Market Overview

The Europe Aviation Manufacturing market is currently valued at approximately USD ~ billion, with steady growth driven by advancements in aircraft production technologies and strong demand across both commercial and military sectors. Factors such as increasing investments in aerospace R&D, production capacity expansions, and strategic partnerships are fueling market growth. The demand for fuel-efficient, environmentally friendly aircraft and the expansion of global air travel further support the expansion of aviation manufacturing in the region.

Dominant countries in this sector include Germany, France, and the United Kingdom, with the industry mainly concentrated in their aerospace clusters. These nations possess well-established aerospace industries, bolstered by strong government backing and a skilled workforce. Regulatory frameworks, such as the European Union’s support for aviation innovations, also play a crucial role in driving the manufacturing capabilities in these countries.

Market Segmentation

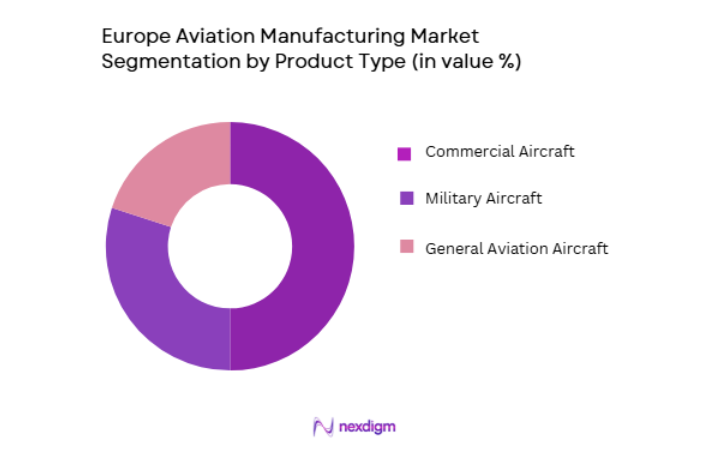

By Product Type

The Europe Aviation Manufacturing market is segmented by product type into commercial aircraft, military aircraft, and general aviation aircraft. Recently, the commercial aircraft sub-segment has a dominant market share, driven by the surge in global air traffic and the demand for new, efficient airliners. Leading aircraft manufacturers like Airbus and Boeing have capitalized on this demand, improving aircraft fuel efficiency and safety features, further enhancing their market position.

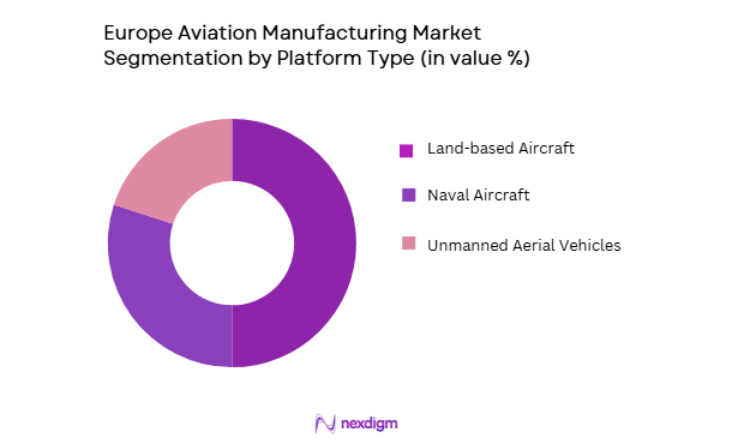

By Platform Type

The Europe Aviation Manufacturing market is also segmented by platform type into land-based aircraft, naval aircraft, and unmanned aerial vehicles (UAVs). The land-based aircraft sub-segment holds a significant market share due to continuous demand for commercial and military aircraft for both passenger and freight transport. As the demand for air travel increases, so does the need for more efficient and reliable land-based aircraft to accommodate this growth.

