Market Overview

The Colombia defense market was valued at USD ~ billion based on a recent historical assessment, driven by national security priorities, modernization efforts, and increasing defense expenditures. The country’s defense spending is fueled by the need to address internal security challenges, including counterinsurgency, terrorism, and organized crime. As a result, Colombia continues to invest in advanced defense systems, particularly in air, land, and maritime platforms, which in turn drives the demand for defense equipment and services.

Major cities such as Bogotá and Cartagena remain key hubs for Colombia’s defense industry due to their strategic military importance and infrastructure support. Bogotá, as the capital, is home to the country’s largest military base and government agencies responsible for defense procurement. Cartagena plays a significant role with its naval base, positioning it as a critical location for maritime defense operations. These cities, coupled with Colombia’s focus on strengthening its defense capabilities, help shape the landscape of the defense market.

Market Segmentation

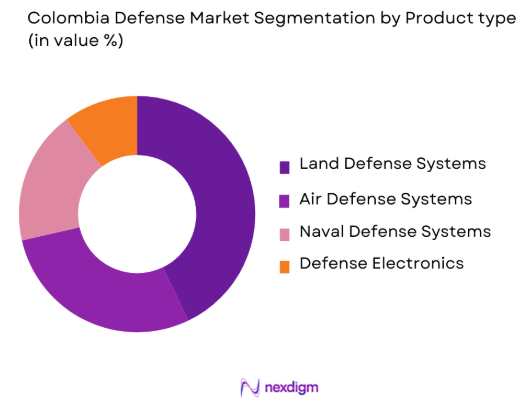

By Product Type

The Colombia defense market is segmented by product type into land defense systems, air defense systems, naval defense systems, and defense electronics. Recently, land defense systems have a dominant market share due to the high demand for infantry weapons, armored vehicles, and artillery to address internal security challenges. These systems are widely used by the Colombian military and law enforcement agencies to combat insurgency and organized crime in various regions of the country. The need for better mobility, protection, and firepower in complex terrains drives the procurement of advanced land-based platforms. Additionally, the ongoing modernization of the Colombian Armed Forces has contributed to higher demand for advanced land defense systems that offer enhanced capabilities for both offensive and defensive operations. Furthermore, land defense systems form the backbone of Colombia’s defense strategy due to their versatility in addressing a range of security concerns, further strengthening their market dominance.

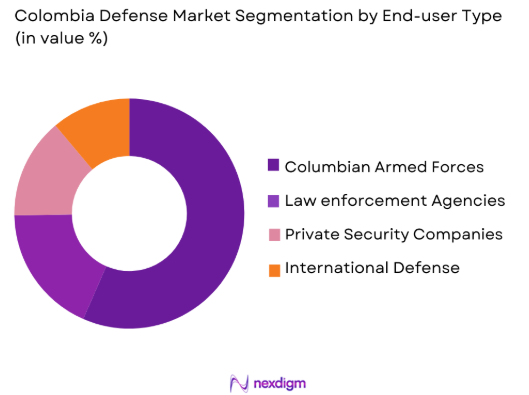

By End-User Type

The Colombia defense market is segmented by end-user into the Colombian Armed Forces, law enforcement agencies, private security companies, and international defense contractors. Recently, the Colombian Armed Forces have a dominant market share due to the government’s focus on strengthening military capabilities to combat insurgency and organized crime. With a large defense budget allocated for modernization programs, the military has been increasingly procuring advanced weapons, vehicles, and systems. The Colombian Armed Forces’ demand is further supported by the need for improved readiness and operational effectiveness. Law enforcement agencies also contribute to the market as they continue to modernize their equipment, especially in urban warfare and counter-terrorism operations. Private security companies and international defense contractors play a complementary role in meeting the rising demand for specialized defense solutions. However, the Colombian Armed Forces remain the primary driver of defense procurement in the country, accounting for the largest share of defense spending.

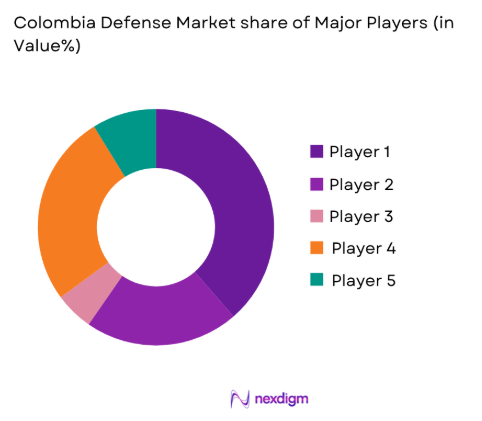

Competitive Landscape

The Colombia defense market is competitive, with both domestic and international players providing a wide range of products and services. Local firms collaborate with global defense companies, fostering technological transfer and enhancing local capabilities. International defense contractors play a significant role in supplying advanced systems, such as fighter jets, surveillance technologies, and naval vessels, while local manufacturers contribute to land defense systems and smaller defense electronics. The market is expected to see consolidation as major players strengthen their position in both procurement and defense-related services.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Government Contracts |

