Market Overview

The Europe Commercial Aircraft Cabin Lighting market is valued at approximately USD ~ million, driven by the growing demand for enhanced passenger experience and energy-efficient solutions in commercial aircraft. Airlines are increasingly investing in advanced cabin lighting systems to improve the ambiance, comfort, and operational efficiency of their aircraft. The market is further bolstered by regulatory requirements for improved safety and the adoption of energy-efficient LED lighting technologies, offering both aesthetic and functional benefits to airline operators.

Countries such as Germany, France, and the United Kingdom lead the Europe Commercial Aircraft Cabin Lighting market due to their strong presence in the aviation and aerospace industries. These countries have large, well-established fleets of commercial aircraft, which require continuous updates and upgrades to their cabin interiors. The demand for cabin lighting solutions is particularly high in these countries as airlines look to enhance passenger comfort and comply with sustainability and energy efficiency regulations. Additionally, these nations host key players in the market, driving innovation and technological advancements in lighting systems.

Market Segmentation

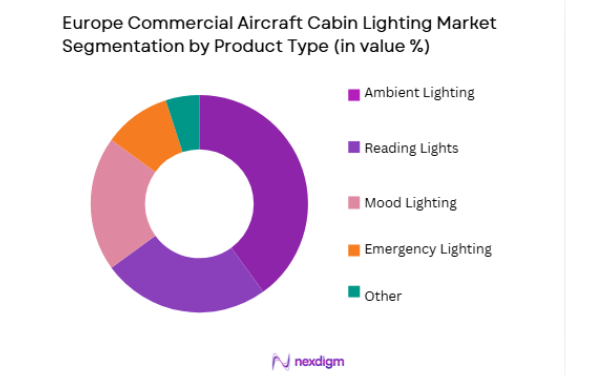

By Product Type

The Europe Commercial Aircraft Cabin Lighting market is segmented by product type into reading lights, mood lighting, emergency lighting, and ambient lighting. Recently, ambient lighting has a dominant market share due to the growing focus on enhancing the overall passenger experience. Ambient lighting systems provide customizable lighting environments, improving the comfort and aesthetic appeal of cabins. Airlines are increasingly adopting these systems to offer passengers a more personalized flying experience. With advancements in LED technology, ambient lighting also offers greater energy efficiency, making it a more cost-effective solution for airlines looking to reduce operational costs.

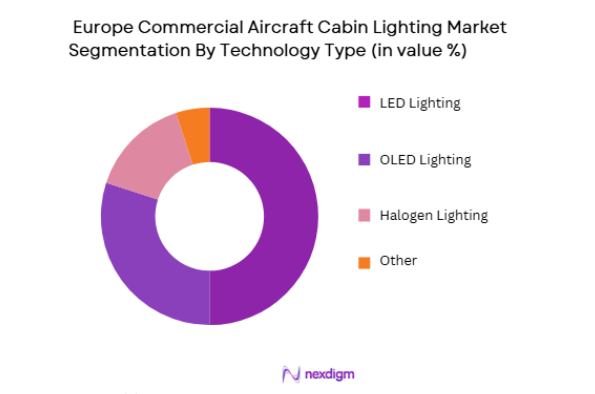

By Technology Type

The Europe Commercial Aircraft Cabin Lighting market is also segmented by technology type into LED, OLED, and halogen lighting. The LED lighting sub-segment dominates the market, primarily due to its energy efficiency, longevity, and low maintenance costs. Airlines are increasingly shifting to LED systems as they offer a longer lifespan compared to traditional lighting technologies and reduce energy consumption, which aligns with the industry’s push for sustainability. Additionally, LED systems can be easily integrated into advanced mood lighting solutions, further driving their adoption in modern aircraft cabins.

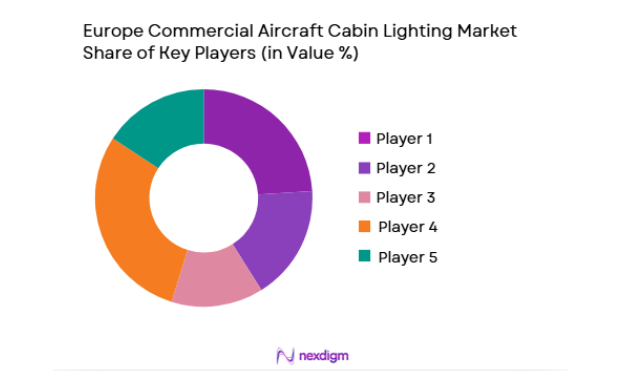

Competitive Landscape

The Europe Commercial Aircraft Cabin Lighting market is competitive, with several key players leading the development of innovative lighting solutions for the aviation industry. Market consolidation is occurring as companies focus on improving technology integration and forming partnerships with airlines. The industry is moving towards more energy-efficient and customizable solutions to meet growing passenger expectations for comfort, along with airline demands for operational cost savings. Technological advancements in LED and OLED lighting are driving growth in the sector, as these solutions align with sustainability goals.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Zodiac Aerospace | 1896 | Plaisir, France | ~ | ~ | ~ | ~ | ~ |

| Diehl Aerosystems | 1902 | Nuremberg, Germany | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | Phoenix, USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1939 | Charlotte, USA | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Technik | 1958 | Hamburg, Germany | ~ | ~ | ~ | ~ | ~ |

