Market Overview

The Europe Artificial Intelligence and Analytics in Defense market is valued at approximately USD ~ billion, driven by the increasing adoption of AI technologies to enhance military decision-making, surveillance, and operational efficiency. Defense agencies across Europe are investing heavily in AI and analytics to improve intelligence gathering, predictive maintenance, and autonomous systems, all of which contribute to strengthening national security. Technological advancements in AI, data analytics, and machine learning are central to this market’s rapid growth.

Countries such as the United Kingdom, Germany, and France dominate the European market due to their significant defense investments, well-established military infrastructure, and strategic geopolitical importance. These nations have the resources and political will to integrate AI and analytics into their defense operations, leveraging advanced technologies to enhance operational capabilities. Their leadership in both defense technology development and AI research places them at the forefront of the adoption of AI solutions within military environments across Europe.

Market Segmentation

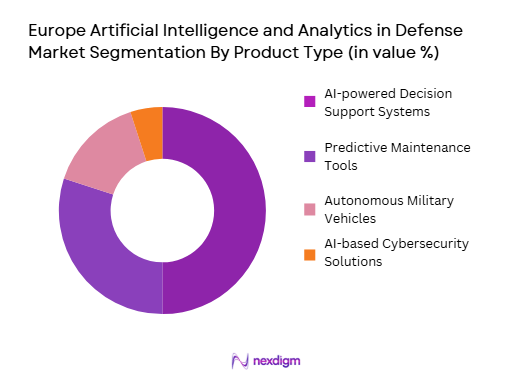

By Product Type

The Europe Artificial Intelligence and Analytics in Defence market is segmented by product type into AI-powered decision support systems, predictive maintenance tools, autonomous military vehicles, and AI-based cybersecurity solutions. Recently, AI-powered decision support systems have taken the dominant market share due to their ability to assist military decision-makers by providing real-time data analysis, predictive insights, and actionable intelligence. These systems are crucial in modern warfare, helping to streamline operations and improve strategic planning. They allow for faster and more informed decisions, which is essential in dynamic combat environments. As military forces increasingly rely on data-driven strategies, the adoption of AI-based decision support systems continues to rise, driving their dominance in the market.

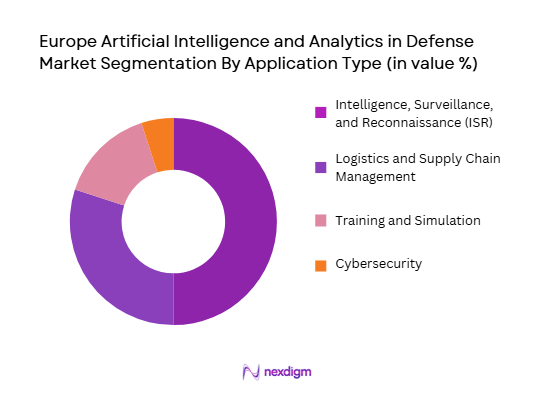

By Application

The market is also segmented by application into intelligence, surveillance and reconnaissance (ISR), logistics and supply chain management, training and simulation, and cybersecurity. ISR applications dominate the market, driven by the growing need for real-time data collection, processing, and analysis in military operations. AI technologies are used to enhance the capability of surveillance systems, enabling them to process large volumes of data from various sources, including drones, satellites, and sensors, to provide actionable intelligence. As military forces increasingly rely on AI to process and analyze ISR data, the demand for AI-based ISR systems continues to expand, making this sub-segment a key market driver.

Competitive Landscape

The competitive landscape in the Europe Artificial Intelligence and Analytics in Defence market is dominated by a few key players specializing in defense technologies and AI integration. These players focus on developing innovative solutions that enhance military operations through AI, including autonomous systems, data analytics, and predictive modeling. The market is characterized by a high level of technological collaboration, as defense agencies and private companies work together to develop advanced solutions. Strategic partnerships and joint ventures are common, as companies aim to leverage AI expertise and expand their capabilities in defense applications.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Thales Group | 1970 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| IBM | 1911 | Armonk, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

Europe Artificial Intelligence and Analytics in Defense Market Analysis

Growth Drivers

Increasing Demand for Enhanced Operational Efficiency:

