Market Overview

The Egypt building materials market is assessed at USD 50.7 billion in 2024, and expected to grow with a CAGR of 8.3% from 2024 to 2030, driven by the rapid urbanization and significant investment in infrastructure development. The market has been stimulated by government-led infrastructure projects alongside an increasing demand for residential and commercial construction.

Cairo and Alexandria are dominant cities in the Egypt building materials market primarily due to their significant urban populations and extensive infrastructure projects. These cities attract both local and international contractors, thereby increasing demand for essential building materials like cement and steel. Government initiatives aimed at enhancing housing and urban development further contribute to their market prominence, solidifying their roles as key players in the sector.

Market Segmentation

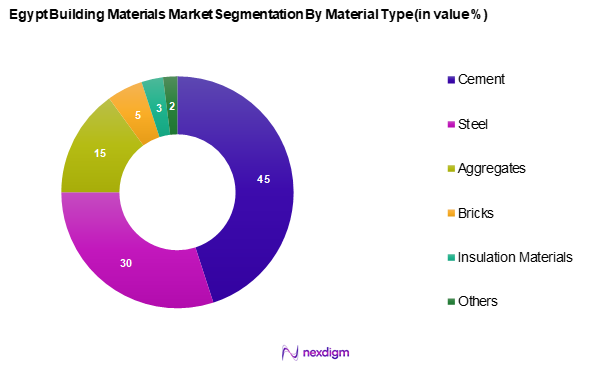

By Material Type

The Egypt building materials market is segmented into cement, steel, aggregates, bricks, insulation materials, and others. Among these, cement holds a substantial market share due to its fundamental role in construction projects across various sectors. Cement’s dominance is attributed to the consistent demand arising from large-scale infrastructure projects and the booming residential construction sector. In fact, cement is seen as a primary construction requirement, making it indispensable for new building developments, thus securing its leading position in the market.

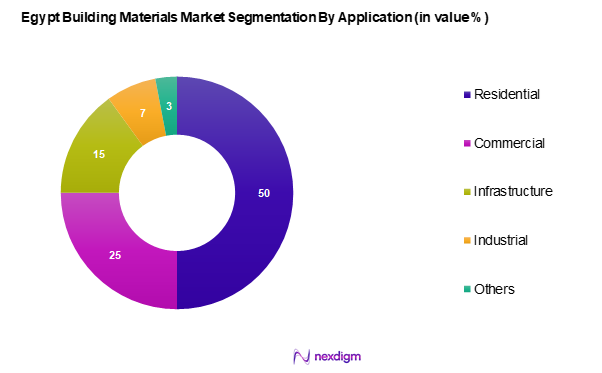

By Application

The Egypt building materials market is segmented into residential, commercial, infrastructure, industrial, and others. The residential segment has emerged as the market leader, driven primarily by increasing urbanization rates and government initiatives aimed at expanding housing facilities. This segment benefits from a consistent influx of population in urban areas, driving demand for new housing units, which leads to a corresponding rise in demand for essential building materials. As the government focuses on developing new housing projects, the residential segment continues to dominate the market landscape.

Competitive Landscape

The Egypt building materials market is characterized by a competitive landscape dominated by several major players. These companies have established strong footholds due to their extensive product ranges and solid distribution networks.

| Company Name | Year Established | Headquarters | Market Focus | Product Range | Industry Strategies | Market Share

% |

| Suez Cement Group | 1977 | Cairo, Egypt | – | – | – | – |

| Lafarge | 1833 | Paris, France | – | – | – | – |

| Misr Steel | 1986 | Cairo, Egypt | – | – | – | – |

| Royal El Minya Cement Co | 2007 | El Minya, Egypt | – | – | – | – |

| Arab Aluminium Company SAE | 1998 | Cairo, Egypt | – | – | – | – |

Egypt Building Materials Market Analysis

Growth Drivers

Rising Urbanization

Egypt is undergoing a pronounced urban transformation, with an increasing share of its population moving to cities. This demographic shift is fueling the need for new residential developments, commercial complexes, and public infrastructure. Major urban centers, particularly Cairo and Alexandria, are expanding rapidly, resulting in heightened demand for essential building materials such as cement, concrete, and steel. As cities grow denser and more populous, the construction sector becomes a pivotal force, positioning urbanization as a key driver of the building materials market.

Government-led Infrastructure Development

The Egyptian government has prioritized infrastructure development as a central component of national economic growth. Strategic projects involving transportation networks, housing schemes, and industrial zones have significantly increased the need for construction inputs. Initiatives aimed at expanding urban housing and public facilities are particularly impactful, as they generate sustained demand for materials like steel, aggregates, and insulation products. This proactive approach by the government continues to inject momentum into the building materials sector.

Market Challenges

Volatility in Raw Material Costs

Manufacturers in Egypt’s building materials industry face mounting pressures from fluctuating input costs. Prices of key raw materials such as steel and cement have been subject to unpredictable changes due to global supply chain disruptions and shifts in energy and transportation expenses. This volatility complicates cost forecasting, affects pricing strategies, and increases the risk of budget overruns in construction projects. For smaller players and new entrants, these challenges can dampen competitiveness and reduce investment confidence.

