Market Overview

The Europe Aircraft Tires market is valued at approximately USD ~, driven by the increasing demand for air travel and expanding airline fleets. Key drivers include the growth in passenger and freight traffic, the rise in air passenger miles, and the continuous demand for high-performance tires designed to meet strict safety and efficiency standards. The demand is also fueled by the increasing investments in fleet modernization, along with the development of advanced tire technologies that improve fuel efficiency and reduce environmental impact.

Dominant countries in the Europe Aircraft Tires market include Germany, the UK, and France, owing to their strong aviation industries and high aircraft fleet numbers. Germany, in particular, has a leading position due to its robust aerospace sector and the presence of major aircraft manufacturers like Airbus. The UK and France, with their large commercial and military aircraft fleets, also play crucial roles in shaping the market’s growth. These countries have extensive aviation infrastructure, including airports and maintenance hubs, which further contribute to the dominance of these regions.

Market Segmentation

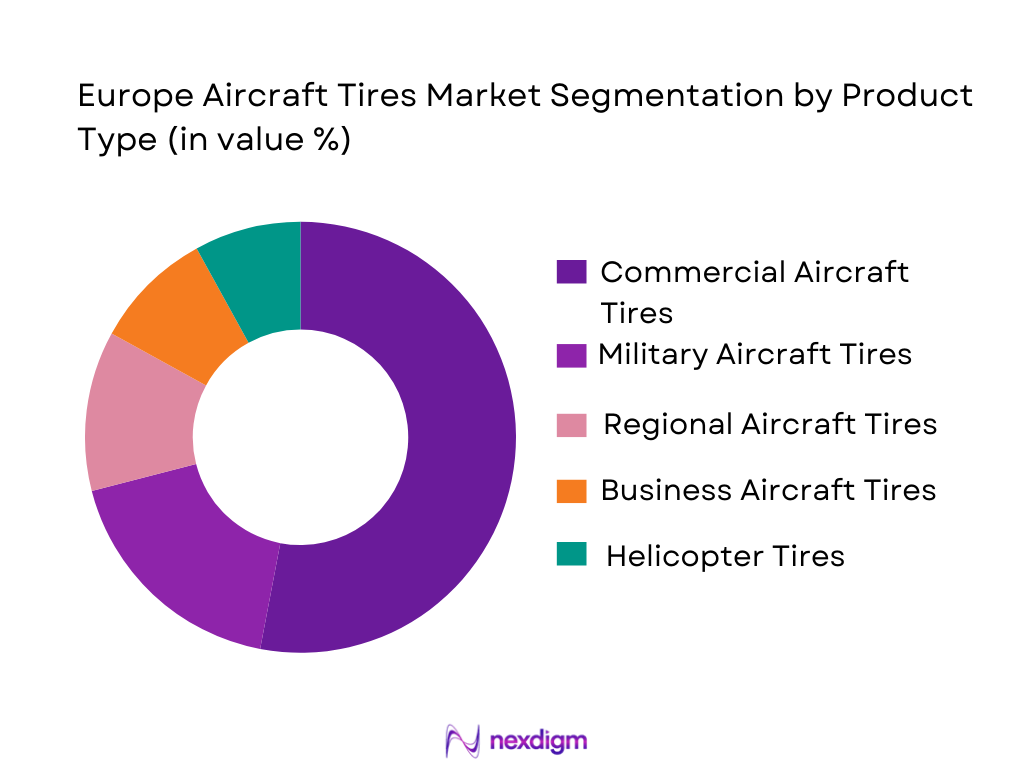

By Product Type

The Europe Aircraft Tires market is segmented by product type into commercial, military, regional, business, and helicopter aircraft tires. Recently, commercial aircraft tires have seen the dominant market share due to the growing global demand for commercial air travel. Factors such as the expansion of airline fleets, increasing air traffic, and the push for more efficient and durable tires for larger aircraft have contributed to this sub-segment’s strong market position.

