Market Overview

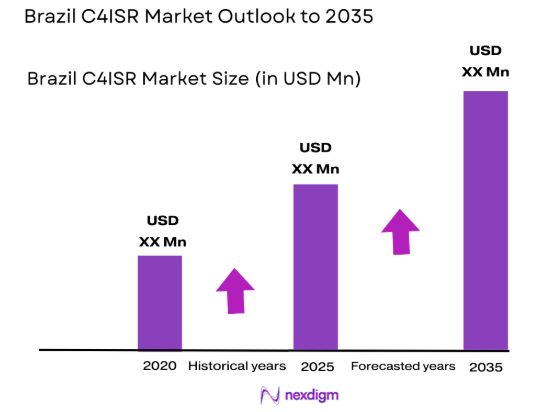

The Brazil C4ISR market was valued at USD~million based on a recent historical assessment, reflecting sustained investment in integrated defense communication and intelligence infrastructure. Growth is primarily driven by modernization programs focused on real-time situational awareness, secure communications, and enhanced surveillance capabilities across land, air, and maritime domains. Increasing adoption of hardware-centric systems and service-based architectures further supports procurement activity as defense organizations prioritize network-enabled operational readiness and interoperability.

São Paulo and Rio de Janeiro remain influential defense and aerospace hubs due to advanced industrial ecosystems and proximity to major contractors, while Brasília plays a central role in procurement and strategic command decisions. National leadership in Latin American C4ISR investment is reinforced by defense modernization programs and partnerships supporting technology transfer. Domestic manufacturers, including aerospace and defense firms, contribute to development capacity while strengthening export potential and regional technological influence.

Market Segmentation

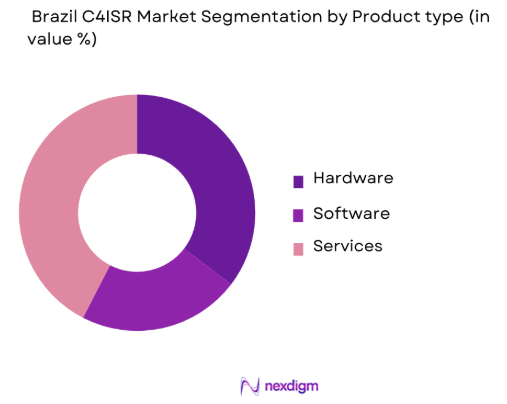

By Product Type

Brazil C4ISR market is segmented by product type into hardware, software, and services. Recently, hardware has a dominant market share due to its foundational role in enabling communication networks, surveillance equipment, sensors, and command terminals required for operational deployment. Defense agencies prioritize physical infrastructure investments to support mission-critical environments, especially where secure data transmission and battlefield coordination are essential. The installed base of legacy equipment also drives replacement cycles, reinforcing procurement. Additionally, hardware platforms typically involve higher upfront expenditure compared with software upgrades, amplifying their revenue contribution. Expanding ISR deployments across border monitoring and maritime awareness programs further increase reliance on robust electronic systems. Integration of advanced sensors and communication modules into multi-domain platforms continues to elevate hardware demand, particularly as modernization strategies emphasize resilience and reliability. Meanwhile, software and services benefit from growth but remain complementary layers supporting the physical architecture that underpins national defense capability.

By Platform

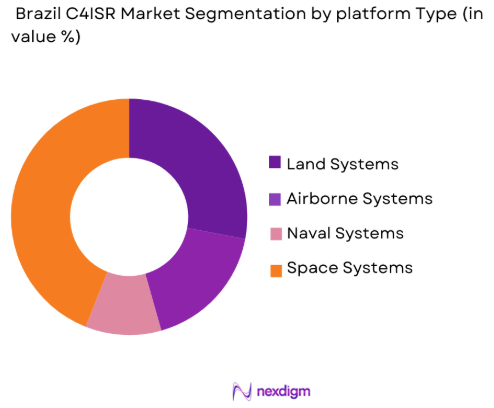

Brazil C4ISR market is segmented by platform into land, airborne, naval, and space systems. Recently, land-based systems have a dominant market share due to extensive border monitoring requirements and the need for coordinated ground operations across large geographic territories. Programs supporting surveillance of remote regions and infrastructure protection continue to channel investment toward terrestrial networks, including command centers and mobile communication units. Land platforms also enable integration with satellite and aerial intelligence feeds, strengthening operational responsiveness. Defense strategies increasingly emphasize multi-layer security, where ground systems function as the primary control interface for tactical deployments. Their comparatively lower deployment complexity and broad applicability across homeland security missions further reinforce adoption. While airborne and naval platforms remain critical for maritime awareness and reconnaissance, land systems persist as the operational backbone supporting intelligence fusion and decision-making environments across defense agencies.

