Market Overview

The Europe Business Jet market is valued at approximately USD ~ billion, driven by increasing demand from both private and corporate users for fast, flexible, and comfortable air travel. Growth in high-net-worth individuals, corporate travel, and leisure flights is propelling the demand for business jets. Additionally, advancements in jet technology, fuel efficiency, and customizations to meet specific customer needs have boosted market potential.

Countries such as the United Kingdom, Germany, and France dominate the Europe Business Jet market, with well-established aviation industries, infrastructure, and strong financial hubs. These nations have seen consistent investments in aircraft manufacturing, maintenance, and private aviation services. Their strategic geographic locations, regulatory frameworks, and economic stability have helped these countries maintain dominance in business aviation across Europe.

Market Segmentation

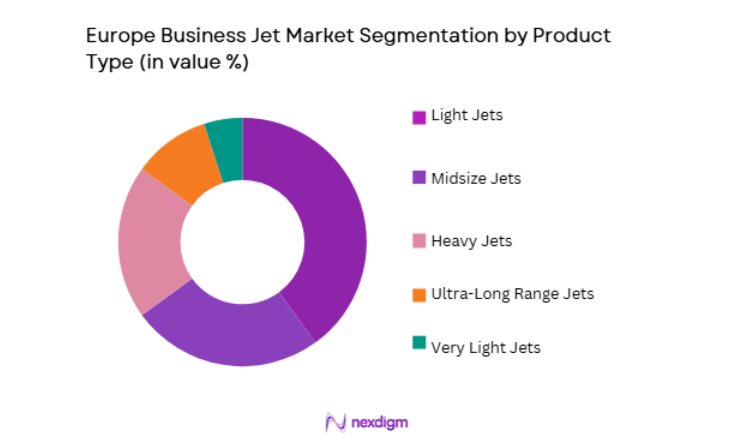

By Product Type

The Europe Business Jet market is segmented by product type into light jets, midsize jets, heavy jets, ultra-long-range jets, and very light jets. The light jet sub-segment has a dominant market share, primarily driven by the growing number of small businesses and entrepreneurs seeking flexible, cost-effective travel solutions. Light jets are more affordable compared to their larger counterparts and offer sufficient range for short to medium-distance travel, making them highly attractive to smaller firms, executives, and private owners. This accessibility, combined with improved fuel efficiency and performance, continues to expand the adoption of light jets in the European market.

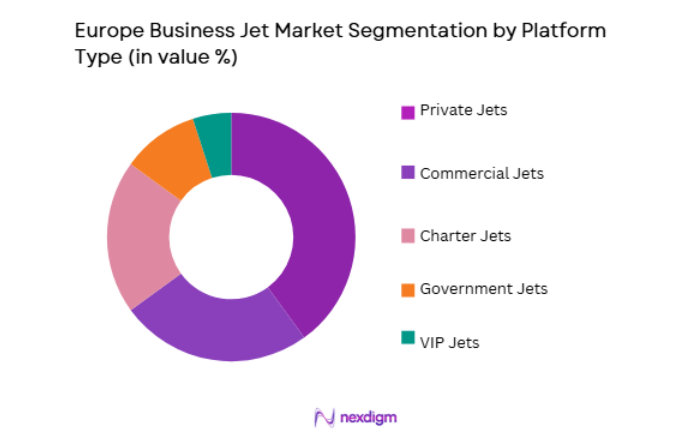

By Platform Type

The Europe Business Jet market is also segmented by platform type into private jets, commercial jets, charter jets, government jets, and VIP jets. Private jets dominate the market due to the increasing number of high-net-worth individuals and corporate leaders opting for private air travel to save time, avoid crowded airports, and enjoy customized services. The growing preference for luxury, comfort, and privacy, combined with the ease of access to business jet ownership or leasing, further bolsters the demand for private jets across Europe.