The growing complexity of modern warfare, coupled with the vast amount of data generated during military operations, is driving the demand for artificial intelligence and analytics in defense. AI technologies are being leveraged to enhance the operational efficiency of defense forces by providing actionable insights, streamlining logistics, and improving the speed and accuracy of decision-making processes. Military operations today generate vast amounts of data from various sensors, surveillance systems, and intelligence sources. AI-powered systems can process and analyze this data in real-time, allowing defense forces to act quickly and with greater precision. These technologies also enable predictive capabilities, which can forecast potential threats or operational issues, giving military personnel more time to respond proactively. The integration of AI into military systems allows defense agencies to maximize the utility of their existing resources while minimizing inefficiencies. This drive for greater operational efficiency, coupled with the increasing complexity of defense environments, makes AI and analytics essential tools for modern defense forces.

Advancements in Autonomous Systems and Machine Learning:

The development of autonomous systems and machine learning technologies is a significant growth driver in the Europe Artificial Intelligence and Analytics in Defence market. Autonomous systems, such as drones and unmanned vehicles, are becoming an integral part of modern defense strategies due to their ability to operate in high-risk environments and perform tasks without direct human intervention. These systems rely on AI to navigate, collect data, and perform missions autonomously, enhancing the operational capabilities of defense forces. Furthermore, machine learning algorithms are being used to improve the performance of defense systems by enabling them to learn from past experiences and adapt to new conditions. This continuous learning process enhances the effectiveness of military operations, making AI-driven systems increasingly valuable in combat and reconnaissance missions. As technology continues to advance, the integration of autonomous systems and machine learning into defense operations is expected to grow, driving further demand for AI and analytics solutions.

Market Challenges

Integration with Legacy Systems:

One of the primary challenges facing the Europe Artificial Intelligence and Analytics in Defence market is the integration of AI technologies with legacy defense systems. Many European military forces rely on older platforms and equipment that were not designed with modern AI capabilities in mind. Integrating AI-driven solutions into these legacy systems requires significant investments in both time and resources. Additionally, there are challenges associated with ensuring that new AI systems are compatible with existing infrastructure, communication networks, and operational protocols. The need for seamless integration while maintaining the reliability and security of older systems adds complexity to the deployment of AI technologies in defense applications. This issue is particularly pronounced in countries with more established defense infrastructures, where upgrading or replacing legacy systems may be costly and logistically challenging. As a result, military agencies may face delays in adopting AI-driven solutions, hindering the speed of innovation in defense capabilities.

Data Privacy and Security Concerns:

The increasing reliance on AI and analytics in defense operations raises significant data privacy and security concerns, particularly regarding the vast amounts of sensitive information being processed. AI systems often require access to large datasets, including personal, military, and classified data, which poses risks in terms of data protection. In defense, where data breaches or cyberattacks could compromise national security, ensuring the confidentiality and integrity of data is critical. As AI and machine learning technologies become more integrated into military systems, the risk of cyber threats, hacking, and unauthorized access to sensitive information increases. The complexity of AI algorithms also presents challenges in ensuring that data privacy regulations are met while maintaining the effectiveness of defense operations. Addressing these security concerns requires continuous innovation in encryption, secure data storage, and cybersecurity measures, making data privacy and security a major challenge for the widespread adoption of AI in defense.

Opportunities

AI-driven Cyber Defense Solutions:

One of the significant opportunities in the Europe Artificial Intelligence and Analytics in Defence market is the development and deployment of AI-driven cybersecurity solutions. As cyber threats continue to evolve and become more sophisticated, traditional defense systems are increasingly inadequate at detecting and mitigating cyber-attacks. AI technologies can analyze network traffic in real-time, detect anomalies, and predict potential vulnerabilities, providing proactive defense against cyber threats. These AI-driven cybersecurity systems can also learn from past attacks and adapt to emerging threats, making them more effective than conventional solutions. The growing importance of cybersecurity in defense operations, combined with the increasing frequency of cyberattacks on military networks and infrastructure, makes AI-driven cybersecurity solutions essential. As defense agencies continue to strengthen their cyber defenses, the demand for AI-powered cybersecurity systems is expected to grow, creating significant market opportunities for AI technology providers.