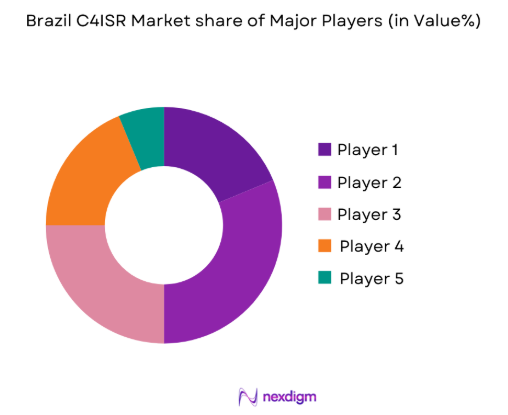

Competitive Landscape

The Brazil C4ISR market demonstrates moderate consolidation, with global defense primes collaborating alongside domestic integrators to deliver multi-domain solutions. Strategic partnerships, technology transfer agreements, and government-led procurement programs shape competitive positioning, while established contractors benefit from long-term modernization initiatives and platform integration expertise.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Defense Integration Capability |

| Embraer Defense & Security | 1969 | Brazil | – | – | – | – | – |

| Thales Group | 1893 | France | – | – | – | – | – |

| Saab AB | 1937 | Sweden | – | – | – | – | – |

| Leonardo S.p.A. | 1948 | Italy | – | – | – | – | – |

| Elbit Systems | 1966 | Israel | – | – | – | – | – |

Brazil c4isr Market Analysis

Growth Drivers

Defense modernization and network-centric warfare adoption

Brazil’s transition toward digitally integrated military operations is accelerating procurement of command, control, communications, computers, intelligence, surveillance, and reconnaissance capabilities across multiple service branches. Modern defense strategies increasingly prioritize unified information environments that allow commanders to synthesize battlefield intelligence and coordinate responses with precision. The growing complexity of regional security conditions encourages investment in systems capable of real-time data exchange between tactical units, headquarters, and allied partners. Government-led modernization programs continue allocating resources toward border surveillance networks, maritime domain awareness, and secure communication channels designed to improve response times. The emphasis on interoperability also compels agencies to replace fragmented legacy infrastructure with cohesive architectures that support joint-force operations. Emerging technologies such as artificial intelligence-enabled analytics and sensor fusion enhance decision-making accuracy, strengthening operational resilience during high-risk missions. Furthermore, integration with satellite-based assets enables persistent monitoring across remote territories, expanding coverage without proportionally increasing manpower requirements. As procurement cycles increasingly favor scalable platforms capable of future upgrades, vendors offering modular solutions gain competitive advantage. These structural shifts collectively reinforce long-term demand for advanced C4ISR frameworks while positioning digital battlefield readiness as a cornerstone of national defense posture.

Rising defense expenditure supporting surveillance and intelligence capabilities

Sustained defense spending plays a pivotal role in expanding Brazil’s technological readiness as authorities allocate significant budgets toward programs enhancing situational awareness and command efficiency. Strategic defense initiatives emphasize strengthening monitoring infrastructure across borders, maritime zones, and critical assets, reflecting heightened concern regarding transnational threats and illegal activities. Investments directed toward systems such as integrated border monitoring platforms demonstrate institutional commitment to maintaining operational visibility across vast geographic areas. Budgetary support also encourages collaboration with international contractors, facilitating technology transfer and accelerating capability development within domestic industry. As procurement frameworks evolve, agencies increasingly prioritize solutions that combine cybersecurity protections with resilient communication networks to safeguard mission-critical data. Defense planners recognize that intelligence superiority reduces operational uncertainty, enabling proactive threat mitigation rather than reactive engagement. Consequently, multi-domain surveillance architectures continue attracting capital because they deliver both tactical benefits and strategic deterrence value. Industrial participation from local manufacturers further multiplies economic impact while enhancing supply chain reliability. Over time, consistent financial backing strengthens lifecycle maintenance ecosystems, ensuring that deployed systems remain operationally relevant amid rapid technological change. This alignment between fiscal policy and modernization objectives sustains a predictable demand environment for advanced C4ISR platforms.

