Market Overview

The Europe Aviation market is valued at approximately USD ~ billion, driven by a strong demand for both commercial and military aircraft. This growth is supported by advancements in aircraft technology, increased air travel, and investments in aviation infrastructure. The market is fueled by a recovery in post-pandemic air travel, government funding, and the continuous push for greener technologies and sustainability initiatives in aviation.

Countries such as Germany, the United Kingdom, and France dominate the Europe Aviation market, supported by well-established aerospace industries and robust manufacturing capabilities. These nations are home to some of the largest aircraft manufacturers in the world, such as Airbus and Rolls-Royce. The region’s dominance is bolstered by strong government policies, a skilled workforce, and a long history of aerospace innovation, making these countries key players in both commercial and military aviation markets.

Market Segmentation

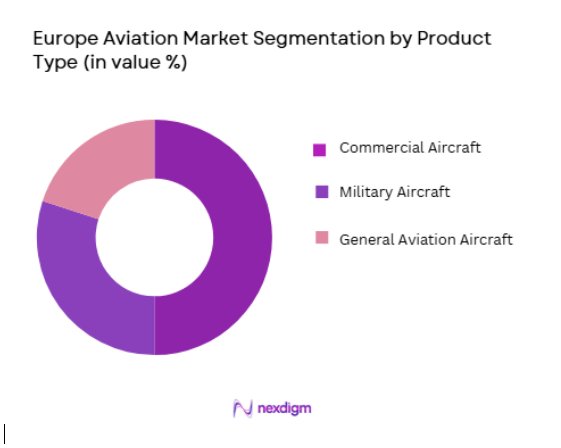

By Product Type:

The Europe Aviation market is segmented by product type into commercial aircraft, military aircraft, and general aviation aircraft. Recently, the commercial aircraft sub-segment has seen dominant market share due to the surge in global air travel and the demand for new, efficient aircraft. The increase in international air travel and the expansion of low-cost carriers has driven airlines to invest in fuel-efficient aircraft, further strengthening the commercial aircraft segment’s position in the market.

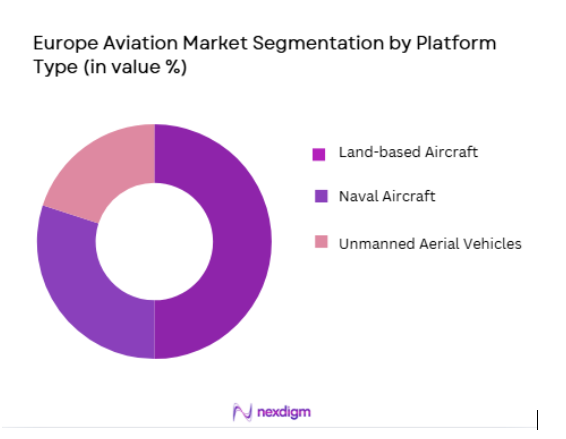

By Platform Type:

The Europe Aviation market is also segmented by platform type into land-based aircraft, naval aircraft, and unmanned aerial vehicles (UAVs). The land-based aircraft sub-segment holds a significant market share due to the constant demand for commercial passenger planes and freight transport aircraft. This segment benefits from the growing air travel demand, as well as the need for more efficient, fuel-saving aircraft, particularly as climate change becomes an increasingly urgent issue for the aviation industry.

Competitive Landscape

The Europe Aviation market is highly competitive, with several established players leading the industry. Companies like Airbus, Rolls-Royce, and Leonardo play a significant role in both commercial and military aviation, investing heavily in R&D to stay ahead of competitors. Mergers and acquisitions in the sector have also contributed to consolidation, creating larger companies that are better equipped to handle industry challenges. The competition is driven by factors such as technological advancements, production capacity, and strategic partnerships.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

Europe Aviation Market Analysis

Growth Drivers

Technological Advancements in Aircraft Manufacturing:

Technological advancements have been a major growth driver for the Europe Aviation market. The development of more fuel-efficient engines, the use of lightweight materials, and the implementation of AI and automation in manufacturing processes have transformed the industry. The increasing focus on reducing carbon emissions has spurred innovations such as hybrid-electric aircraft and sustainable aviation fuel (SAF). The ability to manufacture aircraft with better fuel efficiency and lower environmental impact has increased demand for modern, eco-friendly aircraft. Furthermore, technological developments have improved aircraft safety, reliability, and overall performance, encouraging operators to invest in newer models to replace older, less efficient aircraft. The continuous advancement in manufacturing technologies, such as 3D printing for aircraft parts, has also helped reduce production costs and timelines, making it an attractive prospect for both manufacturers and consumers.

Increased Government Investments in Aviation Infrastructure:

Government investment in aviation infrastructure has significantly boosted the Europe Aviation market. Several European governments have allocated funds for the modernization of airports, expansion of airspace management systems, and the development of new air traffic control technologies. In addition to infrastructure improvements, governments have also supported aerospace manufacturers through subsidies and research funding aimed at encouraging innovation in the aviation sector. These investments have helped streamline the manufacturing process, reduce costs, and foster collaboration between private companies and public entities. Moreover, governments are increasingly focused on sustainable aviation, with policies supporting the development of cleaner technologies and alternative fuels, further driving the demand for next-generation aircraft. The combination of strong government backing and the push for innovation has made the Europe Aviation market more attractive for both new and existing players in the industry.

