Market Overview

The Europe Armored Fighting Vehicles market is valued at approximately USD ~ billion, with growth driven by the increasing need for modernized military capabilities, rising defense budgets, and the growing emphasis on improving the protection of military personnel. As countries continue to enhance their defense infrastructure in response to evolving security threats, there is significant demand for advanced armored vehicles that provide mobility, protection, and firepower in combat scenarios. Technological advancements in armor materials, weapons integration, and vehicle mobility further support market growth.

Countries like Germany, the United Kingdom, and France dominate the European armored fighting vehicles market due to their well-established defense industries, high military spending, and strategic geopolitical importance. These countries have the technological expertise and industrial base required to produce advanced military vehicles. Additionally, strong collaboration with NATO and participation in international defense programs drive the demand for advanced armored vehicles. Their leadership in defense innovation, coupled with strategic military requirements, positions these nations as key players in the development and deployment of armored fighting vehicles across Europe.

Market Segmentation

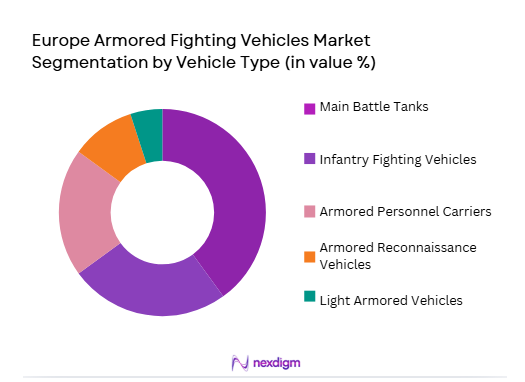

By Vehicle Type

The Europe Armored Fighting Vehicles market is segmented by vehicle type into main battle tanks, infantry fighting vehicles, armored personnel carriers, armored reconnaissance vehicles, and light armored vehicles. Recently, main battle tanks have dominated the market due to their critical role in modern warfare. They are heavily armored and equipped with advanced weaponry, making them the backbone of any mechanized infantry division. The demand for main battle tanks is particularly driven by their ability to provide superior firepower and protection in high-intensity conflicts. Their versatility in both offensive and defensive operations makes them a preferred choice for militaries aiming to maintain operational superiority on the battlefield.

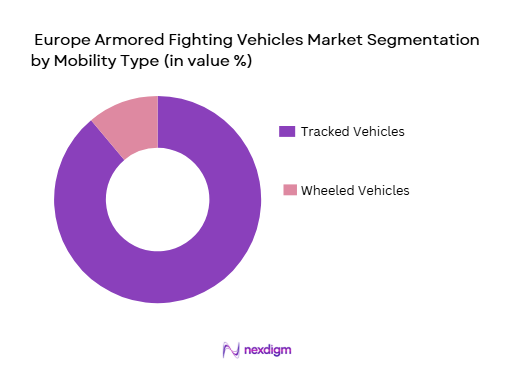

By Mobility Type

The market is segmented by mobility type into tracked vehicles and wheeled vehicles. Tracked vehicles dominate the market due to their superior off-road mobility, stability, and capability to navigate challenging terrains, making them ideal for combat operations in diverse environments. The tracks provide better traction and weight distribution, allowing armored vehicles to perform effectively on soft, uneven, or rugged terrain. This makes tracked vehicles particularly suitable for military operations in hostile or remote areas where maneuverability and endurance are essential. Although wheeled vehicles are more cost-effective and offer better speed on roads, tracked vehicles’ performance in combat scenarios secures their dominant position in the market.

Competitive Landscape

The competitive landscape of the Europe Armored Fighting Vehicles market is characterized by the dominance of a few major defense contractors that design, manufacture, and supply advanced armored vehicles to government and military agencies. The market is highly consolidated, with industry giants competing to deliver cutting-edge technologies, including advanced armor solutions, integrated weapon systems, and enhanced mobility features. These companies are also involved in long-term government contracts and international defense collaborations, further strengthening their position in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Düsseldorf, DE | ~ | ~ | ~ | ~ | ~ |

| General Dynamics | 1952 | Falls Church, US | ~ | ~ | ~ | ~ | ~ |

| Nexter Systems | 2006 | Versailles, FR | ~ | ~ | ~ | ~ | ~ |

| Oshkosh Defense | 1917 | Wisconsin, USA | ~ | ~ | ~ | ~ | ~ |

Europe Armored Fighting Vehicles Market Analysis

Growth Drivers

Increased Military Expenditures and Defense Modernization:

