Market Overview

As of 2024, the Egypt pharmaceutical manufacturing market is valued at USD 1.5 billion, with a growing CAGR of 6.4% from 2024 to 2030, supported by a robust healthcare infrastructure and increasing consumer demand for pharmaceuticals. Growth is driven by rising healthcare expenditure and the proliferation of chronic diseases, which necessitate a higher volume of pharmaceutical products. The market dynamics reflect a significant investment in healthcare by both public and private sectors, enhancing the capacity to meet local and export demands.

Cairo and Alexandria are the dominant cities in the Egypt pharmaceutical manufacturing market due to their advanced healthcare facilities and concentration of pharmaceutical companies. Cairo houses major manufacturing plants and research institutions, while Alexandria serves as a strategic port for import and export activities, consolidating its position in the market. The urban areas provide a larger consumer base, facilitating easier distribution and access to healthcare services.

Market Segmentation

By Drug Type

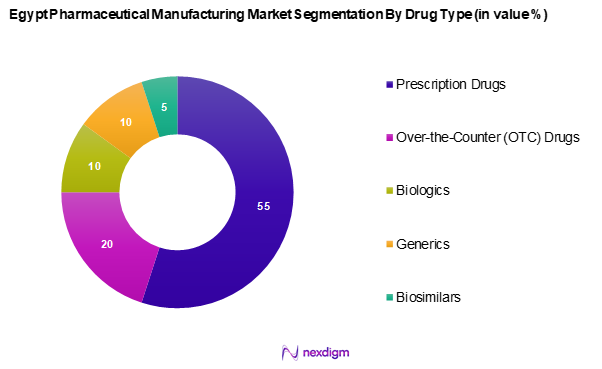

The Egypt pharmaceutical manufacturing market is segmented into prescription drugs, Over-the-Counter (OTC) Drugs, biologics, generics, and biosimilars. Prescription drugs dominate this segment as they account for the majority market share, attributed to the rising prevalence of chronic diseases such as diabetes and cardiovascular disorders that require ongoing medication. Brand loyalty and the established presence of major manufacturers further strengthen the market position of prescription drugs.

By Therapeutic Area

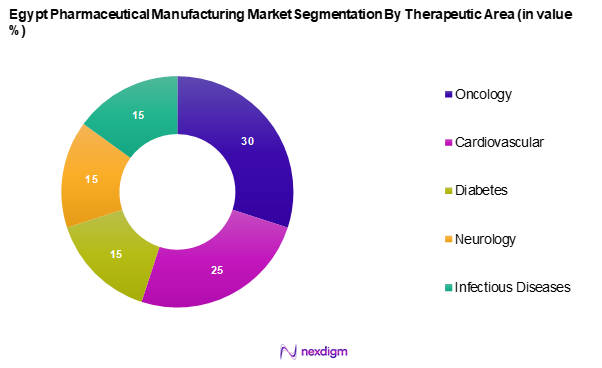

The Egypt pharmaceutical manufacturing market is segmented into oncology, cardiovascular, diabetes, neurology, and infectious diseases. The Oncology segment dominate on the basis of therapeutic area due to the rising incidence of cancer cases in Egypt. This increase has led to heightened investments in oncology drugs and targeted therapies, supported by improved awareness and early diagnosis, making oncology the leading therapeutic area.

Competitive Landscape

The Egypt pharmaceutical manufacturing market is influenced by major players such as Eva Pharma, Pharco Pharmaceuticals, and Amoun Pharmaceutical Co. These key companies dominate the landscape with substantial market shares and extensive distribution networks. The competition is characterized by a mix of local manufacturers and international entities, contributing to innovation and market dynamics.

| Company Name | Establishment Year | Headquarters | Drug Types Offered | Revenue

