Market Overview

The Europe Aircraft Avionics market is estimated to reach USD ~ billion based on a recent historical assessment. The market is primarily driven by the growing demand for enhanced flight safety, navigation precision, and the integration of advanced technologies such as automation and artificial intelligence (AI) into avionics systems. The need for improved efficiency in flight operations, along with the increasing production of aircraft, has resulted in strong market demand for avionics solutions, particularly in the commercial, military, and business aviation sectors.

The dominant countries in the European Aircraft Avionics market include the United Kingdom, France, and Germany. These countries lead the region with their highly developed aerospace industries and robust aviation infrastructure. The UK has a significant presence in the defense aviation sector, while France and Germany have a stronghold in both commercial and defense avionics solutions. These nations benefit from considerable investments in R&D, a thriving manufacturing base, and collaborations with aerospace giants like Airbus and Dassault Aviation, driving their dominance in the market.

Market Segmentation

By Product Type

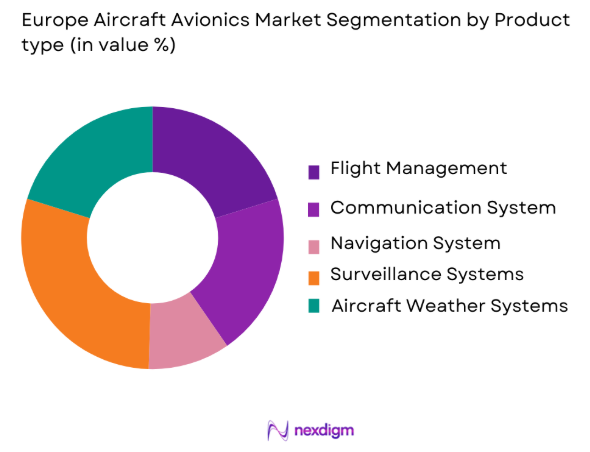

The Europe Aircraft Avionics market is segmented by product type into flight management systems, communication systems, navigation systems, surveillance systems, and aircraft weather systems. Flight management systems (FMS) have a dominant market share due to their crucial role in improving flight safety, operational efficiency, and fuel management. FMS enables pilots to optimize flight routes, calculate fuel consumption, and ensure smoother operations, reducing delays and ensuring accurate navigation. The increasing adoption of digital cockpits and integrated avionics systems in modern aircraft has further propelled the demand for advanced FMS solutions.

By Platform Type

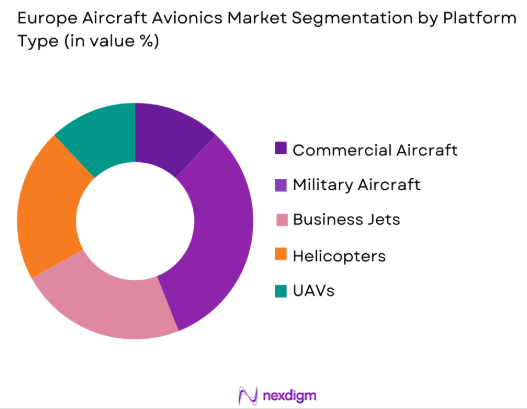

The Europe Aircraft Avionics market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Commercial aircraft dominate the market due to the increasing fleet size and the rising demand for advanced avionics in new-generation aircraft. Avionics systems in commercial aircraft play a critical role in ensuring passenger safety, improving operational efficiency, and supporting the growing air traffic. The ongoing development of next-generation aircraft like the Airbus A320neo and Boeing 787, which are equipped with sophisticated avionics, contributes to the growing demand for advanced avionics solutions in commercial aviation.

Competitive Landscape

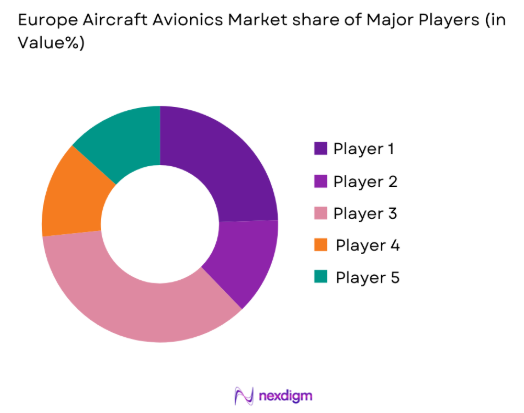

The competitive landscape in the Europe Aircraft Avionics market is marked by the presence of established companies that specialize in the development of advanced avionics solutions for commercial, military, and business aviation sectors. Companies like Thales Group, Honeywell International, and Collins Aerospace lead the market, offering a range of avionics systems including navigation, communication, and flight management systems. The market is also witnessing consolidation, as companies seek to enhance their technological capabilities and product portfolios through mergers, acquisitions, and strategic partnerships.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Thales Group | 2000 | Paris, France | – | – | – | – | – |

