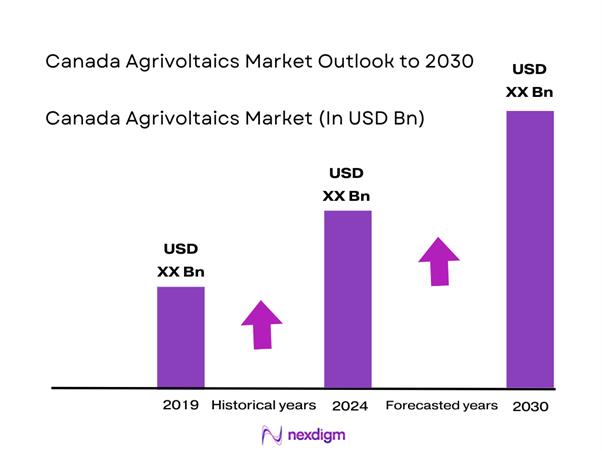

Market Overview

Canada’s agrivoltaics market remains early-stage and project-led, and no single Canadian government statistical series publishes an annual market value (USD/CAD) specifically for “agrivoltaics.” As a result, many industry references size Canada through installed or announced agrivoltaic capacity (MW/GW) and commercial deployments rather than revenue. One widely-circulated industry estimate indicates Canada’s agrivoltaic capacity at ~ GW in the latest reported year, compared with ~ GW in the preceding year—reflecting momentum from greenhouse-linked PV, grazing-compatible PV layouts, and utility-scale ground-mount solar designs adapted for dual land use.

Canada’s leading agrivoltaics activity is concentrated in Ontario, Alberta, and British Columbia, driven by utility-scale solar buildout and interconnection pathways, strong agricultural land bases and farm-scale electrification needs, and research and pilot ecosystems around controlled-environment agriculture and on-farm energy economics. Ontario benefits from dense load pockets and distributed generation opportunities; Alberta is active in utility-scale solar development and land-use optimization; and British Columbia supports higher-value crop systems and innovation networks that make “dual-use PV” more bankable for specific farm profiles.

Market Segmentation

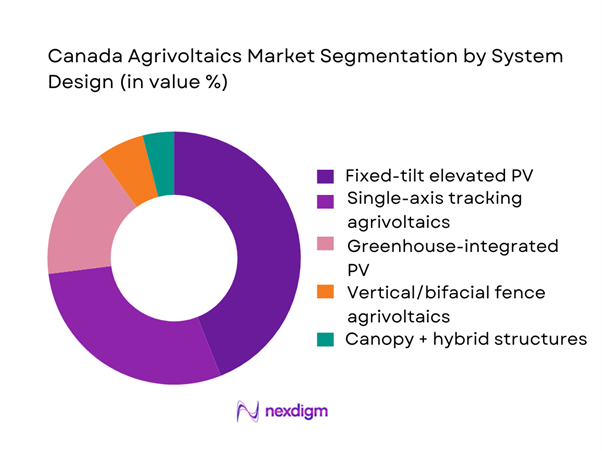

By system design

Fixed-tilt elevated PV tends to dominate agrivoltaics deployments in Canada because it is the most bankable engineering pathway for dual-use layouts when lenders and insurers demand predictable yield, simpler O&M, and lower structural complexity. Fixed-tilt designs also adapt well to Canada’s snow load and wind constraints by prioritizing robust racking and standardized pile foundations, reducing custom engineering compared with complex canopy systems. For pasture or grazing or low-height crop regimes, raised fixed-tilt arrays can be configured with row spacing, ground clearance, and maintenance corridors that preserve farm access while meeting electrical code and safety requirements. In addition, fixed-tilt elevated systems are easier to integrate into conventional EPC workflows—enabling faster permitting packages and more straightforward interconnection studies than bespoke greenhouse or hybrid canopy architectures.

