Market Overview

The Europe Aircraft MRO market is projected to reach USD ~ billion, driven by a combination of fleet expansion, technological innovations, and increasing air traffic across Europe. The rising demand for efficient and safe air travel, coupled with the growing emphasis on reducing the operating costs of aircraft, fuels the need for comprehensive maintenance, repair, and overhaul (MRO) services. Furthermore, the market benefits from advancements in MRO technologies such as predictive maintenance, which enhances the lifespan and operational efficiency of aircraft.

Countries such as the United Kingdom, Germany, and France are dominant players in the European Aircraft MRO market. These countries house major aerospace hubs, with key MRO service providers located in and around major airports and aerospace manufacturing clusters. Additionally, robust defense budgets in these regions contribute to the strong presence of military aircraft MRO services, especially in Germany and France. These factors position these countries as leaders in both commercial and military aircraft maintenance sectors.

Market Segmentation

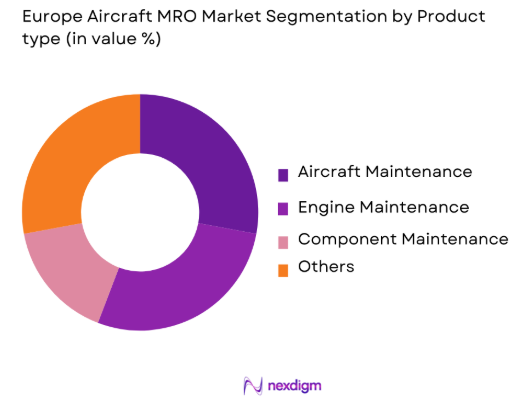

By Product Type

The Europe Aircraft MRO market is segmented by product type into airframe maintenance, engine maintenance, component maintenance, and others. Recently, engine maintenance services have captured a significant portion of the market share due to the rapid advancements in engine technologies, increasing demand for higher fuel efficiency, and the need for frequent overhauls of modern engines. The adoption of new engine technologies, such as next-gen turbofan engines, increases the frequency of maintenance checks, driving growth in this segment.

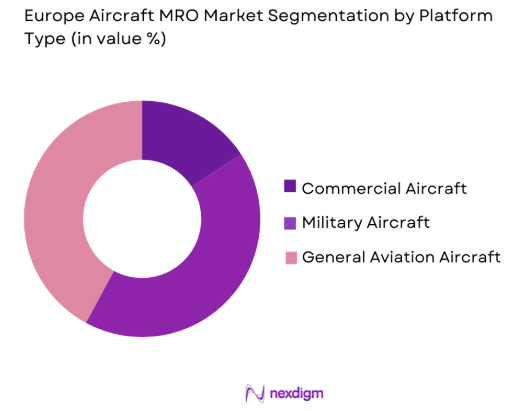

By Platform Type

The Europe Aircraft MRO market is segmented by platform type into commercial aircraft, military aircraft, and general aviation aircraft. The commercial aircraft segment dominates due to the continuous growth of air traffic and airline fleets. Airlines are increasingly focused on reducing operating costs through regular and efficient maintenance of their fleets. This trend, along with the expansion of low-cost carriers in Europe, ensures that commercial aircraft MRO services remain the largest segment in the market.

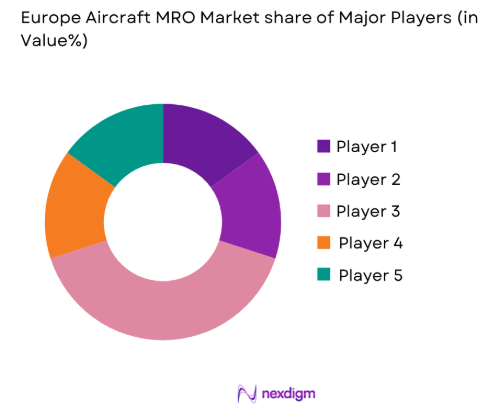

Competitive Landscape

The Europe Aircraft MRO market is characterized by the presence of both global giants and regional players, resulting in a competitive environment. Companies such as Lufthansa Technik, Air France Industries KLM Engineering & Maintenance, and Rolls-Royce dominate the market with comprehensive MRO service offerings, including airframe, engine, and component maintenance. The market has seen some consolidation, with larger players acquiring smaller MRO companies to expand service capabilities and reach. Additionally, strategic partnerships with OEMs and airlines are pivotal in maintaining market share in the evolving landscape.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market Parameter |

