Market Overview

The Brazil small arms ammunition market generated revenue of USD ~ million based on a recent historical assessment, supported by sustained procurement from military forces, law enforcement agencies, and civilian firearm owners. Demand is primarily driven by training requirements, operational readiness, and routine stockpiling across security institutions. Strong domestic manufacturing capabilities and export activity further reinforce production stability, while standardized calibers such as 5.56 mm contribute significantly to overall revenue performance.

São Paulo, Rio de Janeiro, and Brasília function as central consumption hubs due to higher firearm penetration, security infrastructure, and administrative oversight. Urban demand is largely associated with law enforcement usage, whereas rural regions absorb rifle and shotgun cartridges for agricultural protection and subsistence hunting. Brazil maintains regional leadership in ammunition consumption, supported by comprehensive military requirements and an extensive policing network that necessitates continuous supply for training and operational deployment.

Market Segmentation

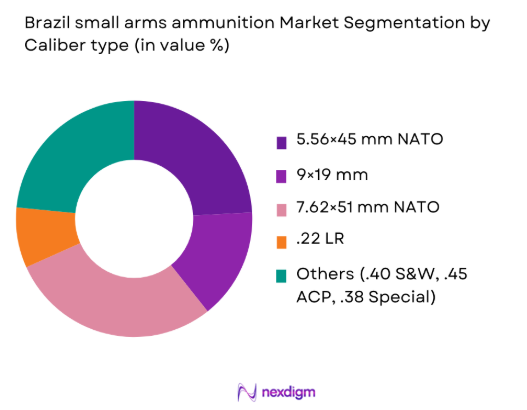

By Caliber

Brazil small arms ammunition market is segmented by caliber into 5.56×45 mm NATO, 9×19 mm, 7.62×51 mm NATO, .22 LR, and others (.40 S&W, .45 ACP, .38 Special). Recently, 5.56×45 mm NATO has a dominant market share due to its widespread adoption by military units and compatibility with standard-issue assault rifles used for national defense and training. Its ballistic efficiency and interoperability with allied platforms make it a preferred choice for operational planning. Procurement frameworks favor standardized ammunition to simplify logistics and inventory management across defense institutions. Additionally, the caliber’s adaptability for both combat and training exercises increases purchasing frequency. Manufacturers benefit from economies of scale in producing this widely utilized round, which lowers per-unit cost and encourages bulk acquisition. As modernization programs prioritize readiness, agencies continue emphasizing reliable calibers capable of supporting diverse tactical environments, reinforcing the leadership position of 5.56 mm within national supply chains.

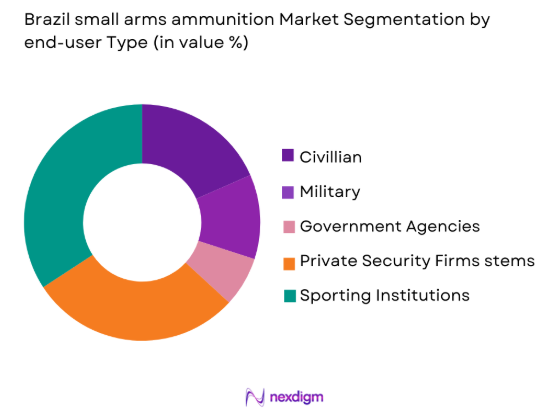

By End User

Brazil small arms ammunition market is segmented by end user into civilian, military, government agencies, private security firms, and sporting institutions. Recently, civilians have a dominant market share due to the sizeable installed base of privately held firearms and recurring purchases for personal defense and recreational shooting. Policy adjustments that expanded cartridge purchase limits contributed to higher transaction volumes, while retail channels broadened accessibility. Civilian demand also tends to be less cyclical than institutional procurement, sustaining steady turnover. Training activities within shooting clubs and competitive sports further elevate consumption rates. Although military and government segments maintain consistent procurement for operational preparedness, civilian purchases account for a larger share because of frequent replacement cycles and ammunition shelf-life considerations. The segment’s diversity, spanning personal protection to sporting applications, continues to underpin commercial sales momentum across domestic markets.

Competitive Landscape

The Brazil small arms ammunition market exhibits moderate consolidation, led by dominant domestic manufacturers complemented by global ammunition producers supplying specialized calibers. Established firms benefit from scale advantages, long-term defense contracts, and export channels, while regulatory compliance requirements create entry barriers for smaller participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Annual Production Capacity |

