Market Overview

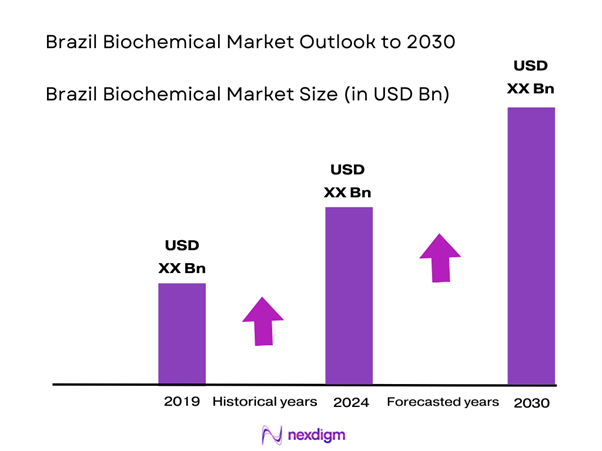

The Brazil Biochemical Market is valued at USD 8.9 million in 2024 with an approximated compound annual growth rate (CAGR) of 7.5% from 2024-2030, driven primarily by increasing investments in biotechnology and a shift towards more sustainable and biodegradable products. The notable increases in demand for biochemicals to meet international standards for environmental sustainability, coupled with governmental initiatives to boost the bio-based economy, have significantly propelled market growth.

Key cities such as São Paulo, Rio de Janeiro, and Campinas dominate the Brazilian biochemical landscape due to their established industrial infrastructure, availability of skilled labor, and proximity to agricultural resources. These urban centers are not only home to numerous research facilities but also host some of the leading manufacturers, making them pivotal for innovations and advancements in biochemistry.

The Brazilian government has actively promoted bio-based products through policies and incentives, allocating USD 1.2 billion to support bioeconomy projects. These initiatives are critical in achieving the national bioeconomy strategy, which targets an increase in biodegradable product utilization across sectors. Such governmental support has led to a notable uptick in the production of biopolymers, accounting for approximately 380 thousand tons produced in the last fiscal year. This proactive stance encourages enterprises to innovate in developing bio-products, fostering a robust market environment conducive to the growth of biochemicals.

Market Segmentation

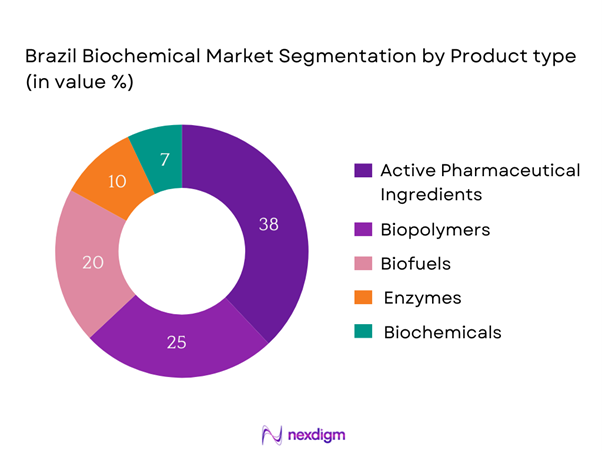

By Product Type

The Brazil Biochemical Market is segmented by product type, which includes Active Pharmaceutical Ingredients (APIs), Biopolymers, Biofuels, Enzymes, and Biochemicals. Among these, Active Pharmaceutical Ingredients (APIs) hold a dominant market share. The surge in production and innovation in drug formulation leads to an increased demand for APIs. Brazil’s emphasis on healthcare and pharmaceutical advancements is amplified by international collaborations, thereby enhancing its production capacities and market presence.

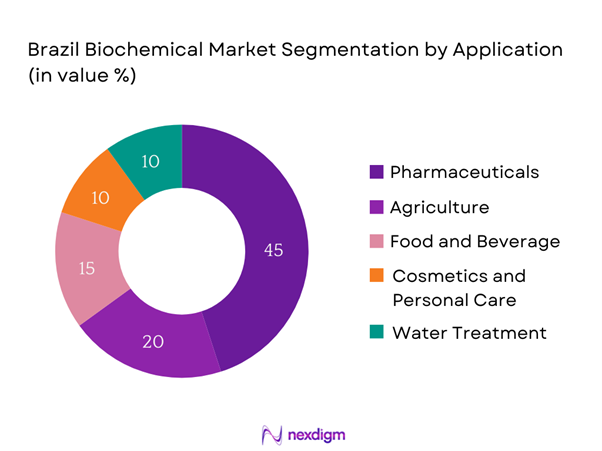

By Application

The market is also segmented by application into Pharmaceuticals, Agriculture, Food and Beverage, Cosmetics and Personal Care, and Water Treatment. The Pharmaceuticals application dominates this market segment due to the increasing prevalence of diseases and the rising focus on biopharmaceuticals. The growth of personalized medicine and advancements in biotechnology drive substantial investments within this vertical, cementing its importance in the overall biochemical landscape.