| Honeywell International | 1906 | Morris Plains, US | – | – | – | – | – |

| Collins Aerospace | 2018 | Charlotte, US | – | – | – | – | – |

| Rockwell Collins | 1933 | Cedar Rapids, US | – | – | – | – | – |

| Leonardo | 1948 | Rome, Italy | – | – | – | – | – |

Europe Aircraft Avionics Market Analysis

Growth Drivers

Increasing Demand for Advanced Avionics Systems

The growing demand for advanced avionics systems in Europe is a key driver of market growth. This is driven by the need to enhance aircraft safety, improve fuel efficiency, and support increasing air traffic. Avionics systems, such as flight management systems (FMS) and advanced communication systems, are crucial for ensuring the safe and efficient operation of aircraft, particularly as new-generation aircraft become more reliant on digital cockpit technology. The European market for avionics is also supported by the increasing need for automation in flight operations, reducing human error and improving decision-making. Moreover, the rise in global passenger traffic, alongside the expansion of commercial aircraft fleets, has contributed to the demand for avionics systems that offer advanced navigation, communication, and surveillance capabilities. As the aviation industry continues to modernize, the adoption of integrated avionics solutions that can enhance operational efficiency, reduce costs, and improve safety standards is expected to drive significant market growth in the coming years.

Technological Advancements in Aircraft Avionics

Technological advancements in avionics have played a pivotal role in the growth of the Europe Aircraft Avionics market. Innovations in areas such as integrated avionics systems, satellite-based navigation, and artificial intelligence (AI) are transforming the capabilities of aircraft avionics. The introduction of advanced flight management systems (FMS), which combine real-time flight data, weather information, and traffic management systems, has greatly improved operational efficiency and safety. AI-powered systems are now being incorporated into avionics to enhance predictive maintenance, automate flight operations, and improve situational awareness for pilots. Moreover, the growing use of electronic flight instrument systems (EFIS), digital cockpits, and integrated communication systems is driving the demand for avionics solutions that offer improved functionality, better connectivity, and greater reliability. As these technologies continue to evolve, their integration into commercial and military aircraft will continue to fuel the growth of the avionics market in Europe.

Market Challenges

High Development and Maintenance Costs

One of the main challenges facing the Europe Aircraft Avionics market is the high development and maintenance costs associated with avionics systems. The cost of producing advanced avionics components, such as navigation systems, communication systems, and flight management systems, is significant due to the advanced technologies and materials required. Additionally, maintaining these complex systems and ensuring they remain up to date with regulatory and technological standards can be costly for both aircraft manufacturers and operators. The high cost of avionics systems can make it difficult for smaller companies or organizations to invest in the latest technologies, limiting market growth potential in certain segments. Furthermore, the cost of training personnel to operate and maintain advanced avionics systems adds to the overall financial burden for aviation stakeholders. These factors present a challenge for the widespread adoption of cutting-edge avionics solutions, particularly in regions or segments with budgetary constraints.

Regulatory and Certification Hurdles

The Europe Aircraft Avionics market is subject to stringent regulations and certification requirements, which can slow down the adoption and deployment of new avionics systems. Aircraft avionics must meet the standards set by aviation authorities such as the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO), ensuring that they are safe, reliable, and effective. The lengthy and complex certification processes, which include rigorous testing and approval procedures, can delay the time-to-market for new avionics technologies. These regulatory hurdles can also increase the cost of product development, limiting the ability of smaller avionics manufacturers to compete with larger players. As the market evolves and new technologies such as AI and machine learning are integrated into avionics, navigating the regulatory landscape will remain a challenge for companies seeking to innovate and maintain compliance with international standards.

