Market Overview

As of 2024, the Egypt food & beverage manufacturing market is valued at USD 45.2 billion, with a growing CAGR of 8.4% from 2024 to 2030. This significant market size is primarily driven by urbanization, changing consumer preferences towards value-added products, and increased investments in food processing technology. The sector is expected to see growth as the population’s health consciousness rises and demand for diverse food products increases.

Dominant cities such as Cairo, Alexandria, and Giza play a critical role in the Food & Beverage Manufacturing market due to their large consumer bases and well-established distribution networks. Cairo, being the capital, serves as the hub for leading food manufacturers and distributors. It’s also notable for its extensive food retail operations, which facilitate access to a wide range of products, contributing to the city’s prominence in the sector.

Market Segmentation

By Product Type

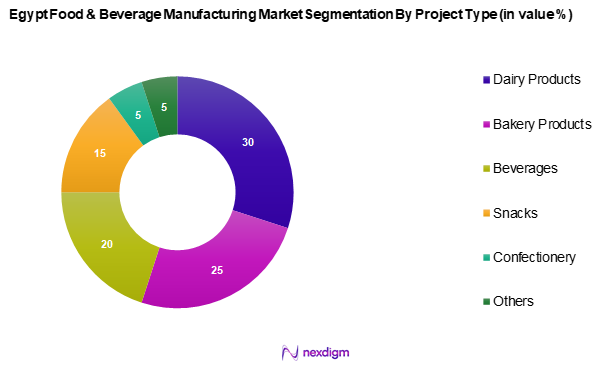

The Egypt food & beverage manufacturing market is segmented into dairy products, bakery products, beverages, snacks, confectionery, and others. Among these, dairy products hold a commanding market share in 2024, attributed to the rising health awareness among consumers seeking nutritious options. Dairy products, being essential for daily dietary needs, benefit from strong consumer loyalty and are widely available through various distribution channels. Brands like Juhayna and Arab Dairy have fortified their market positions by investing in quality and product diversity, responding to consumer demand for healthier options such as low-fat and organic dairy products.

By Distribution Channel

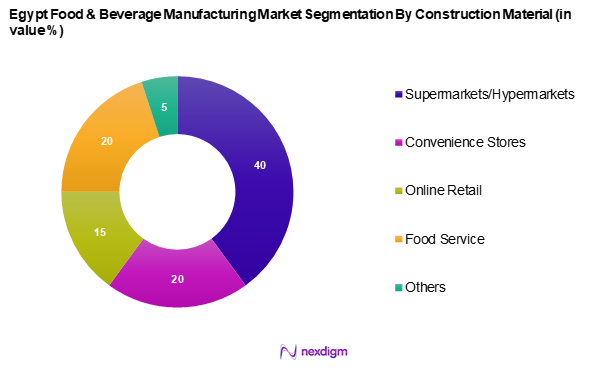

The Egypt food & beverage manufacturing market is segmented into supermarkets/hypermarkets, convenience stores, online retail, food service, and others. Supermarkets and hypermarkets have a leading market share in 2024 due to their extensive geographical reach and diverse product offerings. These retailers provide consumers a one-stop shopping experience, enhancing accessibility and convenience. Additionally, the growth of modern trade and consumer preferences for bulk purchasing contribute to their dominance in the market, facilitating brand visibility and consumer loyalty towards established brands present in these retail formats.

Competitive Landscape

The Egypt food & beverage manufacturing market is dominated by several key players, with notable contributions from local enterprises as well as multinational corporations. This competitive landscape underscores the significance of brand equity, operational efficiency, and strategic market positioning.

| Company Name | Establishment Year | Headquarters | Product

Focus |

Market

Strategy |

Distribution Channels | Revenue

(USD Mn) |

Market

Share |

| Juhayna Food Industries | 1983 | Giza, Egypt | – | – | – | – | – |

| Edita Food Industries | 1996 | Cairo, Egypt | – | – | – | – | – |

| The Coca‑Cola Company | 1886 | Atlanta, Georgia | – | – | – | – | – |

| PepsiCo | 1965 | New York, U.S.A. | – | – | – | – | – |

| Nestlé | 1866 | Vevey, Switzerland | – | – | – | – | – |

Egypt Food & Beverage Manufacturing Market Analysis

Growth Drivers

Rising Urbanization

Egypt is witnessing a steady rise in urbanization, which is transforming the consumption patterns of its population. As more people migrate to urban areas, there is a noticeable shift towards increased accessibility to packaged and processed food due to improved infrastructure and retail penetration. Urban centers are becoming focal points for economic activities, prompting greater demand for convenient and ready-to-eat food products. This urban-centric growth is also encouraging the proliferation of supermarkets, hypermarkets, and food service outlets, further boosting the food and beverage manufacturing sector.

Increasing Health Consciousness

A growing segment of the population is becoming more health-aware, influencing demand for nutritious, organic, and natural food alternatives. The rising incidence of lifestyle-related diseases has heightened awareness around healthy eating habits. In response, consumers are showing a preference for products with cleaner labels and healthier ingredients. Government-led health campaigns and education initiatives have played a vital role in changing dietary behaviours, prompting manufacturers to diversify their offerings to include more health-oriented options.

Market Challenges

Regulatory Compliance

Navigating the regulatory environment remains a key hurdle for food manufacturers in Egypt. The sector is governed by rigorous safety and quality standards that require ongoing adjustments in operational practices. Compliance demands ranging from product labelling to food safety protocols can add substantial pressure to cost structures. Failing to adhere to these regulations can result in severe consequences, including fines or exclusion from the market, making compliance not only a legal necessity but also a strategic priority.

