Market Overview

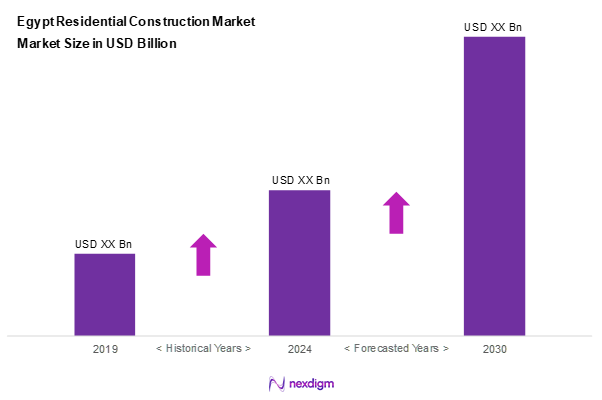

The Egypt residential construction market is projected to reach a value of USD 19.9 billion in 2024 and expected to grow at a CAGR of 7.5% from 2024 to 2030, based on a thorough analysis encompassing the past five years. This growth is largely driven by increasing urbanization, governmental housing initiatives, and heightened demand for residential developments. The Greater Cairo Area holds a dominant position due to its high population density, concentrated investment in infrastructure, and strategic significance as a political and economic hub of the country.

The leading regions in Egypt’s residential construction market are the Greater Cairo Area and Alexandria. Greater Cairo benefits from its status as the economic heart of Egypt, featuring extensive development projects and a burgeoning population. Alexandria’s strategic location on the Mediterranean coast enhances its appeal, coupled with robust local infrastructure and a thriving real estate sector, further solidifying its dominance.

Market Segmentation

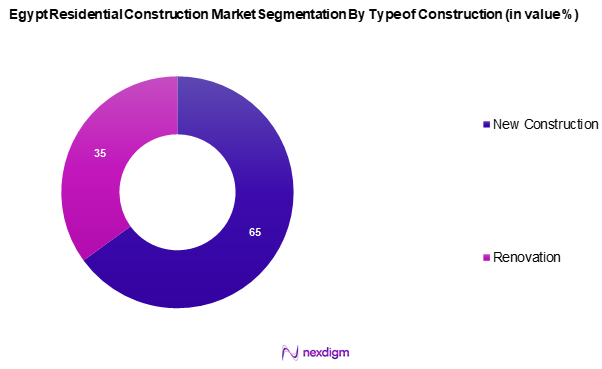

By Type of Construction

Egypt’s residential construction market is segmented by type into new constructions and renovations. Recently, new construction projects have captured a dominant market share, paralleling Egypt’s broader urban expansion and ambitious building plans. Urbanization and government-backed projects, like the New Administrative Capital, underscore this trend, fostering expansive development and providing a significant boost to new construction activities.

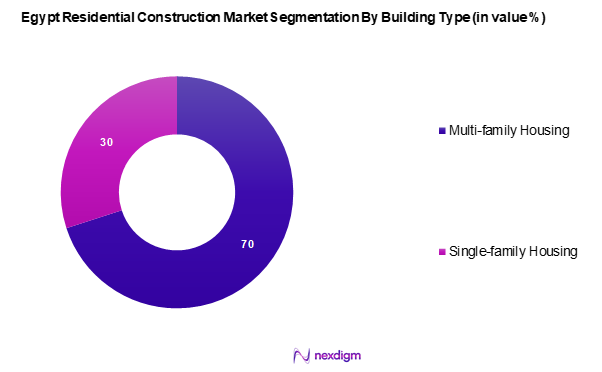

By Building Type

The market is further segmented by building type into multi-family housing and single-family housing. Multi-family housing currently dominates due to its efficiency in addressing population density challenges and catering to consumer demand for urban living. The cost-effectiveness and space optimization it offers makes it an attractive choice for developers looking to address Egypt’s growing urban population needs sustainably.