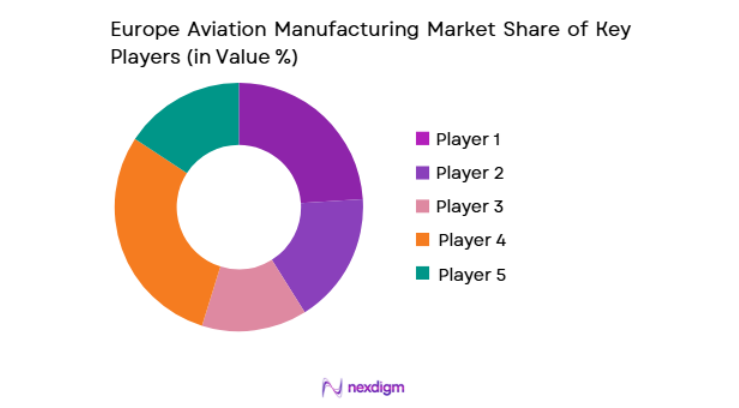

Competitive Landscape

The competitive landscape of the Europe Aviation Manufacturing market is characterized by high consolidation, with major players dominating the market. Leading companies are focusing on innovation, technological advancements, and strategic collaborations to enhance their market share. The presence of numerous players in the market has led to fierce competition, driving improvements in manufacturing capabilities and supply chain efficiency.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Europe Aviation Manufacturing Market Analysis

Growth Drivers

Increased Government Investment in Aerospace

Government investments in the aerospace sector have fueled significant growth in aviation manufacturing. Several European countries have strategically supported this industry, allocating funds for research and development, as well as fostering innovation in the aviation sector. Governments have partnered with key aerospace companies to support the development of next-generation, fuel-efficient aircraft, ensuring sustainable growth. Moreover, European governments are backing the aerospace industry to boost defense capabilities and secure strategic autonomy in military aircraft manufacturing, which directly impacts aviation manufacturing. As the demand for secure transportation increases, government funding to improve infrastructure and technologies has paved the way for robust market development. These investments help improve product development timelines and reduce the risk for manufacturers, allowing the market to expand further.

Technological Advancements in Manufacturing

The Europe Aviation Manufacturing market has benefitted from the continuous integration of advanced technologies in production. With the implementation of automation, AI, and the use of lightweight materials, manufacturers are producing more efficient and cost-effective aircraft. Innovations such as 3D printing for aircraft parts have significantly reduced production costs and time. These technological advancements have led to the creation of fuel-efficient engines, better aerodynamics, and aircraft with reduced carbon footprints. Automation also optimizes the supply chain, making the entire manufacturing process more streamlined and sustainable. These developments provide a competitive edge to the leading companies in Europe, allowing them to meet the increasing demand for new aircraft while adhering to environmental regulations. As technology evolves, these companies are positioning themselves to remain leaders in the global aviation market.

Market Challenges

Supply Chain Disruptions

The Europe Aviation Manufacturing market faces considerable challenges related to supply chain disruptions. The production of aircraft involves complex, multi-tiered supply chains that span across regions, with components being sourced from various suppliers worldwide. However, events such as the COVID-19 pandemic, geopolitical tensions, and disruptions in raw material availability have strained the efficiency of these supply chains. For instance, delays in the production of key components like engines and fuselage materials have slowed down aircraft manufacturing timelines. Additionally, shipping and transportation issues, alongside rising costs for materials, have further complicated the procurement of essential parts. The aviation industry’s reliance on timely deliveries and coordination has made it vulnerable to these disruptions, which ultimately affects the ability to meet market demand.

High Operational Costs

The high operational costs of aviation manufacturing pose a significant challenge to companies in the market. Manufacturing aircraft requires extensive investments in advanced machinery, skilled labor, and R&D to remain competitive. The need for continuous innovation, coupled with compliance with stringent environmental regulations, adds to the financial burden. Moreover, the development of next-generation aircraft, including those with advanced materials and propulsion systems, demands heavy capital expenditures. These high costs often lead to prolonged production timelines and increased prices for consumers. Furthermore, the high operating costs of aerospace firms can reduce profitability, particularly in the face of fluctuating global demand and increased competition. Managing these costs effectively is crucial for maintaining market share in a highly competitive environment.

Opportunities

Emerging Markets in Eastern Europe

Eastern Europe presents a promising opportunity for the Europe Aviation Manufacturing market. The region has witnessed significant growth in its aviation infrastructure, with several countries enhancing their air travel connectivity and investing in modernizing airports. As a result, there is an increased demand for both commercial and military aircraft in countries such as Poland, Hungary, and the Czech Republic. These nations are establishing themselves as key players in the aerospace supply chain, attracting foreign investments and partnerships. The growing air travel demand in Eastern Europe further supports the need for new aircraft and aviation manufacturing capabilities. By targeting these emerging markets, companies can capitalize on the rising demand for both commercial aircraft and defense-related aviation solutions, offering a substantial growth opportunity for the industry.

