Market Overview

The Europe Commercial Aircraft Cabin Interior market is valued at approximately USD ~ billion, driven by the increasing demand for passenger comfort and safety in the aviation industry. The growing focus on enhancing the passenger experience, coupled with advancements in cabin technology, has led to the expansion of this market. Airlines are investing in modern cabin designs, improved seating, lighting systems, and in-flight entertainment solutions to attract more passengers and differentiate their services.

Countries such as Germany, France, and the United Kingdom dominate the Europe Commercial Aircraft Cabin Interior market due to their strong aviation sectors, with major aircraft manufacturers like Airbus located in the region. These countries lead the market due to their large number of airlines, which continuously upgrade their fleets to meet passenger expectations for higher comfort and more innovative features. Additionally, regulatory frameworks in these countries foster the adoption of new technologies and materials in aircraft cabins.

Market Segmentation

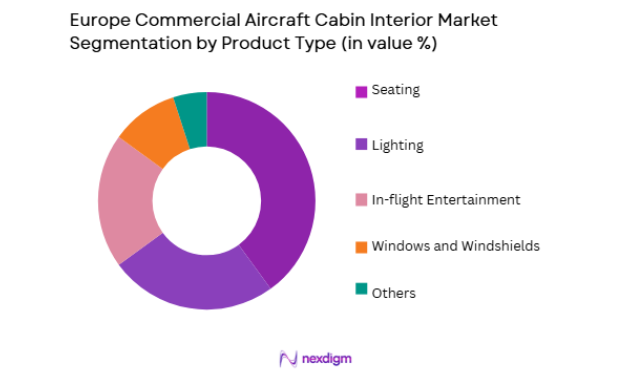

By Product Type

The Europe Commercial Aircraft Cabin Interior market is segmented by product type into seating, lighting, in-flight entertainment, windows and windshields, and others. The seating sub-segment has a dominant market share, driven by the continuous demand for more comfortable and customizable seating options in both economy and premium classes. With increasing competition among airlines, the demand for seating solutions that provide greater comfort, adjustability, and space efficiency is rising. Furthermore, airlines are adopting new materials and technologies to enhance the durability and weight efficiency of seats, contributing to the growth of this sub-segment.

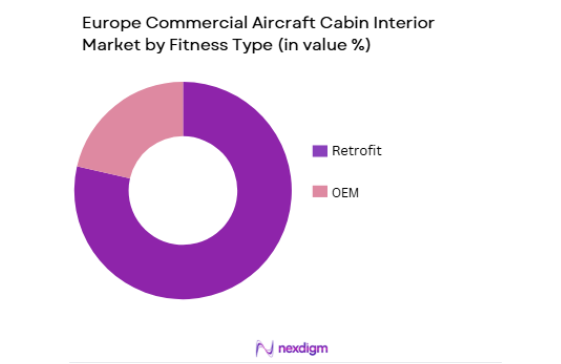

By Fitment Type

The Europe Commercial Aircraft Cabin Interior market is also segmented by fitment type into OEM (Original Equipment Manufacturer) and retrofit. The OEM sub-segment dominates the market due to airlines’ preference for equipping their newly manufactured aircraft with the latest cabin interior designs and technologies. The demand for modern, high-tech, and efficient cabins in new aircraft has increased, particularly with the rise of long-haul flights and luxury services. OEMs offer customized solutions to meet the specific requirements of airlines, contributing to their dominance in the market.

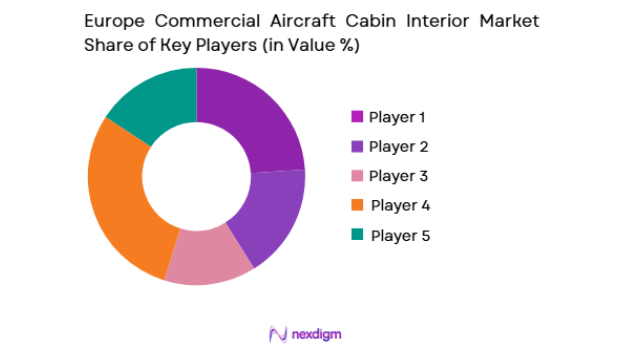

Competitive Landscape

The Europe Commercial Aircraft Cabin Interior market is highly competitive, with a few large players dominating the industry. These companies focus on providing innovative, high-quality cabin interior products to airlines. The market is characterized by technological advancements, such as the integration of smart lighting, seat designs, and advanced in-flight entertainment systems, driving intense competition. Consolidation is also occurring, with key players merging or forming partnerships to broaden their product offerings and expand their market reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Zodiac Aerospace | 1896 | Plaisir, France | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1906 | Schwaebisch Hall, Germany | ~ | ~ | ~ | ~ | ~ |

| Diehl Aerosystems | 1902 | Nuremberg, Germany | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| B/E Aerospace | 1987 | Wellington, USA | ~ | ~ | ~ | ~ | ~ |