(USD Mn) |

Market Strategies |

| Eva Pharma | 1997 | Cairo, Egypt | – | – | – |

| Pharco Pharmaceuticals | 1984 | Alexandria, Egypt | – | – | – |

| Amoun Pharmaceutical Co | 1998 | Obour City, Egypt | – | – | – |

| APEX Pharma S.A.E. | 1997 | Cairo, Egypt | – | – | – |

| Rameda Pharmaceutical | 1994 | Giza, Egypt | – | – | – |

Egypt Pharmaceutical Manufacturing Market Analysis

Growth Drivers

Rising Healthcare Expenditure

Egypt’s pharmaceutical sector is benefitting from a consistent rise in healthcare spending, largely fuelled by government-led initiatives aimed at strengthening the public health system. Key reforms, such as the implementation of the Universal Health Insurance Law, have contributed to expand funding directed toward improving healthcare infrastructure, community-based health programs, and access to essential medicines. These developments are creating favourable conditions for the pharmaceutical industry, improving treatment accessibility and supporting increased local production efforts.

Increasing Chronic Disease Prevalence

The country is experiencing a notable surge in the incidence of chronic conditions, particularly lifestyle-related diseases like diabetes and cardiovascular disorders. These conditions now represent a major share of overall health concerns. As a response, public health campaigns and national strategies have been rolled out to manage the growing disease burden. This trend has significantly increased the demand for effective and affordable pharmaceutical products, thereby encouraging domestic manufacturing and expanding the role of local drug makers in meeting long-term healthcare needs.

Market Challenges

Regulatory Compliance Issues

Egypt’s pharmaceutical regulatory environment is becoming more aligned with international best practices, but the transition has introduced operational hurdles for manufacturers. Strict compliance standards and lengthy approval processes can delay the introduction of new products to the market. While these regulations aim to ensure drug safety and efficacy, they also pose entry barriers for manufacturers, potentially reducing investment attractiveness and slowing innovation in local production.

Counterfeit Drug Concern

The prevalence of counterfeit and substandard medicines remains a persistent challenge within the Egyptian pharmaceutical market. Despite intensified efforts by authorities to strengthen regulatory oversight and promote public awareness, counterfeit products continue to circulate. This issue not only compromises patient health outcomes but also undermines the credibility of legitimate pharmaceutical companies. The presence of unregulated drugs discourages consumer confidence in local products and presents an ongoing obstacle for the growth of trusted domestic brands.

Opportunities

Investment in R&D

The pharmaceutical industry in Egypt is seeing a rising emphasis on innovation, with increasing support for research and development initiatives. Public-private partnerships are emerging as key drivers of this momentum, fostering an environment conducive to advanced drug discovery and production. The creation of specialized research hubs and availability of incentives for R&D projects is expected to enhance the competitiveness of local firms and better align their offerings with both domestic demands and international standards.

Growth in Export Markets

Egypt is steadily positioning itself as a regional pharmaceutical export hub. Through strategic trade agreements and improvements in product quality, the country is gaining access to emerging markets across Africa and the Middle East. This growing export footprint allows domestic manufacturers to tap into broader demand while leveraging competitive production advantages. The expansion into international markets not only diversifies revenue streams but also reinforces Egypt’s role as a key player in global pharmaceutical supply chains.

Future Outlook

Over the next five years, the Egypt pharmaceutical manufacturing market is expected to display significant growth fueled by rising healthcare demands, continuous investment in research and development, and growing government support for local pharmaceuticals. The trend towards digitalization in sales and distribution channels is set to reshape market dynamics, enhancing access to pharmaceuticals across various demographics.

Major Players

- Eva Pharma

- Pharco Pharmaceuticals

- Amoun Pharmaceutical Co

- APEX Pharma S.A.E.

