Market Overview

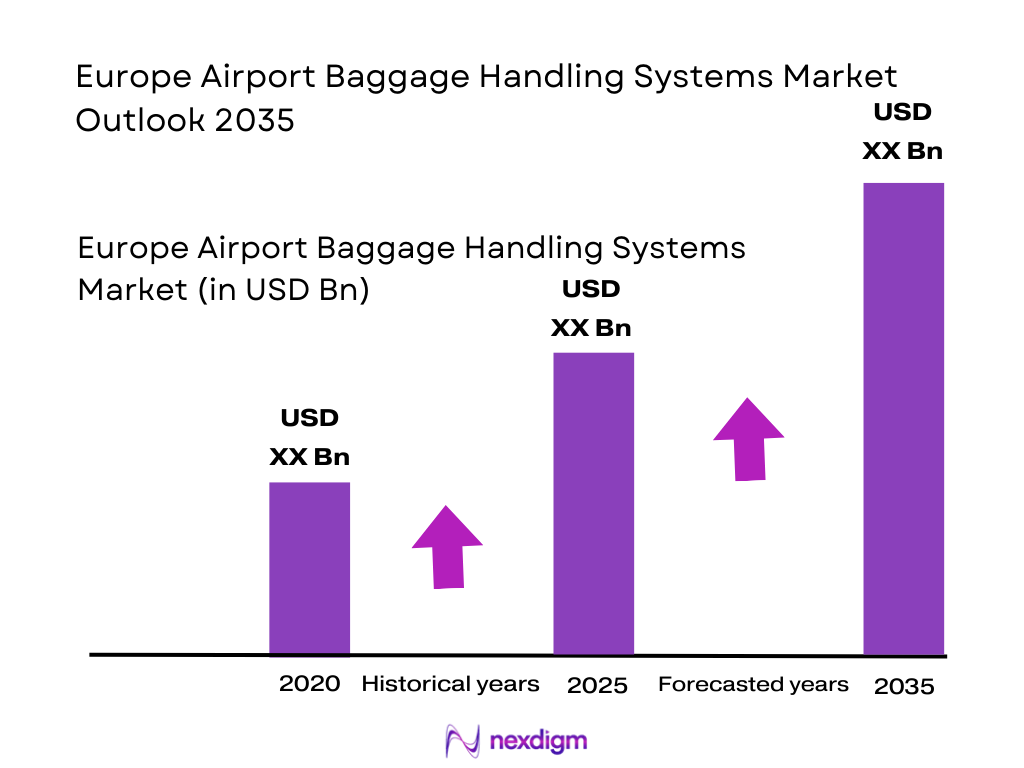

The Europe Airport Baggage Handling Systems market is valued at approximately USD ~, driven by the continuous need for automation and efficiency in airport operations. The market is primarily fueled by the increasing passenger traffic and the focus on upgrading baggage handling systems to improve safety, speed, and operational efficiency. Several airports across Europe are investing in state-of-the-art systems to enhance baggage processing and reduce turnaround time. The rise in air travel and increasing demand for seamless customer experience is boosting the growth of this sector.

Major airports in Europe, such as those in Frankfurt, London, and Paris, dominate the market due to their significant passenger volumes and high operational demands. These cities have extensive baggage handling systems already in place, driving the demand for modern solutions that can cater to growing passenger numbers. In addition, Europe’s central role in international air travel has made its airports key hubs for logistics and passenger flow, necessitating continuous upgrades to maintain high efficiency and meet security standards.

