Market Overview

The Europe Ammunition Market is valued at USD ~, driven primarily by the rising demand for both military and civilian ammunition. Growing defense budgets and the increasing use of ammunition in law enforcement, hunting, and sporting activities are key contributors to the market’s expansion. Technological innovations in ammunition production, along with enhanced military capabilities in several European nations, further fuel growth. Additionally, the demand for high-quality and versatile ammunition is leading to the introduction of advanced products such as smart ammunition.

Europe’s dominance in the ammunition sector is primarily attributed to the strong presence of key defense contractors and military agencies in countries like Germany, the UK, and France. These nations have large defense budgets, with the UK and France investing heavily in military modernization programs. Germany, as a leading exporter of defense equipment, has cemented its position in the global ammunition market. Additionally, these countries have well-established regulatory frameworks for ammunition manufacturing, distribution, and use, further boosting their market positions.

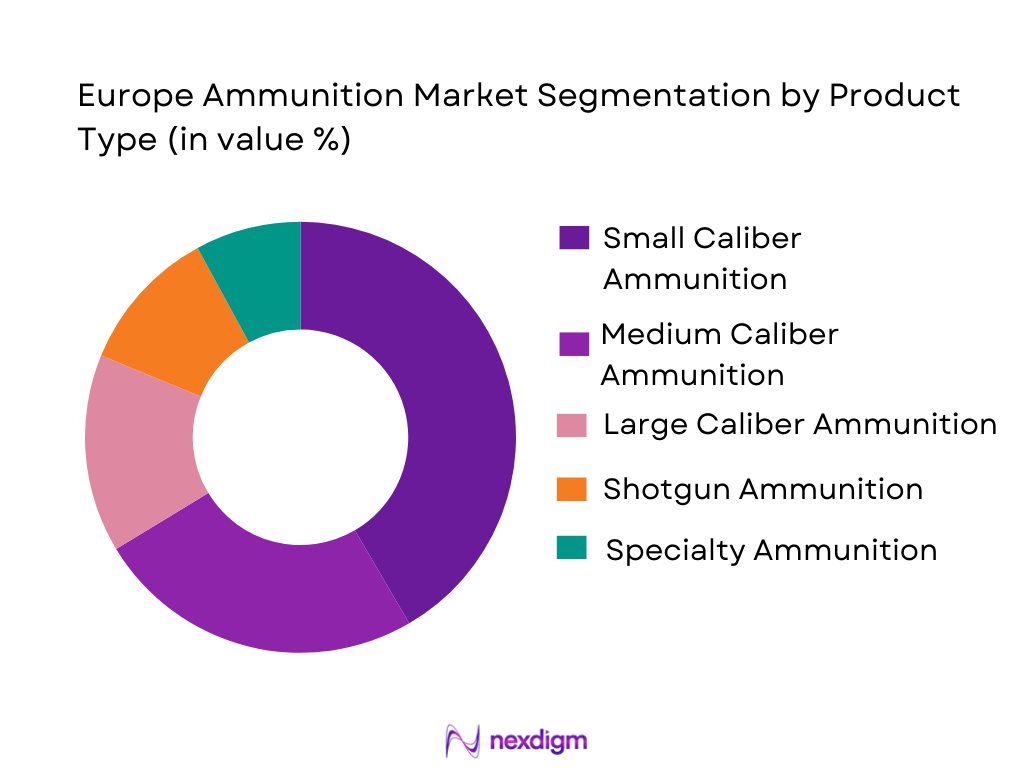

Market Segmentation

By Product Type

The Europe Ammunition Market is segmented by product type into small caliber ammunition, medium caliber ammunition, large caliber ammunition, shotgun ammunition, and specialty ammunition. Small caliber ammunition has the dominant market share due to its high demand in both civilian and military markets. Factors driving the dominance of small caliber ammunition include the widespread use in firearms for personal defense, law enforcement, and military applications. Its versatility and cost-effectiveness make it the preferred choice across a broad range of users, from individual consumers to military organizations.

By Platform Type

The Europe Ammunition Market is segmented by platform type into military platforms, civilian platforms, law enforcement platforms, defense contractors, and military training facilities. Military platforms hold the dominant market share, as the growing number of military operations across Europe fuels demand for a variety of ammunition types. The need for more powerful, precision-driven ammunition for advanced weaponry systems, including armored vehicles and tanks, further drives the growth of military platform-based ammunition. This segment continues to see investment from governments seeking to strengthen their defense capabilities.