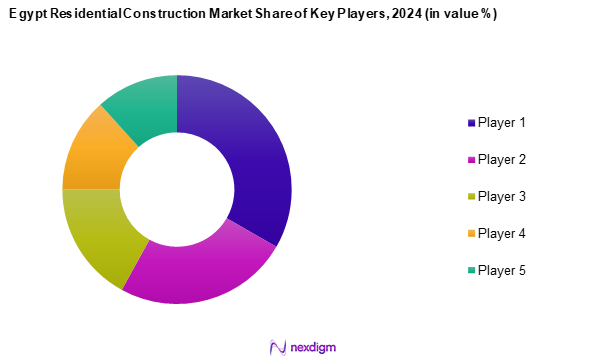

Competitive Landscape

The Egypt residential construction market is characterized by the concentration of several major industry players, many of which have extensive local and international experience. Players like Orascom Construction, Palm Hills Developments, and Talaat Moustafa Group underscore the industry’s dynamics. These companies capitalize on strong financial backing, strategic alliances, and advanced construction technologies to navigate and dominate the competitive landscape.

| Company | Established | Headquarters | Revenue (USD Billion) | Market Share

% |

Projects Completed | Key Markets |

| Orascom Construction | 1976 | Cairo, Egypt | – | – | – | – |

| Palm Hills Developments | 1997 | Cairo, Egypt | – | – | – | – |

| Talaat Moustafa Group | 1998 | Cairo, Egypt | – | – | – | – |

| BIC Contracting & Construction | 2000 | Cairo, Egypt | – | – | – | – |

| Consolidated Contractors Co. | 1952 | Athens, Greece | – | – | – | – |

Egypt Residential Construction Market Analysis

Growth Drivers

Urbanization Trends

Rapid urbanization continues to be a crucial driver for the Egypt residential construction market. As of 2023, around 43% of Egypt’s population of 104 million resides in urban areas, and this figure is projected to reach approximately 50% by 2030. The migration from rural to urban areas is largely fueled by individuals seeking better employment opportunities and improved quality of life. The United Nations expects that cities like Cairo and Alexandria will see increased population densities, which will necessitate elevated residential construction efforts to accommodate housing needs. Urbanization not only affects demand but also drives investment in infrastructure development, further stimulating the construction sector.

Government Policies & Housing Projects

The Egyptian government’s commitment to addressing the housing deficit drives significant investments and initiatives in the residential construction sector. The government has allocated approximately USD 62 billion for new housing projects under its national housing program, aimed at creating 1 million new housing units. Furthermore, there are initiatives focused on affordable housing to support low and middle-income families, reflecting the government’s intent to mitigate the shortage of residential properties. As of 2024, these policies are expected to result in the completion of over 500,000 housing units annually, bolstering the growth of the construction market.

Market Challenges

Supply Chain Inefficiencies

Supply chain inefficiencies present significant challenges for the Egypt residential construction market. A report from the World Bank indicates that logistical costs can account for up to 14% of construction costs in Egypt, hindering the timely delivery of materials and increasing project timelines. Compounding this issue, the reliance on imported construction materials makes the sector vulnerable to fluctuations in global supply chains, especially in light of recent geopolitical tensions affecting trade routes. As of 2023, procurement delays caused by these inefficiencies have led to project overruns, triggering cost hikes and dissatisfaction among stakeholders in the construction ecosystem.

Government Policies & Housing Projects

The Egyptian government’s proactive stance toward reducing the housing gap is a critical growth enabler for the residential construction sector. Large-scale initiatives are underway to increase the availability of housing units, particularly for lower and middle-income groups. These efforts are aligned with national housing programs that emphasize accessibility and affordability. The state’s strategic investments are aimed at boosting housing stock and enhancing urban planning, which directly contributes to a healthier and more robust construction pipeline.

Market Challenges

Supply Chain Inefficiencies

Persistent inefficiencies in the supply chain are among the foremost challenges facing the residential construction sector in Egypt. Delays in procuring materials and disruptions in logistics often hinder project timelines and escalate costs. The sector’s reliance on imported construction materials exposes it to global trade fluctuations, making it susceptible to delays and price volatility. Such challenges can cause extended project durations, increased financial risk, and strained relationships between developers, suppliers, and end-users.

Economic Volatility

Economic instability continues to impact the construction market by undermining investor confidence and raising the costs of essential building materials. Fluctuating prices and exchange rate uncertainty make financial planning difficult for developers and contractors. As inflation affects consumer purchasing power, demand for new housing can be tempered, especially in middle- and low-income segments. The unpredictable economic landscape adds an additional layer of complexity for stakeholders across the residential construction value chain.

Opportunities

Rise of Sustainable Practices

Sustainability has emerged as a compelling opportunity within the Egypt residential construction market. Growing public awareness around environmental concerns is shifting consumer preferences toward eco-friendly housing solutions. Developers are increasingly adopting green building techniques, driven by both market demand and national commitments to environmental targets. Embracing sustainable practices not only contributes to environmental goals but also strengthens the market position of developers by aligning with evolving buyer expectations.

