trends

- Regulatory Compliance Needs

- User Needs and Challenges

- Decision-Making Process Overview

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030