Market Overview

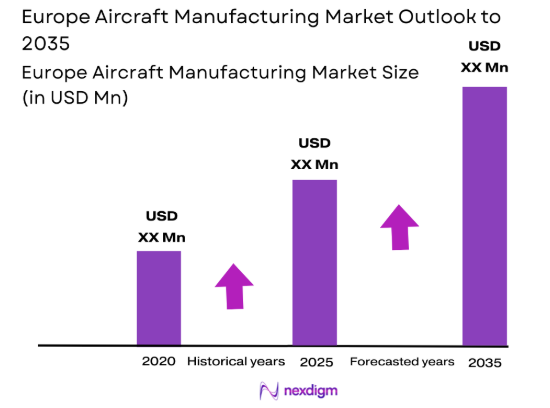

The Europe Aircraft Manufacturing market is expected to reach USD ~ billion based on a recent historical assessment. This market growth is largely driven by the increasing demand for commercial and military aircraft, alongside the rise in air traffic and airline fleet expansions. Furthermore, continuous technological advancements in aircraft design and manufacturing are fueling growth, with a focus on improving fuel efficiency, reducing emissions, and meeting strict regulatory standards in the aerospace industry.

Key countries such as Germany, France, and the United Kingdom dominate the Europe Aircraft Manufacturing market. Germany leads with a robust aerospace industry, focusing on both commercial and military aircraft production. France is home to major players like Airbus, a global leader in aircraft manufacturing, while the UK benefits from a strong defense and aerospace sector. These nations dominate due to their established industrial bases, skilled labor, and technological innovations that drive both domestic and international aircraft manufacturing.

Market Segmentation

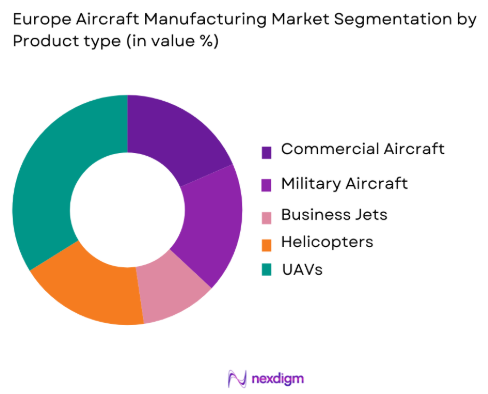

By Product Type

The Europe Aircraft Manufacturing market is segmented by product type into commercial aircraft, military aircraft, business jets, helicopters, and UAVs. Commercial aircraft dominate this segment due to the increasing air traffic and the rise in demand for long-haul flights. The rapid expansion of low-cost carriers and full-service airlines is boosting the demand for efficient and large-capacity commercial aircraft. These aircraft offer higher passenger capacity, longer ranges, and greater fuel efficiency, thus driving their dominant position in the market.

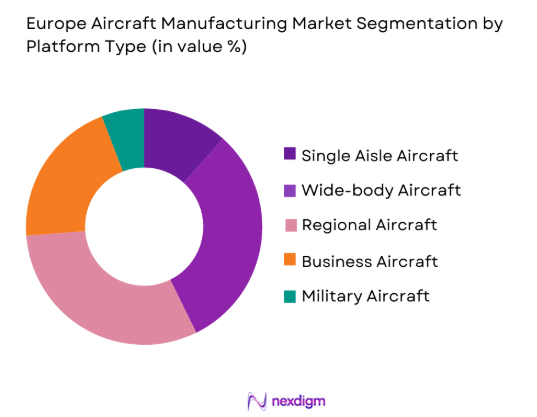

By Platform Type

The Europe Aircraft Manufacturing market is segmented by platform type into single-aisle aircraft, wide-body aircraft, regional aircraft, business jets, and military aircraft. Single-aisle aircraft dominate the market due to their wide adoption by low-cost carriers and regional airlines. These aircraft are typically more fuel-efficient and cost-effective, making them ideal for shorter routes, which are growing rapidly due to increasing passenger travel. As a result, they represent a large portion of the market, particularly in the commercial sector.