Opportunities

Growth of Autonomous Aircraft and UAVs

The growth of autonomous aircraft and unmanned aerial vehicles (UAVs) presents a significant opportunity for the Europe Aircraft Avionics market. As the demand for UAVs in sectors such as defense, logistics, and surveillance continues to grow, there is an increasing need for advanced avionics systems to ensure safe, efficient, and reliable operations. Avionics systems designed for autonomous aircraft require advanced navigation systems, flight control systems, and communication networks to operate without human intervention. The integration of AI and machine learning in avionics systems for UAVs also presents opportunities for innovation and growth, as these technologies enable greater autonomy and decision-making capabilities. Additionally, regulatory bodies are working on frameworks to integrate UAVs into the national airspace, creating new opportunities for avionics providers to develop solutions for both manned and unmanned aircraft in the future.

Retrofit and Modernization of Legacy Aircraft

Another key opportunity in the Europe Aircraft Avionics market is the growing demand for the retrofit and modernization of legacy aircraft. As many older aircraft are still in service, there is a need to update their avionics systems to meet current standards of safety, efficiency, and regulatory compliance. Retrofitting older aircraft with advanced avionics solutions, such as upgraded flight management systems (FMS), communication systems, and navigation equipment, is becoming increasingly common across Europe. This trend is driven by the need to improve operational efficiency, enhance safety, and extend the lifespan of aging fleets. Additionally, the retrofitting market is supported by initiatives to reduce carbon emissions and improve fuel efficiency, as newer avionics systems can help optimize flight paths and reduce fuel consumption. The demand for avionics retrofitting solutions offers significant growth opportunities for avionics manufacturers and service providers.

Future Outlook

The Europe Aircraft Avionics market is expected to see strong growth over the next five years, driven by technological innovations and the increasing demand for advanced avionics systems in both commercial and military aviation. Advancements in areas such as artificial intelligence, satellite-based navigation, and autonomous flight control systems are set to reshape the avionics landscape. The growing adoption of integrated avionics solutions, digital cockpits, and automated systems will continue to drive demand, while the expansion of the UAV sector presents new opportunities for growth. As the European aviation industry continues to modernize, the market for aircraft avionics will remain robust, supported by regulatory backing and the push for greater operational efficiency.

Major Players

- Garmin Ltd.

- Honeywell International

- Rockwell Collins

- Thales Group

- General Electric

- L3 Technologies

- Cobham plc

- BAE Systems

- UTC Aerospace Systems

- Northrop Grumman

- Leonardo

- Diehl Aerospace

- Harris Corporation

- Moog Inc.

- Safran Electronics & Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Aircraft operators and fleet managers

- Air traffic management providers

- Airlines and airport authorities

- Aerospace technology developers

- Aviation safety organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of key market drivers and barriers, including technological advancements, regulatory changes, and industry trends.

Step 2: Market Analysis and Construction

Gathering data from primary and secondary sources to build a comprehensive market model based on historical and current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts to validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesis of research findings into actionable insights, providing a clear picture of the market landscape and future trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Avionics

Increasing Demand for Advanced Navigation Systems

Growth of Unmanned Aerial Vehicles (UAVs) - Market Challenges

High Costs of Advanced Avionics Systems

Regulatory and Certification Hurdles

Integration Challenges Across Platforms - Market Opportunities

Expansion of Avionics Applications in UAVs

Growth in Retrofit Market for Avionics

Emerging Demand for Autonomous Aircraft Systems - Trends

Shift Toward Digital Cockpit Systems

Increasing Use of AI in Avionics

Growth of Integrated Avionics Solutions - Government Regulations

Regulations on Avionics Safety and Certification

Data Privacy and Cybersecurity Standards

Government Initiatives Supporting Avionics Innovation

- By Market Value 2020-2025By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Flight Management Systems

Communication Systems

Navigation Systems

Surveillance Systems

Aircraft Weather Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

UAVs - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Integrated Systems

Standalone Systems - By End User Segment (In Value%)

OEM Manufacturers

Aftermarket Service Providers

Defense Contractors

Commercial Airlines

Private Operators - By Procurement Channel (In Value%)

Direct Procurement

OEM Sourcing

Third-Party Procurement

Government Contracts

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Garmin Ltd.

Honeywell International

Rockwell Collins

Thales Group

General Electric

L3 Technologies

Cobham plc

BAE Systems

Saab AB

UTC Aerospace Systems

Northrop Grumman

Leonardo

Diehl Aerospace

Harris Corporation

Moog Inc.

- OEM Manufacturers Increasing Focus on Avionics Innovation

- Aftermarket Providers Expanding Avionics Services

- Military and Defense Operators Upgrading Avionics Systems

- Private Operators Seeking Advanced Avionics Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035