Market Segmentation

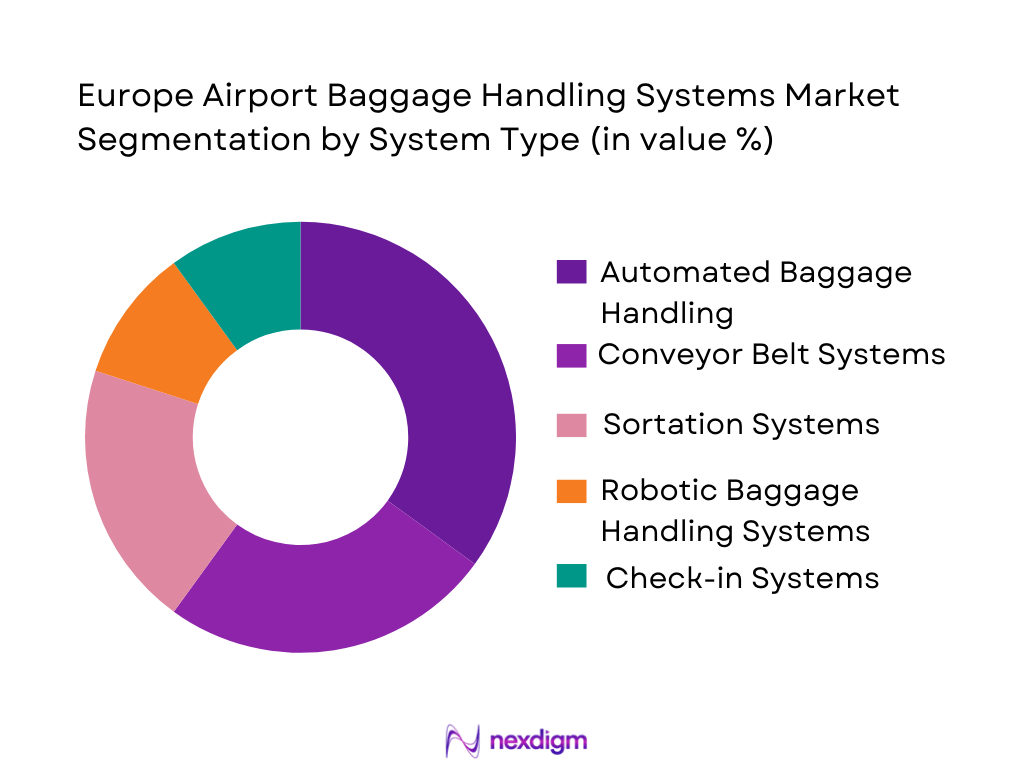

By System Type

Europe Airport Baggage Handling Systems market is segmented by system type into automated baggage handling systems, conveyor belt systems, sortation systems, robotic baggage handling systems, and check-in systems. Recently, automated baggage handling systems have a dominant market share due to the increased demand for automation, which reduces the need for manual labor, enhances efficiency, and minimizes human error. These systems are also integral to managing higher passenger traffic and ensuring quicker turnaround times. The demand for automated systems is driven by the growing focus on improving airport operations, passenger experience, and security, making them a preferred choice across major airports.