Complex Regulatory Environment

Regulatory compliance represents a significant operational hurdle in Egypt’s building materials landscape. Companies are required to meet stringent safety and environmental standards, especially in the production of high-impact materials like cement and steel. Adhering to these regulations necessitates investments in compliance systems, audits, and cleaner technologies, which can elevate operational costs. Inconsistent enforcement and bureaucratic delays further complicate compliance efforts, posing risks of project slowdowns and potential penalties.

Opportunities

Growing Focus on Sustainability

The demand for sustainable construction solutions is steadily rising across Egypt, supported by both environmental awareness and policy encouragement. Eco-friendly building materials, such as low-emission cement and recycled aggregates, are gaining traction among developers and contractors seeking to align with green building standards. This trend opens doors for innovation and product diversification within the sector. Companies that invest in sustainable solutions are likely to benefit from enhanced market differentiation and long-term growth prospects.

Advancements in Construction Technology

Technological innovation is reshaping Egypt’s building materials industry. From automated production techniques to digital tools like Building Information Modeling (BIM), these advancements are improving efficiency, precision, and resource management in construction projects. Early adopters are leveraging these tools to streamline workflows and minimize waste, positioning themselves as leaders in a modernized construction value chain. As adoption widens, the market is expected to see increased productivity, quality enhancement, and demand for high-performance materials tailored to tech-driven construction environments.

Future Outlook

Over the next five years, the Egypt building materials market is expected to demonstrate significant growth fueled by government-backed infrastructure development, robust growth in the residential sector, and increasing investments in sustainable building practices. The government’s focus on urbanization and modernization of infrastructure augments this optimistic outlook, prompting various stakeholders to adapt new technologies and explore sustainable materials in response to environmental concerns.

Major Players

- Suez Cement Group

- Lafarge

- Misr Steel

- Royal El Minya Cement Co

- Misr Cement Group

- Egypt National Company for Cement

- Arab Aluminium Company SAE

- Beshay Steel Co

- Zamil Steel

- Arabian Cement Company (ACC)

- Arab Swiss Engineering Company

- Misr Cement Qena

- Unique Furnace

Key Target Audience

- Contractors

- Developers

- Industrial Builders

- Government and Regulatory Bodies (Ministry of Housing, Utilities & Urban Communities)

- Real Estate Investment Firms

- Construction Material Distributors

- Investments and Venture Capitalist Firms

- Large Scale Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map of stakeholders within the Egypt Building Materials market. Extensive desk research uses secondary and proprietary databases to gather comprehensive industry-level information. The objective is ultimately to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Egypt Building Materials market. This includes assessing market penetration, the ratio of material suppliers to construction companies, and resultant revenue generation. An evaluation of service quality statistics is conducted to ensure the reliability and accuracy of revenue estimates, allowing for precise market forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing various stakeholders, from manufacturers to infrastructure development organizations. These consultations provide invaluable operational insights directly from practitioners in the sector, contributing significantly to refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple stakeholders in the building materials sector to gather detailed insights regarding product segments, sales performance, consumer preferences, and other relevant factors. This interactive approach serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive and validated analysis of the Egypt Building Materials market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Government Infrastructure Projects - Market Challenges

Raw Material Costs

Regulatory Compliance - Opportunities

Sustainable Building Practices

Technological Advancements - Trends

Shift Towards Green Building Materials - Government Regulation

Building Codes

Safety Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (In Value %)

Cement

– Ordinary Portland Cement (OPC)

– Sulfate Resistant Cement

– White Cement

– Blended Cement

Steel

– Rebars (Reinforcing Bars)

– Structural Steel

– Steel Plates and Sheets

– Steel Beams and Columns

Aggregates

– Crushed Stone

– Gravel

– Sand

– Recycled Aggregates

Bricks

– Clay Bricks

– Fly Ash Bricks

– Concrete Bricks

– AAC (Autoclaved Aerated Concrete) Blocks

Insulation Materials

– Fiberglass

– Foam Boards (XPS, EPS)

– Mineral Wool

– Reflective Insulation

Others

– Tiles and Ceramics

– Paints and Coatings

– Waterproofing Materials

– Gypsum Products - By Application (In Value %)

Residential

– Apartments

– Villas

– Housing Compounds

Commercial

– Office Buildings

– Shopping Malls

– Hotels

Infrastructure

– Roads and Bridges

– Airports and Ports

– Railways and Metro Projects

Industrial

– Warehouses

– Factories

– Energy Plants

Others

– Educational Institutions

– Healthcare Facilities

– Religious Buildings - By Region (In Value %)

Cairo

Alexandria

Giza

Delta Region - By Sales Channel (In Value %)

Distributors

Direct Sales

Online Sales - By Customer Type (In Value %)

Contractors

– Civil and General Contractors

– Subcontractors for Specialty Works

Developers

– Real Estate Developers

– Government and Public Developers

Individuals

– Independent Builders

– Home Renovators and DIY Consumers

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Material Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Price Competitiveness, Distribution Network)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Suez Cement Group

Lafarge

Misr Steel

Royal El Minya Cement Co

Misr Cement Group

Egypt National Company for Cement

Arab Aluminium Company SAE

Beshay Steel Co

Zamil Steel

Arabian Cement Company (ACC)

Arab Swiss Engineering Company

Misr Cement Qena

Unique Furnace

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030