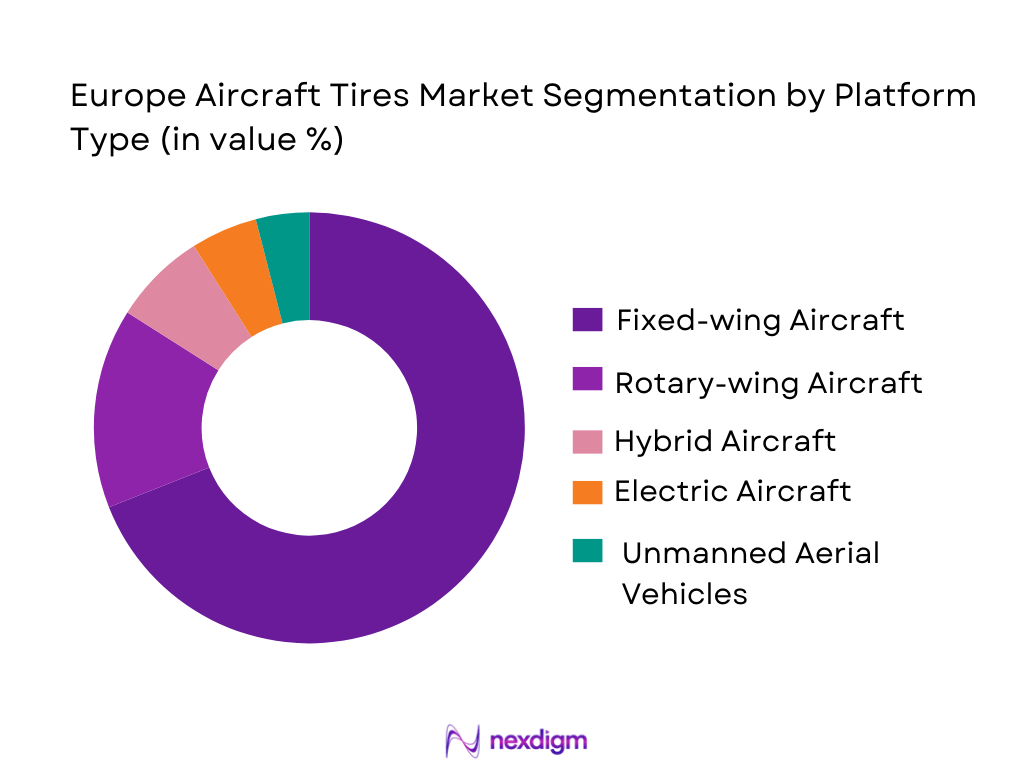

By Platform Type

The market is segmented by platform type into fixed-wing, rotary-wing, hybrid, electric, and unmanned aerial vehicles (UAVs). Fixed-wing aircraft tires dominate this segment as the majority of commercial and military aircraft are of the fixed-wing type. The substantial number of commercial airliners and the increasing fleet sizes in major airlines across Europe ensure that fixed-wing aircraft tires account for the largest market share.