| CBC Global Ammunition | 1926 | Brazil | – | – | – | – | – |

| Taurus Armas | 1939 | Brazil | – | – | – | – | – |

| IMBEL | 1934 | Brazil | – | – | – | – | – |

| Winchester Ammunition | 1866 | United States | – | – | – | – | – |

| Fiocchi Munizioni | 1876 | Italy | – | – | – | – | – |

Brazil Small Ammunition Market Analysis

Growth Drivers

Expansion of civilian firearm ownership and sporting culture

Brazil’s evolving firearms environment has significantly influenced ammunition consumption patterns, particularly as civilian ownership expands within regulated frameworks. The presence of millions of privately held firearms creates recurring demand for cartridges used in training, practice, and personal defense, ensuring steady market turnover. Recreational shooting and organized sporting events contribute additional volume, as participants require frequent replenishment due to ammunition shelf-life and performance considerations. Retail distribution networks have matured, allowing consumers to access a broader range of calibers through licensed dealers. Policy measures increasing permissible cartridge purchases have further amplified transaction volumes while supporting domestic manufacturers. From an economic perspective, civilian demand often demonstrates resilience during procurement slowdowns in institutional segments, providing revenue stability for producers. Manufacturers respond by diversifying product lines with training rounds and premium ballistic variants tailored to enthusiast communities. The segment also encourages innovation in packaging, safety features, and environmentally compliant materials to meet regulatory expectations. Over time, sustained participation in shooting sports reinforces cultural acceptance and fosters predictable replacement cycles. These structural dynamics collectively position civilian consumption as a critical pillar supporting long-term growth across Brazil’s ammunition ecosystem.

Military modernization and sustained security preparedness requirements

National defense strategies emphasize readiness, prompting consistent ammunition procurement to maintain operational effectiveness across armed forces and policing institutions. Training exercises, peacekeeping deployments, and tactical drills necessitate reliable stockpiles capable of supporting prolonged engagement scenarios. Brazil’s leadership in regional defense expenditure underscores institutional commitment to maintaining strategic deterrence and territorial protection. Integrated logistics planning encourages bulk purchasing agreements that stabilize production schedules for domestic manufacturers. Security challenges such as organized crime and border protection further reinforce ammunition usage during routine operations. Procurement authorities increasingly prioritize standardized calibers to streamline supply chains and improve interoperability among service branches. Export activity also supports production scalability, enabling companies to optimize manufacturing throughput while strengthening economic returns. As modernization programs introduce upgraded weapon platforms, compatible ammunition demand rises accordingly, creating follow-on procurement opportunities. Lifecycle management practices require periodic replenishment to prevent degradation, sustaining baseline consumption. Collectively, these factors ensure that defense-driven demand remains a foundational growth catalyst within the national market.

Market Challenges

Regulatory complexity governing firearms and ammunition distribution

Brazil enforces structured control policies administered through federal authorities, shaping how ammunition is manufactured, sold, and consumed across civilian and institutional channels. Compliance obligations increase administrative workload for producers and distributors, often extending approval timelines for new products. Manufacturers must align with safety standards, environmental requirements, and traceability protocols designed to prevent diversion into illicit markets. Regulatory shifts can create uncertainty for long-term planning, particularly when procurement frameworks adjust eligibility or licensing conditions. Dealers must maintain rigorous documentation, adding operational costs that can indirectly affect pricing structures. Civilian access rules also influence demand elasticity, as purchase limits and background verification procedures determine transaction frequency. For multinational suppliers, navigating local certification requirements may delay market entry. These constraints encourage industry participants to invest heavily in compliance infrastructure and legal oversight. While regulations enhance accountability and public safety, they simultaneously introduce structural friction that moderates expansion speed. Balancing regulatory rigor with industrial competitiveness therefore remains an ongoing strategic consideration for stakeholders.

Dependence on imported propellant materials and supply chain exposure

Ammunition production relies on specialized inputs such as nitrocellulose and antimony, materials that are often sourced internationally and subject to price volatility. Disruptions in global supply networks can elevate manufacturing costs and delay delivery schedules, particularly when geopolitical developments constrain trade flows. Producers must maintain buffer inventories to mitigate shortages, tying up working capital that could otherwise support expansion initiatives. Currency fluctuations further complicate procurement because imported components become more expensive during periods of depreciation. Supply uncertainty may also encourage buyers to negotiate longer contracts, reducing flexibility for manufacturers. Industrial planners increasingly explore domestic sourcing alternatives, yet establishing local chemical production requires significant investment and regulatory clearance. Transportation bottlenecks and logistics inefficiencies can compound risk, especially for hazardous materials requiring specialized handling. Companies therefore prioritize supplier diversification and strategic stock management to enhance resilience. Despite these mitigation strategies, structural reliance on imported inputs continues to represent a persistent operational vulnerability within the production ecosystem.

Opportunities

Growth in export-oriented ammunition manufacturing capacity

Brazil’s established industrial base enables manufacturers to participate actively in international ammunition supply chains, creating pathways for revenue diversification beyond domestic consumption. Export contracts help stabilize factory utilization rates, allowing producers to achieve economies of scale that improve cost efficiency. Strong overseas demand encourages investment in advanced production technologies capable of delivering consistent ballistic performance. Global distribution networks also strengthen brand recognition, positioning Brazilian manufacturers as competitive suppliers within emerging defense markets. Partnerships with foreign governments facilitate technology exchange while broadening product portfolios. Export momentum can offset cyclical fluctuations in domestic procurement, ensuring balanced revenue streams. Companies leveraging international demand often reinvest profits into research and development, accelerating innovation in propellant chemistry and projectile design. Regulatory alignment with international standards further enhances market accessibility. Over time, expanding export footprints may elevate Brazil’s role within the global ammunition landscape. This outward-oriented strategy therefore represents a significant avenue for long-term industry expansion.

