Market Overview

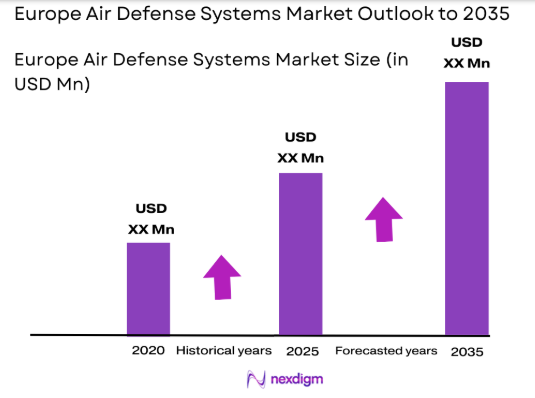

The Europe Air Defense Systems market is expected to reach USD ~ billion based on a recent historical assessment. The market growth is driven by increasing defense budgets, the rising demand for advanced air defense systems, and the geopolitical climate in Europe. The need for integrated and advanced defense systems, particularly in response to evolving threats, including missile attacks and cyber warfare, is boosting the adoption of air defense solutions across European nations. Additionally, defense modernization initiatives and the growing importance of homeland security are contributing to this upward market trend.

Dominant countries in the Europe Air Defense Systems market include the United Kingdom, France, and Germany. These nations are at the forefront of defense technology advancements, with large defense budgets and highly developed air defense infrastructures. The United Kingdom is known for its cutting-edge radar and missile defense systems, while France and Germany continue to lead in the production and deployment of multi-layered defense systems. These countries also collaborate extensively within NATO and the European Union, driving innovation and standardization in air defense solutions.

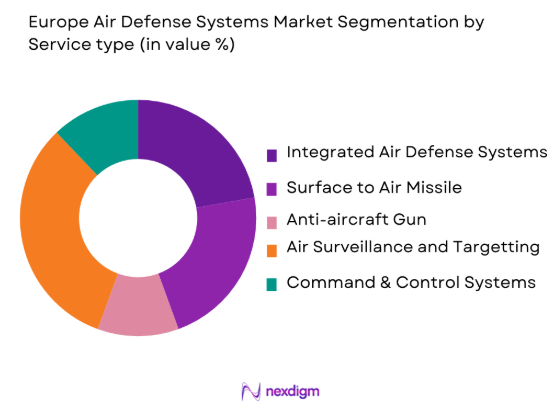

Market Segmentation

By System Type

The Europe Air Defense Systems market is segmented by system type into Surface-to-Air Missile (SAM) systems, Anti-Aircraft Guns, Integrated Air Defense Systems (IADS), Air Surveillance and Targeting Systems, and Command & Control Systems. Recently, Integrated Air Defense Systems (IADS) have dominated the market share due to the increasing need for multi-layered defense mechanisms that offer comprehensive protection. IADS combines a range of components, including radar, interceptors, and command control, to provide a robust defense against aerial threats such as missiles and aircraft. This integrated approach enhances the operational efficiency of defense forces, making IADS the preferred choice for many European nations focused on modernizing their defense infrastructure.

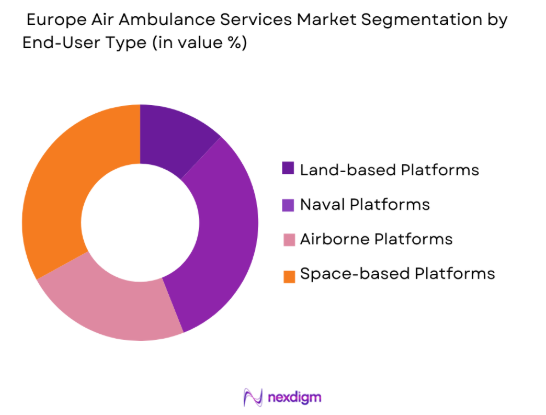

By Platform Type

The Europe Air Defense Systems market is segmented by platform type into land-based platforms, naval platforms, airborne platforms, and space-based platforms. Land-based platforms have a dominant market share, primarily driven by the increasing need for cost-effective, high-performance air defense systems that can be deployed across a wide range of terrains. These systems are easy to integrate with existing military infrastructure and offer superior flexibility in terms of defense deployment. Additionally, land-based platforms can be quickly adapted for various defense scenarios, such as urban and rural areas, contributing to their widespread adoption in European defense strategies.

