Market Overview

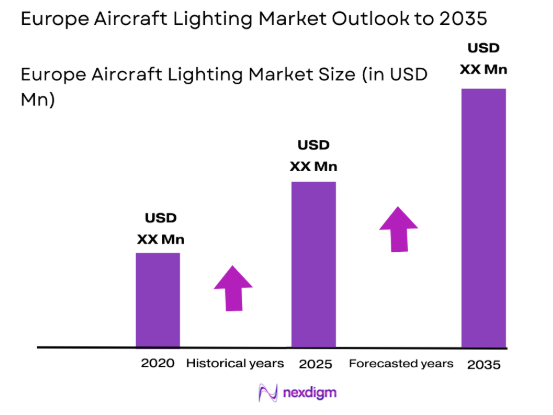

The Europe Aircraft Lighting market is projected to reach USD ~ billion, based on a recent historical assessment. This growth is fueled by the increasing demand for more energy-efficient and customizable lighting systems in both commercial and military aircraft. The push for better passenger experiences, along with stringent safety and regulatory requirements, are contributing to the development and adoption of advanced lighting technologies, including LED-based solutions. Additionally, the continuous expansion of air traffic and the demand for modern, fuel-efficient aircraft are driving the market.

Countries such as Germany, France, and the United Kingdom dominate the European Aircraft Lighting market. These nations are home to several leading aerospace manufacturers, MRO service providers, and defense contractors. Germany benefits from a strong industrial base, housing prominent aircraft OEMs and MRO facilities. The UK and France have major aerospace and defense sectors, with airlines and aircraft manufacturers focusing on enhancing the passenger experience with state-of-the-art lighting systems, thus contributing to their dominance in the region’s aircraft lighting industry.

Market Segmentation

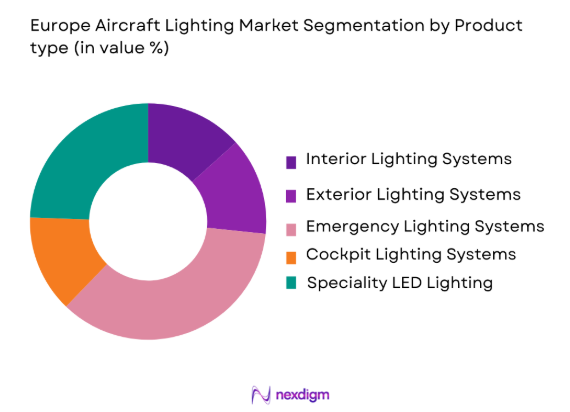

By Product Type

The Europe Aircraft Lighting market is segmented by product type into interior lighting systems, exterior lighting systems, emergency lighting systems, cockpit lighting systems, and specialty LED lighting systems. Interior lighting systems have the largest market share due to the growing demand for enhanced passenger comfort and customizable lighting in cabins. The rise of LED technology in interior lighting systems allows airlines to offer better passenger experiences, such as dynamic mood lighting and lower energy consumption, which makes it the dominant sub-segment. These systems are also gaining popularity due to their long lifespan and reduced maintenance requirements.

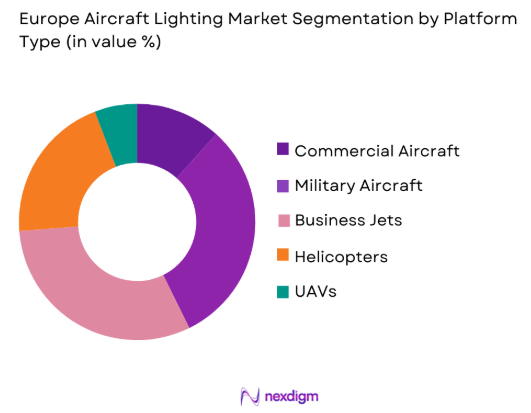

By Platform Type

The Europe Aircraft Lighting market is segmented by platform type into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Commercial aircraft dominate this segment due to the higher demand for lighting systems in large fleets operated by major airlines. The growing number of long-haul and regional flights, combined with an increasing focus on passenger comfort and safety, has led to the widespread adoption of advanced lighting systems. Additionally, commercial aircraft platforms have strict regulatory requirements for lighting, which further drives the demand for innovative lighting solutions.