Competitive Landscape

The Brazil Biochemical Market is characterized by a few dominant players, including multinational corporations and local manufacturers. Leading companies like Braskem and Oxiteno have established significant market positions due to their innovation capabilities and extensive product portfolios. This consolidation underscores the industry’s competitive nature, where major players continuously enhance their offerings to capture a larger share of the expanding market.

| Company Name | Establishment Year | Headquarters | Market Specific Parameter 1 | Market Specific Parameter 2 | Market Specific Parameter 3 | Market Specific Parameter 4 | Market Specific Parameter 5 | Market Specific Parameter 6 |

| Braskem | 2002 | São Paulo, Brazil | – | – | – | – | – | – |

| Oxiteno | 1965 | São Paulo, Brazil | – | – | – | – | – | – |

| Granbio | 2013 | São Paulo, Brazil | – | – | – | – | – | – |

| Solvay | 1863 | Brussels, Belgium | – | – | – | – | – | – |

| Cargill | 1865 | Wichita, Kansas, USA | – | – | – | – | – | – |

Brazil Biochemical Market Analysis

Growth Drivers

Increasing Demand for Renewable Resources

Brazil’s push towards renewable energy resources is backed by substantial investments, amounting to USD 15 billion in 2023. The country’s prominence in biofuel production, particularly with sugarcane ethanol output reaching 34 billion liters last year, underscores its commitment to renewable resources. Such capabilities stem from Brazil’s extensive agricultural sector, which employs over 17 million people, thereby providing a rich feedstock for biofuel production. This demand is further fueled by global calls for cleaner energy sources, positioning Brazil as a crucial player in the biochemical industry’s renewable resource segment.

Technological Advancements

The integration of technology in Brazil’s biochemical sector is evident with investments surpassing USD 3 billion into R&D over the recent years. Technological breakthroughs, such as enzymatic processing in biochemical manufacturing, have enhanced efficiency and yielded significant output improvements. Notably, Brazil has seen an increase in registered patents in biotechnology, with over 1,300 new patents filed in the past year alone. This surge exemplifies the innovative spirit driving the sector, translating scientific advancements into tangible industrial applications that enhance the production and quality of biochemical products.

Market Challenges

Volatility in Raw Material Prices

The Brazil biochemical market faces challenges with raw material price volatility, influenced by factors like global supply chain disruptions. For instance, Brazil’s exports and imports saw a reported variance of 2% in total volume due to fluctuating trade conditions. The agricultural sector, a vital supplier of biomass, experienced pricing uncertainties as global commodity prices for corn and sugarcane fluctuated by around USD 5 per bushel and USD 20 per ton, respectively, last year. Such price instabilities can hamper production planning and cost forecasting in the biochemical industry.

Regulatory Barriers

Regulatory barriers remain a challenge for the Brazilian biochemical market, with the country maintaining a complex framework for approvals and compliance. For example, the process for new biochemical approval involves extensive testing and an approval period that can range from two to four years. This lengthy regulatory journey, coupled with requirements like environmental impact assessments that cost upwards of USD 200,000 per project, poses significant hurdles. Compliance burdens can result in delays and increased operational costs that affect the speed and efficiency of bringing new biochemical products to market.

Opportunities

Growing Demand for Sustainable Products

Brazil is witnessing a substantial rise in the demand for sustainable products, with the organic product market alone reaching USD 4.7 billion in value. Consumer awareness about environmental impact has driven adoption rates of organically sourced and bio-based products, reflecting heightened interest in sustainability. In addition, over 40% of domestic manufacturers have reportedly incorporated sustainability strategies into their operations, focusing on reducing waste and utilizing eco-friendly materials. These developments hint at a growing market potential for sustainable biochemicals, creating avenues for industry expansion and innovation.

Innovations in Biochemical Applications

Advancements in the application of biochemicals are paving the way for diverse uses across industries in Brazil. Notably, the food and beverage industry has integrated biochemicals valued at USD 2.6 billion in various processes, enhancing product shelf life and nutritional profile. Furthermore, innovations in biodegradable packaging have seen the adoption rate soar, with estimates showing over 15,000 tons produced yearly. Such progress reflects Brazil’s capability to lead in the development and application of biochemicals, satisfying both local demand and positioning itself as a key exporter in this sector.

