Market Overview

The European aerospace and defense market has been experiencing significant growth, driven by increased defense budgets across major European countries and a rise in defense-related technological advancements. The total market size is projected to reach USD ~billion in 2025, supported by substantial investments in defense infrastructure, aerospace research, and development. These growth drivers include increasing geopolitical tensions and the need for enhanced security systems. Moreover, the increasing demand for innovative defense solutions in areas such as cybersecurity, autonomous systems, and aerospace manufacturing plays a pivotal role in shaping the market’s future trajectory.

Countries such as the United Kingdom, France, and Germany dominate the European aerospace and defense landscape. The United Kingdom remains a global leader in both defense manufacturing and technology, while France excels in aerospace and defense collaborations with NATO and the European Union. Germany is a key player in the manufacturing of military vehicles and aircraft. The dominance of these countries is attributed to their technological expertise, established defense industries, strong R&D capabilities, and strategic government policies that prioritize defense spending.

Market Segmentation

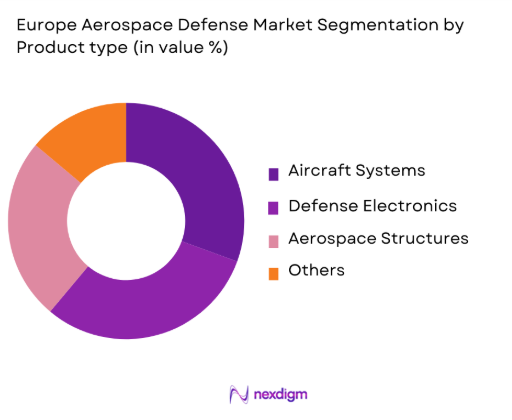

By Product Type

The European aerospace and defense market is segmented by product type into aircraft systems, defense electronics, aerospace structures, and others. Recently, aircraft systems have a dominant market share, driven by the increasing need for advanced military aircraft, UAVs, and commercial aerospace technology. The demand for fighter jets, cargo planes, and commercial airliners has fueled growth in this segment, alongside governmental procurement programs in key European countries. Aircraft systems’ dominance is bolstered by their pivotal role in both defense and commercial aviation, with technological advancements such as stealth capabilities and high-performance engines further propelling demand.

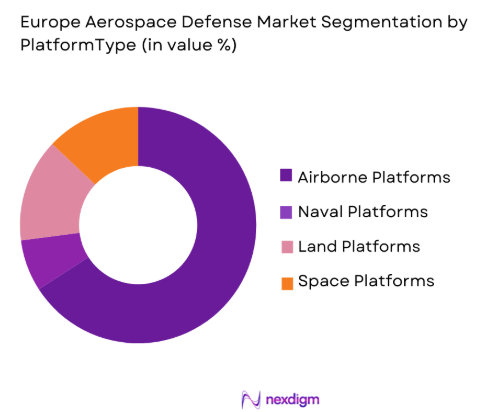

By Platform Type

The European aerospace and defense market is segmented by platform type into airborne platforms, naval platforms, land platforms, and space platforms. Among these, airborne platforms have a dominant market share, driven by the increasing demand for fighter jets, helicopters, drones, and commercial aircraft. The technological advancements in stealth technology, the growing importance of air superiority, and the robust defense procurement plans in countries like the UK and France are some of the key factors driving this dominance. Airborne platforms remain central to military strategy, which further consolidates their position in the market.

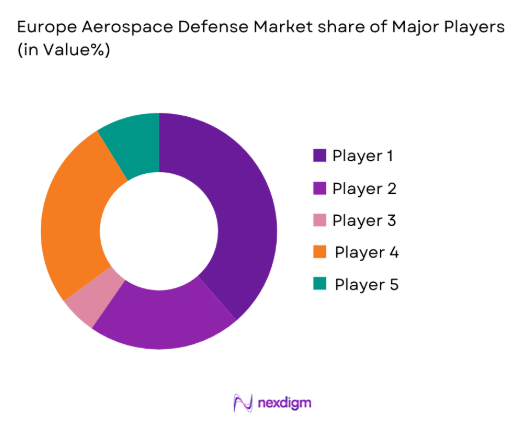

Competitive Landscape

The European aerospace and defense market is highly competitive, with major players continuously investing in advanced technologies and strategic partnerships. Key players are focused on consolidating their positions through mergers, acquisitions, and collaborations, especially in defense electronics and UAVs. The influence of companies like Airbus, BAE Systems, and Thales Group cannot be overstated as they continue to shape the market through product innovation and expanding their global reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Airbus | 1970 | Toulouse, France | – | – | – | – | – |