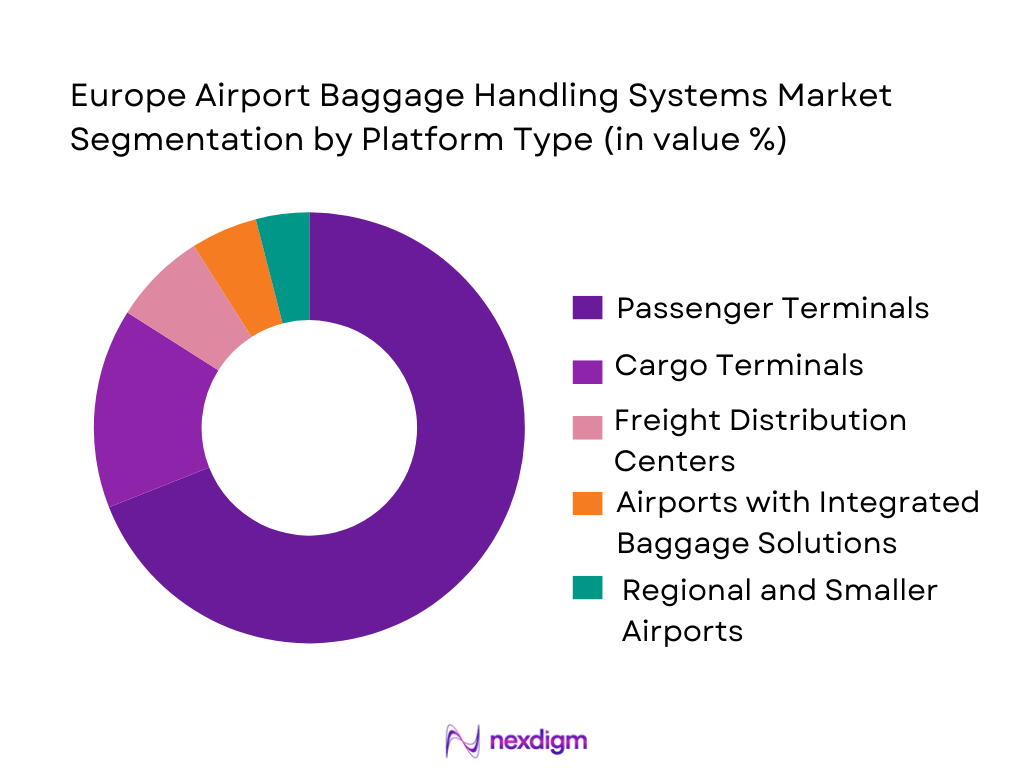

By Platform Type

The Europe Airport Baggage Handling Systems market is segmented by platform type into passenger terminals, cargo terminals, freight distribution centers, airports with integrated baggage solutions, and regional and smaller airports. The dominant sub-segment is passenger terminals, as they account for the largest share due to the substantial passenger traffic that requires efficient baggage handling. The focus on improving the passenger experience, reducing wait times, and enhancing safety in passenger terminals drives the demand for advanced baggage handling systems. Airports are prioritizing the integration of sophisticated systems to meet high expectations for speed and reliability.