| Lufthansa Technik | 1951 | Frankfurt, Germany | – | – | – | – | – |

| Air France Industries KLM | 1933 | Paris, France | – | – | – | – | – |

| Rolls-Royce | 1904 | London, UK | – | – | – | – | – |

| Safran Aircraft Engines | 2005 | Paris, France | – | – | – | – | – |

| MTU Aero Engines | 1934 | Munich, Germany | – | – | – | – | – |

Europe aircraft MRO Market Analysis

Growth Drivers

Growing Demand for Aircraft Maintenance Due to Expanding Fleets

The Europe Aircraft MRO market is experiencing growth primarily due to the continuous expansion of commercial aircraft fleets across the region. Airlines are increasingly adopting larger and more fuel-efficient aircraft, which requires regular and extensive maintenance. Additionally, the expansion of low-cost carriers in Europe has contributed to an increase in aircraft fleet size, leading to greater demand for MRO services. The need for regular airframe and engine maintenance, along with the requirement for compliance with stringent safety and environmental regulations, further drives the growth of the market. The increasing demand for more efficient operations and cost reduction is compelling airlines to invest heavily in MRO services.

Technological Advancements in MRO Services

Another significant driver for the Europe Aircraft MRO market is the adoption of new technologies in aircraft maintenance. Innovations such as predictive maintenance, 3D printing for parts replacement, and advanced diagnostics are transforming the MRO landscape. These technologies allow for more efficient and cost-effective maintenance, as they reduce downtime and improve the accuracy of diagnostics. Predictive maintenance, which leverages data analytics to predict when maintenance is required, is particularly appealing to airlines as it helps prevent unscheduled repairs and increases operational efficiency. The rise of digitalization in MRO services is enabling service providers to offer more personalized, efficient, and scalable solutions to airlines and operators.

Market Challenges

High Capital Investment and Operational Costs

One of the major challenges in the Europe Aircraft MRO market is the high capital investment required to establish and maintain maintenance facilities, acquire the latest tools, and invest in skilled labor. The costs involved in training technicians, purchasing equipment, and ensuring that facilities comply with safety regulations are significant. Additionally, the rising costs of raw materials and components, particularly for engine maintenance, are impacting the profit margins of MRO providers. For smaller companies in the market, these high costs can be prohibitive, making it difficult to remain competitive against the larger, more established players.

Complex Regulatory Environment

The aircraft MRO industry in Europe is heavily regulated by aviation authorities, including the European Union Aviation Safety Agency (EASA). These regulations dictate the standards for aircraft safety, component certification, and maintenance practices, which require constant updates and compliance. MRO companies face challenges in staying ahead of these evolving regulations, particularly when dealing with international clients. Furthermore, the increasing pressure to adhere to environmental regulations, such as carbon emissions standards, adds an additional layer of complexity to MRO operations. Non-compliance can result in heavy penalties and damage to reputation, making it a significant challenge for market players.