Market Challenges

High capital intensity and lifecycle cost pressures

Deployment of sophisticated C4ISR ecosystems requires substantial upfront investment in hardware, communication infrastructure, and integration services, creating financial constraints for procurement authorities operating within finite defense budgets. Beyond acquisition expenses, lifecycle costs associated with maintenance, upgrades, cybersecurity hardening, and operator training significantly expand total ownership expenditure. Decision makers must therefore balance capability enhancement against competing priorities such as personnel, logistics, and conventional equipment modernization. Budget fluctuations can delay project timelines, introducing uncertainty for suppliers and complicating long-term planning. Additionally, complex systems often necessitate specialized technical expertise, increasing reliance on contractors and elevating service expenditures. When modernization programs progress incrementally rather than through large-scale deployments, interoperability challenges may persist, requiring further spending to harmonize architectures. Economic conditions also influence procurement pace, particularly when currency volatility affects the affordability of imported components. Governments consequently evaluate cost-benefit tradeoffs rigorously before committing to multi-year contracts. Vendors that fail to demonstrate measurable operational value may encounter prolonged approval cycles. These financial realities collectively constrain rapid expansion while compelling stakeholders to pursue cost-efficient solutions that maximize performance without compromising fiscal discipline.

Dependence on foreign technology and interoperability complexity

Although domestic industry participation is expanding, Brazil continues to rely on international partners for advanced electronics, cybersecurity frameworks, and specialized intelligence platforms. This dependence introduces risks related to supply chain disruptions, export controls, and technology access restrictions that can affect program continuity. Integrating foreign-origin systems with locally developed infrastructure often requires extensive customization to ensure compatibility with national standards and operational doctrines. Interoperability challenges become particularly pronounced when legacy platforms coexist with next-generation technologies, necessitating middleware solutions and additional engineering resources. Security considerations further complicate procurement decisions because imported technologies must comply with stringent data protection requirements. Governments frequently negotiate offset agreements to encourage knowledge transfer, yet such arrangements can prolong contract timelines and elevate administrative complexity. Differences in technical protocols across allied systems may also hinder seamless information exchange during joint operations. Consequently, planners must invest in rigorous testing and validation processes before deployment. While partnerships deliver access to cutting-edge innovation, they simultaneously underscore the importance of cultivating indigenous capabilities capable of reducing strategic vulnerability. Addressing these structural dependencies remains critical for achieving sustainable autonomy within national defense networks.

Opportunities

Expansion of satellite-enabled surveillance and ISR coverage

Increasing reliance on satellite and aerial surveillance technologies presents a substantial opportunity to strengthen persistent intelligence gathering across remote territories and maritime corridors. Space-integrated architectures allow defense agencies to monitor vast regions without requiring proportional growth in physical infrastructure, improving operational efficiency. Enhanced imaging resolution and data transmission speeds support rapid threat identification, enabling authorities to respond proactively to emerging risks. Integration of satellite feeds with terrestrial command centers further enhances situational awareness by consolidating information streams into unified dashboards. As ISR requirements evolve, procurement strategies increasingly emphasize scalable platforms capable of incorporating new sensors and analytics tools. Collaboration between aerospace firms and defense agencies accelerates deployment while fostering technological advancement within the domestic ecosystem. These developments also encourage cross-domain coordination, allowing air, land, and naval units to operate with synchronized intelligence. Over time, satellite-driven architectures can reduce blind spots in national security coverage, strengthening deterrence. Vendors specializing in space communication technologies therefore gain significant growth prospects as governments prioritize resilience against asymmetric threats. This structural shift positions space-enabled C4ISR as a strategic pillar supporting future defense readiness.

Localization through domestic manufacturing and technology transfer partnerships

Growing emphasis on domestic defense production creates opportunities for local firms to participate more actively in the C4ISR value chain while reducing dependence on imported technologies. Offset agreements increasingly require foreign contractors to collaborate with national manufacturers, facilitating skills development and intellectual property sharing. Such arrangements stimulate innovation ecosystems capable of designing tailored solutions aligned with regional operational requirements. Domestic production also enhances supply chain resilience, minimizing vulnerability to geopolitical disruptions. Governments benefit from broader economic spillovers as high-technology manufacturing generates employment and strengthens industrial capability. Furthermore, localized support services improve system availability by shortening maintenance cycles and reducing logistical complexity. As defense planners pursue long-term autonomy, investments in research and development accelerate the emergence of indigenous platforms capable of competing globally. Partnerships between startups and established defense enterprises further expand experimentation in areas such as cybersecurity and data analytics. This progressive shift toward self-reliance not only improves strategic flexibility but also cultivates export potential within Latin America. Consequently, stakeholders positioned within the domestic innovation landscape are likely to capture meaningful value as procurement frameworks increasingly favor localized participation.