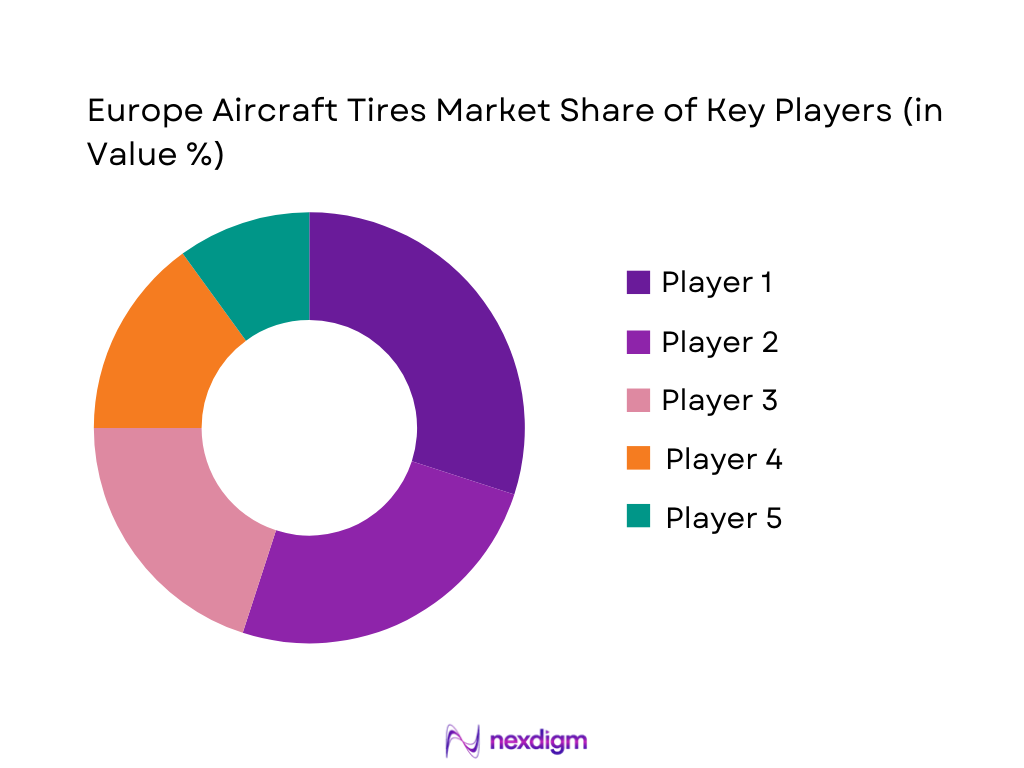

Competitive Landscape

The Europe Aircraft Tires market has a highly competitive landscape, characterized by the presence of well-established global tire manufacturers. These players are involved in various consolidation strategies to enhance market reach and innovation. Key players focus on expanding their product portfolios through technological advancements and new product offerings, including eco-friendly and more durable tire solutions. The market is also influenced by increasing partnerships with airlines, aircraft manufacturers, and military organizations to strengthen their position in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Michelin | 1889 | Clermont-Ferrand, France | ~ | ~ | ~ | ~ | ~ |

| Bridgestone | 1931 | Tokyo, Japan | ~ | ~ | ~ | ~ | ~ |

| Goodyear | 1898 | Akron, Ohio, USA | ~ | ~ | ~ | ~ | ~ |

| Continental AG | 1871 | Hanover, Germany | ~ | ~ | ~ | ~ | ~ |

| Dunlop Aircraft Tyres | 1929 | Birmingham, UK | ~ | ~ | ~ | ~ | ~ |

Europe Aircraft Tires Market Analysis

Growth Drivers

Increased Air Traffic and Fleet Expansion

Increased air traffic across Europe and the expansion of airline fleets are major drivers of the aircraft tire market. With a steady rise in passenger and freight air traffic, airlines are under pressure to meet the demand for air travel, resulting in the need for more aircraft and, in turn, more tires. Furthermore, the continuous replacement of outdated fleets with newer, more efficient models fuels the demand for high-performance tires. The growing number of air travelers and the expansion of regional aviation networks also play a significant role in propelling the market growth. Additionally, advancements in tire technology that increase tire durability, reduce environmental impact, and improve fuel efficiency are boosting market demand. The drive for sustainability in the aviation industry is encouraging the development of eco-friendly tires with improved performance and longer lifespan, making the sector more appealing to consumers and businesses alike. Airline operators are increasingly investing in these technologies to reduce operational costs while ensuring compliance with stringent environmental regulations.

Technological Advancements in Tire Manufacturing

The development of advanced tire technologies has significantly influenced the market, with innovations in materials and design playing a pivotal role in enhancing tire performance. Modern aircraft tires are being manufactured with materials that provide greater durability, lower weight, and improved fuel efficiency. These advances not only help reduce operational costs for airlines but also extend the life of the tires and improve overall safety. Advances in tire tread design, material composition, and manufacturing processes are essential in responding to the growing demand for high-performance and low-maintenance solutions in the aviation sector. For example, tires designed with advanced composites offer better resistance to wear and tear and perform better under extreme operating conditions. Additionally, the use of smart tires that can monitor tire pressure and temperature in real-time has become more prevalent. These innovations provide operators with valuable insights, reducing the likelihood of in-flight failures and enhancing safety.

Market Challenges

High Operational Costs of Aircraft Tires

The high operational costs associated with aircraft tires pose a significant challenge to the growth of the market. Aircraft tires are expensive to manufacture, and their maintenance and replacement costs can be substantial, particularly for commercial airlines that operate large fleets. The cost of tire replacement is further exacerbated by the need for specialized facilities and trained personnel to handle tire maintenance. These factors contribute to the overall high cost of operation for airlines, which could hinder the growth of the market, especially for low-cost carriers. Additionally, aircraft tires need to undergo regular inspections and servicing to ensure their safety and performance, adding to the operational costs of airlines. The high initial cost of purchasing tires, coupled with the need for regular replacements, could also limit the growth of smaller airlines or low-cost carriers that operate under tight budget constraints.

Regulatory and Compliance Barriers in Tire Manufacturing

The stringent regulatory standards and compliance requirements surrounding the production and use of aircraft tires present significant challenges for manufacturers. The aviation industry is heavily regulated, and aircraft tires must meet strict safety and performance standards imposed by regulatory bodies such as the European Union Aviation Safety Agency (EASA). These regulations govern various aspects of tire manufacturing, including material quality, durability, and performance in extreme conditions. The complexity of these standards and the frequent updates to regulations make compliance challenging, especially for smaller manufacturers with limited resources. The certification process for aircraft tires can also be lengthy and costly, further adding to the operational difficulties for tire manufacturers. Moreover, the constant need to innovate and stay ahead of regulatory requirements means that manufacturers must continuously invest in research and development, which increases costs and timelines for product development.