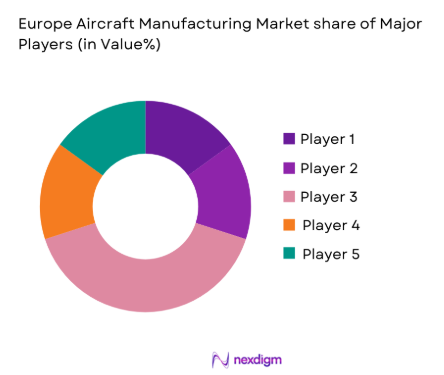

Competitive Landscape

The Europe Aircraft Manufacturing market is highly competitive, with key players like Airbus, Boeing, and Lockheed Martin dominating the industry. These companies are not only the primary manufacturers of aircraft but are also focused on technological advancements, with an increasing focus on fuel efficiency and environmentally sustainable aircraft. The consolidation of smaller manufacturers and collaborations between leading players are shaping the competitive dynamics. The growth of commercial aircraft demand and government contracts in defense are driving major market players to innovate and expand their product portfolios.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Airbus | 1970 | – | – | – | – | – | – |

| Boeing | 1916 | – | – | – | – | – | – |

| Lockheed Martin | 1912 | – | – | – | – | – | – |

| Dassault Aviation | 1929 | – | – | – | – | – | – |

| Embraer | 1969 | – | – | – | – | – | – |

Europe Aircraft Manufacturing Market Analysis

Growth Drivers

Increasing Demand for Air Travel and Fleet Expansions

The Europe Aircraft Manufacturing market is primarily driven by the growing demand for air travel, which in turn is fueling fleet expansions by airlines. As global air traffic rises, both low-cost carriers and full-service airlines are increasing their aircraft orders, leading to a surge in commercial aircraft manufacturing. Additionally, the need for replacement of aging fleets in Europe contributes to the continuous demand for new aircraft. With air travel expected to maintain a steady growth trajectory, aircraft manufacturers are benefiting from sustained demand, particularly for fuel-efficient, high-performance models that cater to both short and long-haul routes.

Technological Advancements in Aircraft Design and Manufacturing

Technological advancements play a critical role in driving the growth of the Europe Aircraft Manufacturing market. Companies are increasingly focusing on improving fuel efficiency, reducing carbon emissions, and enhancing the overall performance of aircraft. Innovations such as lightweight materials, improved aerodynamics, and next-generation engine technologies are enabling manufacturers to offer aircraft that meet the stringent environmental regulations set by European aviation authorities. Furthermore, advancements in electric and hybrid propulsion systems are expected to transform the market in the coming years, offering significant growth opportunities for manufacturers that invest in these technologies.

Market Challenges

High Capital Investment and Operational Costs

One of the key challenges facing the Europe Aircraft Manufacturing market is the significant capital investment required for the development, production, and certification of new aircraft. The development of advanced aircraft models involves substantial R&D expenses, as well as compliance with rigorous safety and environmental regulations. Additionally, manufacturers must continuously invest in new technologies and innovations to stay competitive, which can strain financial resources, particularly for smaller players in the market. This high capital intensity is a significant barrier to entry for new competitors and limits the pace at which new manufacturers can scale operations in the industry.

Supply Chain Disruptions and Component Shortages

Another challenge faced by the Europe Aircraft Manufacturing market is the ongoing supply chain disruptions and component shortages. The global semiconductor shortage, logistical challenges, and raw material price fluctuations have affected the production timelines for aircraft manufacturers. The reliance on complex global supply chains for components, including avionics, engines, and materials, makes the industry vulnerable to delays and cost increases. These disruptions can lead to extended lead times for aircraft deliveries and affect the overall profitability of manufacturers, creating uncertainty for operators and consumers alike.

Opportunities

Growth in Military Aircraft and Defense Contracts

The growth of military aircraft production, fueled by increasing defense budgets in Europe, presents significant opportunities for aircraft manufacturers. Several European countries are investing heavily in defense modernization programs, including the procurement of advanced military aircraft. With rising geopolitical tensions and security concerns, governments are looking to enhance their military capabilities, which is driving demand for next-generation fighter jets, transport aircraft, and UAVs. This demand is expected to remain strong over the coming years, providing a lucrative market segment for aircraft manufacturers specializing in military and defense-related products.

