Market Overview

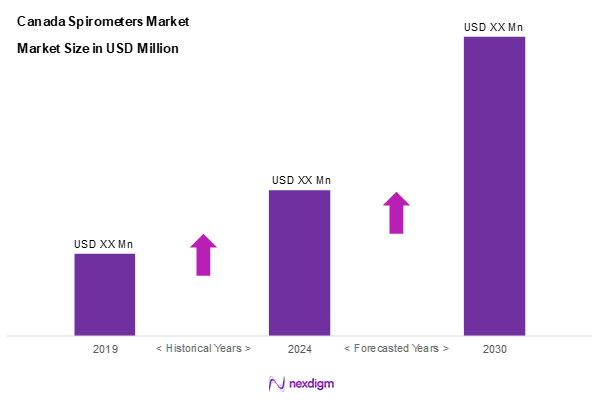

As of 2024, the Canada spirometers market is valued at USD 52.7 million, with a growing CAGR of 10.7% from 2024 to 2030, driven by the rising prevalence of respiratory diseases and an increasing focus on early diagnosis. The demand for spirometers, essential for assessing lung function, is supported by advancements in technology and the integration of AI in healthcare solutions. Ongoing investments in healthcare infrastructure further enhance market growth, with healthcare providers prioritizing respiratory diagnostics.

Ontario and Quebec are the dominant regions in the Canada spirometers market, attributed to their robust healthcare systems and higher population densities that drive greater demand for respiratory diagnostics. These provinces have a significant number of hospitals and clinics equipped with the latest spirometry technologies, ensuring rapid adoption of advanced spirometers. Additionally, continuous medical research and development initiatives in these regions support the market’s growth prospects.

Market Segmentation

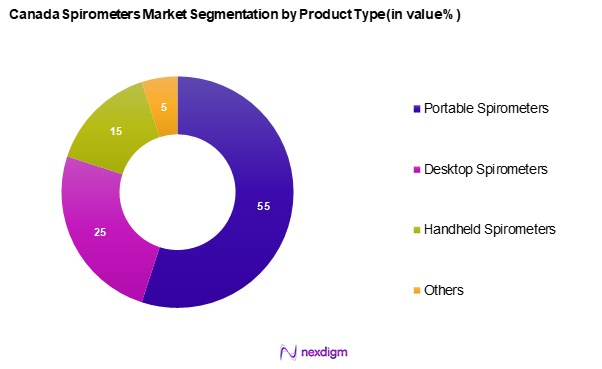

By Product Type

The Canada spirometers market is segmented into portable spirometers, desktop spirometers, handheld spirometers, and others. Portable spirometers hold a dominant share in this segmentation due to their convenience and versatility, allowing healthcare providers to conduct tests across multiple environments, including home care settings. Their growing popularity is driven by increasing patient demands for home-based healthcare solutions and advancements in battery technology that enhance portability without compromising accuracy.

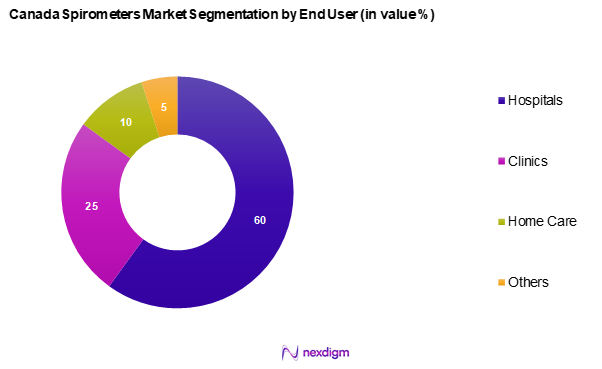

By End User

The Canada spirometers market is segmented into hospitals, clinics, home care, and others. Hospitals dominate this segment due to their need for comprehensive respiratory care and diagnostic capabilities. Advanced spirometers facilitate accurate monitoring of patients with chronic respiratory conditions, leading to improved health outcomes. Hospitals are increasingly prioritizing investments in respiratory equipment and diagnostics, supported by funding from healthcare systems to enhance service delivery and patient care quality.

Competitive Landscape

The Canada spirometers market is characterized by the presence of several major players, including Koninklijke Philips N.V., BD, Vitalograph, Medtronic, and SCHILLER. These companies wield significant influence due to their robust product portfolios and commitment to innovation. The competitive landscape highlights the ongoing advancements in technology and product offerings that cater to diverse patient needs.

| Company Name | Establishment Year | Headquarters | Revenue

(USD Mn) |

Product Range | Market

Share |

Global Reach |

| Koninklijke Philips N.V. | 1891 | Amsterdam, Netherlands | – | – | – | – |

| BD | 1897 | Franklin Lakes, New Jersey | – | – | – | – |

| Vitalograph | 1963 | Maids Moreton, UK | – | – | – | – |

| Medtronic | 1949 | Minnesota, USA | – | – | – | – |

| SCHILLER | 1974 | Baar, Switzerland | – | – | – | – |

Canada Spirometers Market Analysis

Growth Drivers

Rising Incidence of Respiratory Diseases

The prevalence of respiratory diseases in Canada is on the rise, with a significant number of individuals living with conditions such as asthma and chronic obstructive pulmonary disease (COPD). This growing concern translates to substantial healthcare costs and emphasizes the urgent need for reliable diagnostic tools like spirometers. Additionally, an aging population contributes to the increasing rates of respiratory conditions, leading to a robust demand for spirometry services and devices within the healthcare landscape. The combination of these factors presents a pressing need for innovations in respiratory disease management.