| Fabricato S.A. | 1927 | Colombia | – | – | – | – | – |

| Embraer Defense & Security | 1969 | Brazil | – | – | – | – | – |

| Indumil S.A. | 1945 | Colombia | – | – | – | – | – |

| Saab AB | 1937 | Sweden | – | – | – | – | – |

| Thales Group | 1893 | France | – | – | – | – | – |

Columbia Defense Market Analysis

Growth Drivers

Increased defense spending and military modernization

Colombia has consistently increased its defense budget, driven by the need to combat internal threats such as insurgency and organized crime. The growing focus on military modernization is a key growth driver for the Colombia defense market. Modernizing the Colombian Armed Forces has led to a rise in demand for advanced weaponry, vehicles, and systems to enhance operational efficiency. This shift toward modernizing equipment allows the military to tackle more complex security challenges, including counter-terrorism and anti-drug operations. Additionally, strategic partnerships with international defense contractors have facilitated access to advanced technologies, allowing Colombia to enhance its defense capabilities. Colombia’s efforts to modernize also extend to the development of its defense infrastructure, including the expansion of airbases, naval ports, and military facilities. These investments have encouraged growth in both the procurement of defense systems and the development of local defense manufacturing capacity. As regional security concerns increase, the need for Colombia to enhance its defense posture further accelerates market demand. Increased defense cooperation within the region also strengthens Colombia’s defense capabilities, which further drives spending and procurement. (imarcgroup.com)

Technological advancements in defense systems

Technological advancements in defense systems are another significant growth driver for the Colombia defense market. As global defense technologies continue to evolve, Colombia’s Armed Forces and law enforcement agencies are adopting advanced systems such as unmanned aerial vehicles (UAVs), sophisticated surveillance systems, and cutting-edge radar technologies. These innovations provide a substantial boost to the country’s defense capabilities, allowing for enhanced threat detection, rapid response, and improved operational efficiency. The integration of C4ISR systems into Colombia’s defense strategy plays a crucial role in improving the coordination and management of security forces. Furthermore, the development of autonomous defense systems and AI-powered platforms offers increased intelligence and support for Colombia’s national defense strategy. With a growing focus on cybersecurity, Colombia is also investing in digital defense technologies to safeguard critical infrastructure and information networks. These technological advancements not only enhance defense capabilities but also provide Colombia with the tools needed to maintain an edge over adversaries. The adoption of these technologies continues to stimulate investment, ensuring that the Colombia defense market remains at the forefront of innovation.

Market Challenges

High operational and maintenance costs

The high costs associated with the procurement, operation, and maintenance of advanced defense systems represent a significant challenge for Colombia’s defense sector. Maintaining a large fleet of modern weapons, aircraft, and naval vessels requires considerable financial resources, including ongoing costs for personnel, spare parts, and upgrades. With a focus on modernizing the military, Colombia must also contend with the rising operational and maintenance costs that come with advanced systems. For example, fighter jets and high-tech surveillance systems require expensive upkeep, including scheduled maintenance, repairs, and replacement of components. The challenge of balancing the need for advanced technology with budgetary constraints has led to increased pressure on defense planners to prioritize investments and ensure that they achieve the greatest return on investment. As Colombia continues to invest in military and defense technologies, the challenge of managing the total lifecycle costs of these systems becomes a key consideration. To address this challenge, Colombia has been working to optimize the maintenance and operational efficiency of its defense systems through strategic partnerships with international defense contractors and local MRO providers.

Regional geopolitical tensions and security threats

Colombia faces a range of regional security challenges that influence its defense strategy. Neighboring countries and organizations, particularly Venezuela and non-state actors such as insurgent groups, have contributed to heightened security threats in the region. As a result, Colombia must remain vigilant and prepared to respond to external and internal security risks, which increases the country’s defense requirements. Additionally, Colombia’s role in regional peacekeeping and counter-narcotics efforts further drives demand for defense technologies and resources. The challenge of securing Colombia’s borders and combating organized crime in its neighboring countries requires the implementation of a sophisticated defense infrastructure. As these regional threats persist, Colombia will need to maintain a capable and modern military force capable of responding to emerging challenges. Regional tensions, particularly in relation to Venezuela’s military buildup, put pressure on Colombia’s defense strategy and influence its procurement and spending decisions. Furthermore, Colombia’s defense strategy must adapt to the changing dynamics of security threats and geopolitical shifts, which can complicate long-term defense planning and force procurement priorities to shift.