Technological advancement in environmentally compliant ammunition solutions

Environmental oversight is prompting manufacturers to develop lead-free and low-toxicity cartridges that align with emerging compliance frameworks. Adoption of cleaner materials can open premium product segments while reducing long-term ecological impact. Research initiatives increasingly focus on improving projectile composition without compromising ballistic reliability, fostering differentiation in competitive markets. Producers capable of meeting stringent environmental benchmarks may gain preferential access to institutional contracts emphasizing sustainability. Technological upgrades also enhance worker safety and manufacturing efficiency through improved chemical handling processes. As regulatory bodies tighten environmental expectations, innovation becomes a strategic imperative rather than an optional enhancement. Early adopters benefit from reputational advantages and stronger relationships with procurement authorities seeking responsible sourcing. Investment in advanced metallurgy and propellant alternatives further supports product longevity. These developments collectively position environmentally compliant ammunition as a catalyst for modernization within the industry.

Future Outlook

The Brazil small arms ammunition market is expected to progress steadily as defense preparedness and civilian participation continue supporting baseline demand. Technological improvements in ballistic materials and environmentally safer cartridges are likely to influence product development. Regulatory oversight will remain a defining factor, encouraging structured growth while maintaining compliance. Export expansion and domestic manufacturing capabilities are anticipated to strengthen supply resilience and sustain long-term industry stability.

Major Players

- CBC Global Ammunition

- Taurus Armas

- IMBEL

- Aguila Ammunition

- Winchester Ammunition

- Federal Ammunition

- Remington Ammunition

- Hornady Manufacturing

- Fiocchi Munizioni

- Sellier & Bellot

- RUAG Ammotec

- Nammo AS

- Olin Corporation

- Denel PMP

- BAE Systems

Key Target Audience

- Defense ministries

- Federal and state law enforcement agencies

- Firearms manufacturers

- Ammunition distributors

- Private security companies

- Sporting goods retailers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Primary variables included procurement volumes, civilian firearm ownership, export activity, regulatory policies, and manufacturing capacity. Secondary indicators such as defense expenditure and security operations were evaluated to understand demand behavior. Data triangulation ensured consistent interpretation across sources.

Step 2: Market Analysis and Construction

Revenue datasets were consolidated to establish baseline valuation and segmentation logic. Supply chain mapping identified relationships between manufacturers, distributors, and institutional buyers. Comparative analysis across calibers supported structural validation of segment hierarchy.

Step 3: Hypothesis Validation and Expert Consultation

Findings were cross-verified through defense industry publications and subject-matter commentary. Analytical assumptions were refined using corroborated datasets to reduce interpretive bias. Expert perspectives strengthened reliability in forecasting demand drivers.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured framework emphasizing clarity and decision relevance. Quantitative and qualitative findings were integrated to reflect market realities. Final review ensured methodological coherence and analytical accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Defense and Internal Security Spending

Expansion of Law Enforcement Modernization Programs

Increasing Civilian Firearms Ownership for Sporting Activities - Market Challenges

Strict Firearms and Ammunition Regulations

Supply Chain Constraints for Raw Materials

Volatility in Government Procurement Cycles - Market Opportunities

Domestic Manufacturing Expansion

Technological Advancements in Ammunition Design

Growth in Training and Simulation Ammunition Demand - Trends

Shift Toward High-Performance Tactical Ammunition

Adoption of Environmentally Safer Ammunition Materials

Increasing Integration of Smart Manufacturing Techniques - Government Regulations

National Firearms Control Statutes

Import and Export Compliance Requirements

Defense Procurement and Local Content Policies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Centerfire Ammunition

Rimfire Ammunition

Shotshell Ammunition

Military Grade Ammunition

Specialty and Training Ammunition - By Platform Type (In Value%)

Handguns

Rifles

Shotguns

Submachine Guns

Light Machine Guns - By Fitment Type (In Value%)

Standard Ball Ammunition

Armor-Piercing Ammunition

Tracer Ammunition

Hollow Point Ammunition

Frangible Ammunition - By End User Segment (In Value%)

Military Forces

Federal Law Enforcement

State and Municipal Police

Private Security Firms

Civilian and Sporting Users - By Procurement Channel (In Value%)

Government Defense Contracts

Law Enforcement Procurement Programs

Licensed Firearms Dealers

Direct Manufacturer Sales

Sporting Goods Distributors

- Market Share Analysis

- Cross Comparison Parameters (Caliber Range, Production Capacity, Ballistic Performance, Contract Reliability, Distribution Network)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

CBC Global Ammunition

Companhia Brasileira deCartuchos

Taurus Armas

IMBEL

Aguila Ammunition

Winchester Ammunition

Federal Ammunition

Remington Ammunition

Hornady Manufacturing

Fiocchi Munizioni

Sellier & Bellot

RUAG Ammotec

Nammo AS

Olin Corporation

Denel PMP

- Military modernization driving consistent ammunition demand

- Law enforcement agencies prioritizing operational readiness

- Private security sector expanding amid urban protection needs

- Sport shooting communities supporting commercial sales

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035