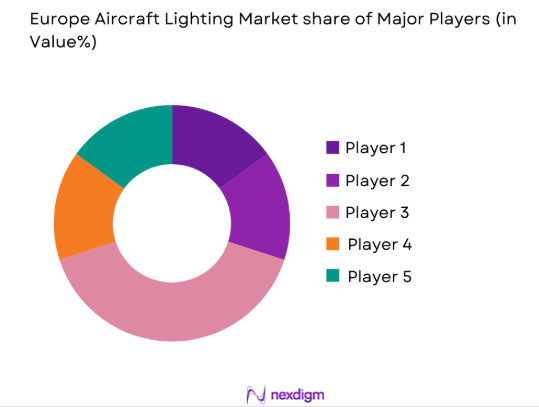

Competitive Landscape

The Europe Aircraft Lighting market is highly competitive, with major players focused on developing innovative lighting solutions for both commercial and military aircraft. Companies such as Collins Aerospace, Safran Cabin, and Honeywell Aerospace dominate the market, offering a range of lighting systems that cater to the needs of airlines, aircraft manufacturers, and MRO service providers. The market is also witnessing consolidation, with mergers and acquisitions taking place to expand product offerings and increase technological capabilities. The growing trend toward energy-efficient and sustainable lighting solutions is also shaping the competitive dynamics of the industry.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Collins Aerospace | 2018 | Charlotte, USA | – | – | – | – | – |

| Safran Cabin | 2005 | Paris, France | – | – | – | – | – |

| Honeywell Aerospace | 1999 | Phoenix, USA | – | – | – | – | – |

| Diehl Aerospace | 1902 | Nuremberg, Germany | – | – | – | – | – |

| Astronics Corporation | 1968 | East Aurora, USA | – | – | – | – | – |

Europe Aircraft Lighting Market Analysis

Growth Drivers

Technological Advancements in Lighting Systems

The rapid evolution of lighting technology, particularly in LED lighting, is a major growth driver in the Europe Aircraft Lighting market. LED technology has become the preferred choice for aircraft lighting systems due to its energy efficiency, long lifespan, and low maintenance requirements. This advancement not only helps airlines reduce operating costs but also allows for more flexible and customizable lighting solutions that enhance the passenger experience. Additionally, the integration of smart lighting systems, which adjust based on factors such as flight phase and time of day, is gaining traction, further driving the demand for innovative lighting solutions. These technological advancements are revolutionizing both interior and exterior lighting systems in aircraft, creating a competitive edge for companies that provide these solutions. The increased adoption of LED and smart lighting technologies is expected to continue driving market growth in the coming years.

Growth in Air Traffic and Aircraft Fleet Expansion

The Europe Aircraft Lighting market is also experiencing significant growth due to the rise in air traffic and the expansion of commercial and military aircraft fleets. As air travel continues to increase, airlines are investing in modernizing their fleets with the latest technology, including advanced lighting systems. This trend is particularly noticeable in the commercial aviation sector, where airlines are looking to improve passenger comfort, safety, and operational efficiency. Furthermore, military aircraft platforms are also modernizing with advanced lighting systems to meet new operational requirements and safety standards. The fleet expansion, combined with the increasing demand for longer flight durations, drives the need for advanced lighting solutions that offer improved visibility, energy efficiency, and compliance with stringent aviation regulations. This growing demand for modern aircraft, coupled with the need to replace aging fleets, is expected to further fuel the market’s expansion.

Market Challenges

High Development and Certification Costs

A significant challenge in the Europe Aircraft Lighting market is the high cost of developing, testing, and certifying new lighting systems. Aircraft lighting systems must meet strict safety and performance standards set by aviation authorities such as the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO). The cost of R&D for developing innovative lighting technologies and the expenses associated with certification processes can be substantial for manufacturers. Furthermore, regulatory approval processes often take a considerable amount of time, delaying the market entry of new products and increasing overall development costs. Smaller companies may struggle to keep up with the investment required to compete in this highly regulated and competitive market, leading to consolidation in the industry as larger players expand their portfolios.

Integration Challenges with Legacy Aircraft Platforms

Another challenge in the Europe Aircraft Lighting market is the integration of modern lighting systems into older aircraft platforms. Many older aircraft models still in service require retrofitting to meet current safety, efficiency, and lighting standards. However, retrofitting legacy aircraft with new lighting systems can be complex and costly. Compatibility issues between modern lighting technologies and older aircraft systems, as well as the need for customization to fit specific aircraft models, can create challenges for MRO providers and OEMs. The cost and time required for retrofitting can be a significant barrier to the widespread adoption of advanced lighting solutions, particularly for operators of older fleets. This presents a challenge for the market, as it limits the speed at which new lighting technologies are adopted across the entire European fleet.

Opportunities

Growing Demand for Sustainable and Energy-Efficient Lighting

There is a growing opportunity in the Europe Aircraft Lighting market for sustainable and energy-efficient lighting solutions, driven by the aviation industry’s focus on reducing its environmental impact. Airlines and manufacturers are increasingly adopting lighting systems that reduce energy consumption, support green initiatives, and help meet sustainability targets. LED lighting, in particular, is gaining traction due to its low power consumption, longer lifespan, and reduced heat emission. The European Union’s Green Deal, which includes measures to reduce aviation emissions, further supports the shift towards more energy-efficient lighting solutions. Companies that focus on developing and providing environmentally friendly lighting systems stand to gain a significant market share as sustainability continues to be a key factor in the decision-making process of airlines and aircraft operators.