Competitive Landscape

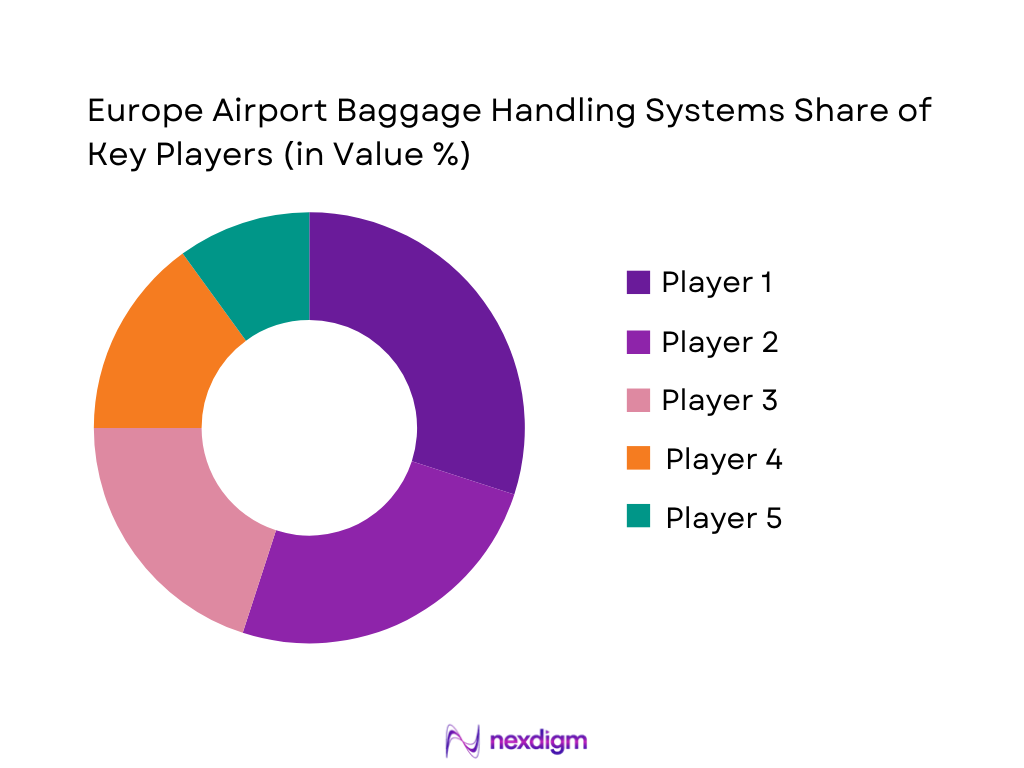

The competitive landscape of the Europe Airport Baggage Handling Systems market is highly consolidated, with several key players leading the industry. These major players are focusing on technological innovations, mergers, and strategic partnerships to strengthen their market position. The industry is driven by investments in automation and robotics, aiming to enhance baggage handling efficiency. Companies are also focusing on reducing operational costs while improving service delivery, which is influencing the competitive dynamics in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Siemens AG | 1847 | Germany | ~ | ~ | ~ | ~ |

| Vanderlande Industries | 1955 | Netherlands | ~ | ~ | ~ | ~ |

| Beumer Group | 1935 | Germany | ~ | ~ | ~ | ~ |

| Daifuku Co., Ltd. | 1937 | Japan | ~ | ~ | ~ | ~ |

| MHI Group | 1884 | Japan | ~ | ~ | ~ | ~ |

Europe Airport Baggage Handling Systems Market Analysis

Growth Drivers

Increasing Passenger Traffic

The rising number of international and domestic passengers across Europe is a key driver for the demand for baggage handling systems. With airports expecting higher passenger volumes, there is a growing need to implement advanced solutions that can handle the volume efficiently and reduce waiting times. The European aviation industry is witnessing steady growth in air traffic, especially post-pandemic, prompting airports to upgrade their systems to handle more baggage and optimize throughput. The shift towards improving customer experience, coupled with the pressure to enhance operational efficiency, is driving the market for automated baggage handling systems. These systems enable faster processing, reduced human intervention, and improved safety protocols.

Technological Advancements

Technological advancements in robotics, AI, and IoT are revolutionizing the baggage handling systems in Europe. The adoption of smart technologies such as autonomous baggage handling robots and automated sorting systems has led to increased efficiency, reduced operational costs, and enhanced baggage security. These innovations offer faster baggage handling times, higher capacity, and greater reliability compared to traditional systems. Additionally, AI and machine learning allow for predictive maintenance, minimizing downtime and operational disruptions. These technological advancements are attracting investments and driving the overall growth of the market as airports look for more efficient and cost-effective solutions to cater to growing passenger numbers.

Market Challenges

High Initial Investment Costs

One of the major challenges in the Europe Airport Baggage Handling Systems market is the high initial cost associated with installing advanced baggage handling systems. Automated and robotic systems, while offering long-term operational benefits, require significant upfront capital investment. Smaller airports or those operating on tighter budgets may find it difficult to justify the investment, which can limit their ability to upgrade systems. Additionally, the integration of these systems into existing infrastructure adds to the complexity and cost, further discouraging some airports from adopting the latest solutions.

Integration with Legacy Systems

Another challenge facing the market is the difficulty of integrating new baggage handling systems with older, legacy systems. Many airports still rely on outdated infrastructure that lacks compatibility with modern technologies such as AI and automation. Upgrading or replacing legacy systems often requires extensive retrofitting, which can disrupt airport operations and lead to delays. Furthermore, the need for specialized expertise to integrate new systems with existing ones increases operational costs and complicates the transition process, making it challenging for some airports to modernize their baggage handling operations.

Opportunities

Smart Airport Developments

The growing trend of smart airports presents a significant opportunity for the baggage handling systems market. Airports across Europe are investing in digital infrastructure, automation, and AI to enhance passenger experience and operational efficiency. The implementation of IoT-enabled systems, touchless baggage handling, and real-time tracking is gaining traction. These developments align with the increasing demand for automation in airports and open new avenues for the deployment of advanced baggage handling technologies. Smart airports aim to reduce turnaround times, improve efficiency, and ensure a seamless passenger experience, driving demand for sophisticated baggage handling solutions.