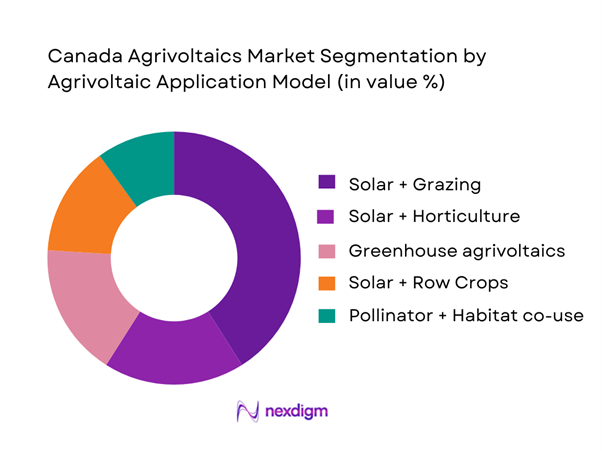

By application model

Solar plus grazing often leads because it solves an immediate operational problem for solar sites—vegetation management—while creating a clear “dual-use” narrative that is comparatively easy to permit and insure versus crop-yield-dependent agrivoltaics. Grazing models reduce mowing frequency and can improve site maintainability, making them attractive to owners and operators and EPCs looking to de-risk long-term O&M. In Canada, grazing-based agrivoltaics is also easier to scale across provinces because it does not require the same level of crop microclimate control or specialized agronomy as horticulture-focused deployments. The model aligns well with standard ground-mount solar footprints while still meeting many municipal expectations for land-use productivity. As a result, developers can move faster from feasibility to execution with fewer unknowns in farm yield variability and fewer bespoke structural requirements.

Competitive Landscape

Canada’s agrivoltaics competition is best described as a convergence of renewable IPPs and developers, EPCs, agri-tech and controlled-environment agriculture specialists, racking and tracker providers, and O&M providers. The market is not dominated by agrivoltaics pure-plays alone; instead, major solar developers and integrators lead activity by adapting conventional PV into farm-compatible layouts, partnering with landowners, and proving dual-use performance in provincial permitting environments.

| Company | Est. Year | HQ | Canada Agrivoltaics Route-to-Market | Typical Project Mode | Dual-use Design Strength | Agronomy/Ag Partnerships | Tracking/Racking Ecosystem | Interconnection Capability | O&M Model |

| Canadian Solar | 2001 | Guelph, Canada | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Brookfield Renewable | 1999 | Toronto, Canada | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| RES (Renewable Energy Systems) | 1981 | UK (Canada operations) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Enel Green Power | 2008 | Italy (global) | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| BayWa r.e. | 2009 | Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Canada Agrivoltaics Market Analysis

Growth Drivers

Farm income volatility hedge

Canada’s farm operators are increasingly looking for stable, non-crop-linked cashflow to smooth income swings across seasons and commodities, which supports agrivoltaics lease and host models when structured around long-term site access and shared operations. This income-stability logic matters in a large, high-cost economy where macro conditions directly affect farm inputs and debt servicing: Canada’s GDP is USD ~ trillion and GDP per capita is USD ~, while the country’s population is ~—a scale that keeps food, logistics, and energy markets tightly coupled. On-farm cashflow volatility is visible in the latest national farm income signal: farm cash receipts totalled CAD ~ billion for the first three quarters of the year, with CAD ~ billion lower receipts than the same period a year earlier, reflecting how quickly top-line farm revenue can shift. Against that backdrop, agrivoltaics is positioned as a hedge instrument because it can pair farm continuity with predictable non-yield revenue, while still keeping production in the operating plan rather than converting farmland purely to energy land-use.

Decarbonization targets

Decarbonization commitments and emissions accountability are a direct pull for Canadian dual-use solar concepts because agrivoltaics can add clean generation without fully displacing agricultural output, which is politically and operationally important in food-producing regions. Canada’s national emissions baseline and trajectory are publicly tracked: greenhouse gas emissions decreased, underscoring why additional clean electricity is continuously prioritized across provinces. At the same time, the macro backdrop supports capital formation in energy transition infrastructure: Canada’s economy at USD ~ trillion and population at ~ implies a large electricity demand base and a broad investment pool that utilities and IPPs can finance against. Agrivoltaics aligns to these targets by enabling solar build-out where land-use constraints are highest, particularly when paired with operational models that keep agriculture active. This dual mandate helps projects fit policy narratives better than single-use land conversion in prime agricultural corridors.