Europe Commercial Aircraft Cabin Interior Market Analysis

Growth Drivers

Increased Focus on Passenger Experience

The growing emphasis on passenger experience is a key growth driver for the Europe Commercial Aircraft Cabin Interior market. Airlines are recognizing the importance of enhancing the travel experience to attract and retain passengers. As a result, there is a rising demand for more comfortable and advanced cabin interiors that offer better seating, in-flight entertainment, and improved lighting. Airlines are upgrading their aircraft with modern interiors to improve customer satisfaction and differentiate their services in a highly competitive industry. Innovations such as mood lighting, high-tech seating, and advanced entertainment systems are increasingly becoming standard offerings in both economy and premium cabins. Additionally, the introduction of more spacious cabins with features such as lie-flat beds in business class and larger overhead bins for carry-on luggage is contributing to passenger comfort, further driving the market.

Technological Advancements in Cabin Design

The continuous technological advancements in cabin design have played a significant role in shaping the Europe Commercial Aircraft Cabin Interior market. With the integration of lightweight materials, advanced seating technologies, and energy-efficient lighting systems, cabin interiors are becoming more efficient, sustainable, and comfortable. Airlines are adopting new materials such as composites to reduce the weight of aircraft interiors, which contributes to fuel savings and better overall aircraft performance. Furthermore, the implementation of smart systems for controlling lighting, temperature, and seat configurations has improved the passenger experience. The growing use of augmented reality (AR) and virtual reality (VR) for in-flight entertainment is another technological advancement that is gaining traction in cabin designs. These technologies not only improve passenger satisfaction but also help airlines reduce operational costs, contributing to the growth of the market.

Market Challenges

High Cost of Cabin Interior Upgrades

One of the key challenges faced by the Europe Commercial Aircraft Cabin Interior market is the high cost associated with upgrading cabin interiors. Airlines must balance the need for improved passenger comfort with the significant capital required to retrofit or install new interiors. For legacy airlines with older fleets, the cost of replacing seats, upgrading lighting systems, and implementing in-flight entertainment systems can be prohibitively expensive. Additionally, the need for frequent maintenance and repair of high-tech systems further raises the operational costs. While passengers increasingly demand high-end cabins, the financial burden of providing these amenities remains a challenge for many carriers, particularly smaller airlines and those with limited budgets. This challenge may slow down the pace of cabin interior upgrades and create barriers to market entry for new players.

Regulatory and Safety Compliance

Compliance with stringent aviation safety standards and regulations is another challenge in the Europe Commercial Aircraft Cabin Interior market. Cabin interior designs must meet specific safety standards set by regulatory bodies such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA). This includes the use of fire-retardant materials, seat strength requirements, and emergency evacuation procedures. Ensuring that new cabin designs comply with these regulations can add time and cost to the manufacturing and installation process. Additionally, as new technologies, such as electric seat motors or integrated lighting systems, are introduced, ensuring compliance with evolving safety standards can be challenging for manufacturers. Regulatory hurdles can delay the rollout of new cabin technologies, affecting the overall market growth.

Opportunities

Sustainability and Eco-friendly Designs

The increasing focus on sustainability presents significant opportunities for the Europe Commercial Aircraft Cabin Interior market. Airlines and manufacturers are investing in eco-friendly cabin interior materials and systems that reduce carbon footprints. The use of sustainable materials, such as biodegradable seat covers and energy-efficient lighting, is gaining traction as part of the aviation industry’s push towards sustainability. Additionally, the growing demand for more energy-efficient cabin interiors is leading to innovations such as LED lighting systems and the adoption of lighter materials to reduce fuel consumption. Airlines that can offer environmentally friendly cabins not only meet regulatory requirements but also cater to the rising number of eco-conscious travelers. As sustainability continues to be a major driver in the aviation sector, there will be increasing opportunities for manufacturers to provide sustainable cabin interior solutions.

