Market Overview

The Colombia Commercial Aircraft MRO market was valued at USD ~million based on a recent historical assessment, driven by the growing demand for maintenance, repair, and overhaul services from both domestic and international airlines operating in Colombia. The market’s growth is primarily fueled by the expansion of the country’s aviation sector, with an increase in both regional and international flight operations. Airlines continue to invest in MRO services to ensure fleet readiness, minimize downtime, and optimize operational efficiency.

The demand for MRO services in Colombia is concentrated in major cities such as Bogotá and Medellín, where the country’s largest airports are located. Bogotá, the capital, is the hub for international flights, attracting a significant portion of the country’s MRO activity, while Medellín serves as a central point for regional aviation services. The dominance of these cities is reinforced by their strategic location and robust infrastructure, which makes them ideal for maintenance operations. International airlines also rely on Colombia for MRO services due to the country’s proximity to key aviation markets in Latin America.

Market Segmentation

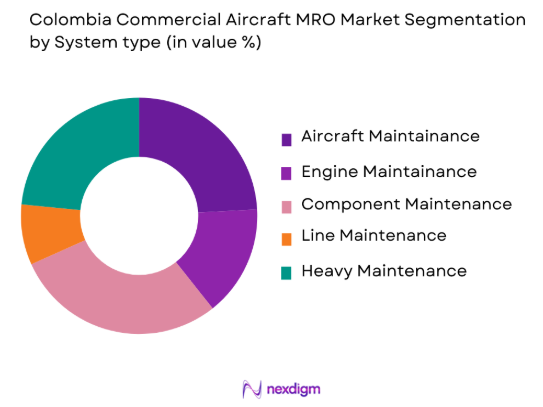

By System Type

The Colombia Commercial Aircraft MRO market is segmented by system type into airframe maintenance, engine maintenance, component maintenance, line maintenance, and heavy maintenance. Recently, airframe maintenance has a dominant market share due to the significant demand for routine checks and inspections of aircraft structures. Airlines prefer to outsource airframe maintenance to specialized MRO providers to ensure compliance with safety standards and to prolong the lifespan of the aircraft. Airframe maintenance also includes essential services such as fuselage, wing, and landing gear checks, which are crucial for ensuring operational safety and preventing unforeseen downtime. This segment’s dominance is supported by the large number of commercial aircraft in service, which require periodic airframe maintenance to maintain airworthiness. Airlines also prioritize airframe services to meet regulatory requirements and enhance the overall operational efficiency of their fleets. The growth in passenger traffic, which drives the need for more flight hours, further accelerates demand for airframe maintenance services.

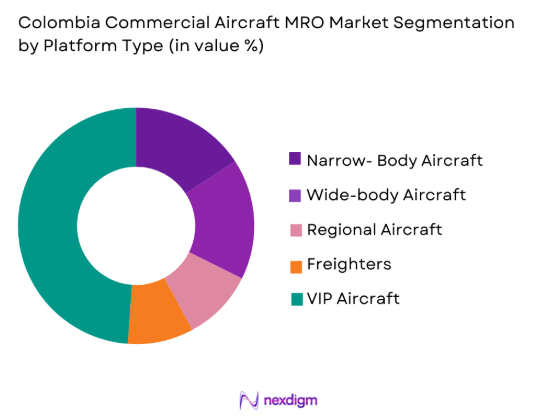

By Platform Type

The Colombia Commercial Aircraft MRO market is segmented by platform type into narrow-body aircraft, wide-body aircraft, regional aircraft, freighters, and VIP aircraft. Recently, narrow-body aircraft have a dominant market share due to their widespread usage by low-cost carriers and regional airlines operating in Colombia. These aircraft are frequently utilized for both domestic and short-haul international flights, making them subject to more frequent maintenance cycles. Their versatility and fuel efficiency further drive the demand for MRO services. Narrow-body aircraft, which make up the majority of Colombia’s commercial fleet, require regular maintenance to ensure operational safety and minimize turnaround times. The growing number of budget airlines and their increasing fleet sizes have led to higher demand for narrow-body aircraft MRO services. This market segment’s dominance is supported by the cost-effectiveness of narrow-body aircraft in both domestic and regional aviation operations, with operators increasingly opting for them due to their operational flexibility.