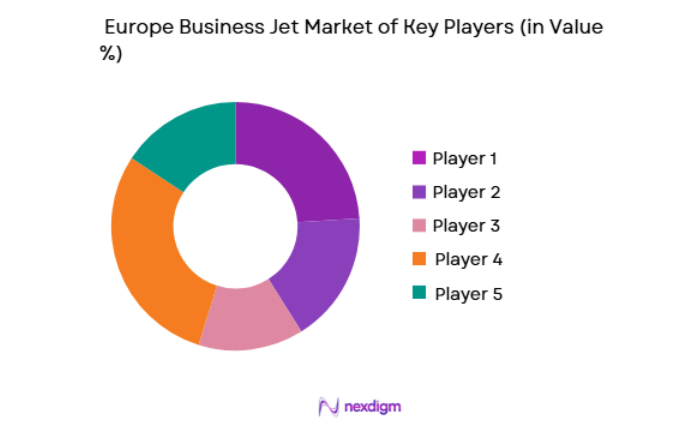

Competitive Landscape

The Europe Business Jet market is highly competitive, with a mix of established manufacturers and new entrants offering innovative solutions. Leading players are focusing on technological advancements, luxury customization, and fuel efficiency to maintain market leadership. Strong demand from private and corporate clients, along with increasing interest in sustainable aviation technologies, is further intensifying competition. Consolidation is also evident, as companies merge and acquire smaller firms to enhance their product portfolios and expand their reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Gulfstream Aerospace | 1958 | Savannah, USA | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Montreal, Canada | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | São Paulo, Brazil | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 1923 | Wichita, USA | ~ | ~ | ~ | ~ | ~ |

Europe Business Jet Market Analysis

Growth Drivers

Rising Demand for Luxury Air Travel

The demand for luxury air travel continues to drive growth in the Europe Business Jet market. High-net-worth individuals, corporate executives, and government leaders seek business jets for their convenience, privacy, and personalized services. As the global economy strengthens and personal wealth rises, the desire for time-saving and comfortable travel solutions has increased. Furthermore, these individuals value the ability to travel on their own schedules, reducing the hassle of commercial air travel. This has led to an increase in jet ownership and chartering, creating a robust market for business jets in Europe. With improvements in jet design, fuel efficiency, and the availability of leasing options, business jets have become more accessible to a wider range of customers, further driving demand.

Technological Advancements in Jet Design

Technological advancements in business jet design have been a key driver in the market. Manufacturers are continuously innovating to improve fuel efficiency, reduce emissions, enhance speed, and increase cabin comfort. For instance, the introduction of composite materials, new engine technologies, and advanced aerodynamics has resulted in lighter, more efficient, and faster jets. Additionally, cabin technology such as improved Wi-Fi connectivity, better noise reduction systems, and enhanced interior layouts has made business jets more attractive to corporate and private owners. These technological innovations have not only increased the appeal of business jets but have also contributed to the reduction in operational costs, making ownership and leasing more viable for a broader customer base.

Market Challenges

High Operational and Maintenance Costs

A significant challenge faced by the Europe Business Jet market is the high operational and maintenance costs associated with owning and operating business jets. These costs include fuel, maintenance, insurance, and crew salaries, which can be substantial, particularly for smaller businesses or individuals with limited budgets. Additionally, maintaining a fleet of aircraft requires specialized expertise and facilities, increasing operational costs. For companies that provide charter services or manage corporate fleets, these high expenses can limit profitability and growth. While there are leasing and fractional ownership options, the costs involved still present a barrier to entry for some potential customers. Managing these costs effectively is a critical challenge for both manufacturers and operators in the business jet market.

Regulatory Compliance and Certification Challenges

The regulatory environment governing business jets is another challenge for the market. In Europe, aviation regulations are governed by the European Union Aviation Safety Agency (EASA), which imposes stringent safety, operational, and environmental standards. These regulations require business jet manufacturers to comply with various safety certifications, which can add to the time and cost of aircraft production. Additionally, operators must meet certain requirements for crew training, maintenance procedures, and environmental impact, which can be burdensome. As new technologies, such as electric and hybrid aircraft, emerge, ensuring they meet these regulations will also require significant investment in research and development. Navigating these regulatory frameworks remains a challenge for manufacturers and operators.

Opportunities

Expansion of Air Charter Services

The expansion of air charter services presents a significant opportunity for the Europe Business Jet market. Many companies and high-net-worth individuals are opting for charter services instead of purchasing their own jets due to the flexibility, cost-effectiveness, and convenience it offers. Charter services allow clients to access a wide range of aircraft types without the capital investment and operational overhead of ownership. As demand for business travel continues to grow, especially for short- and medium-range flights, charter companies are seeing increased bookings. Furthermore, technological advances in booking platforms and flight management systems have made charter services more accessible and efficient, attracting new customers and expanding the market.