Future Outlook

The Brazil C4ISR market is expected to advance steadily as defense authorities continue prioritizing integrated intelligence and communication networks. Technological convergence across cybersecurity, satellite communication, and AI-enabled analytics is likely to enhance operational efficiency. Regulatory backing for modernization and domestic manufacturing may further strengthen procurement pipelines. Demand will remain closely tied to security preparedness and multi-domain coordination requirements, supporting sustained investment momentum.

Major Players

- Embraer Defense & Security

- AEL Sistemas

- Thales Group

- Saab AB

- Leonardo S.p.A.

- Elbit Systems

- Indra Sistemas

- L3Harris Technologies

- Northrop Grumman

- BAE System

- Lockheed Martin

- Honeywell Aerospace

- General Dynamics Mission Systems

- Rafael Advanced Defense Systems

- Omnisys Engenharia

Key Target Audience

- Defense ministries and armed forces

- Homeland security agencies

- Aerospace and defense manufacturers

- System integrators

- Cybersecurity solution providers

- Satellite communication companies

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The study identified critical indicators including defense spending patterns, modernization initiatives, procurement pipelines, and technological adoption trends. Data sources encompassed industry databases, defense publications, and financial disclosures. Emphasis was placed on quantifiable metrics shaping demand dynamics.

Step 2: Market Analysis and Construction

Researchers consolidated revenue data, validated segment structures, and mapped supply chains to construct a comprehensive market framework. Comparative benchmarking across platforms ensured analytical consistency. Macroeconomic and defense policy factors were integrated to contextualize growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through consultations with defense analysts, technology specialists, and procurement stakeholders. Cross-verification minimized interpretive bias while strengthening methodological reliability. Expert insights refined segmentation assumptions and competitive positioning.

Step 4: Research Synthesis and Final Output

Validated datasets were synthesized into structured insights emphasizing clarity and decision relevance. Analytical models translated raw data into actionable intelligence for stakeholders. Final outputs underwent editorial and methodological review to ensure accuracy and coherence.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense modernization initiatives across Brazil’s armed forces

Increasing demand for integrated situational awareness capabilities

Expansion of border surveillance and maritime security programs - Market Challenges

High capital investment requirements for advanced defense networks

Complex interoperability with legacy military systems

Dependence on foreign technology providers - Market Opportunities

Localization of C4ISR technologies through domestic manufacturing partnerships

Adoption of AI-enabled intelligence and data fusion platforms

Expansion of satellite-based communication infrastructure - Trends

Shift toward network-centric warfare frameworks

Growing integration of cybersecurity within command systems

Adoption of real-time data analytics for operational decision-making - Government Regulations

Defense procurement policies emphasizing domestic participation

Export control compliance for sensitive communication technologies

National cybersecurity directives impacting defense networks

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Command & Control Systems

Communications Intelligence Systems

Surveillance and Reconnaissance Systems

Electronic Warfare Systems

Battlefield Management Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Space-Based Assets

Joint and Integrated Platforms - By Fitment Type (In Value%)

Line-Fit Installations

Retrofit Solutions

Modular Deployable Units

Vehicle-Mounted Systems

Fixed Infrastructure Systems - By End User Segment (In Value%)

Brazilian Army

Brazilian Navy

Brazilian Air Force

Homeland Security Agencies

Joint Defense Commands - By Procurement Channel (In Value%)

Direct Government Contracts

Defense Modernization Programs

Strategic International Partnerships

Public Sector Tenders

Technology Transfer Agreements

- Market Share Analysis

- Cross Comparison Parameters (System Integration Capability, Interoperability Standards, Platform Compatibility, Cybersecurity Architecture, Lifecycle Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Embraer Defense & Security

AEL Sistemas

Savis Tecnologia eSistemas

Omnisys Engenharia

Thales Group

Saab AB

Leonardo

Elbit Systems

Rafael Advanced Defense Systems

Indra Sistemas

L3Harris Technologies

General Dynamics Mission Systems

Northrop Grumman

BAE Systems

Honeywell Aerospace

- Military branches prioritizing integrated battlefield communication

- Naval forces investing in coastal and offshore monitoring systems

- Air force adoption of advanced surveillance coordination tools

- Security agencies enhancing intelligence-sharing frameworks

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035