Opportunities

Sustainability Initiatives and Eco-friendly Tire Development

The growing demand for sustainability in the aviation sector presents a significant opportunity for the aircraft tire market. Airlines and manufacturers are increasingly prioritizing environmentally friendly solutions, which has prompted the development of eco-friendly aircraft tires. These tires are designed to reduce the environmental impact of aviation operations by improving fuel efficiency, reducing carbon emissions, and incorporating sustainable materials. Tire manufacturers are focusing on developing tires that are made from recyclable materials or materials that have a lower environmental impact during their production and disposal. The adoption of green manufacturing practices, including the reduction of carbon emissions in tire production, is expected to become a major differentiator in the market. Airlines are also eager to adopt these sustainable solutions as they align with their corporate sustainability goals.

Expansion of Military Aircraft Fleet and Defense Contracts

Another key opportunity in the Europe Aircraft Tires market lies in the expansion of military aircraft fleets and defense contracts. With increasing geopolitical tensions and military modernization programs across Europe, there is a rising demand for military aircraft, which, in turn, drives the need for military aircraft tires. Several countries in Europe are expanding their defense budgets and upgrading their military fleets to enhance their defense capabilities. This provides an opportunity for tire manufacturers to develop specialized tires for military aircraft that meet the unique demands of military operations, including extreme durability, enhanced performance under various terrain conditions, and reliability in combat scenarios. As defense contractors look to meet the demands of military modernization, they require specialized tire solutions that offer high performance and reliability. This market is expected to grow significantly over the coming years as European governments continue to invest in defense and aerospace technologies.

Future Outlook

The future of the Europe Aircraft Tires market looks promising, with expected growth driven by technological advancements, increasing air traffic, and fleet expansions across commercial and military aviation sectors. As the demand for high-performance, sustainable tire solutions rises, manufacturers are poised to focus on eco-friendly materials, smart tire technologies, and innovations that reduce operational costs. Regulatory support and safety standards will continue to shape the market dynamics, ensuring that new tire technologies meet stringent performance criteria. With airlines focusing on fleet modernization and the military sector expanding its fleet, the market is expected to continue growing, driven by the need for efficient, durable, and cost-effective tire solutions.

Major Players

- Michelin

- Bridgestone

- Goodyear

- Continental AG

- Dunlop Aircraft Tyres

- Trelleborg Group

- Aviation Products International

- Mitas Tires

- Aero Tire Systems

- Rubber Resources

- Cheng Shin Rubber

- Vikrant Tyres

- Aero-Tech Industries

- Desser Tire & Rubber

- Aviation Tyres

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines and fleet operators

- Aircraft manufacturers

- Aircraft maintenance, repair, and overhaul (MRO) service providers

- Tire manufacturers and suppliers

- Defense and military organizations

- Aerospace and aviation consultants

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market size, growth drivers, challenges, and competitive landscape are identified through a combination of secondary research, industry reports, and expert opinions.

Step 2: Market Analysis and Construction

An in-depth analysis of market trends, segmentation, and potential opportunities is conducted by reviewing historical data and examining market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are carried out to validate assumptions and hypotheses, ensuring the market insights are accurate and aligned with industry trends.

Step 4: Research Synthesis and Final Output

The findings are synthesized into a final report, providing a comprehensive analysis of the Europe Aircraft Tires market, complete with strategic recommendations and market forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Air Traffic and Aircraft Demand

Rising Military Defense Budgets

Advancements in Aircraft Tire Technologies - Market Challenges

Stringent Regulatory Standards

High Cost of Aircraft Tires

Maintenance and Lifecycle Management - Market Opportunities

Development of Eco-friendly Tires

Growing Aftermarket Services

Technological Integration in Tire Performance - Trends

Adoption of Smart Tires with IoT Integration

Sustainability and Tire Retreading Innovations - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Commercial Aircraft Tires

Military Aircraft Tires

Regional Aircraft Tires

Business Aircraft Tires

Helicopter Tires - By Platform Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Hybrid Aircraft

Electric Aircraft

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

OEM Tires

Replacement Tires

Retread Tires

Specialty Tires - By End User Segment (In Value%)

Airlines

Aircraft Manufacturers

Military Organizations

MRO Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Distributors

Government Tenders

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Michelin

Bridgestone

Goodyear

Continental AG

Hankook Tire

Dunlop Aircraft Tyres

Rubber Resources

Trelleborg Group

Aerospace Products International

Cheng Shin Rubber

Aviation Tires & Rubber

Aerotech Holdings

Aero Tire Systems

Mitas Tires

Vikrant Tyres

- Demand for Tires in Commercial Aviation

- Military Aircraft Tire Procurement Patterns

- Growing MRO Segment for Aircraft Tires

- Increasing Focus on Tire Safety and Reliability

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035