Market Overview

The Europe Airport Ground Handling Systems market is expected to reach USD ~ based on a recent historical assessment. This growth is driven by increased air traffic, which continues to stimulate demand for airport infrastructure improvements. The demand for ground handling systems is particularly bolstered by the rise in passenger numbers and freight movement, necessitating more advanced and efficient handling solutions. Airports are increasingly upgrading their ground operations with automation technologies, adding to the market’s value.

Dominant countries in the Europe Airport Ground Handling Systems market include the UK, Germany, and France, primarily due to their established aviation hubs and well-developed airport infrastructures. These nations have airports with high passenger traffic, fostering investments in state-of-the-art ground handling systems. Additionally, regulatory frameworks supporting airport modernization in these regions push for continuous development and the adoption of new technologies, reinforcing their dominance in the market.

Market Segmentation

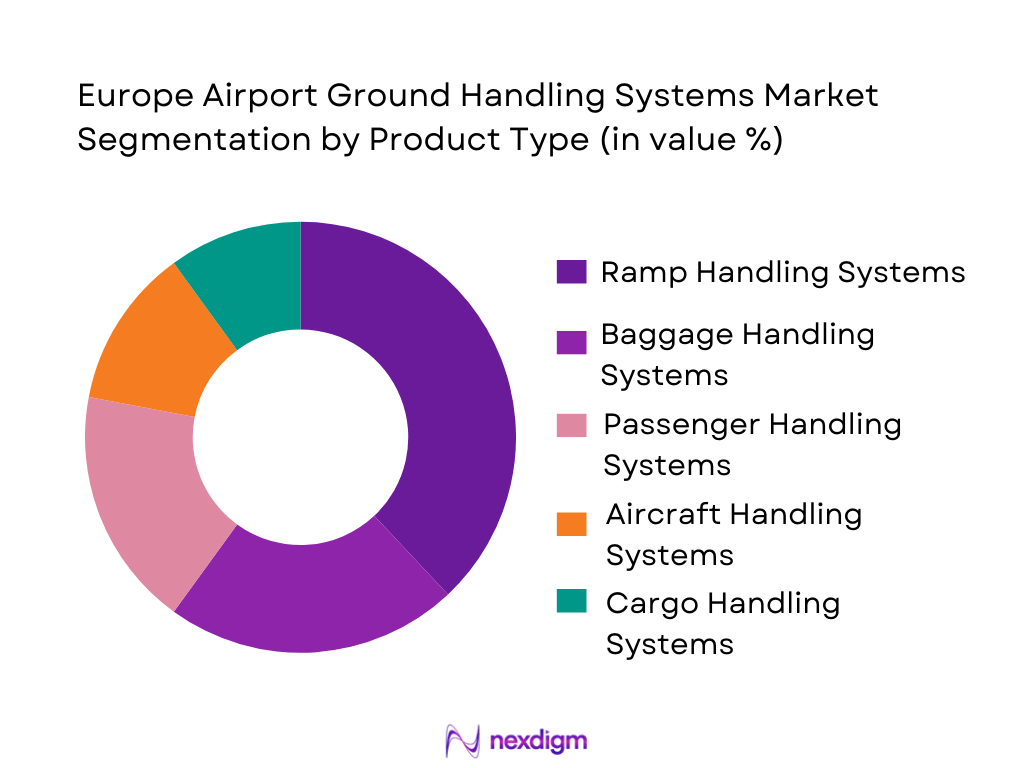

By Product Type

The Europe Airport Ground Handling Systems market is segmented by product type into ramp handling systems, baggage handling systems, passenger handling systems, aircraft handling systems, and cargo handling systems. Recently, ramp handling systems have dominated the market due to the increasing number of aircraft operations, requiring efficient ground handling to ensure timely departures and arrivals. Ramp handling systems are essential for tasks like loading/unloading and maintenance of aircraft, contributing to improved turnaround times and operational efficiency. As a result, demand for these systems has surged, especially with the expanding number of flights across major European airports.

