Market Overview

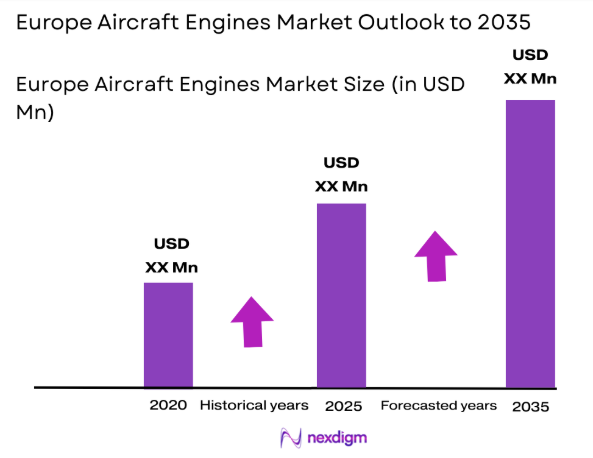

The Europe Aircraft Engines market is projected to reach USD ~ billion based on a recent historical assessment. This growth is driven by the increasing demand for more fuel-efficient and environmentally friendly engines, as well as the rise in aircraft production and fleet expansion. Moreover, the need for frequent maintenance, repair, and overhaul (MRO) services as engines age is propelling the demand for new engine models and upgrades. Technological advancements in engine design, such as lighter, quieter, and more fuel-efficient engines, are further driving the market.

Countries like the United Kingdom, France, Germany, and Spain dominate the European Aircraft Engines market. These nations have a strong presence in the aerospace sector, including leading engine manufacturers, MRO service providers, and aerospace defense contractors. The UK, home to Rolls-Royce, is a global leader in jet engine manufacturing, while France and Germany benefit from major OEMs like Safran and MTU Aero Engines, respectively. The continuous investments in R&D and partnerships with global players enable these countries to maintain dominance in the aircraft engine industry.

Market Segmentation

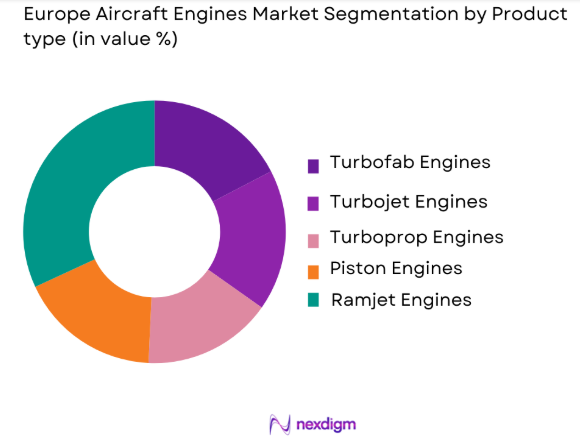

By Product Type

The Europe Aircraft Engines market is segmented by product type into turbofan engines, turbojet engines, turboprop engines, piston engines, and ramjet engines. Turbofan engines currently dominate the market share due to their widespread use in commercial and military aircraft. These engines offer a balance of high thrust and fuel efficiency, making them ideal for long-haul flights and heavy-duty aircraft operations. The continued rise in passenger traffic and fleet expansions, along with the growing demand for fuel-efficient engines, further solidifies the dominance of turbofan engines in the market.

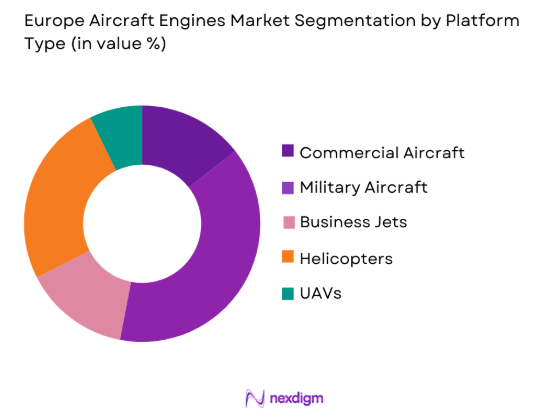

By Platform Type

The Europe Aircraft Engines market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Commercial aircraft dominate this segment due to the growing global demand for air travel and the expansion of fleets by major airlines. Commercial aircraft engines, particularly turbofan engines, are designed for long-distance and high-performance operations, thus they are the most widely used in the aviation industry. As more aircraft are built to cater to the increasing passenger demand, the commercial aircraft platform continues to lead the market.