Expansion of Aircraft Modernization Programs

Another significant opportunity in the Europe Aircraft Lighting market lies in the expansion of aircraft modernization programs. As airlines and defense organizations seek to extend the operational life of their fleets, they are increasingly investing in the modernization of both commercial and military aircraft. These modernization efforts often include the installation of advanced lighting systems that offer better energy efficiency, improved passenger comfort, and enhanced safety. Additionally, the demand for retrofitting older aircraft with modern lighting solutions is on the rise, as airlines strive to meet new regulatory requirements and improve the overall passenger experience. The growing trend of aircraft upgrades and retrofits presents an opportunity for lighting manufacturers to expand their product offerings and tap into the growing demand for modern lighting solutions.

Future Outlook

The Europe Aircraft Lighting market is expected to continue its growth over the next five years, driven by technological advancements, rising air traffic, and the need for more energy-efficient lighting solutions. The shift toward sustainable aviation practices, including the adoption of LED and smart lighting systems, will further enhance market prospects. The increasing focus on enhancing the passenger experience and improving aircraft safety will contribute to the demand for innovative lighting systems. As fleet modernization and retrofitting programs gain momentum, the market will see increased adoption of advanced lighting technologies, ensuring continued market growth.

Major Players

- Collins Aerospace

- Safran Cabin

- Honeywell Aerospace

- Diehl Aerospace

- Astronics Corporation

- Luminator Aerospace

- Bruce Aerospace

- Cobham Aerospace Communications

- Heads Up Technologies

- Oxley Group

- Precise Flight

- Whelen Aerospace Technologies

- Aveo Engineering

- Soderberg Manufacturing Company

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft operators and fleet managers

- MRO service providers

- Aircraft manufacturers

- Engine leasing companies

- Aerospace technology developers

- Aviation maintenance organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of key drivers such as technological advancements, regulatory impacts, and market trends.

Step 2: Market Analysis and Construction

Gathering data from industry reports and expert opinions to build a comprehensive market model based on historical and current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry professionals and stakeholders to validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesis of research findings into actionable insights and a comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Aircraft Deliveries Across Commercial Aviation

Increasing Adoption of Energy-Efficient LED Lighting

Growing Focus on Passenger Cabin Experience - Market Challenges

High Certification Requirements for Aircraft Lighting

Integration Complexity with Legacy Aircraft Platforms

Supply Chain Constraints for Electronic Components - Market Opportunities

Advancements in Smart Cabin Lighting Technologies

Retrofit Demand for Aging Aircraft Fleets

Expansion of Defense Aviation Programs in Europe - Trends

Shift Toward Adaptive Mood Lighting Systems

Integration of Lightweight Lighting Materials

Adoption of IoT-Enabled Lighting Monitoring - Government Regulations

European Union Aviation Safety Lighting Standards

Environmental Regulations Promoting Low-Power Systems

Defense Procurement Compliance Requirements

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Interior Lighting Systems

Exterior Lighting Systems

Emergency Lighting Systems

Cockpit Lighting Systems

Specialty LED Lighting Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

Unmanned Aerial Vehicles - By Fitment Type (In Value%)

Line Fit Installations

Retrofit Installations

Aftermarket Upgrades

OEM Integrated Systems

Modular Lighting Solutions - By End User Segment (In Value%)

Aircraft Manufacturers

Airlines

Defense Organizations

MRO Service Providers

Private Aircraft Operators - By Procurement Channel (In Value%)

Direct OEM Procurement

Supplier Contracts

Government Defense Contracts

Third-Party Distributors

Aftermarket Vendors

- Market Share Analysis

- Cross Comparison Parameters (Lighting Technology, Platform Compatibility, Installation Type, End User Focus, Certification Standards)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Safran Cabin

Collins Aerospace

Honeywell Aerospace

Diehl Aerospace

Astronics Corporation

STG Aerospace

Luminator Aerospace

Bruce Aerospace

Cobham Aerospace Communications

Heads Up Technologies

Oxley Group

Precise Flight

Whelen Aerospace Technologies

Aveo Engineering

Soderberg Manufacturing Company

- Airlines Investing in Cabin Modernization Programs

- OEMs Prioritizing Lightweight Lighting Integration

- Defense Forces Upgrading Tactical Aircraft Lighting

- MRO Providers Expanding Retrofit Capabilities

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035