Challenges

Prime farmland permitting barriers

Prime farmland sensitivity is a structural barrier because many Canadian permitting pathways evaluate whether a proposed land use preserves agricultural utility, soil capability, and long-term land stewardship. Even when the technical solar design is feasible, the land-use test can dominate approvals, driving higher development costs and longer timelines. This is not a marginal issue: Canada’s agriculture and agri-food system generated CAD ~ billion of GDP contribution and employed ~ million people, so provincial agencies and municipalities treat farmland protection as an economic and social priority, not only an environmental one. Macro indicators underscore the scale of the stakeholder base: ~ population and USD ~ trillion GDP imply large downstream food demand and supply-chain dependencies that policymakers link back to domestic production resilience. For agrivoltaics, the permitting hurdle is therefore proving that co-activity is genuine and measurable and not simply a symbolic add-on to a conventional solar project footprint.

Interconnection queues

Interconnection bottlenecks create a direct execution risk because agrivoltaics sites are often rural and depend on capacity at specific feeders or substations. In practice, delays are driven by procedural stages, system impact studies, and coordination with transmission and distribution owners. Ontario’s connection process is explicitly structured into multiple steps, which can extend lead times for generation projects that require deeper studies and upgrades. This queue friction sits on top of the broader electricity system scale: Canada generated ~ million MWh of electricity, which reflects a complex, highly integrated grid where incremental connections must be engineered carefully. The macro environment adds pressure because the economy at USD ~ trillion and population at ~ support ongoing electrification demand, meaning grids are being asked to serve both new loads and new generation. For agrivoltaics developers, interconnection queues can become the binding constraint even when land access and community support are strong.

Opportunities

Solar-grazing scaling

Solar-grazing is a scalable near-term opportunity because it provides a repeatable co-activity model that can be deployed across many Canadian solar sites with fewer agronomic unknowns than specialty crops. The opportunity is strengthened by the scale of the existing renewable build ecosystem: Canada has ~ GW of wind, solar energy and energy storage installed capacity, which implies mature EPC capacity, O&M vendor depth, and procurement channels that can integrate grazing protocols into standard site operations. It is also supported by the economic weight of agriculture: the agri-food system employed ~ million people and generated CAD ~ billion of GDP contribution, meaning there is a broad base of farm operators and rural service providers who can participate in grazing contracts, fencing, livestock management, and compliance services. Macro stability matters here: Canada’s GDP is USD ~ trillion and population is ~, sustaining long-run electricity demand and land-use scrutiny that favors dual-use narratives. Solar-grazing can therefore expand agrivoltaics adoption by turning a routine solar O&M requirement into a farm-compatible operational layer that improves community acceptance and landowner economics.

Specialty crop canopy deployment

Specialty crop canopy agrivoltaics is an opportunity where Canada’s high-value horticulture and greenhouse-adjacent production clusters can justify more engineered, crop-specific solar layouts—especially when shading, microclimate moderation, and weather protection align with crop economics. Canada’s controlled-environment and horticulture scale provides a credible base for this model: there were ~ commercial greenhouse vegetable operations producing ~ metric tons of vegetables, and horticulture output values in greenhouse categories are material, including CAD ~ million in greenhouse-produced cut flowers and CAD ~ million in field-produced cut flowers. These production systems are already capital-intensive and management-driven, which makes them more compatible with the monitoring, access control, and agronomy integration required by crop-focused agrivoltaics. The macro context strengthens the investment rationale: Canada’s GDP per capita is USD ~, supporting premium domestic demand segments, while the agri-food system’s CAD ~ billion GDP contribution creates institutional support for productivity-oriented innovation. The commercial opportunity is therefore to standardize canopy designs for specific Canadian crop systems using verifiable production metrics rather than relying on generic dual-use claims.

Future Outlook

Canada’s agrivoltaics market is expected to expand through grid-connected solar growth, rising interest in farm resilience and land productivity, and better-defined provincial pathways for dual-use permitting. The strongest pipeline is likely to sit where land economics, interconnection feasibility, and agricultural value intersect—especially in grazing-compatible solar, greenhouse PV integration, and high-value horticulture shading applications. As performance evidence accumulates, bankability should improve, unlocking more standardized designs and repeatable execution models.

Major Players

- Canadian Solar

- Brookfield Renewable

- Boralex

- Northland Power

- Innergex Renewable Energy

- TransAlta Renewables

- RES

- Enel Green Power

- BayWa r.e.