The growth of the Europe Armored Fighting Vehicles market is significantly driven by the rising defense budgets and the ongoing modernization of military fleets across the region. As European nations confront evolving security challenges, including the rise of hybrid warfare, border conflicts, and terrorism, there is an increasing need for advanced armored fighting vehicles that offer superior protection, mobility, and firepower. Nations such as Germany, the United Kingdom, and France are heavily investing in the modernization of their armored vehicle fleets, with a focus on upgrading existing platforms and acquiring next-generation vehicles equipped with advanced armor, weapons systems, and communications technology. The need to maintain operational superiority in both traditional and asymmetric warfare scenarios is prompting defense agencies to prioritize the acquisition of high-performance armored vehicles. As a result, armored vehicle manufacturers are responding with enhanced offerings to meet the evolving demands of defense ministries and military agencies, further driving market growth. This trend of defense modernization, coupled with geopolitical instability and increased defense cooperation within NATO, ensures continued growth in armored vehicle procurement and upgrades over the coming years.

Technological Advancements in Armored Vehicle Capabilities:

Technological innovations in the fields of armor materials, mobility, and weapons integration are key growth drivers in the Europe Armored Fighting Vehicles market. Advancements in composite armor and reactive armor technology have significantly improved the survivability and protection capabilities of armored vehicles, enabling them to withstand more powerful projectiles and explosives. At the same time, manufacturers are incorporating autonomous systems, AI-based targeting, and advanced sensors into armored vehicles, enhancing their battlefield performance. Additionally, improvements in hybrid and electric mobility solutions are increasing the operational range and fuel efficiency of armored vehicles, making them more cost-effective and environmentally friendly.

Market Challenges

High Development and Procurement Costs:

One of the primary challenges facing the Europe Armored Fighting Vehicles market is the high cost associated with the development, procurement, and maintenance of these advanced systems. Armored fighting vehicles are highly complex and require significant investments in both research and development and manufacturing. The integration of advanced armor technologies, weapons systems, and electronic components increases the overall cost of production, making them expensive to acquire. For many European countries, particularly smaller nations with limited defense budgets, these costs can be prohibitive. Additionally, maintaining and upgrading these vehicles throughout their service life adds to the financial burden. With defense budgets under scrutiny, especially in light of other national priorities, military agencies face challenges in securing sufficient funding for large-scale procurement of armored vehicles. This cost barrier is especially prominent in the procurement of next-generation systems, which require substantial upfront investments. As such, the high costs associated with these vehicles can slow market adoption, particularly in countries with more restricted defense spending.

Regulatory and Environmental Constraints:

The Europe Armored Fighting Vehicles market also faces regulatory and environmental challenges, particularly in the areas of environmental sustainability and defense procurement regulations. Governments and defense agencies are increasingly under pressure to meet environmental standards, which include reducing the carbon footprint of military vehicles and improving energy efficiency. As a result, there is a growing demand for hybrid and electric-powered armored vehicles that can operate with lower emissions while maintaining their combat capabilities. However, integrating these new power systems into armored vehicles presents significant engineering and technological challenges, especially in ensuring that these vehicles maintain the same level of performance as traditional fuel-powered systems.

Opportunities

Expansion of Hybrid and Electric Armored Vehicles:

An emerging opportunity in the Europe Armored Fighting Vehicles market lies in the development and integration of hybrid and electric-powered armored vehicles. As European countries focus on sustainability and reducing the environmental impact of their defense forces, hybrid and electric solutions present a viable alternative to traditional fuel-powered vehicles. These vehicles offer the potential to significantly reduce operational costs, improve fuel efficiency, and lower emissions while maintaining the mobility and protection required for military operations. Additionally, hybrid and electric systems can provide enhanced silent operation capabilities, making these vehicles suitable for covert and reconnaissance missions. As governments face growing pressure to meet environmental regulations, the demand for eco-friendly military vehicles is expected to increase, providing manufacturers with opportunities to innovate and cater to this emerging market segment. The development of these next-generation vehicles aligns with both sustainability goals and defense modernization strategies, ensuring their relevance in future procurement programs.