Technological Advancements in Spirometry

Technological innovations in spirometry have greatly improved the accuracy and usability of these devices, resulting in enhanced patient outcomes. The integration of digital platforms facilitates real-time monitoring of patient data, providing significant benefits to both patients and healthcare providers. The shift towards more advanced and user-friendly spirometers signals a growing market trend that is supported by increased investments in healthcare technology. These advancements are paving the way for more effective management of respiratory diseases, driving market penetration as healthcare facilities embrace these new capabilities.

Market Challenges

High Costs of Advanced Spirometers

The high costs associated with advanced spirometers pose a considerable challenge in the Canadian market. This financial barrier strains smaller medical facilities and independent practices, making it difficult for them to adopt the latest spirometry technologies. The resulting impact is a limitation on the accurate diagnosis and management of respiratory diseases. Furthermore, tightening healthcare budgets under economic pressures can lead to delays in the investment needed for essential medical devices, ultimately hindering market growth.

Reimbursement Issues

Reimbursement challenges significantly affect the spirometer market in Canada, with many advanced devices lacking full coverage by provincial health plans. This situation forces patients to incur substantial out-of-pocket expenses, leading to reduced access to necessary medical equipment. The limited availability of insurance reimbursement for spirometers presents a barrier to patient engagement and adoption in clinical settings, which in turn restricts market expansion potential within the industry.

Opportunities

Expanding Online Distribution Channels

The COVID-19 pandemic has expedited the shift towards online distribution channels for medical equipment. This trend facilitates easier access for healthcare professionals and patients seeking spirometry devices, leading to greater awareness and an increase in sales volumes. The convenience of online platforms is driving significant changes in the purchasing behaviour of medical devices, fostering market growth and making it increasingly feasible for diverse demographics to obtain necessary equipment.

Emerging Markets in Homecare

The homecare sector presents an increasingly attractive opportunity for spirometer manufacturers, as there is a noticeable shift towards patient-cantered care. The demand for portable and user-friendly spirometry devices that can be utilized in home settings is growing, driven by a substantial number of individuals relying on homecare services for chronic conditions, including respiratory illnesses. Current initiatives aimed at enhancing home monitoring solutions reflect a commitment to this sector, suggesting a promising future for the spirometry market as technology and convenience continue to evolve in homecare environments.

Future Outlook

Over the next five years, the Canada spirometers market is anticipated to experience significant growth, fuelled by increasing healthcare expenditures and a rising focus on preventative health measures. The convergence of technological advancements and the growing adoption of telehealth services are likely to create new opportunities for spirometer manufacturers. Additionally, the aging population will contribute to heightened demand for respiratory diagnostics, reinforcing the need for innovative solutions in the healthcare sector.

Major Players

- Koninklijke Philips N.V.

- WA Warehouse

- BD

- Vitalograph

- SCHILLER

- Siemens Healthineers AG

- Medtronic

- Borg pharmaceutical Ind.

- Germfree

- Honeywell International Inc.

- MGC Diagnostics Corporation

- MIR – Medical International Research S.p.A.

- OSMED

- NuvoAir Inc.

- Champion Health

Key Target Audience

- Healthcare Providers

- Hospitals

- Clinics

- Home Care Agencies

- Medical Equipment Distributors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Health Canada)

- Respiratory Care Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Canada spirometers market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Canada spirometers market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple spirometer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Canada spirometers market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain

- Growth Drivers

Rising Incidence of Respiratory Diseases

Technological Advancements in Spirometry - Market Challenges

High Costs of Advanced Spirometers

Reimbursement Issues - Opportunities

Expanding Online Distribution Channels

Emerging Markets in Homecare - Industry Trends

Integration of AI in Spirometry

Growing Demand for Portable Devices - Regulatory Landscape

Health Canada Regulations

ISO Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Portable Spirometers

Desktop Spirometers

Handheld Spirometers

Others - By End User (In Value %)

Hospitals

Clinics

Home Care

Others - By Application (In Value %)

Asthma

Chronic Obstructive Pulmonary Disease (COPD)

Cystic Fibrosis

Pulmonary Fibrosis

Others - By Technology (In Value %)

Volume Measurement

Flow Measurement

Peak Flow Measurement - By Distribution Channel (In Value %)

Offline Sales

Online Sales - By Disease Type (In Value %)

Bronchitis

Emphysema

Chronic Obstructive Lung Disease

Lung Cancer

Others - By Disposable Components (In Value %)

Filters

Sensors

Tubes - By Region (In Value %)

Ontario

Quebec

British Columbia

Alberta

Other Regions

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Market Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Product Portfolio, Geographic Spread, Market Penetration)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Competitors

Koninklijke Philips N.V.

WA Warehouse

BD

Vitalograph

Schiller

Siemens Healthineers AG

Medtronic

Borg pharmaceutical ind.

Germfree

Honeywell International Inc.

MGC Diagnostics Corporation

MIR – Medical International Research S.p.A.

OSMED

NuvoAir Inc.

Champion Health

- Market Demand and Utilization

- Budget Alignment for Equipment Acquisition

- Regulatory and Compliance Requirements

- Patient Needs and Pain Points

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030