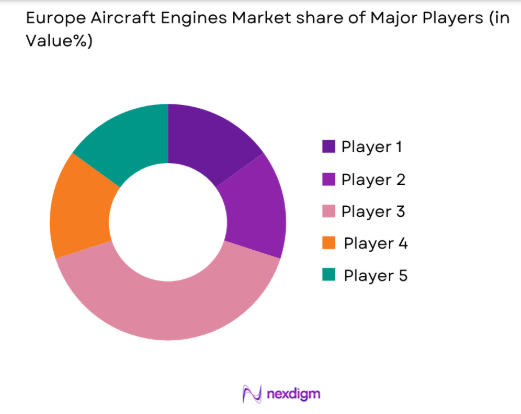

Competitive Landscape

The Europe Aircraft Engines market is characterized by intense competition among leading manufacturers and service providers. Companies like Rolls-Royce, General Electric, and Safran Aircraft Engines dominate the market, providing a range of high-performance engines for commercial, military, and private aircraft. These companies are continuously innovating to improve engine efficiency, reduce emissions, and enhance overall performance. The market is also experiencing consolidation, with strategic mergers and acquisitions taking place to enhance technological capabilities and expand service offerings.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Rolls-Royce | 1906 | Derby, UK | – | – | – | – | – |

| General Electric | 1905 | Boston, US | – | – | – | – | – |

| Safran Aircraft Engines | 2005 | Paris, France | – | – | – | – | – |

| MTU Aero Engines | 1934 | Munich, Germany | – | – | – | – | – |

| ITP Aero | 1989 | Bilbao, Spain | – | – | – | – | – |

Europe Aircraft Engines Market Analysis

Growth Drivers

Increasing Air Traffic and Aircraft Fleet Growth

The growth of air traffic and the increasing size of global aircraft fleets are key drivers of the Europe Aircraft Engines market. As air travel continues to rise, airlines are expanding their fleets to meet demand. This results in greater requirements for new engine models, as well as for the repair and maintenance of existing engines. With older aircraft engines requiring more frequent repairs and overhauls, the demand for advanced and reliable engines is also increasing. Additionally, airlines are looking to invest in engines that provide higher fuel efficiency, lower emissions, and longer service life to reduce operational costs and improve their sustainability goals. The aviation sector’s continued expansion directly fuels the demand for new engines, propelling growth in the market.

Technological Advancements in Aircraft Engines

Advancements in technology, particularly in engine efficiency, sustainability, and performance, are accelerating the growth of the Europe Aircraft Engines market. Innovations in materials, such as lightweight alloys and composites, are enabling the design of more fuel-efficient and environmentally friendly engines. The integration of digital technologies, such as real-time monitoring systems and predictive maintenance solutions, is also enhancing the operational lifespan of engines and reducing downtime. Furthermore, the shift toward greener aviation, including the development of hybrid and electric propulsion systems, presents a significant opportunity for growth in the market. These advancements are not only improving engine performance but also driving the demand for next-generation aircraft engines, boosting the overall market.

Market Challenges

High Development and Operational Costs

The development and operation of aircraft engines remain a costly endeavor, posing a significant challenge for the Europe Aircraft Engines market. Engine manufacturers must invest heavily in R&D to develop more fuel-efficient, sustainable, and technologically advanced engines. The cost of raw materials, components, and skilled labor also adds to the financial burden. Additionally, as the complexity of modern engines increases, so do the maintenance and repair costs for operators. With the continued growth in air traffic and fleet sizes, the high operational costs associated with maintaining and overhauling aircraft engines become more burdensome for airlines, making it difficult for smaller operators to keep pace with the demand for engine services. These high costs may limit the adoption of new technologies and the expansion of the market.

Regulatory and Certification Hurdles

The aircraft engine market in Europe is subject to stringent regulations and certification standards enforced by aviation authorities such as the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO). These regulations ensure that engines meet high standards for safety, efficiency, and environmental impact. However, complying with these regulations can be time-consuming and costly, particularly for new engine models. The certification process requires extensive testing, validation, and modifications to meet international standards, which delays the time-to-market for new engines and increases development costs. As the industry moves towards more sustainable solutions, including hybrid and electric propulsion, regulatory frameworks must evolve, presenting further challenges for manufacturers and operators.