- EDF Renewables Canada

- Pattern Energy

- BluEarth Renewables

- Potentia Renewables

- Lightsource bp

Key Target Audience

- Utility-scale solar developers and IPPs

- Agricultural landowners and farm operators

- Greenhouse operators and controlled-environment agriculture developers

- Power utilities and system planners

- EPC contractors and solar engineering firms

- Racking, trackers, and module technology providers

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We build an ecosystem map covering developers, EPCs, farmers, greenhouse operators, utilities, racking and tracker providers, and regulators. Desk research consolidates public policy, interconnection norms, and project databases to define variables such as land-lease structures, dual-use compliance requirements, and system-design constraints.

Step 2: Market Analysis and Construction

We compile historical activity using capacity-led indicators, project announcements, and development pipelines, then normalize by system type and application model. The objective is to structure the market by what is actually financeable: permitting, grid access, constructability, and long-term O&M feasibility.

Step 3: Hypothesis Validation and Expert Consultation

We validate adoption drivers and blockers via interviews with solar developers, EPC engineering leads, farm cooperatives, and greenhouse operators. Interviews focus on permitting friction, lease pricing logic, agronomy constraints, and design decisions under Canadian snow and wind conditions.

Step 4: Research Synthesis and Final Output

We triangulate project evidence with stakeholder inputs to finalize segmentation, competitive mapping, and go-to-market playbooks. The output emphasizes practical decision tools: bankability benchmarks, province-level execution pathways, and partner selection criteria for scalable agrivoltaics.

- Executive Summary

- Research Methodology (Market definitions and inclusion criteria, Agrivoltaics typology framework, Assumptions and conversion factors, Data triangulation approach, Bottom-up capacity mapping, Top-down policy-led demand modeling, Primary interview program, Validation workshop process, Limitations and sensitivity checks)

- Definition and Scope

- Market Genesis and Evolution

- Agrivoltaics Business Cycle

- Value Chain and Stakeholder Stack

- Canada-Specific Agrivoltaics Use-Case Map

- Growth Drivers

Farm income volatility hedge

Decarbonization targets

Land-use conflict resolution

Community acceptance uplift

Grid capacity build-out - Challenges

Prime farmland permitting barriers

Interconnection queues

Decommissioning security requirements

Operational complexity of agricultural co-activity

Winter performance risks - Opportunities

Solar-grazing scaling

Specialty crop canopy deployment

Indigenous equity participation structures

Storage-hybrid agrivoltaics projects

Retrofit of existing solar farms to dual-use - Trends

Bifacial module adoption

Tracker agronomic tuning

Snow-shedding structural designs

Microclimate sensing integration

Agronomic decision-support platforms - Regulatory & Policy Landscape

- SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Installed Capacity, 2019–2024

- By Land Footprint, 2019–2024

- By Revenue Stack, 2019–2024

- By Agrivoltaics Configuration (in Value %)

Elevated canopy agrivoltaics

Wide-row fixed-tilt dual-use systems

Single-axis tracker agrivoltaics

Vertical bifacial fence PV

Hybrid agrivoltaics designs - By Agricultural Co-Activity (in Value %)

Sheep grazing and managed pasture

Pollinator habitat and beekeeping

Row crops

Specialty crops

Orchards, berries, and vineyards - By End User (in Value %)

Farm operators and agribusinesses

Utilities and independent power producers

Indigenous communities and development corporations

Municipal and regional entities

Commercial and industrial landholders - By Grid and Offtake Pathway (in Value %)

Distribution-connected projects

Transmission-connected utility-scale projects

Behind-the-meter agrivoltaics

Community and cooperative offtake models

Storage-hybrid agrivoltaics - By Region (in Value %)

Alberta

Ontario

Saskatchewan

British Columbia

Québec and Atlantic Canada

- Cross Comparison Parameters (Agronomic coexistence design rigor, Racking and clearance specification maturity, Shading-control strategy, Winterization engineering capability, Interconnection execution capability, Decommissioning and reclamation security readiness, Indigenous partnership depth, Co-revenue integration capability)

- Company Profiles

Boralex

Brookfield Renewable

Northland Power

Innergex Renewable Energy

TransAlta

Canadian Solar

RES Canada

EDF Renewables Canada

Enbridge Renewables

AMP Energy Canada

Potentia Renewables

SolarBank

SkyFire Energy

Lightsource bp Canada

- Buyer personas

- Procurement triggers

- Success metrics

- Adoption barriers

- Decision journeys

- By Value, 2025–2030

- By Installed Capacity, 2025–2030

- By Land Footprint, 2025–2030

- By Revenue Stack, 2025–2030