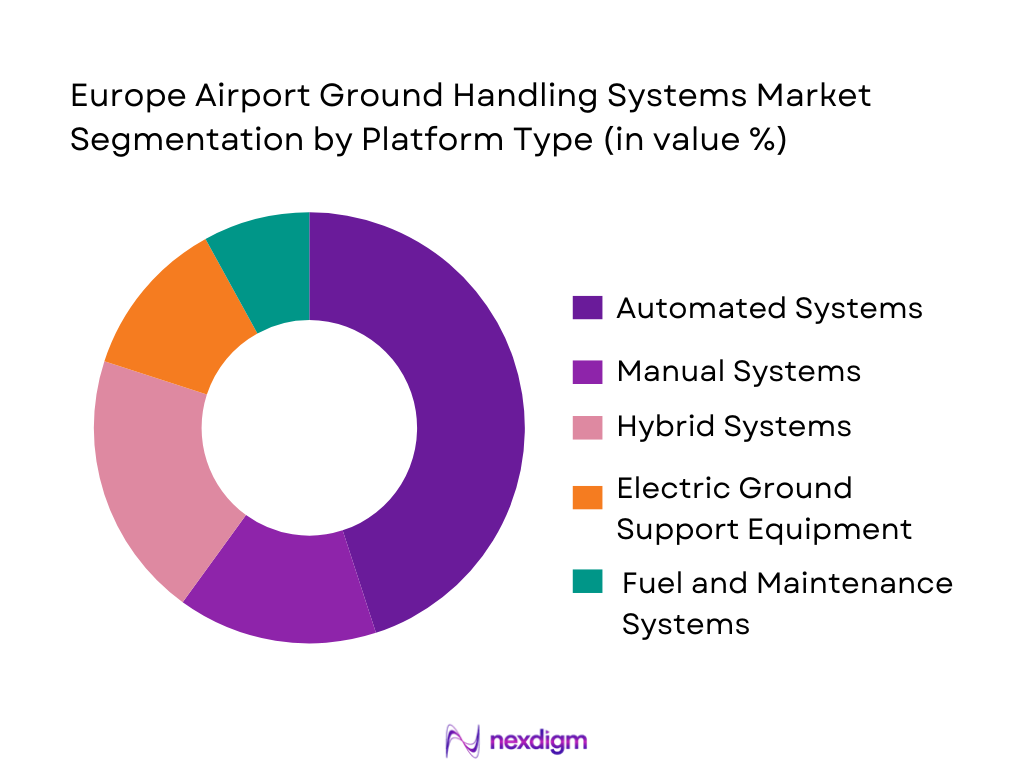

By Platform Type

The Europe Airport Ground Handling Systems market is also segmented by platform type into automated systems, manual systems, hybrid systems, electric ground support equipment, and fuel and maintenance systems. Automated systems are currently leading the market share due to their efficiency and cost-effectiveness in managing high passenger volumes. The growing demand for operational efficiency in major European airports has prompted the widespread adoption of automated systems, with airports aiming to enhance throughput and reduce human labor costs. Moreover, the advancement of AI and IoT technologies has made automation more feasible, contributing to its dominance in the market.