Advancements in Sustainable Aviation Technologies

The shift towards sustainable aviation presents a significant opportunity for manufacturers in the European market. With the European Union’s strong push for decarbonization and environmental sustainability, aviation companies are under pressure to develop cleaner technologies. The growing focus on electric and hybrid aircraft, alongside innovations in sustainable fuel, is set to revolutionize the industry. By adopting green manufacturing practices and eco-friendly technologies, companies can cater to both regulatory demands and consumer preferences for low-emission travel. This trend not only helps companies meet environmental standards but also positions them as leaders in the eco-conscious aviation sector. The global focus on sustainability is expected to drive the development and manufacturing of next-generation aircraft, contributing to long-term market growth.

Future Outlook

Over the next five years, the Europe Aviation Manufacturing market is poised for significant growth, driven by advancements in technology, an increasing focus on sustainability, and expanding aerospace infrastructure across Europe. The continued rise in air travel, coupled with a strong push for greener aircraft solutions, is expected to propel demand for innovative, fuel-efficient aircraft. Additionally, the growth of unmanned aerial systems (UAS) and military aircraft will play a pivotal role in shaping market dynamics. Strong governmental support for aerospace innovations, coupled with regulatory initiatives for sustainable aviation, will further encourage market expansion. As the industry embraces new manufacturing techniques and improves its operational efficiency, it is expected to witness a steady upward trajectory.

Major Players

- Airbus

- Boeing

- Rolls-Royce

- Leonardo

- Safran

- Thales Group

- Lockheed Martin

- General Electric Aviation

- Northrop Grumman

- Raytheon Technologies

- Saab Group

- Bombardier

- Dassault Aviation

- Embraer

- Pratt & Whitney

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- Aviation OEMs

- Commercial airlines

- Airport operators

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

Identifying critical factors that influence the market, including technological advancements, regulatory frameworks, and market demand dynamics.

Step 2: Market Analysis and Construction

Evaluating market size, historical data, and segmentation to build a comprehensive market model, including demand drivers and constraints.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses through expert interviews, industry reports, and consultation with key stakeholders to ensure accuracy in predictions.

Step 4: Research Synthesis and Final Output

Synthesis of findings into a cohesive report, ensuring a detailed and actionable analysis based on data validation and expert feedback.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Aircraft Manufacturing

Increasing Demand for Sustainable Aviation Solutions

Government Support for Aerospace R&D - Market Challenges

High Cost of Aircraft Manufacturing

Stringent Regulatory Standards

Supply Chain Disruptions and Component Shortages - Market Opportunities

Rise in Demand for Electric Aircraft

Growth in Military Aircraft Modernization

Technological Innovations in Autonomous Flight Systems - Trends

Increasing Adoption of Smart Manufacturing Technologies

Surge in Aircraft Electrification

Growth of 3D Printing in Aerospace Production - Government regulations

- SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Aircraft Components

Aircraft Assemblies

Avionics Systems

Landing Gear Systems

Engine Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

Drones

Business Jets - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

MRO Services

Retrofit Systems

Upgrade Systems - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Government Defense Agencies

Aerospace Contractors

Freight Companies - By Procurement Channel (In Value%)

Direct Procurement

Tender-based Procurement

Distribution through Dealers

Third-party Platforms

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technological Advancements, Geographic Presence, Product Quality, Regulatory Compliance, Sustainability Initiatives)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Rolls-Royce

Safran

GE Aviation

Thales

Honeywell Aerospace

Lockheed Martin

Northrop Grumman

Leonardo

MTU Aero Engines

Dassault Aviation

General Electric

Pratt & Whitney

Collins Aerospace

- Airlines Increasing Investment in Modern Aircraft

- Aerospace Contractors Focusing on Production Efficiency

- Government Defense Agencies Expanding Aircraft Fleet

- Freight Companies Upgrading Cargo Aircraft

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035