- Rameda Pharmaceutical

- Minapharm Pharmaceuticals

- Mash Premiere

- PharmaOverseas

- SEDICO

- Ibnsina Pharma

- MACRO GROUP Pharmaceuticals

- Inspire Pharmaceuticals

- Utopia Pharmaceuticals

- Marcyrl

- LIPITS PHARMACEUTICALS

- EIPICO

Key Target Audience

- Healthcare providers and hospital administrators

- Pharmaceutical manufacturers

- Distributors and wholesalers

- Retail pharmacies

- Government and regulatory bodies (Ministry of Health, Egyptian Drug Authority)

- Investors and venture capitalist firms

- Market research firms

- Industry associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map encompassing all key stakeholders within the Egypt pharmaceutical manufacturing market. This step is underpinned by extensive desk research utilizing a combination of secondary and proprietary databases to gather in-depth industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Egypt pharmaceutical manufacturing market is compiled and analyzed. This includes assessing market penetration and revenue generation trends related to specific drug types and therapeutic areas. A thorough evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through expert consultations via computer-assisted telephone interviews (CATIs) with industry experts and practitioners from leading companies in the pharmaceutical sector. These discussions provide valuable operational and financial insights, critical for corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with various pharmaceutical manufacturers to obtain detailed insights regarding specific product segments, sales performance, consumer preferences, and other pertinent factors. This engagement serves to verify and complement the statistics derived from the bottom-up approach, culminating in a comprehensive, accurate, and validated analysis of the Egypt pharmaceutical manufacturing market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Healthcare Expenditure

Increasing Chronic Disease Prevalence - Market Challenges

Regulatory Compliance Issues

Counterfeit Drug Concern - Opportunities

Investment in R&D

Growth in Export Markets - Trends

Digitalization in Pharmaceutical Sales

Enhancements in Drug Delivery Systems - Government Regulations

Local Manufacturing Policies

Drug Registration and Approval Processes - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Drug Type (In Value %)

Prescription Drugs

– Brand-Name Prescription Drugs

– Generic Prescription Drugs

Over-the-Counter (OTC) Drugs

– Pain Relievers

– Cold & Flu Medications

– Gastrointestinal Medications

Biologics

– Monoclonal Antibodies

– Hormones

– Vaccines

Generics

– Small Molecule Generics

– Branded Generics

Biosimilars

– Oncology Biosimilars

– Autoimmune Disease Biosimilars

– Insulin Biosimilars - By Therapeutic Area (In Value %)

Oncology

– Chemotherapy Drugs

– Targeted Therapies

Cardiovascular

– Anti-Hypertensives

– Lipid-Lowering Agents

Diabetes

– Oral Anti-Diabetics

– Insulin and Injectables

Neurology

– Anti-Epileptics

– Anti-Parkinsonian Drugs

Infectious Diseases

– Antibiotics

– Antivirals

– Antifungals - By Formulation Type (In Value %)

Tablets

– Immediate-Release

– Extended-Release

Capsules

– Hard Gelatin Capsules

– Soft Gelatin Capsules

Injectables

– Vials

– Prefilled Syringes

Topicals

– Creams

– Ointments

– Gels

Others

– Syrups

– Powders

– Inhalers - By Distribution Channel (In Value %)

Hospital Pharmacies

Retail Pharmacies

E-commerce Platforms

Wholesalers

Others - By Region (In Value %)

Cairo

Alexandria

Giza

Other Urban Areas

Rural Areas

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Drug Segment, 2024 - Cross Comparison Parameters (Company Overview, Market Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenue by Drug Type, Distribution Channels, Regulatory Compliance, R&D Investments, Therapeutic Area Focus, Manufacturing Capacity, Global Footprint, Unique Value Propositions, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Global Pharmaceutical Group

Eva Pharma

Pharco Pharmaceuticals

Amoun Pharmaceutical Co

APEX Pharma S.A.E.

Rameda Pharmaceutical

Minapharm Pharmaceuticals

Mash Premiere

PharmaOverseas

SEDICO

Ibnsina Pharma

MACRO GROUP Pharmaceuticals

Inspire Pharmaceuticals

Utopia Pharmaceuticals

Marcyrl

LIPITS PHARMACEUTICALS

EIPICO

- Market Demand and Utilization

- Purchasing Patterns and Budget Allocation

- Regulatory and Compliance Impacts

- Consumers’ Needs, Desires, and Pain Points

- Decision-Making Processes

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030