Opportunities

Expansion of Engine Leasing and Component Repair

The growing trend of engine leasing and the increasing demand for component repair services present significant opportunities for the Europe Aircraft Engines market. As airlines seek to reduce capital expenditures, leasing engines rather than purchasing them outright has become a popular option, particularly for operators with fluctuating demand or smaller fleets. The demand for high-performance engines and components in leasing programs is increasing, creating opportunities for engine manufacturers and MRO providers to expand their service offerings. Additionally, the growing need for engine component repair services is spurring investment in specialized MRO facilities, which can reduce the operational costs associated with engine overhauls and repairs, making it a lucrative market segment for industry players.

Shift Toward Sustainable Aviation and Green Technologies

The growing focus on sustainable aviation and reducing the environmental impact of air travel presents a major opportunity for the Europe Aircraft Engines market. With increasing pressure to meet environmental regulations and achieve carbon neutrality, airlines and manufacturers are exploring innovative engine technologies that reduce emissions and improve fuel efficiency. Hybrid-electric and fully electric propulsion systems are gaining attention as potential solutions for reducing the aviation industry’s carbon footprint. The European Union’s Green Deal and other regulatory frameworks incentivize the development of sustainable aviation technologies, driving investment in cleaner, more efficient engines. Companies that focus on developing next-generation eco-friendly engines will capitalize on this emerging market trend, contributing to long-term growth in the sector.

Future Outlook

The Europe Aircraft Engines market is expected to grow steadily in the next five years, driven by advancements in engine technology, the expansion of aircraft fleets, and increasing air traffic. The continued push for more fuel-efficient and sustainable engines, as well as innovations in hybrid and electric propulsion systems, will play a significant role in shaping the future of the market. Regulatory support for sustainable aviation and the rise in engine leasing and MRO services will also contribute to the market’s growth, ensuring a robust outlook for the coming years.

Major Players

- Rolls-Royce

- General Electric Aviation

- Pratt & Whitney

- Safran Aircraft Engines

- MTU Aero Engines

- International Aero Engines

- Honeywell Aerospace

- Aero Engine Corporation of China

- CFM International

- Engine Alliance

- Lufthansa Technik

- IHI Corporation

- Raytheon Technologies

- Boeing

- Airbus

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft operators and fleet managers

- MRO service providers

- Aircraft manufacturers

- Engine leasing companies

- Aerospace technology developers

- Aviation maintenance organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of key market drivers and barriers, including technological advancements, regulatory impacts, and market trends.

Step 2: Market Analysis and Construction

Gathering data from industry reports and expert opinions to build a comprehensive market model based on historical and current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry professionals and stakeholders to validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesis of research findings into actionable insights and a comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Traffic and Fleet Expansion

Technological Advancements in Engine Design

Rising Demand for Fuel-Efficient Engines - Market Challenges

High Capital Investment and Operational Costs

Stringent Regulatory and Environmental Compliance

Supply Chain and Component Shortages - Market Opportunities

Emerging Demand for Sustainable Aviation Technologies

Growth in Aircraft Engine Leasing

Expansion of Aircraft Engine MRO Services - Trends

Shift Toward Hybrid and Electric Propulsion Systems

Increased Adoption of AI in Engine Performance Management

Focus on Lightweight and Fuel-Efficient Engines - Government Regulations

Environmental Regulations and Emission Standards

Regulations on Aircraft Engine Safety and Performance

Government Funding for Sustainable Aviation Technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Turbojet Engines

Turbofan Engines

Turboprop Engines

Piston Engines

Ramjet Engines - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

UAVs - By Fitment Type (In Value%)

OEM Services

Aftermarket Services

Retrofit Services

Integrated Services

Standalone Services - By End User Segment (In Value%)

Airlines

OEM Manufacturers

MRO Service Providers

Defense Contractors

Private Operators - By Procurement Channel (In Value%)

Direct Procurement

OEM Sourcing

Third-Party Procurement

Bidding Contracts

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rolls-Royce

General Electric Aviation

Pratt & Whitney

Safran Aircraft Engines

MTU Aero Engines

International Aero Engines

Honeywell Aerospace

Aero Engine Corporation of China

CFM International

Engine Alliance

Lufthansa Technik

IHI Corporation

Raytheon Technologies

Boeing

Airbus

- Airlines Upgrading Fleets with Newer Engines

- MRO Service Providers Expanding Engine Repair Capabilities

- Defense Contractors Increasing Demand for Advanced Military Engines

- Private Operators Seeking Fuel-Efficient Engine Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035