Integration of Autonomous and Remote-Controlled Systems:

Another key opportunity in the European market is the integration of autonomous and remote-controlled systems into armored fighting vehicles. These technologies allow for increased operational efficiency, reduced risk to personnel, and enhanced battlefield awareness. Autonomous systems, including autonomous navigation and weapons targeting, can improve the overall effectiveness of armored vehicles, enabling them to operate with minimal human intervention. The integration of remote-controlled capabilities also offers greater flexibility in battlefield operations, allowing military forces to deploy armored vehicles in dangerous environments without risking the lives of crew members. As defense agencies increasingly look for ways to reduce human casualties and enhance operational capabilities, the demand for autonomous and remotely operated armored vehicles is expected to grow. This trend aligns with broader technological developments in the defense sector and presents significant growth opportunities for companies that are leading the way in autonomous vehicle systems.

Future Outlook

The future outlook for the Europe Armored Fighting Vehicles market is positive, with continued growth expected over the next five years. Technological advancements in vehicle mobility, weapon systems, and armor materials will continue to drive innovation, resulting in more effective and cost-efficient armored vehicles. The integration of hybrid and electric systems, along with the growing demand for autonomous capabilities, will further transform the market. As European nations continue to invest in defense modernization, the market will benefit from increased procurement programs, particularly for next-generation armored vehicles. Geopolitical instability and the rising threat of hybrid warfare will further accelerate the need for advanced military vehicles in the region, ensuring a robust market expansion.

Major Players

- BAE Systems

- Rheinmetall AG

- General Dynamics

- Nexter Systems

- Oshkosh Defense

- Krauss-Maffei Wegmann

- Lockheed Martin

- Thales Group

- Hanwha Defense

- Leonardo

- Textron Systems

- Elbit Systems

- Hyundai Rotem

- Iveco Defence Vehicles

- Tatra Trucks

Key Target Audience

- Government Defense Agencies

- Military Forces

- Aerospace and Defense Contractors

- Vehicle Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Security and Surveillance Providers

- Technology Integration Companies

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the critical market variables, such as demand drivers, technological advancements, and geopolitical factors, to ensure a precise market analysis.

Step 2: Market Analysis and Construction

Data from primary and secondary sources are analyzed to understand market trends, consumer behavior, and competitive dynamics, forming the foundation of the market model.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are tested by consulting with defense industry experts, military personnel, and technology providers to refine insights.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report, offering actionable insights, forecasts, and strategic recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets across European countries

Rising geopolitical tensions and defense needs

Technological advancements in vehicle armor and weaponry systems - Market Challenges

High production and operational costs

Complex regulatory and compliance requirements

Logistical and maintenance challenges in remote or hostile environments - Market Opportunities

Advancements in unmanned and autonomous armored vehicles

Growing demand for amphibious and versatile platforms

Shift towards environmentally friendly and fuel-efficient technologies - Trends

Integration of AI and autonomous systems in combat vehicles

Use of advanced materials to enhance vehicle protection

Growing adoption of hybrid propulsion systems in military vehicles - Government regulations

Defense procurement regulations and military standards

Environmental standards for vehicle emissions

Safety and protection standards for crew members in combat zones - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By Vehicle Type (In Value%)

Main Battle Tanks

Infantry Fighting Vehicles

Armored Personnel Carriers

Light Armored Vehicles

Armored Reconnaissance Vehicles - By Platform Type (In Value%)

Land-Based Platforms

Tracked Vehicles

Wheeled Vehicles

Hybrid Platforms

Amphibious Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Integrated Fitment

Custom Fitment

Modular Fitment - By End-User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Security Firms

Commercial Operators - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Leasing

Third-party Distributors

- Market Share Analysis

Cross Comparison Parameters (Cost per Unit, Maintenance Cycle, Vehicle Payload Capacity, Armor Material Innovation, Integration with Other Military Systems, Defense Capability) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Rheinmetall AG

General Dynamics European Land Systems

Krauss-Maffei Wegmann

Thales Group

Navistar Defense

Lockheed Martin

Leonardo

Oshkosh Defense

L3 Technologies

Patria

MOWAG

Saab Group

FNSS Defence Systems

Indra Sistemas

- Military forces increasing their fleet size for modernization efforts

- Defense contractors focused on providing advanced armored solutions

- Government agencies focusing on national security and defense upgrades

- Private security firms investing in light armored vehicles for special operations

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035