| BAE Systems | 1999 | London, UK | – | – | – | – | – |

| Thales Group | 2000 | Paris, France | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, US | – | – | – | – | – |

| Leonardo | 1948 | Rome, Italy | – | – | – | – | – |

Europe Aerospace Defense Market Analysis

Growth Drivers

Increased Defense Budgets

Increased defense spending in Europe has played a crucial role in driving the growth of the aerospace and defense market. Geopolitical instability and the need for stronger defense capabilities have compelled European countries to allocate more resources towards enhancing their military capabilities. For instance, NATO member states have committed to meeting defense spending targets, which has resulted in significant investments in defense equipment, including advanced fighter jets, surveillance systems, and cybersecurity infrastructure. These investments are intended to maintain security while addressing modern warfare needs, such as cyber warfare and autonomous systems, thereby spurring the demand for aerospace and defense solutions. Governments are also investing in technological advancements such as AI and machine learning, which are expected to improve the effectiveness of defense operations. Additionally, new procurement programs for air defense, naval defense systems, and missile systems are further propelling market growth. The European defense market is expected to continue expanding as governments prioritize defense sector innovation, security, and military modernization in response to emerging threats.

Technological Advancements in Aerospace

The continuous technological advancements in aerospace systems, such as the development of autonomous aircraft, hypersonic flight, and advanced navigation systems, have significantly driven the growth of the aerospace market in Europe. Technological breakthroughs in materials science, engine efficiency, and aircraft design are creating new opportunities for both commercial and military aviation. The integration of AI and machine learning into flight control systems and UAVs is allowing for greater precision and operational efficiency. Additionally, the rise of urban air mobility (UAM) and the expansion of space exploration initiatives, including satellite systems and the development of reusable rockets, are expected to play a pivotal role in shaping the future of the aerospace market. These advancements are driving competition among European aerospace companies, such as Airbus and Rolls-Royce, to develop and deploy next-generation aircraft and related technologies. The increasing demand for environmentally friendly solutions in aviation and space exploration is also pushing the development of greener technologies, like electric propulsion systems for aircraft.

Market Challenges

Supply Chain Disruptions

One of the major challenges faced by the European aerospace and defense market is the ongoing supply chain disruptions, which have been exacerbated by the COVID-19 pandemic. The aerospace sector, in particular, relies heavily on complex global supply chains to source critical components such as semiconductors, avionics, and advanced materials. Disruptions in the supply of these components have led to delays in aircraft production, repairs, and maintenance. These delays have impacted the ability of aerospace companies to meet delivery deadlines, especially in defense projects that require timely procurement of military equipment and systems. Additionally, the reliance on certain regions for the sourcing of specific components, such as engines and avionics, has made the European aerospace and defense market vulnerable to geopolitical risks. As countries continue to adjust to the post-pandemic economic environment, the industry faces the challenge of improving supply chain resilience to mitigate future disruptions. The shift towards just-in-time manufacturing and lean inventory models has also placed increased pressure on suppliers to maintain production schedules.

Cybersecurity Threats

As aerospace and defense systems become more digitized and connected, the increasing threat of cyberattacks has emerged as a significant challenge. Cybersecurity risks in aerospace are particularly critical as these systems are often targeted by malicious actors due to their strategic importance. European countries have faced several high-profile cyberattacks on defense systems, including hacks aimed at compromising military data, communications, and weapon systems. The rising sophistication of cyber threats requires European defense companies to implement advanced cybersecurity measures to safeguard sensitive information. The integration of AI and autonomous systems into military platforms, such as drones and fighter jets, adds an additional layer of complexity to cybersecurity defense, as these systems can be vulnerable to hacking or data manipulation. European governments and defense contractors must continually upgrade their cybersecurity protocols to address new and emerging threats, ensuring that military and aerospace technologies remain secure and resilient against cyberattacks.