Expansion of Low-Cost Carriers in Europe

The growth of low-cost carriers (LCCs) in Europe presents an opportunity for the Europe Commercial Aircraft Cabin Interior market. As LCCs expand their fleets and offer more affordable travel options, there is a rising demand for cost-effective yet functional cabin interiors. While LCCs typically operate on thinner profit margins, they are still investing in cabin upgrades to improve the passenger experience and stay competitive. Manufacturers are responding by providing low-cost yet high-quality cabin solutions that balance passenger comfort with operational efficiency. For example, lighter seating solutions and compact in-flight entertainment systems are being introduced to suit the needs of budget carriers. As the LCC segment continues to grow, particularly in emerging European markets, the demand for innovative cabin interior solutions will rise, presenting opportunities for suppliers to enter this segment.

Future Outlook

The future outlook for the Europe Commercial Aircraft Cabin Interior market is favorable, with continued growth expected in the next five years. Technological advancements in cabin design, sustainability, and passenger comfort will drive demand for more innovative and cost-effective cabin solutions. Airlines will continue to prioritize passenger experience while managing operational costs, contributing to the rise of advanced cabin designs. Additionally, the expanding low-cost carrier segment and the increasing focus on eco-friendly materials will shape the market dynamics. Regulatory support for sustainable aviation will further enhance market growth, creating opportunities for both new entrants and established players in the cabin interior market.

Major Players

- Zodiac Aerospace

- Recaro Aircraft Seating

- Diehl Aerosystems

- Airbus

- B/E Aerospace

- Honeywell International

- Lufthansa Technik

- Thales Group

- Rockwell Collins

- Safran

- Panasonic Avionics

- Collins Aerospace

- MHIRJ

- FACC AG

- EADS

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Commercial aircraft manufacturers

- Airlines and airline operators

- Aircraft interior solution providers

- Aviation technology developers

- Aerospace R&D companies

- Aircraft leasing companies

Research Methodology

Step 1: Identification of Key Variables

Identification of the key variables influencing the Europe Commercial Aircraft Cabin Interior market, including technological advancements, regulatory frameworks, and customer demand.

Step 2: Market Analysis and Construction

Comprehensive market analysis based on historical data, segmentation, and growth trends to build an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Consultation with industry experts, stakeholders, and key players to validate hypotheses and ensure data accuracy.

Step 4: Research Synthesis and Final Output

Synthesis of the research findings into a comprehensive and actionable report, ensuring clarity and precision.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Air Travel Demand and Passenger Expectations

Technological Advancements in Cabin Comfort

Focus on Sustainability and Fuel Efficiency - Market Challenges

High Manufacturing Costs and Supply Chain Issues

Regulatory and Certification Compliance

Customization Challenges and Lead Time Delays - Market Opportunities

Growth in Eco-friendly and Sustainable Cabin Interiors

Increase in Aircraft Modernization and Refurbishment Projects

Demand for High-tech and Smart Cabin Features - Trends

Integration of IoT and Smart Technologies in Cabin Interiors

Shift Towards More Comfortable and Spacious Cabin Designs

Increased Focus on Cabin Health and Hygiene Solutions - Government regulations

- SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Seating Systems

Lighting Systems

Lavatory Systems

Cabin Management Systems

Cargo & Storage Systems - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Jets

Freighters - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

Upgrades & Refurbishments

Modular Systems

Custom-designed Interiors - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Maintenance, Repair & Overhaul (MRO) Providers

Private Aircraft Operators

Freight Operators - By Procurement Channel (In Value%)

Direct Procurement

Online Procurement Platforms

Third-party Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technological Innovation, Sustainability Initiatives, Customization Flexibility, Manufacturing Lead Times)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Zodiac Aerospace

Recaro Aircraft Seating

Diehl Aviation

Honeywell Aerospace

Safran

Collins Aerospace

Panasonic Avionics

Thales Group

Airbus Interiors

Boeing Commercial Airplanes

GKN Aerospace

Lufthansa Technik

UTC Aerospace Systems

Satair Group

FACC AG

- Airlines’ Demand for Enhanced Passenger Experience

- Aircraft Manufacturers’ Focus on Lightweight and Durable Materials

- MRO Providers Upgrading Cabin Systems for Efficiency

- Private Operators Seeking Customizable and Luxurious Interiors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035