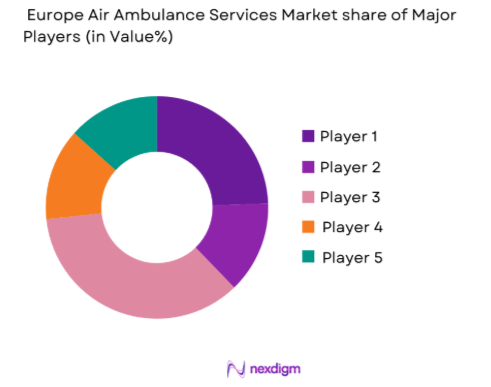

Competitive Landscape

The European air defense systems market is highly competitive, with several global players leading the way in technological advancements and strategic partnerships. Key players in the market are focusing on consolidating their positions through mergers, acquisitions, and collaborations, especially within NATO and the European Union. These players are investing heavily in the development of innovative air defense systems, including next-generation missile systems, radar technologies, and advanced command and control solutions. Companies like MBDA, Thales Group, and BAE Systems are at the forefront of the market, contributing significantly to the research, development, and deployment of air defense solutions.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| MBDA | 2001 | Paris, France | – | – | – | – | – |

| Thales Group | 2000 | Paris, France | – | – | – | – | – |

| BAE Systems | 1999 | London, UK | – | – | – | – | – |

| Lockheed Martin | 1912 | Bethesda, US | – | – | – | – | – |

| Leonardo | 1948 | Rome, Italy | – | – | – | – | – |

Europe Air Defense Systems Market Analysis

Growth Drivers

Increased Defense Budgets and Military Modernization

Increased defense budgets in European countries, driven by the rising geopolitical instability and security threats, have been a key growth driver for the air defense systems market. European nations are focused on modernizing their defense infrastructure to keep pace with new technological threats, including advanced missile systems and cyber warfare capabilities. The integration of multi-layered defense solutions such as Integrated Air Defense Systems (IADS) has become a priority for countries seeking to bolster their defense capabilities and safeguard against aerial threats. These efforts are supported by robust governmental policies, NATO initiatives, and intergovernmental defense collaborations aimed at strengthening regional security. This focus on military modernization has led to the increasing adoption of advanced air defense systems, propelling the market forward. As defense budgets continue to rise, investment in air defense technologies will remain a central strategy for many European countries.

Technological Advancements in Air Defense Systems

Technological advancements in air defense systems have significantly contributed to the growth of the market. Innovations in radar technology, missile defense systems, and integrated defense networks have made air defense more effective and efficient. Advances in radar systems, such as phased array radars and AESA (Active Electronically Scanned Array) radars, have significantly improved detection and tracking capabilities, even in complex environments with multiple targets. Additionally, the development of smart interceptors and autonomous systems has improved the responsiveness of air defense systems, enabling faster reaction times in combat scenarios. The integration of artificial intelligence (AI) and machine learning into command and control systems has further enhanced decision-making and threat assessment capabilities, driving the adoption of these advanced technologies. With the continuous evolution of these technologies, air defense systems are becoming increasingly sophisticated, offering better protection and more effective deterrence against aerial threats.

Market Challenges

High Capital Expenditure and Operational Costs

One of the primary challenges faced by the European air defense systems market is the high capital expenditure associated with the acquisition and maintenance of advanced air defense systems. The procurement of air defense systems, including missiles, radar equipment, and command control systems, requires significant financial investment, which may be a barrier for smaller nations or organizations with limited defense budgets. Additionally, the operational costs involved in maintaining and upgrading these systems, including training personnel, conducting regular tests, and replacing outdated equipment, further add to the financial burden. These high costs may limit the adoption of cutting-edge air defense systems in certain regions and delay the implementation of necessary defense upgrades. For countries facing economic constraints, balancing defense spending with other priorities remains a significant challenge.

Complexity in System Integration and Interoperability

Another challenge in the European air defense systems market is the complexity of system integration and ensuring interoperability across different platforms. Modern air defense systems often involve a wide range of components, including radar, sensors, command and control networks, and missile systems. Ensuring that these components work seamlessly together is a significant technical challenge, as compatibility issues can arise between different manufacturers’ products or legacy systems. Furthermore, as many European countries are part of multinational defense alliances like NATO, ensuring interoperability between different national systems is crucial for effective collaboration during joint operations. These challenges in integration and system compatibility can delay the deployment of air defense systems and increase costs for defense contractors, ultimately affecting market growth.