Competitive Landscape

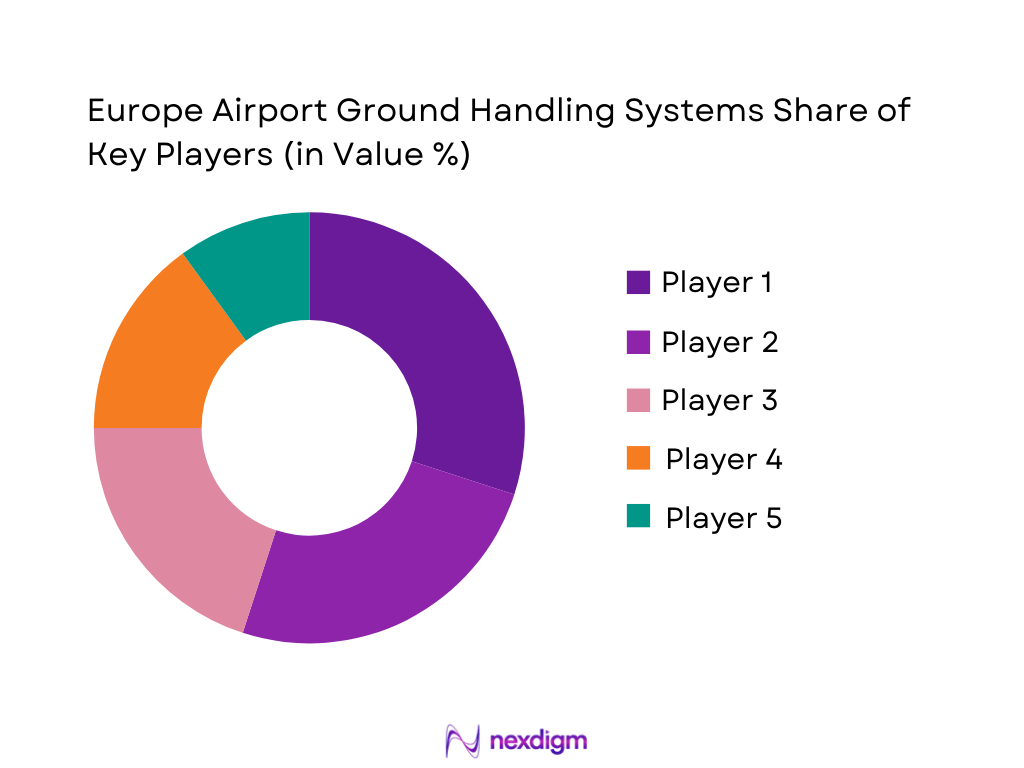

The competitive landscape of the Europe Airport Ground Handling Systems market reflects a consolidation trend, with major players acquiring smaller firms to expand their technological capabilities and geographical presence. This strategic consolidation enables companies to leverage innovations in automation and electric ground support equipment, enhancing their competitive edge. Leading players are focusing on partnerships with airports for long-term contracts, ensuring steady revenue streams and market dominance.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Key Parameter |

| Swissport International Ltd. | 1996 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Menzies Aviation | 2005 | UK | ~ | ~ | ~ | ~ | ~ |

| Dnata | 1959 | UAE | ~ | ~ | ~ | ~ | ~ |

| Kuehne + Nagel | 1890 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| TCR International | 1994 | Belgium | ~ | ~ | ~ | ~ | ~ |

Europe Airport Ground Handling Systems Market Analysis

Growth Drivers

Increase in Air Traffic

The growth in air traffic is one of the key drivers behind the increasing demand for airport ground handling systems. Europe’s position as a global hub for air travel, especially for connecting flights, has resulted in consistent year-on-year increases in passenger numbers. Airports are under pressure to enhance their infrastructure to accommodate the growing volume of air travelers and cargo. This results in significant investments in ground handling systems to ensure smoother, more efficient operations. With air traffic expected to continue its upward trajectory, airports are turning to advanced ground handling technologies that optimize operational efficiency, reduce turn-around time, and improve passenger experiences. Increased demand for air freight, driven by e-commerce growth, further fuels the demand for upgraded ground handling systems, as airports are tasked with handling a larger volume of shipments. To address these needs, ground handling systems are evolving to incorporate automation and enhanced tracking technologies. As such, the rising air traffic acts as a major catalyst for innovation and growth in this sector.

Government Regulations Supporting Modernization

Government regulations are playing a pivotal role in the development of the Europe Airport Ground Handling Systems market. Airports are facing stringent guidelines from both local governments and the European Union regarding safety, environmental standards, and operational efficiency. Regulations aimed at reducing carbon emissions and promoting sustainability are encouraging airports to adopt greener technologies, such as electric ground support equipment (eGSE). This shift is significantly driving the demand for automated and eco-friendly systems. Moreover, the EU’s commitment to sustainability, coupled with regulations demanding improved air traffic management, means that ground handling systems must comply with higher safety standards, as well as meet emissions and noise control regulations. These regulatory frameworks are pushing airports to invest in newer, more advanced ground handling solutions that comply with environmental and safety standards. As a result, government regulations continue to be a strong growth driver, propelling the market toward increased adoption of sustainable technologies and smarter, automated systems that comply with evolving regulatory frameworks.

Market Challenges

High Initial Investment Costs

One of the significant challenges faced by airports and ground handling service providers in Europe is the high initial investment required for advanced systems. While automation and smart technologies offer long-term cost-saving benefits, the initial capital needed to procure, install, and integrate such systems is substantial. Smaller airports or those operating with limited budgets may find it difficult to make such large upfront investments. These high costs can slow down the rate of adoption of newer technologies, as the financial barriers may outweigh the perceived immediate benefits. Additionally, the complexity of installing these systems in existing airport infrastructures adds to the overall expenses. Even though the return on investment (ROI) for these systems is generally high due to efficiency gains, improved safety, and reduced manpower costs, the initial financial outlay remains a significant barrier for many stakeholders. This challenge is particularly prevalent for airports in emerging European markets, where budget constraints may limit the adoption of modern handling systems despite the growing demand for more efficient services.

Integration with Legacy Systems

Another pressing challenge is the integration of new ground handling systems with existing legacy infrastructure. Many airports across Europe are operating with outdated systems that were implemented decades ago, which makes it difficult to incorporate advanced technologies seamlessly. Integrating automation systems with older infrastructure can lead to compatibility issues, system downtimes, and increased operational complexity. This challenge is especially prominent in older airports that have not undergone significant renovations in recent years. Additionally, the integration of electric ground support equipment with existing fueling and maintenance systems presents technical hurdles that require careful planning and execution. Overcoming these integration challenges requires specialized expertise and can result in costly downtime or operational disruptions during the transition. As such, airports are faced with the dilemma of modernizing their systems without disrupting day-to-day operations, adding another layer of difficulty to the process.