Supply Chain Disruptions

Global and regional disruptions have exposed vulnerabilities in Egypt’s food supply chain. The sector has faced logistical constraints, including fluctuating transportation costs and delays in imports of essential raw materials. External shocks, such as geopolitical instability and global health crises, have further strained the flow of goods.

Opportunities

Innovation in Product Development

There is significant scope for innovation within Egypt’s food and beverage industry, particularly in catering to evolving consumer preferences. Manufacturers are increasingly developing products tailored to dietary restrictions and lifestyle choices, such as plant-based, gluten-free, and fortified foods. Investment in research and development is becoming more prominent, enabling companies to improve product quality and introduce sustainable packaging solutions. This focus on innovation not only meets domestic demand but also aligns with global consumption trends.

Expansion into Overseas Markets

Egypt’s strategic location and cultural ties with neighbouring regions present strong opportunities for export growth. The government’s proactive support for international trade and market expansion is enabling local manufacturers to tap into demand across the MENA region and beyond. With an emphasis on meeting international quality standards and navigating export regulations, Egyptian food producers are well-positioned to strengthen their presence in global markets and enhance their competitiveness.

Future Outlook

Over the next five years, the Egypt food & beverage manufacturing market is expected to show significant growth driven by increased urbanization, expanding middle-class consumers, and a growing preference for packaged and value-added food products. Continuous advancements in food technology and evolving consumer trends towards health and nutrition are likely to further boost market dynamics. As consumer habits shift and demand for a variety of products rises, manufacturers will need to adopt innovative approaches to meet the preferences of an increasingly discerning market.

Major Players

- Juhayna Food Industries

- Edita Food Industries

- The Coca‑Cola Company

- PepsiCo

- Nestlé

- Almarai Company

- Halwani Bros

- Faragalla

- Gourmet Egypt

- Sunbulah Group

- Egypt Foods Group

- Arab Dairy Products Co.

- The Savola Group

- Mondelēz International

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (National Food Safety Authority)

- Supply Chain and Distribution Companies

- Food and Beverage Retail

- Food Processing Equipment Manufacturers

- Industry Associations and Trade Organizations

- Health and Wellness Advocates

- Importers and Exporters of Food Products

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Egypt food & beverage manufacturing market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including key trends, consumer preferences, and regulatory influences.

Step 2: Market Analysis and Construction

This phase includes compiling and analyzing historical data pertaining to the Egypt food & beverage manufacturing market. This encompasses assessing market penetration, evaluating the distribution of manufacturers, and understanding revenue generation patterns. A critical examination of production volume, pricing trends, and regional differences is also conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

To develop robust market hypotheses, computer-assisted telephone interviews (CATIs) with industry experts and executives from reputable companies are carried out. The insights gathered from these consultations are invaluable in refining market data and verifying the assumptions underlying the analysis. This engagement provides real-world operational and financial insights that enhance the accuracy of our findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research data by engaging with leading food and beverage manufacturers to acquire detailed insights into specific product segments, sales figures, consumer preferences, and other relevant market factors. This interaction serves to verify and complement statistics derived from previous analysis phases, ensuring a comprehensive, accurate, and validated overview of the Egypt food & beverage manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Urbanization

Increasing Health Consciousness - Market Challenges

Regulatory Compliance

Supply Chain Disruptions - Opportunities

Innovation in Product Development

Expansion into Overseas Markets - Trends

Growth of Organic Foods

Demand for Ready-to-Eat Meals - Government Regulations

Food Safety Standards

Labelling Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type

Dairy Products

– Milk and Milk-Based Drinks

– Cheese (Processed, Soft, Hard)

– Yogurt (Regular, Flavored, Greek-style)

– Butter and Cream

– Flavored/Functional Dairy Drinks

Bakery Products

– Bread

– Cakes and Pastries

– Biscuits and Cookies

– Frozen Bakery Items

Beverages

– Carbonated Soft Drinks

– Juices and Nectars

– Bottled Water

– Energy and Sports Drinks

– Tea and Coffee (Ready-to-Drink and Ground) - By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Food Service - By Packaging Type

Flexible Packaging

– Pouches

– Sachets

– Wraps

Rigid Packaging

– Plastic Containers

– Metal Cans

– Cardboard Cartons

Glass Packaging

– Bottled Juices

– Dairy Jars

– Premium Condiments and Sauces - By Region

Cairo

Alexandria

Giza

Delta Region

Upper Egypt

Suez Canal Cities - By Consumable Segment

Retail Consumers

– Households and Individual Buyers

– Online Grocery Shoppers

Institutional Consumers

– Hotels and Hospitality Chains

– Hospitals, Schools, and Universities

– Industrial Catering Services

- Market Share of Major Players on the Basis of Value/Volume

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Distribution Channels, Number of Retail Outlets, Unique Value Offering)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Juhayna Food Industries

Edita Food Industries

Arab Dairy Products Co.

Mondelēz International

The Coca‑Cola Company

PepsiCo

Nestlé

Almarai Company

Halwani Bros

The Savola Group

Sunbulah Group

Gourmet Egypt

Faragalla

Egypt Foods Group

Juhayna

- Market Demand and Utilization

- Consumer Preferences and Behaviour

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030