Opportunities

Increasing Demand for Multi-Layered Defense Solutions

One of the most significant opportunities in the European air defense systems market is the increasing demand for multi-layered defense solutions. As new and more sophisticated aerial threats emerge, including hypersonic missiles, drones, and cyber-attacks, countries are looking for comprehensive defense systems capable of providing protection across multiple layers. Multi-layered defense systems integrate a range of components, including surface-to-air missile systems, anti-aircraft guns, and advanced radar systems, offering a more comprehensive and effective defense strategy. The growing threat of missile attacks, especially from state and non-state actors, is driving the demand for integrated air defense systems (IADS), which provide defense against a wide variety of airborne threats. This demand presents a significant opportunity for air defense system manufacturers to develop innovative, all-encompassing solutions that can be deployed to address the evolving threats in both military and civilian sectors.

Technological Innovations in Air Defense Capabilities

Technological innovations in air defense capabilities offer another major opportunity for market growth. The development of next-generation air defense technologies, such as directed-energy weapons, laser systems, and high-powered microwave systems, is revolutionizing the market. These technologies promise to provide more efficient, cost-effective, and scalable solutions for defending against a wide range of threats, from drones to advanced missiles. Additionally, advancements in artificial intelligence and machine learning are enhancing decision-making and threat assessment capabilities in real time, enabling air defense systems to respond more swiftly and accurately. With the increasing focus on autonomous systems and robotic defense solutions, these innovations are expected to drive the demand for more advanced and automated air defense systems across Europe.

Future Outlook

The European air defense systems market is expected to see substantial growth over the next five years, fueled by increasing defense investments and technological advancements. As nations modernize their defense infrastructures to address evolving threats, the demand for integrated air defense systems and advanced air surveillance technologies will continue to rise. Additionally, innovations in missile defense, AI-driven systems, and multi-layered defense approaches will shape the future of the market. Regulatory support and government defense spending will further accelerate market growth, positioning air defense systems as an integral part of Europe’s security strategy.

Major Players

- MBDA

- Thales Group

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies

- Leonardo

- Harris Corporation

- Saab Group

- General Dynamics

- Elbit Systems

- L3 Technologies

- Huntington Ingalls Industries

- Saab AB

- Rheinmetall AG

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Aerospace and defense manufacturers

- Military agencies

- Air defense system suppliers

- Technology developers in defense

- Security and defense policy planners

Research Methodology

Step 1: Identification of Key Variables

Key factors influencing the air defense systems market, including technological advancements, defense budgets, and geopolitical security concerns, are identified.

Step 2: Market Analysis and Construction

Analysis of market data and trends is conducted to construct a detailed market model, incorporating historical insights and future forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts to help validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

The final report synthesizes findings into actionable insights, ensuring clarity and relevance for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Defense Budgets and Military Modernization

Technological Advancements in Air Defense Systems

Rising Geopolitical Tensions and Security Threats - Market Challenges

High Capital Expenditure for Air Defense Systems

Integration and Interoperability Issues

Regulatory and Compliance Barriers - Market Opportunities

Expanding Demand for Advanced Integrated Air Defense Solutions

Technological Innovations in Autonomous and Cyber Defense Systems

Growing Military Collaborations and Alliances in Europe - Trends

Shift Toward Multi-Layered Defense Systems

Integration of Artificial Intelligence in Air Defense

Increasing Use of Autonomous Systems and Drones in Air Defense - Government Regulations

Regulations on Air Defense Systems and Military Exports

Environmental and Safety Standards for Air Defense Systems

Government Funding and Support for Air Defense Innovation

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Surface-to-Air Missile (SAM) Systems

Anti-Aircraft Guns and Systems

Air Surveillance Systems

Integrated Air Defense Systems (IADS)

Command & Control Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval-Based Platforms

Airborne Platforms

Space-Based Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Systems

Cloud-Based Systems

Hybrid Systems

Modular Systems

Integrated Systems - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-Party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

MBDA

Rheinmetall AG

Thales Group

BAE Systems

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Leonardo

Harris Corporation

Saab Group

General Dynamics

Elbit Systems

L3 Technologies

Huntington Ingalls Industries

Saab AB

- Increasing Defense Budgets and Demand for Advanced Defense Systems

- Military Forces’ Focus on Modernizing Air Defense Technologies

- Role of Government Agencies in Air Defense System Procurement

- Private Sector’s Growing Interest in Air Defense Technologies

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035