Sustainable Aviation Technologies

The growing focus on sustainability in aviation presents a significant opportunity for the Europe Business Jet market. The European Union has set ambitious goals for reducing carbon emissions, and as a result, there is increasing demand for eco-friendly aviation solutions. Business jet manufacturers are investing in the development of electric and hybrid-electric aircraft, which promise to reduce environmental impact and operational costs. Additionally, the use of sustainable aviation fuels (SAF) and other green technologies is becoming more prevalent. These innovations not only help businesses comply with environmental regulations but also appeal to eco-conscious customers. As sustainability becomes a more prominent factor in consumer decision-making, companies that can provide green alternatives will gain a competitive edge in the market.

Future Outlook

The future outlook for the Europe Business Jet market is optimistic, with continued growth expected in the next five years. Technological advancements, particularly in sustainable aviation, will play a pivotal role in driving the demand for more efficient and eco-friendly business jets. Additionally, the expansion of charter services, particularly in emerging markets, will provide a boost to the market. Governments’ supportive policies for green technologies and private aviation, along with increasing demand for luxury travel, will further contribute to the growth of the market. With these factors in play, the Europe Business Jet market is poised for a positive trajectory, offering significant opportunities for both manufacturers and operators.

Major Players

- Gulfstream Aerospace

- Dassault Aviation

- Bombardier

- Embraer

- Textron Aviation

- Honda Aircraft

- Piaggio Aerospace

- Pilatus Aircraft

- Cessna

- Falcon Aviation

- Flexjet

- NetJets

- VistaJet

- Bombardier Flexjet

- Monarch Air Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Private jet owners

- Business aviation service providers

- Aircraft manufacturers

- Charter service providers

- Aviation industry consultants

- Aviation technology developers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables influencing the Europe Business Jet market, including technological trends, regulatory influences, and customer demand patterns.

Step 2: Market Analysis and Construction

Comprehensive analysis of historical data, market size, and trends to build an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts and key stakeholders to validate the hypotheses and ensure the accuracy of the market model.

Step 4: Research Synthesis and Final Output

Synthesis of findings into a final actionable report, ensuring clarity, accuracy, and relevance.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Luxury Air Travel

Increased Global Corporate Travel

Advancements in Aircraft Technology - Market Challenges

High Operational and Maintenance Costs

Stringent Regulatory Compliance

Fluctuations in Fuel Prices - Market Opportunities

Expanding Air Travel in Emerging Markets

Increase in Charter Services Demand

Adoption of Sustainable Aviation Technologies - Trends

Growing Popularity of Air Taxi Services

Increasing Use of Electric Aircraft

Enhanced Connectivity in Business Jets - Government regulations

- SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Light Jets

Midsize Jets

Heavy Jets

Very Light Jets

Ultra-Long Range Jets - By Platform Type (In Value%)

Private Jets

Commercial Jets

Charter Jets

Government Jets

VIP Jets - By Fitment Type (In Value%)

OEM Jets

Refurbished Jets

Custom-Designed Jets

Luxury Jets

Specialized Jets - By EndUser Segment (In Value%)

Corporate Executives

Private Owners

Government Organizations

Charter Companies

Aviation Service Providers - By Procurement Channel (In Value%)

Direct Purchases

Aircraft Leasing

Brokered Sales

Auction Sales

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Market Share, Technological Innovation, Geographic Coverage, Product Reliability, Regulatory Compliance, Integration Capabilities, Cost Efficiency, R&D Investment, Customer Support, Environmental Impact)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Dassault Aviation

Bombardier

Gulfstream Aerospace

Embraer

Textron Aviation

Honda Aircraft Company

Airbus Corporate Jets

Beechcraft

Piaggio Aerospace

Cessna

Global Jet

Flexjet

Lufthansa Technik

Pilatus Aircraft

Aerion Supersonic

- Corporate Executives Seeking Time Efficiency

- Private Owners Seeking Flexibility and Privacy

- Government Organizations Focusing on Security and Prestige

- Charter Companies Expanding Fleet for Growing Demand

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035