Competitive Landscape

The competitive landscape of the Europe Ammunition Market is shaped by strong consolidation, with leading defense contractors and ammunition manufacturers competing for market dominance. The industry sees frequent mergers and partnerships, enabling companies to enhance their technological offerings and expand their production capabilities. A significant influence is also exerted by state-owned enterprises and government-backed manufacturers who supply ammunition for military and law enforcement agencies across the region.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Military Contracting Experience |

| FN Herstal | 1889 | Belgium | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Olin Corporation | 1892 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

Europe Ammunition Market Analysis

Growth Drivers

Rising Defense Budgets

Increasing defense budgets across European nations have fueled the growth of the ammunition market. Governments are investing heavily in defense modernization programs, with significant allocations for new technologies, weapons systems, and ammunition. This rise in spending is a response to growing geopolitical tensions and national security concerns, particularly from neighboring regions. The demand for both traditional and advanced ammunition is expected to continue growing as defense agencies modernize their arsenals. Additionally, many European nations are focusing on enhancing their military readiness by increasing military training exercises, which also drives ammunition consumption. Higher defense spending enables more consistent procurement cycles for ammunition, ensuring a steady market demand. For instance, the UK and France are among the countries leading in defense investments, which directly impacts ammunition requirements.

Increased Civilian and Sporting Ammunition Demand

Alongside military usage, there is a significant rise in the demand for ammunition from civilian markets, including sports and personal defense. Hunting and shooting sports are widely popular in European countries like Germany, the UK, and France. As civilian firearm ownership increases, the demand for ammunition for sporting and self-defense purposes also grows. Additionally, several European countries have stringent regulations and safety standards governing the sale of ammunition, ensuring a high level of quality and security in the market. The steady rise in demand for high-performance ammunition tailored to these segments has led to a surge in product innovations, particularly in terms of precision, efficiency, and versatility. Manufacturers are increasingly focusing on high-quality ammunition solutions for both competitive shooting and self-defense, which has spurred growth in this sub-segment.

Market Challenges

Regulatory Compliance and Restrictions

A significant challenge for the Europe Ammunition Market is the complex and ever-evolving regulatory environment governing the production, sale, and use of ammunition. European nations have strict regulations on firearms and ammunition, with some countries implementing bans on certain types of ammunition or restricting their use. These regulations vary across countries, adding complexity for manufacturers who must comply with multiple laws and standards. The regulatory burden increases operational costs, as manufacturers must ensure that their products meet all safety, environmental, and legal standards. In addition to national regulations, there are also international restrictions, such as arms control treaties, which limit the production and distribution of certain types of ammunition. Compliance with these regulatory frameworks is both costly and time-consuming for ammunition manufacturers, and failure to comply with these standards can result in fines or bans on product sales.

Fluctuating Raw Material Prices

The volatility in raw material prices is another significant challenge for the Europe Ammunition Market. Ammunition production relies heavily on metals like brass, copper, and lead, which are subject to price fluctuations due to changes in global supply and demand dynamics. The increasing cost of raw materials impacts the overall cost structure of ammunition manufacturers, who often face the challenge of absorbing these higher costs or passing them on to customers. This price volatility is exacerbated by geopolitical factors, trade policies, and supply chain disruptions, all of which can lead to significant price hikes in raw materials. Such fluctuations make it difficult for ammunition manufacturers to predict and stabilize production costs, leading to pricing instability in the market. This can affect both consumers and producers, as unexpected price hikes may reduce demand from cost-sensitive customers, such as law enforcement agencies and civilian shooters. Additionally, fluctuating raw material prices affect profitability and may force manufacturers to scale back on production, especially during periods of high cost volatility.

Opportunities

Technological Advancements in Ammunition

One of the most significant opportunities in the Europe Ammunition Market lies in the development of technologically advanced ammunition, such as smart and guided munitions. Advances in technology have made it possible to develop ammunition that offers superior precision, reduced environmental impact, and enhanced safety features. These technological innovations present an opportunity for ammunition manufacturers to differentiate their products and meet the growing demand for advanced defense solutions. As militaries across Europe focus on enhancing their weapon systems, the demand for more accurate and efficient ammunition is expected to rise. Smart ammunition, which incorporates sensors and guidance systems to improve targeting and effectiveness, is especially promising. These technological improvements are increasingly being adopted in military applications, such as anti-tank and anti-aircraft weapons, offering a chance for companies to lead in the development of next-generation ammunition.