Expansion of Autonomous Defense Systems:

Another key opportunity in the market is the expansion of autonomous defense systems, which leverage AI to perform a variety of functions, from reconnaissance to offensive operations. Autonomous vehicles, drones, and robots equipped with AI capabilities can operate in hazardous environments, reducing the risk to personnel while performing critical missions. These systems are increasingly being used for surveillance, reconnaissance, and combat operations, offering greater flexibility and efficiency than traditional manned systems. The ability of autonomous systems to gather real-time intelligence, make decisions on the battlefield, and even engage in combat provides a major advantage in modern military operations. As AI technology advances, the capabilities of autonomous defense systems will continue to improve, offering defense agencies more effective solutions to address security threats. The growing demand for autonomous systems in military operations presents a significant opportunity for companies that specialize in AI and autonomous technologies.

Future Outlook

The Europe Artificial Intelligence and Analytics in Defence market is set to experience robust growth over the next five years, driven by continued advancements in AI technologies and the growing need for enhanced defense capabilities. The market will benefit from increased adoption of AI-powered decision support systems, autonomous defense platforms, and cybersecurity solutions. As defense agencies prioritize modernization, the demand for AI and analytics solutions to improve operational efficiency, enhance security, and support strategic decision-making will continue to rise. Technological developments in AI and machine learning will further propel market growth, while regulatory support for defense innovation will encourage the integration of AI into military systems.

Major Players

- Thales Group

- BAE Systems

- Leonardo

- IBM

- Northrop Grumman

- Airbus Defence and Space

- General Dynamics

- Lockheed Martin

- SAIC

- Raytheon Technologies

- L3Harris Technologies

- Honeywell Aerospace

- Palantir Technologies

- Cisco Systems

- Booz Allen Hamilton

Key Target Audience

- Government Defense Agencies

- Military Forces

- AI Technology Providers

- Aerospace and Defense Contractors

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Technology Integration Companies

- Security and Surveillance Providers

Research Methodology

Step 1: Identification of Key Variables

Identify the key market variables, including technological advancements, defense budgets, and security threats, to ensure accurate and comprehensive market analysis.

Step 2: Market Analysis and Construction

Analyze data from primary and secondary sources, focusing on trends, consumer preferences, and market dynamics, to create a structured market model.

Step 3: Hypothesis Validation and Expert Consultation

Validate hypotheses by consulting with experts, military professionals, and technology providers to refine insights and improve the accuracy of the analysis.

Step 4: Research Synthesis and Final Output

Synthesize findings into a detailed report that offers actionable insights, forecasts, and strategic recommendations for stakeholders in the AI and defense sector.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for automation and AI in defense operations

Growing investment in cybersecurity and defense intelligence

Rising geopolitical tensions and need for advanced defense technologies - Market Challenges

High cost of AI system development and integration

Regulatory hurdles for deploying AI in defense

Complexity in ensuring interoperability between AI systems and legacy equipment - Market Opportunities

Expansion of AI-driven predictive maintenance solutions

Development of autonomous and semi-autonomous military platforms

Increasing demand for real-time battlefield analytics and decision support systems - Trends

Growing integration of machine learning algorithms in defense systems

Adoption of AI for cyber defense and threat detection

Rise in defense agencies adopting data analytics for strategic decision-making - Government regulations

AI ethics and regulatory frameworks in defense operations

National security-related certification standards

Export controls for AI technology in defense applications - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

AI-based Surveillance Systems

Predictive Maintenance Systems

Autonomous Defense Systems

Intelligence Processing Systems

Cybersecurity Analytics Systems - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Satellite Platforms

Unmanned Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Integrated Fitment

Custom Fitment

Modular Fitment - By End-User Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Intelligence Agencies

Private Security Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Leasing

Third-party Distributors

- Market Share Analysis

CrossComparison Parameters (System Type, Platform Type, Procurement Channel, End-User Segment, Fitment Type, Integration with Legacy Systems, AI Capabilities, Operational Lifespan, Training Requirements, Data Security Measures, Cost of Ownership, Maintenance Needs) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

Key Players

Boeing

Lockheed Martin

Thales Group

Northrop Grumman

General Dynamics

BAE Systems

Raytheon Technologies

Leonardo

L3 Technologies

Sikorsky Aircraft

Elbit Systems

Harris Corporation

Airbus

Israel Aerospace Industries

MITRE Corporation

- Military forces investing in AI for enhanced combat decision-making

- Government agencies integrating AI for intelligence gathering and cybersecurity

- Defense contractors focusing on providing AI-based solutions to armed forces

- Intelligence agencies using analytics for surveillance and threat detection

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035