Future Outlook

Over the next five years, the Brazil Biochemical Market is expected to exhibit substantial growth, driven by continuous governmental support for the bioeconomy, rising consumer demand for sustainable products, and ongoing advancements in biotechnological innovations. The expansion of the pharmaceutical and agricultural sectors will further boost market dynamics, providing ample growth opportunities for established and emerging players alike.

Major Players

- Braskem

- Oxiteno

- Granbio

- Solvay

- Cargill

- Bioenergia

- BASF

- Dow Chemical Company

- Evonik Industries

- Archer Daniels Midland

- LanzaTech

- Genomatica

- FutureFuel Chemical Company

- DSM

Key Target Audience

- Biochemical Manufacturers

- Pharmaceutical Companies

- Agricultural Organizations

- Food and Beverage Companies

- Cosmetics and Personal Care Manufacturers

- Environmental Regulatory Agencies (e.g., Ministry of the Environment)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., ANVISA – National Health Surveillance Agency)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Brazil Biochemical Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Brazil Biochemical Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple biochemical manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Brazil Biochemical Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Renewable Resources

Government Initiatives for Bio-based Products - Market Challenges

Volatility in Raw Material Prices

Regulatory Barriers - Opportunities

Growing Demand for Sustainable Products

Innovations in Biochemical Applications - Trends

Shift Towards Circular Economy

Advances in Biotechnology - Government Regulation

Environmental Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Active Pharmaceutical Ingredients (APIs)

– Small Molecule APIs

– Biologic APIs

– High Potency APIs (HPAPIs)

– Synthetic APIs

Biopolymers

– Polylactic Acid (PLA)

– Polyhydroxyalkanoates (PHA)

– Starch-Based Biopolymers

– Cellulose-Based Biopolymers

– Biodegradable Polyesters

Biofuels

– Bioethanol (1st and 2nd Generation)

– Biodiesel

– Biogas

– Renewable Diesel

Enzymes

– Industrial Enzymes (e.g., Protease, Amylase)

– Food Enzymes

– Pharmaceutical Enzymes

– Specialty Enzymes

Biochemicals

– Organic Acids (e.g., Lactic Acid, Citric Acid)

– Alcohols (e.g., Butanol, Ethanol)

– Amino Acids

– Ketones and Aldehydes - By Application (In Value %)

Pharmaceuticals

– Drug Manufacturing

– Vaccine Production

– Biotech Therapies

Agriculture

– Biofertilizers

– Biopesticides

– Biostimulants

Food and Beverage

– Food Additives

– Natural Flavor Enhancers

– Nutraceuticals

Cosmetics and Personal Care

– Natural Emollients

– Plant-Based Actives

– Bio-based Preservatives

Water Treatment

– Bioflocculants

– Biocides

– Enzyme-Based Cleaners - By Distribution Channel (In Value %)

Direct Sales

– B2B Contracts with Manufacturers

– Institutional Bulk Supply

Distributors

– Regional Chemical Distributors

– Specialized Biochemical Distributors

E-commerce

– Manufacturer-Owned Platforms

– B2B Marketplaces

– Chemical E-tailers - By Region (In Value %)

Southeast Brazil

South Brazil

Central-West Brazil

Northeast Brazil

North Brazil - By Technology Type (In Value %)

Fermentation Technology

– Microbial Fermentation

– Yeast-Based Production

– Anaerobic Digestion

Enzymatic Processes

– Enzyme-Assisted Synthesis

– Biocatalysis for Fine Chemicals

– Enzyme Immobilization Systems

Chemical Synthesis

– Green Chemistry Routes

– Chemo-Enzymatic Hybrid Processes

– Catalytic Conversions

- Market Share of Major Players (By Value/Volume), 2024

Market Share by Product Type Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Product Type, Number of Touchpoints, Distribution Channels, Market Presence, R&D Investments, Unique Value Proposition)

- SWOT Analysis of Key Market Players

- Pricing Analysis Based on Key Segments

- Detailed Profiles of Major Companies

Braskem

Bioenergia

Granbio

Oxiteno

Solvay

Dow Chemical Company

BASF

Evonik Industries

DSM

Archers Daniels Midland

Cargill

FutureFuel Chemical Company

Genomatica

Calyxt

LanzaTech

- Market Demand and Utilization Patterns

- Purchasing Power Analysis

- Consumer Regulatory Compliance Considerations

- Needs, Preferences, and Pain Points

- Decision-Making Framework

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030