Smart Home Integration

Technological advancements are paving the way for smart home integration in residential projects. The demand for modern, connected living environments is gaining momentum as consumers seek homes equipped with enhanced security, energy efficiency, and convenience features. This trend is supported by the widespread adoption of mobile technology, which increases awareness and accessibility of smart home systems. For developers, incorporating smart technologies adds value to residential offerings and positions them to tap into a rapidly evolving segment of the housing market.

Future Outlook

In the next five years, the Egypt residential construction market is expected to experience substantial growth, fueled by continued governmental investment in housing projects, urbanization trends, and rising demand for sustainable building practices. This growth trajectory highlights advancements in construction technologies and smart home integrations that are anticipated to become more prevalent across the sector.

Major Players

- Orascom Construction

- Palm Hills Developments

- Talaat Moustafa Group

- BIC Contracting & Construction

- Consolidated Contractors Company

- Detac

- The Arab Contractors

- A.Construction (H.A.C)

- El Megharbel Construction

- Redcon Construction

- Madinet Nasr for Housing & Development

- Emaar Misr

- Amer Group

- Al Ahly For Real Estate Development

- Sixth of October Development & Investment (SODIC)

Key Target Audience

- Real estate investment trusts (REITs)

- Private real estate investors

- Government and regulatory bodies (e.g., Ministry of Housing)

- Real estate developers

- Construction material suppliers

- Urban planners and architecture firms

- Investments and venture capital firms

- Financial institutions and banks

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the Egypt residential construction market. This process relies on extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the Egypt residential construction market. This entails assessing market penetration, the ratio of residential projects to construction service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through structured interviews with industry experts representing diverse companies within the residential construction space. These consultations yield valuable operational and financial insights from professionals directly involved in the industry, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The concluding phase involves engaging with a variety of residential construction stakeholders to glean detailed insights into product segments, project performance, consumer preferences, and other pertinent factors. This interaction serves to both verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Egypt residential construction market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Urbanization Trends

Government Policies & Housing Projects - Market Challenges

Supply Chain Inefficiencies

Economic Volatility - Opportunities

Rise of Sustainable Practices

Smart Home Integration - Trends

Increase in Mixed-Use Developments

Advanced Building Technologies - Government Regulation

Building Codes and Standards

Incentives for Green Construction - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume (Number of Units Constructed), 2019-2024

- By Average Selling Price, 2019-2024

- By Type of Construction (In Value %)

New Construction

– Affordable Housing Projects

– Mid-range Apartments and Villas

– Luxury Residential Developments

Renovation

– Structural Upgrades

– Interior Renovation

– Restoration of Historical Residential Buildings - By Building Type (In Value %)

Multi-family Housing

– Apartment Complexes

– Condominiums

– Gated Community Flats

Single-family Housing

– Standalone Villas

– Townhouses

– Duplexes - By Material (In Value %)

Concrete

– Precast Concrete

– Ready-Mix Concrete

Brick

– Clay Bricks

– Fly Ash Bricks

Steel

– Reinforced Steel Frames

– Light Gauge Steel Structures

Others

– Wood-Based Construction

– Composite Materials

– Recycled Building Materials - By Technology (In Value %)

Traditional

– Masonry and Concrete-Based

– Manual On-Site Construction

Prefabricated

– Modular Housing Units

– Precast Panels and Walls

Green Building

– Solar-Integrated Homes

– Energy-Efficient HVAC & Lighting

– Rainwater Harvesting and Insulation Systems - By Region (In Value %)

Greater Cairo Area

Alexandria

Nile Delta

Upper Egypt

Red Sea Coast

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Construction Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue, Revenue by Type of Construction, Project Portfolio, Construction Technology Used, Geographic Presence, Distribution or Sales Channels, Land Bank and Pipeline, Regulatory Compliance, Customer Satisfaction Metrics, Unique Value Proposition, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Orascom Construction

BIC Contracting & Construction

Consolidated Contractors Company

Detac

Palm Hills Developments

The Arab Contractors

H.A.Construction (H.A.C)

El Megharbel Construction

Redcon Construction

Talaat Moustafa Group

Madinet Nasr for Housing & Development

Palm Hills Developments

Emaar Misr

Amer Group

Al Ahly For Real Estate Development

Sixth of October Development & Investment (SODIC)

Misr Italia Properties

City Edge Developments

Hyde Park Developments

Mountain View

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume(Number of Units Constructed), 2025-2030

- By Average Price, 2025-2030