Expansion into Emerging Markets

As the global defense landscape evolves, European ammunition manufacturers have an opportunity to expand into emerging markets in Eastern Europe and beyond. Nations in Eastern Europe are increasingly modernizing their armed forces in response to rising security concerns, particularly in the wake of regional instability. As defense budgets rise in these regions, there is growing demand for modern ammunition to equip newly upgraded military platforms. European manufacturers have a unique opportunity to cater to these markets, leveraging their advanced technologies, production capabilities, and established track record. With the European Union’s support for defense cooperation and shared security initiatives, manufacturers can tap into these emerging markets with favorable trade terms and government-backed defense contracts. As these regions develop their defense infrastructure, the demand for ammunition will grow, creating a fertile market for European producers to expand their reach.

Future Outlook

The future of the Europe Ammunition Market appears strong, driven by increasing defense budgets, ongoing technological innovations, and growing demand from civilian markets. Over the next five years, the market is expected to experience steady growth, with advancements in ammunition technology, such as smart munitions and precision-guided systems, playing a significant role in shaping the market. Additionally, demand from emerging European markets is anticipated to rise, spurred by regional defense cooperation and modernization programs. Regulatory support for defense-related industries is also expected to continue, providing a favorable environment for growth.

Major Players

- FN Herstal

- BAE Systems

- Rheinmetall AG

- Olin Corporation

- Thales Group

- General Dynamics Ordnance and Tactical Systems

- Leonardo DRS

- Textron Systems

- Winchester Ammunition

- Northrop Grumman

- Prvi Partizan

- Remington Arms Company, LLC

- Hornady Manufacturing Company

- Swarovski Optik

- Beretta Holding S.p.A.

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Defense agencies

- Private security firms

- Law enforcement agencies

- Civilian firearm and ammunition manufacturers

- Hunting and sporting goods retailers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market drivers, technological advancements, and geopolitical factors are identified through primary and secondary research.

Step 2: Market Analysis and Construction

Market trends are analyzed using historical data, expert consultations, and secondary sources. Forecasting models are built to project future trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth drivers are validated through consultations with industry experts and stakeholders.

Step 4: Research Synthesis and Final Output

Data is synthesized into a comprehensive market report, ensuring all findings align with the research objectives and market dynamics.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets

Rise in Civilian Firearm Ownership

Enhanced Security Needs

Expansion of Military Operations

Technological Advancements in Ammunition - Market Challenges

Stringent Government Regulations

Increasing Raw Material Prices

Environmental Concerns

Supply Chain Disruptions

Technological Integration Costs - Market Opportunities

Emerging Markets in Eastern Europe

Innovation in Smart Ammunition

Defense Industry Partnerships - Trends

Shift Towards Eco-friendly Ammunition

Growing Military Modernization - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Small Caliber Ammunition

Medium Caliber Ammunition

Large Caliber Ammunition

Shotgun Ammunition

Specialty Ammunition - By Platform Type (In Value%)

Military Platforms

Civilian Platforms

Law Enforcement Platforms

Defense Contractors

Military Training Facilities - By Fitment Type (In Value%)

Rifle Ammunition

Pistol Ammunition

Shotgun Ammunition

Machine Gun Ammunition - By End User Segment (In Value%)

Defense Forces

Law Enforcement Agencies

Private Security Firms

Civilian Sports Enthusiasts - By Procurement Channel (In Value%)

Direct Procurement

Online Retail

Distributor Networks

- Market Share Analysis

- Cross Comparison Parameters (Price, Quality, Distribution Network, Technology, Market Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

FN Herstal

BAE Systems

General Dynamics Ordnance and Tactical Systems

Rheinmetall AG

Beretta Holding S.p.A.

Northrop Grumman

Remington Arms Company, LLC

Olin Corporation

Leonardo DRS

Thales Group

Textron Systems

Swarovski Optik

Prvi Partizan

Winchester Ammunition

Hornady Manufacturing Company

- Demand for Personal Defense Ammunition

- Growth in Military Ammunition Demand

- Technological Adoption in Law Enforcement

- Trends in Hunting and Sports Ammunition

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035