Sustainability Initiatives and Green Aviation Technologies

Sustainability is becoming increasingly important in the Europe Aircraft Manufacturing market, offering substantial growth opportunities for companies that invest in green technologies. The European Union’s commitment to achieving carbon neutrality by 2050 and reducing aviation emissions presents a strong incentive for manufacturers to develop more fuel-efficient and eco-friendly aircraft. Electric and hybrid propulsion systems, as well as sustainable aviation fuel (SAF), are key areas where significant technological advancements are taking place. Manufacturers that prioritize these innovations are well-positioned to capitalize on the demand for sustainable aviation solutions in Europe.

Future Outlook

The Europe Aircraft Manufacturing market is expected to continue its positive growth trajectory in the next five years, driven by increasing air traffic, fleet expansions, and technological advancements in aircraft design. The demand for more fuel-efficient, environmentally friendly aircraft will lead to a continued focus on sustainable aviation technologies. Additionally, the European defense sector’s expansion and the adoption of electric propulsion systems will provide significant growth opportunities for manufacturers. However, challenges related to supply chain disruptions, capital investments, and regulatory compliance will need to be navigated carefully for sustained market growth.

Major Players

- Airbus

- Boeing

- Lockheed Martin

- Dassault Aviation

- Embraer

- General Dynamics

- Saab Group

- Bombardier

- MTU Aero Engines

- Pratt & Whitney

- Rolls-Royce

- GE Aviation

- IHI Corporation

- Honeywell Aerospace

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft operators and fleet managers

- MRO service providers

- Aircraft manufacturers

- Engine leasing companies

- Aerospace technology developers

- Aviation maintenance organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of market drivers and challenges, including technological advancements, regulatory impacts, and market trends

Step 2: Market Analysis and Construction

Gathering data from industry reports and expert opinions to build a comprehensive market model based on historical and current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry professionals and stakeholders to validate assumptions and refine market projections.

Step 4: Research Synthesis and Final Output

Synthesis of research findings into actionable insights and a comprehensive market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Demand for Air Travel and Fleet Expansions

Technological Advancements in Aircraft Design and Manufacturing

Rising Military Aircraft Production in Europe - Market Challenges

High Capital Investment and Operational Costs

Stringent Regulatory and Compliance Barriers

Global Supply Chain Disruptions - Market Opportunities

Emerging Demand for Electric and Hybrid Aircraft Technologies

Government Defense and Aerospace Contracts

Growth of the Aircraft Leasing Market - Trends

Shift Towards Sustainable Aviation Technologies

Growing Interest in Autonomous Aircraft Systems

Innovation in Aircraft Lightweighting and Fuel Efficiency - Government Regulations

Environmental Regulations and Emission Standards

Aircraft Safety and Certification Regulations

Defense Procurement and Compliance Policies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Military Aircraft

Business Jets

Helicopters

UAVs - By Platform Type (In Value%)

Single-aisle Aircraft

Wide-body Aircraft

Regional Aircraft

Business Jets

Military Aircraft - By Fitment Type (In Value%)

OEM Services

Aftermarket Services

Retrofit Services

Integrated Solutions

Standalone Installations - By End User Segment (In Value%)

Airlines

OEM Manufacturers

MRO Service Providers

Defense Contractors

Private Operators - By Procurement Channel (In Value%)

Direct Procurement

OEM Sourcing

Private Sector Procurement

Third-Party Distributors

Government Contracts

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type]

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Airbus

Boeing

Dassault Aviation

Airbus Defence and Space

Leonardo

Embraer

Bombardier

Lockheed Martin

General Dynamics

Saab Group

MTU Aero Engines

Pratt & Whitney

Rolls-Royce

GE Aviation

IHI Corporation

- Airlines Expanding Fleets and Aircraft Upgrades

- OEM Manufacturers Focusing on Technological Integration

- Defense Contractors Increasing Demand for Military Aircraft

- Private Operators Seeking Cost-Effective Aircraft Solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035