Opportunities

Expanding defense exports and partnerships

Colombia has significant opportunities in expanding its defense export sector, particularly to neighboring Latin American countries and other developing regions. Colombia’s established defense manufacturing base, which produces small arms, ammunition, and vehicles, positions the country as a competitive player in the regional defense export market. Increased international demand for Colombian-made defense products, along with the country’s proximity to key markets, enhances its ability to secure export contracts. Colombia’s existing trade agreements with other Latin American countries, such as MERCOSUR, help facilitate defense exports to regional markets. Additionally, Colombia’s defense industry has the opportunity to collaborate with international defense contractors to offer advanced systems such as radar and surveillance technologies. Strengthening its export capabilities will not only drive growth in the local defense sector but also improve the country’s geopolitical standing as a regional defense exporter. Expanding defense partnerships with countries in Central America and the Caribbean, as well as further cooperation with the United States, will provide further growth potential in the defense market.

Investment in indigenous defense technologies

The Colombian government and private defense companies have the opportunity to invest in the development of indigenous defense technologies to reduce reliance on foreign imports. By focusing on domestic R&D and manufacturing, Colombia can boost its self-sufficiency and reduce procurement costs over time. Investments in indigenous technologies, such as drones, cybersecurity solutions, and surveillance systems, will allow Colombia to tailor defense solutions to its unique needs and challenges. Additionally, this approach will create a more sustainable and resilient defense sector, as the country will not be as vulnerable to external supply chain disruptions. Fostering a local defense industry will also promote job creation, economic growth, and technology transfer within Colombia, creating long-term strategic advantages. As Colombia focuses on strengthening its indigenous defense capabilities, it will be able to improve operational efficiency, reduce costs, and create a stronger defense ecosystem. Furthermore, this focus on domestic manufacturing will enhance the country’s position within the Latin American defense market, providing the potential for future defense exports.

Future Outlook

The Colombia defense market is expected to continue its growth trajectory over the next five years, driven by increased defense spending, regional security concerns, and technological advancements. The country will likely invest in advanced air and missile defense systems, as well as in cybersecurity and surveillance technologies. Furthermore, the government’s commitment to strengthening its military and addressing internal security threats will sustain the demand for defense products and services. Investments in indigenous defense technologies and partnerships with international players will also provide ample opportunities for growth in the coming years.

Major Players

- Embraer Defense & Security

- Indumil S.A.

- Fabricato S.A.

- Saab AB

- Thales Group

- Lockheed Martin

- Airbus Defense and Space

- BAE Systems

- Northrop Grumman

- Boeing Defense

- General Dynamics

- Raytheon Technologies

- Naval Group

- General Electric

- Leonardo S.p.A.

Key Target Audience

- Colombian Ministry of Defense

• Colombian Armed Forces

• National Police of Colombia

• Private security companies in Colombia

• Defense technology manufacturers

• Government agencies responsible for procurement

• Military contractors and suppliers

• Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Key variables identified in this research include defense budgets, defense procurement policies, regional geopolitical factors, and technology adoption in defense sectors. Relevant data was gathered from industry reports, defense publications, and government sources.

Step 2: Market Analysis and Construction

Market analysis was conducted to assess the defense spending patterns, procurement cycles, and market dynamics. Quantitative and qualitative data was analyzed to evaluate the impact of defense modernization programs and regional security concerns on market growth.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with defense analysts, military experts, and procurement officials were conducted to validate the research findings. Feedback from key stakeholders helped refine assumptions and ensure data accuracy.

Step 4: Research Synthesis and Final Output

Data was synthesized into actionable insights, with a focus on emerging trends, market challenges, and strategic opportunities. The final output offers detailed forecasts and recommendations for industry participants.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in Defense Systems

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Strategic Partnerships with Private Sector for Technology Integration

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous Systems

Integration of AI and Machine Learning in Military Operations

Surge in Cybersecurity Investments for Defense Systems - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value 2020-2025

- Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Command & Control Systems

Cybersecurity Systems

Surveillance & Reconnaissance Systems

Weapon Systems

Communication Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Integrated Platforms

Space Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Modern Defense Systems

- Government Agencies’ Role in Regulating and Procuring Defense Solutions

- Defense Contractors’ Focus on Innovation and Cost Reduction

- Private Sector’s Growing Role in Military and Technology Integration

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035