Market Challenges

Supply Chain Disruptions:

One of the major challenges faced by the Europe Aviation market is supply chain disruptions. The manufacturing of aircraft involves complex and intricate supply chains, with parts sourced from multiple suppliers across different regions. However, disruptions caused by factors such as the COVID-19 pandemic, natural disasters, and geopolitical tensions have led to delays in production timelines. These delays affect the ability of manufacturers to meet growing demand for aircraft and parts. Moreover, the ongoing shortage of semiconductor chips has had a significant impact on aviation production, leading to the delay of several aircraft models and components. Manufacturers have been forced to look for alternative suppliers or modify designs to mitigate these disruptions, further increasing costs. These supply chain challenges are likely to continue as the global economy recovers, making it imperative for manufacturers to diversify their supply chains and adopt more resilient strategies.

High Operational Costs in Aircraft Manufacturing:

High operational costs are another significant challenge in the Europe Aviation market. The aviation manufacturing industry requires substantial investments in both human and capital resources. The cost of raw materials, such as high-strength composites, advanced alloys, and rare metals, has risen in recent years, impacting manufacturers’ bottom lines. Additionally, the highly skilled workforce required to design and build complex aircraft is costly to maintain. The development of new aircraft technologies, such as electric engines and autonomous systems, requires heavy R&D expenditure, adding to the overall operational costs. To remain competitive, manufacturers must balance the need for innovation with the high costs of production, often leading to delays and budget overruns. These high costs can deter smaller players from entering the market and make it challenging for established players to maintain profitability, especially when market demand fluctuates.

Opportunities

Emerging Markets in Eastern Europe:

Eastern Europe represents a significant opportunity for the Europe Aviation market. The region is undergoing rapid modernization, with increasing demand for both commercial and military aircraft. Countries like Poland, Hungary, and Romania are investing in their aviation infrastructure, upgrading airports, and expanding their airline fleets. This growth is spurred by the rising middle class, increasing disposable incomes, and a greater desire for international travel. Eastern Europe’s proximity to Western Europe also positions it as an ideal location for aircraft manufacturing and assembly. As the demand for air travel and defense solutions increases, these countries present an untapped market for aircraft manufacturers. By targeting these emerging markets, companies can benefit from increased demand and potentially lower production costs due to favorable labor conditions and government incentives.

Sustainable Aviation and Green Technologies:

The growing focus on sustainability presents a valuable opportunity for companies in the Europe Aviation market. With the European Union’s emphasis on reducing carbon emissions and adopting green technologies, there is a growing demand for sustainable aviation solutions. Manufacturers are investing in the development of electric and hybrid-electric aircraft, as well as alternative fuels such as sustainable aviation fuel (SAF) to meet these regulatory requirements. The shift towards eco-friendly aviation not only addresses environmental concerns but also provides a competitive edge to companies that prioritize sustainable manufacturing processes. As the aviation industry seeks to reduce its carbon footprint, the demand for green technologies and sustainable solutions will continue to drive growth in the market, opening up new avenues for innovation and investment.

Future Outlook

The future outlook for the Europe Aviation market is positive, with significant growth expected over the next five years. Technological advancements, particularly in sustainable aviation, will continue to drive the demand for next-generation aircraft. The increasing focus on decarbonization and government incentives for green technologies will fuel the development of eco-friendly aviation solutions. Additionally, the growth of emerging markets in Eastern Europe will contribute to higher demand for both commercial and military aircraft. As the industry adapts to evolving environmental and technological trends, the Europe Aviation market is poised for continued expansion, supported by strategic investments and innovations in manufacturing.

Major Players

- Airbus

- Boeing

- Rolls-Royce

- Leonardo

- Safran

- Thales Group

- Lockheed Martin

- General Electric Aviation

- Northrop Grumman

- Raytheon Technologies

- Saab Group

- Bombardier

- Dassault Aviation

- Embraer

- Pratt & Whitney

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace manufacturers

- Defense contractors

- Aviation OEMs

- Commercial airlines

- Airport operators

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

Identification of key variables, including technological trends, market dynamics, and regulatory factors, that influence the Europe Aviation market.

Step 2: Market Analysis and Construction

Comprehensive analysis of the market size, historical growth patterns, and segmentation to build a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts and validation of hypotheses through interviews, secondary research, and feedback.

Step 4: Research Synthesis and Final Output

Synthesis of collected data into a final report, ensuring accuracy, consistency, and actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Aircraft Manufacturing

Rising Demand for Sustainable Aviation

Increase in Military and Defense Spending - Market Challenges

High Production Costs

Stringent Regulatory Compliance

Supply Chain Disruptions - Market Opportunities

Growth in Electric Aircraft

Development of Autonomous Flight Technologies

Increase in Aerospace Modernization Projects - Trends

Emerging Trends in Sustainable Aviation

Integration of AI in Aircraft Systems

Increased Adoption of 3D Printing in Aircraft Manufacturing - Government regulations

Aviation Emissions Reduction Regulations

Aircraft Safety and Certification Standards

Government Initiatives for Aerospace R&D - SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft Engines

Flight Control Systems

Avionics

Landing Gear Systems

Cabin Systems - By Platform Type (In Value%)

Commercial Aircraft

Military Aircraft

Helicopters

Business Jets

Drones - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

MRO Services

Upgrade Solutions

Retrofit Systems - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Military Defense Forces

Freight and Cargo Operators

Private Aircraft Owners - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Procurement

Distributors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Market Share, Technological Innovation, Geographic Reach, Product Quality, Regulatory Compliance, Sustainability Practices, Customer Support, R&D Investment, Manufacturing Efficiency, Pricing Strategy)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Boeing

Rolls-Royce

GE Aviation

Safran

Thales

Honeywell Aerospace

Leonardo

Northrop Grumman

Raytheon Technologies

Collins Aerospace

L3 Technologies

Pratt & Whitney

Bae Systems

Lockheed Martin

- Increased Fleet Modernization in Airlines

- Growing Focus on Cybersecurity in Aircraft Systems

- Defense Agencies Expanding Aircraft Procurement

- Private Owners Seeking Premium Aircraft Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform ,2026-2035