Opportunities

Expansion of the Military Aircraft MRO Market

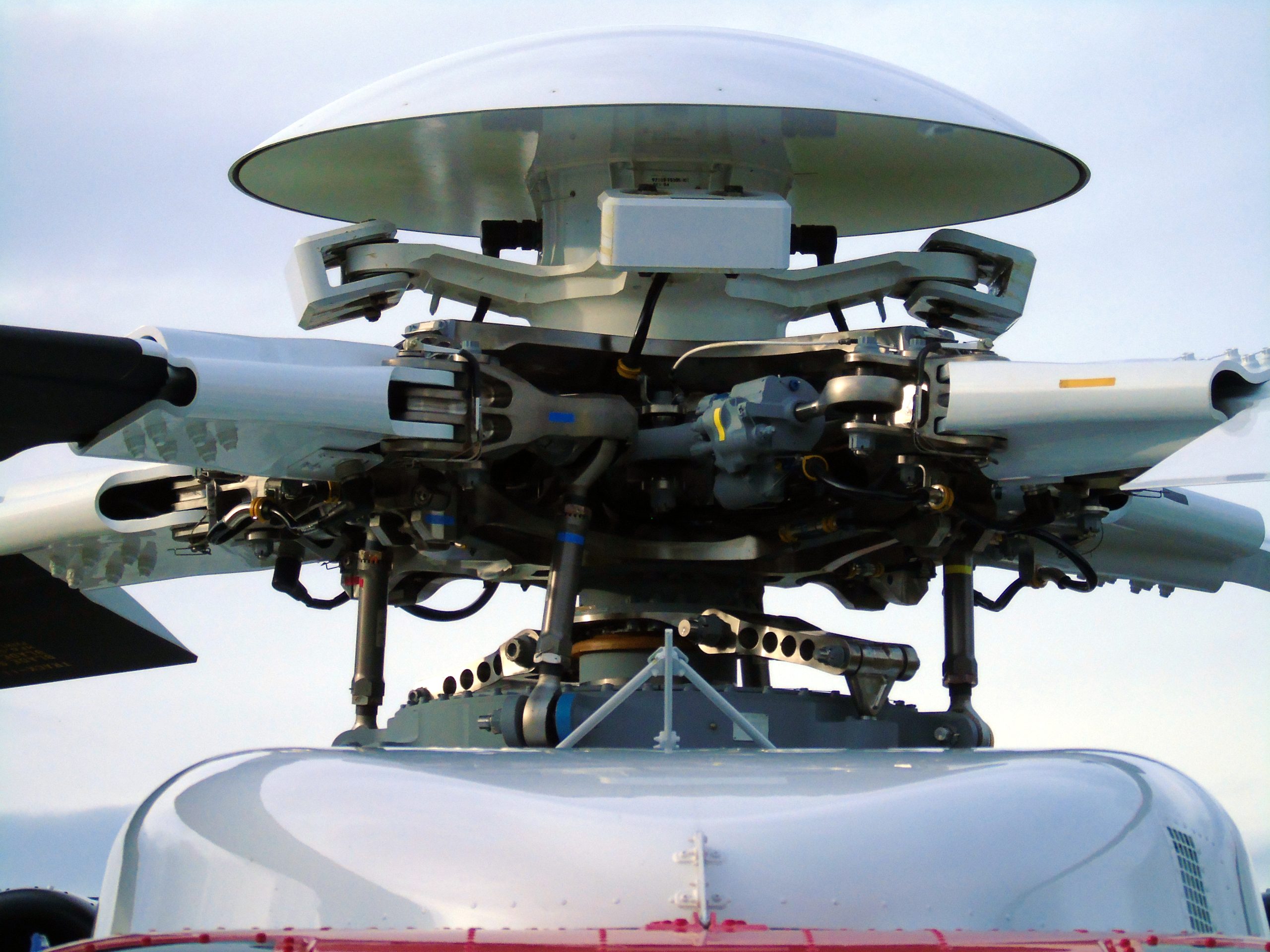

Military aircraft are in high demand due to increasing defense budgets in Europe and rising geopolitical tensions. As a result, the European MRO market has seen significant growth in the maintenance of military aircraft, including fighter jets, transport aircraft, and helicopters. The demand for military MRO services is expected to grow as defense spending continues to rise across Europe. This growth presents opportunities for companies specializing in military aircraft MRO, particularly those focused on high-performance military engines and components. Expanding partnerships with defense contractors and governments could provide MRO companies with long-term, stable contracts.