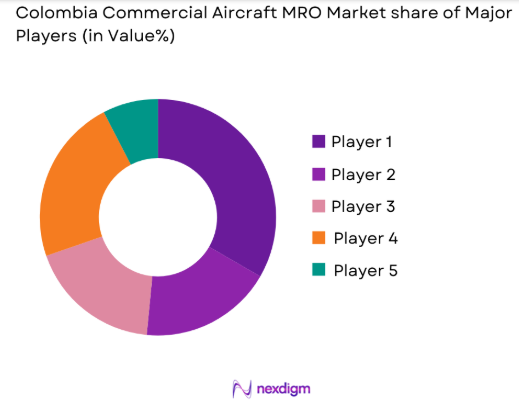

Competitive Landscape

The Colombia Commercial Aircraft MRO market is moderately consolidated, with both domestic and international players offering MRO services. Major international MRO providers have established service agreements with Colombian airlines, while local players cater to the growing demand for regional maintenance services. The market is influenced by the technological capabilities, service network, and reputation of major MRO providers, which continue to expand their operations to meet the increasing demand for efficient and cost-effective solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Aircraft Fleet Supported |

| Avianca MRO Services | 1995 | Colombia | – | – | – | – | – |

| Lufthansa Technik | 1951 | Germany | – | – | – | – | – |

| Aeroman | 1994 | El Salvador | – | – | – | – | – |

| Air France Industries KLM Engineering & Maintenance | 1999 | France | – | – | – | – | – |

| Delta TechOps | 1929 | United States | – | – | – | – | – |

Columbia Commercial Aircraft MRO Market Analysis

Growth Drivers

Increasing passenger traffic and fleet expansion

Colombia’s aviation market has been experiencing consistent growth, driven by an increase in both domestic and international passenger traffic. The country’s strategic position within Latin America has led to a rise in travel demand, which, in turn, drives the need for more commercial aircraft. Airlines operating in Colombia are expanding their fleets to cater to this growing demand, resulting in an increased need for maintenance, repair, and overhaul (MRO) services. Both international and local airlines are investing in fleet renewal, which includes the acquisition of new aircraft and the maintenance of older models. As airlines continue to expand their fleets, they require MRO services to ensure that their aircraft remain operational, safe, and compliant with regulatory standards. This growth driver is closely linked to Colombia’s thriving tourism sector, increasing business activities, and enhanced connectivity with international markets. The higher number of aircraft in service directly correlates to an increase in the frequency of MRO activities, which further propels the market’s expansion. The demand for MRO services is further supported by the growing trend of cost optimization, which encourages airlines to maintain their fleets for longer periods and increase their utilization. Furthermore, government incentives supporting aviation development contribute to market growth by facilitating more airline operations, thus reinforcing demand for maintenance services.

Technological advancements and digitalization in MRO services

The advent of advanced technologies and digital solutions in the aircraft MRO sector has greatly influenced the Colombia Commercial Aircraft MRO market. Digital technologies such as predictive maintenance, the Internet of Things (IoT), and data analytics are playing a crucial role in transforming the maintenance process. Predictive maintenance, for instance, enables airlines to foresee potential issues before they occur, allowing for proactive maintenance that reduces downtime and costs. The integration of these technologies helps airlines to optimize their fleet operations, extend the life cycle of their aircraft, and improve the efficiency of their MRO operations. Colombia’s growing interest in digitalization is driving the adoption of these advanced technologies by local MRO service providers, creating a competitive advantage in the market. The use of data analytics helps track aircraft performance, monitor component health, and predict when maintenance is required. Moreover, the increasing reliance on cloud-based systems and remote monitoring solutions has enabled airlines to enhance their operational efficiency and reduce maintenance turnaround times. With these advancements, MRO providers can offer more accurate and faster services, thereby attracting more clients. Additionally, the ability to gather and analyze real-time data helps providers identify trends and improve their service offerings, leading to improved customer satisfaction. This technology-driven shift is expected to continue driving growth in the market, particularly as airlines seek cost-effective, efficient, and more reliable maintenance solutions.