Focus on Sustainability and Energy Efficiency

There is an increasing focus on sustainability within the airport industry, and this is creating opportunities for eco-friendly baggage handling solutions. Airports are looking for systems that not only reduce energy consumption but also lower their carbon footprint. This includes the adoption of energy-efficient conveyor systems, green technologies in baggage handling, and systems that utilize renewable energy. As regulatory pressure grows and sustainability becomes a central objective for the aviation industry, airports are prioritizing green initiatives, which will drive the demand for eco-conscious baggage handling solutions and contribute to market growth.

Future Outlook

Over the next five years, the Europe Airport Baggage Handling Systems market is expected to experience steady growth, driven by technological advancements, rising passenger traffic, and a strong focus on automation. With continuous demand for more efficient, faster, and safer baggage handling solutions, the market is set to see increased adoption of AI, robotics, and IoT technologies. The ongoing development of smart airports, along with regulatory support for eco-friendly initiatives, will further contribute to the market’s expansion. Additionally, airports are likely to invest more in automation and integration to improve operational efficiency and enhance passenger satisfaction.

Major Players

- Siemens AG

- Vanderlande Industries

- Beumer Group

- Daifuku Co., Ltd.

- MHI Group

- Pteris Global Limited

- LogPlan GmbH

- Fives Group

- Ultra Electronics Airport Systems

- KUKA AG

- IBM Corporation

- Porsche Engineering

- G&S Airport Conveyor

- BCS Group

- ADELTE Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators

- Airlines

- Ground handling companies

- Airport equipment manufacturers

- Third-party service providers

- Logistics companies

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying the key market variables that impact the Europe Airport Baggage Handling Systems market, including demand drivers, technological trends, and economic factors.

Step 2: Market Analysis and Construction

This step focuses on analyzing the market using primary and secondary research, including expert interviews, data collection from relevant reports, and market observation to build a comprehensive market structure.

Step 3: Hypothesis Validation and Expert Consultation

This phase ensures that the findings are validated by consulting industry experts and key stakeholders, reviewing market assumptions, and revisiting hypotheses based on expert feedback.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the findings into a clear and concise report, ensuring all insights are backed by data and are presented in a user-friendly format for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of Air Travel Infrastructure

Increased Focus on Automation and Efficiency

Rising Demand for Contactless Solutions - Market Challenges

High Initial Investment Costs

Complexity in Integration with Legacy Systems

Maintenance and Operational Costs - Market Opportunities

Growing Demand for Smart Airports

Shift Toward Sustainable and Eco-friendly Solutions

Technological Advancements in AI and Robotics - Trends

Adoption of IoT and Cloud Technologies

Enhanced Passenger Experience Through Automation - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Automated Baggage Handling Systems

Conveyor Belt Systems

Sortation Systems

Robotic Baggage Handling Systems

Check-in Systems - By Platform Type (In Value%)

Passenger Terminals

Cargo Terminals

Freight Distribution Centers

Airports with Integrated Baggage Solutions

Regional and Smaller Airports - By Fitment Type (In Value%)

New Installations

Upgrades and Expansions

Retrofitting of Existing Systems

Modular Fitment Solutions - By End User Segment (In Value%)

Airport Operators

Airlines

Ground Handling Companies

Third-party Service Providers - By Procurement Channel (In Value%)

Direct Procurement

Third-party Integrators

OEM Suppliers

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End User Segment, Fitment Type, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Siemens AG

Vanderlande Industries

Beumer Group

Daifuku Co., Ltd.

SABRE Rail

Honeywell International Inc.

MHI Group

Pteris Global Limited

LogPlan GmbH

Fives Group

Glory Ltd.

Ultra Electronics Airport Systems

KUKA AG

IBM Corporation

Porsche Engineering

- Growing Investments in Airport Modernization

- Focus on Improving Baggage Handling Efficiency

- Increased Collaboration Between Airlines and Service Providers

- Growth in Low-Cost Carrier Segments

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035