Opportunities

Adoption of Electric Ground Support Equipment

The growing focus on sustainability presents a unique opportunity for the Europe Airport Ground Handling Systems market. The adoption of electric ground support equipment (eGSE) is becoming increasingly viable due to the rising pressure to reduce carbon emissions in the aviation industry. Electric GSE provides an environmentally friendly alternative to traditional fuel-powered ground support vehicles, helping airports comply with stringent environmental regulations. Many European countries are offering incentives to promote the adoption of green technologies, which is driving the demand for electric ground handling systems. As part of the EU’s Green Deal, airports are being encouraged to transition to more sustainable solutions, which has led to an uptick in investments in electric GSE. Additionally, the cost of electric vehicles has been steadily decreasing, making them more accessible to a broader range of airports.

Investment in Smart Airport Technologies

The rising trend of smart airports presents another lucrative opportunity for the Europe Airport Ground Handling Systems market. Smart airports leverage Internet of Things (IoT) technologies, artificial intelligence, and big data analytics to streamline operations and enhance the overall passenger experience. Ground handling systems are a key component of this transformation, as they can be integrated with smart technologies to optimize tasks such as baggage handling, ramp management, and passenger services. These advancements enable airports to improve operational efficiency, reduce turnaround times, and enhance safety. The growing focus on passenger convenience and the increasing demand for seamless travel experiences are driving the adoption of smart airport technologies. This shift toward smarter, data-driven solutions presents a significant opportunity for companies providing ground handling systems to innovate and capitalize on the demand for integrated, intelligent systems.

Future Outlook

The future outlook for the Europe Airport Ground Handling Systems market is characterized by rapid technological advancements and increasing investments in automation. The demand for smart, automated systems is expected to grow as airports aim to improve efficiency and reduce operational costs. Additionally, stricter environmental regulations and sustainability goals will continue to drive the adoption of electric ground support equipment. Over the next five years, a combination of regulatory support, technological innovation, and increasing air traffic will create a strong growth trajectory for the market.

Major Players

- Swissport International Ltd.

- Menzies Aviation

- Dnata

- Kuehne + Nagel

- TCR International

- Worldwide Flight Services

- ABM Industries

- Jetex Flight Support

- LUG aircargo handling GmbH

- Fraport AG

- Groupe Aeroports de Paris

- SATS Ltd.

- IAG Ground Handling

- ICTS Europe

- SITA

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport authorities

- Ground handling service providers

- Airlines

- Airport technology providers

- Logistics and supply chain firms

- Equipment manufacturers

Research Methodology

Step 1: Identification of Key Variables

Understanding the critical factors affecting the market such as air traffic trends, government regulations, and technological advancements.

Step 2: Market Analysis and Construction

Compiling historical data, analyzing current trends, and building a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses through expert interviews and industry consultations.

Step 4: Research Synthesis and Final Output

Consolidating findings into actionable insights and finalizing the market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Air Travel Demand

Technological Advancements in Ground Support Equipment

Focus on Airport Infrastructure Development - Market Challenges

High Capital Investment Requirements

Complex Regulatory Compliance

Integration of New Technologies with Legacy Systems - Market Opportunities

Rising Adoption of Electric Ground Support Equipment

Opportunities in Emerging Markets

Increased Focus on Sustainability and Eco-Friendly Solutions - Trends

Automation in Ground Handling Operations

Growth in Smart Airports - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ramp Handling Systems

Baggage Handling Systems

Passenger Handling Systems

Aircraft Handling Systems

Cargo Handling Systems - By Platform Type (In Value%)

Automated Systems

Manual Systems

Hybrid Systems

Electric Ground Support Equipment

Fuel and Maintenance Systems - By Fitment Type (In Value%)

New Installations

Retrofit Installations

Upgrades and Enhancements

Replacement Systems - By End User Segment (In Value%)

Airports

Ground Handling Service Providers

Airlines

Cargo Operators - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Leasing and Rental Services

- Market Share Analysis

- Cross Comparison Parameters (Market Value, Installed Units, Growth Rate, System Complexity, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

TCR International

Swissport International Ltd.

Menzies Aviation

Dnata

Worldwide Flight Services

Kuehne + Nagel

SATS Ltd.

Groupe Aeroports de Paris

Fraport AG

IAG Ground Handling

LUG aircargo handling GmbH

ABM Industries

STG Group

Jetex Flight Support

ICTS Europe

- Growing Demand from Airports and Airlines

- Shift Towards Outsourcing Ground Handling Operations

- Expansion of Low-Cost Carriers

- Adoption of New Technologies by Ground Handling Service Providers

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035