Market Challenges

High capital investment and operational costs

One of the major challenges facing the Colombia Commercial Aircraft MRO market is the high capital investment and operational costs associated with maintaining and operating MRO facilities. The costs involved in acquiring and maintaining specialized equipment, hiring skilled labor, and ensuring compliance with industry standards can be significant, making it difficult for small and medium-sized MRO providers to compete. Furthermore, the high capital expenditure required to establish and maintain MRO facilities capable of servicing modern aircraft fleets is often a barrier to entry for new players in the market. Existing providers must also constantly invest in upgrading their facilities and technologies to keep pace with industry standards and customer demands. Additionally, fluctuations in the price of raw materials and labor costs can impact the profitability of MRO services. For example, the rising cost of aircraft parts and components, combined with labor shortages in specialized MRO skills, has made it more challenging for providers to keep service prices competitive while maintaining high-quality standards. These financial and operational hurdles often lead to consolidation in the market, where larger players with the financial backing and infrastructure to invest in technology and resources are more likely to succeed.

Regulatory compliance and certification requirements

The regulatory environment in Colombia, as in many other regions, poses a significant challenge for MRO providers in the aviation industry. The strict certification requirements for aircraft maintenance and repair services require MRO providers to ensure that their facilities and personnel meet rigorous industry standards. These regulations are enforced by the Colombian Civil Aviation Authority (AAC), which oversees compliance with local and international safety standards. Non-compliance with these standards can result in penalties, delays in services, or even loss of operating licenses. Moreover, the constantly evolving nature of aviation regulations, including safety standards, environmental laws, and industry best practices, requires MRO providers to adapt and invest in training, certifications, and process upgrades. Meeting these regulatory requirements adds complexity and cost to MRO operations, particularly for smaller service providers who may not have the resources to stay ahead of changing regulations. For larger companies, staying compliant with international safety and quality standards such as those set by the International Air Transport Association (IATA) and the Federal Aviation Administration (FAA) further adds to operational costs. As these regulatory hurdles increase, MRO service providers must adapt by continually upgrading their processes, certifications, and staff training programs, which can increase operational overheads.

Opportunities

Increasing demand for low-cost carriers (LCCs) and regional airlines

The growing popularity of low-cost carriers (LCCs) in Colombia has created a significant opportunity for the commercial aircraft MRO market. LCCs often operate larger fleets of narrow-body aircraft, which require frequent maintenance due to the high utilization of their fleets. These airlines prioritize cost-effective MRO services to maintain their aircraft and ensure optimal performance at lower operational costs. The expansion of regional airlines that serve domestic and short-haul international routes also boosts demand for MRO services, as these airlines often operate a higher number of smaller aircraft, which require regular maintenance to ensure safety and compliance. The increase in air travel due to economic growth, improved disposable incomes, and rising tourism has accelerated the need for both narrow-body aircraft and their corresponding MRO services. Furthermore, regional carriers and LCCs are expected to continue their growth trajectory as consumers increasingly prioritize affordable travel options, driving the need for more cost-efficient and widespread MRO service providers.

Growth in international partnerships and foreign investment

As the Colombian aviation market expands, there is a growing opportunity for international MRO partnerships and foreign investment in the country. International players are increasingly entering the Colombian market to take advantage of the growing demand for MRO services in Latin America. These partnerships provide Colombian MRO providers with access to advanced technologies, equipment, and best practices from global leaders in the aviation maintenance industry. As global airlines expand their fleets in the region, foreign investments help to enhance the technological capabilities of local MRO facilities and improve the overall efficiency of operations. Additionally, foreign investment supports the expansion of maintenance facilities and the introduction of cutting-edge tools and systems to streamline maintenance processes, which leads to cost reductions and increased service quality. As Colombia is strategically positioned in Latin America, it offers attractive growth prospects for international investors and global MRO service providers. This opportunity not only strengthens the local economy but also provides Colombian airlines with high-quality services that meet international standards.