Opportunities

Emerging Demand for Autonomous Systems

The growing interest in autonomous systems presents a significant opportunity for the European aerospace and defense market. Military applications of unmanned aerial vehicles (UAVs), autonomous drones, and robotics are on the rise, driven by the increasing need for cost-effective and risk-reducing solutions. These systems are increasingly being deployed in surveillance, reconnaissance, and combat operations, providing greater precision and reducing the need for human intervention in high-risk missions. European defense companies, including Airbus and BAE Systems, are focusing on developing next-generation autonomous systems that can operate in complex environments. The European Union’s emphasis on supporting innovation in defense technology through funding and research programs is also contributing to the growth of autonomous systems. As the demand for advanced unmanned systems increases, companies in the aerospace and defense sector are presented with new opportunities to develop and commercialize these technologies, which could help reshape modern military operations.

Growth in Space Exploration and Satellite Systems

The rapid expansion of space exploration and satellite technology presents lucrative opportunities for the European aerospace and defense market. Countries such as France, Germany, and Italy have significantly invested in space exploration programs and satellite communication systems, positioning Europe as a key player in the global space sector. The European Space Agency (ESA) has been at the forefront of several high-profile space missions, including Mars exploration and the development of satellite constellations for communications and Earth observation. These initiatives, along with the rise of private space companies in Europe, are driving demand for advanced aerospace technologies, including satellite launch vehicles, propulsion systems, and space mission systems. Furthermore, the increasing demand for satellite-based services in industries such as telecommunications, weather forecasting, and defense applications is expected to drive market growth. The establishment of commercial partnerships and the growth of space tourism are also providing additional opportunities in the European aerospace sector.

Future Outlook

The European aerospace and defense market is expected to experience steady growth over the next five years, driven by increased investments in defense infrastructure and advanced technologies. Technological developments, particularly in AI, cybersecurity, and autonomous systems, will shape the industry’s future. The demand for next-generation military and aerospace solutions will be fueled by geopolitical factors, defense modernization programs, and government support. The market is also expected to benefit from regulatory frameworks that prioritize defense and aerospace innovation, contributing to long-term growth prospects.

Major Players

- Airbus

- BAE Systems

- Thales Group

- Lockheed Martin

- Leonardo

- Safran

- Rolls-Royce

- Raytheon Technologies

- Northrop Grumman

- L3 Technologies

- General Dynamics

- Boeing

- Rheinmetall AG

- Saab Group

- Honeywell

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military agencies

- Aerospace manufacturers

- Technology developers in aerospace and defense

- Procurement officers in defense and aerospace sectors

- Research and development departments

Research Methodology

Step 1: Identification of Key Variables

Identify critical market variables affecting growth, such as defense budgets, technological trends, and geopolitical factors.

Step 2: Market Analysis and Construction

Analyze historical data and forecast future trends to construct a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

Consult with industry experts and stakeholders to validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesize findings into a comprehensive report, ensuring accuracy and clarity of insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Defense Spending

Technological Advancements in Aerospace

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Aerospace and Defense Projects

Cybersecurity Risks in Aerospace Systems

Supply Chain Disruptions - Market Opportunities

Partnerships with Private Tech Firms for Advanced Aerospace Solutions

Emerging Demand for Autonomous Systems and Drones

Integration of AI in Defense Systems - Trends

Increase in Autonomous Air and Ground Systems

Integration of AI and Machine Learning in Aerospace and Defense Operations

Growth in Cybersecurity Investments for Defense Systems - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Aerospace and Defense Technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Avionics Systems

Aircraft Structures

Defense Electronics

Weapon Systems

Flight Control Systems - By Platform Type (In Value%)

Airborne Platforms

Land Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Commercial Aerospace Manufacturers

Government Agencies

Defense Contractors

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Airbus

BAE Systems

Lockheed Martin

Northrop Grumman

Thales Group

Raytheon Technologies

Leonardo

General Dynamics

Leonardo

Rheinmetall AG

Safran

Honeywell

L3 Technologies

Boeing

Rolls-Royce

- Military Forces’ Focus on Modernizing Defense Systems

- Government Agencies’ Increasing Role in Aerospace and Defense Procurement

- Commercial Aerospace Manufacturers Adapting to Technological Changes

- Private Sector’s Growing Involvement in Aerospace and Defense Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035