Sustainability and Green Aviation Technologies

The push for sustainability in aviation is opening new opportunities in the MRO sector, particularly around the maintenance and repair of green technologies, such as electric aircraft and alternative fuel systems. As European regulations around aviation emissions become stricter, airlines and aircraft manufacturers are increasingly investing in sustainable aviation solutions. MRO companies that specialize in maintaining electric and hybrid aircraft, or those that can repair and upgrade engines to use sustainable aviation fuel (SAF), are poised to capture a growing share of the market. This shift towards sustainable aviation practices presents a lucrative opportunity for companies to differentiate themselves and meet the demand for greener technologies.

Future Outlook

The Europe Aircraft MRO market is expected to experience continued growth, driven by the expansion of aircraft fleets and technological advancements in maintenance practices. Over the next five years, the demand for both commercial and military aircraft MRO services will increase, supported by the rising need for operational efficiency, sustainability, and compliance with stricter environmental regulations. Additionally, innovations in predictive maintenance and digital technologies will help streamline operations and reduce costs, further propelling market growth. As the market matures, consolidation among smaller players and partnerships with OEMs will also play a critical role in shaping the competitive landscape.

Major Players

- Lufthansa Technik

- Air France Industries KLM Engineering & Maintenance

- Rolls-Royce

- Safran Aircraft Engines

- MTU Aero Engines

- General Electric Aviation

- Thales Group

- Honeywell Aerospace

- United Technologies Corporation

- Collins Aerospace

- Lockheed Martin

- Pratt & Whitney

- Airbus

- Boeing

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and fleet operators

- Aircraft manufacturers and OEMs

- MRO service providers

- Aircraft leasing companies

- Military contractors

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

Defining key drivers, challenges, and market segmentation factors through secondary research and expert consultation.

Step 2: Market Analysis and Construction

Quantitative and qualitative analysis of the market, drawing from industry reports, financial data, and government publications.

Step 3: Hypothesis Validation and Expert Consultation

Consulting with industry experts to validate market assumptions and refine the projections.

Step 4: Research Synthesis and Final Output

Synthesizing findings into a comprehensive, actionable market report, providing insights and recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Aircraft Fleet Size

Technological Advancements in MRO Solutions

Rising Air Traffic and Airline Expansion - Market Challenges

High Maintenance Costs

Regulatory Compliance Barriers

Shortage of Skilled Workforce - Market Opportunities

Growth in Military Aircraft MRO Services

Adoption of Predictive Maintenance Technologies

Increasing Demand for Sustainable Aviation Solutions - Trends

Shift Toward Digitalization in MRO Processes

Increased Focus on Eco-Friendly MRO Practices

Growth in MRO Services for UAVs - Government Regulations

EU Aviation Safety Agency Regulations

Environmental Standards for Aircraft Maintenance

Maintenance Certification and Licensing Requirements

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Engine Overhaul Services

Component Maintenance Services

Airframe Maintenance Services

Modifications & Upgrades

Avionics Maintenance Services - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

General Aviation Aircraft

Unmanned Aerial Vehicles (UAVs)

Helicopters - By Fitment Type (In Value%)

Line Maintenance

Base Maintenance

Heavy Maintenance

On-Demand Maintenance

Component Replacement - By End User Segment (In Value%)

Aircraft Operators

MRO Service Providers

OEMs (Original Equipment Manufacturers)

Airlines

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement

Third-Party MRO Providers

OEM-Contracted Services

Online Bidding Platforms

Private Service Contracts

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lufthansa Technik

Air France Industries KLM Engineering & Maintenance

ST Aerospace

MTU Aero Engines

Rolls-Royce

SIA Engineering Company

GE Aviation

Boeing Global Services

Airbus Maintenance

Safran Aircraft Engines

Honeywell Aerospace

Iberia Maintenance

ATR Maintenance

Raytheon Technologies

Spirit AeroSystems

- Aircraft Operators’ Need for Efficient Maintenance Solutions

- Airlines’ Demand for Cost-Effective MRO Services

- MRO Providers’ Technological Innovations in Service Delivery

- Private Aircraft Owners Seeking Quality Maintenance Options

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035