Future Outlook

The Colombia Commercial Aircraft MRO market is expected to experience steady growth over the next five years, driven by the increasing demand for MRO services as passenger traffic continues to rise. Technological advancements, including predictive maintenance and IoT solutions, will enhance operational efficiency. The market will benefit from an expanding fleet and new aircraft models, while regional airlines and low-cost carriers will drive demand for cost-effective maintenance solutions. Regulatory support and foreign investments will further bolster industry growth.

Major Players

- Avianca MRO Services

- Lufthansa Technik

- Aeroman

- Air France Industries KLM Engineering & Maintenance

- Delta TechOps

- HAECO

- AAR Corp

- Air India Engineering Services

- Flynas Engineering Services

- Rolls-Royce MRO Services

- GE Aviation

- MTU Maintenance

- Hong Kong Aircraft Engineering Company

- United Airlines TechOps

- Safran Aircraft Engines

Key Target Audience

Airlinesoperatingin Colombia

• Regional airlines and low-cost carriers

• Aircraft manufacturers

• MRO service providers

• Government aviation agencies

• Private investors in the aviation sector

• International aviation regulatory bodies

• Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

The research process focused on identifying the primary drivers of demand, regulatory requirements, and technological advancements within the commercial aircraft MRO market. Data sources included industry reports, company financial statements, and interviews with key stakeholders.

Step 2: Market Analysis and Construction

Quantitative and qualitative data were analyzed to establish market size and growth potential. Historical data, including fleet sizes, maintenance schedules, and service contracts, helped in constructing market models.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including MRO service providers and aviation industry analysts, were consulted to validate market assumptions and provide insights into upcoming trends.

Step 4: Research Synthesis and Final Output

The research findings were synthesized into a comprehensive report, focusing on actionable insights for stakeholders. The final output emphasized market dynamics, growth drivers, challenges, and strategic opportunities.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Aircraft Fleet and Demand for MRO Services

Rising Air Traffic and Expansion of Airline Operations

Government Policies Supporting Aviation Infrastructure Development - Market Challenges

High Capital Investment in MRO Facilities and Equipment

Skilled Workforce Shortage in Aircraft Maintenance

Regulatory Compliance and Certification Challenges - Market Opportunities

Technological Advancements in Aircraft Maintenance Technologies

Emerging Demand for Digital MRO Solutions

Collaborations between OEMs and Independent MRO Providers - Trends

Adoption of Predictive Maintenance and IoT in MRO Services

Shift Toward Green MRO Solutions and Sustainable Practices

Growth in Regional and International MRO Partnerships - Government Regulations

Aviation Safety Regulations and Certification Standards

Environmental and Sustainability Compliance for MRO Operations

Government Incentives for MRO Facility Investments

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airframe Maintenance

Engine Maintenance

Component Maintenance

Line Maintenance

Heavy Maintenance - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Freighters

VIP Aircraft - By Fitment Type (In Value%)

OEM Services

Independent MRO Providers

In-house Maintenance

Specialized Maintenance Providers

Third-Party MROs - By End User Segment (In Value%)

Commercial Airlines

Private Operators

Freight Operators

Government and Military Operators

MRO Providers - By Procurement Channel (In Value%)

Direct Contracting

Outsourced MRO Services

Integrated MRO Solutions

OEM MRO Services

Third-Party Service Providers

- Market Share Analysis

- Cross Comparison Parameters (Service Offering, Geographic Reach, Certification Status, Technological Capability, Cost Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Avianca MRO Services

LATAM Airlines Group

SATA International MRO Services

Aero PATRIA MRO

Aerolíneas Argentinas MRO

Southwest Airlines MRO

MRO Holdings

Delta TechOps

Airbus MRO Services

Collins Aerospace MRO Services

GE Aviation MRO Services

Rolls-Royce MRO Services

MTU Maintenance

Honeywell Aerospace

Air France Industries KLM Engineering & Maintenance

- Airlines investing in in-house MRO capabilities

- Growing reliance on third-party MRO service providers

- Expansion of low-cost carriers requiring efficient maintenance

- Increased focus on aircraft fleet management by regional operators

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035