Europe Commercial Aircraft Cabin Lighting Market Analysis

Growth Drivers

Increasing Demand for Enhanced Passenger Comfort

The increasing demand for enhanced passenger comfort is a significant growth driver for the Europe Commercial Aircraft Cabin Lighting market. Airlines are increasingly focusing on providing a superior travel experience to passengers, which includes offering customizable lighting solutions. The ability to control lighting in the cabin based on different flight phases (such as takeoff, cruising, and landing) improves passenger comfort and reduces the effects of jet lag. Additionally, mood lighting systems are being integrated into modern aircraft cabins to create a more pleasant and calming atmosphere, further driving demand. The growing trend toward premium cabins, where passengers expect superior amenities and personalized services, is also contributing to the need for advanced lighting systems that improve the overall flight experience. Airlines are also adopting energy-efficient lighting solutions to reduce operational costs, adding another layer of demand for these systems.

Technological Advancements in LED Lighting

Technological advancements in LED lighting are playing a crucial role in the growth of the Europe Commercial Aircraft Cabin Lighting market. LED technology is more energy-efficient, durable, and versatile compared to traditional lighting solutions like halogen bulbs. This makes it an ideal choice for modern aircraft cabins, where airlines are striving to reduce weight, energy consumption, and maintenance costs. LED lights also offer airlines greater flexibility in terms of design, allowing for a more dynamic and aesthetically pleasing cabin environment. Innovations in LED lighting, such as smart systems that can adjust brightness and color based on flight stages or passenger preferences, are gaining popularity among airlines looking to differentiate their services. The shift towards LED lighting is being further accelerated by the growing demand for sustainable and environmentally friendly technologies in the aviation industry.

Market Challenges

High Initial Installation Costs

One of the primary challenges in the Europe Commercial Aircraft Cabin Lighting market is the high initial installation costs associated with upgrading aircraft lighting systems. The installation of advanced lighting solutions, such as LED or OLED systems, requires significant upfront investment, particularly for aircraft manufacturers and retrofit companies. The cost of integrating these systems into existing fleets can be prohibitive, especially for smaller airlines or those with older aircraft. While these lighting solutions can reduce operational costs in the long run due to their energy efficiency and longer lifespan, the initial cost remains a barrier to widespread adoption. Furthermore, airlines must factor in the cost of ensuring compliance with safety standards and regulatory requirements, which can further increase installation costs. This financial burden can delay the adoption of new lighting technologies, hindering market growth.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards present significant challenges for the Europe Commercial Aircraft Cabin Lighting market. The aviation industry is subject to stringent regulations imposed by entities such as the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), which govern the safety and functionality of cabin lighting systems. These regulations require lighting solutions to meet specific requirements for brightness, color, and emergency lighting performance. The need to comply with these standards can lead to delays in product development and increase the cost of designing and manufacturing new lighting systems. Additionally, airlines must invest in ensuring that their lighting systems are regularly tested and certified, which adds to the operational costs. As the industry moves toward adopting new technologies like OLED and smart lighting, meeting evolving safety standards may pose a challenge for manufacturers.

Opportunities

Adoption of Smart Lighting Solutions

The adoption of smart lighting solutions presents a significant opportunity for the Europe Commercial Aircraft Cabin Lighting market. Smart lighting systems, which use sensors and automation to adjust lighting based on flight conditions or passenger preferences, are becoming increasingly popular in modern aircraft cabins. These systems not only enhance passenger comfort by creating a more dynamic and personalized environment but also contribute to energy efficiency. By integrating with in-flight entertainment and cabin control systems, smart lighting can optimize the overall passenger experience. Airlines are increasingly incorporating smart lighting solutions into their cabins to differentiate their services and provide added value to passengers, making this a growing segment of the market. As the demand for personalized experiences rises, the adoption of smart lighting in aircraft cabins is expected to increase, providing opportunities for manufacturers to innovate and expand their product offerings.

Growth in the Low-Cost Carrier (LCC) Segment

The growth in the low-cost carrier (LCC) segment presents an opportunity for the Europe Commercial Aircraft Cabin Lighting market. As LCCs continue to expand their fleets and operations, there is a rising demand for cost-effective and efficient cabin lighting solutions. While LCCs typically operate on thinner profit margins, they are increasingly investing in modern cabin designs, including lighting systems, to improve the passenger experience and remain competitive. LCCs are adopting energy-efficient lighting systems to minimize operational costs while maintaining a level of comfort that attracts customers. Additionally, as more LCCs focus on expanding international routes, the need for reliable and sustainable cabin lighting solutions will grow, providing a significant market opportunity for lighting system manufacturers. The LCC sector’s expansion in Europe is expected to drive demand for affordable and high-quality lighting solutions, opening up new avenues for growth.

Future Outlook

The future outlook for the Europe Commercial Aircraft Cabin Lighting market is positive, with continued growth driven by technological advancements and rising passenger expectations. Innovations in LED and OLED technologies, along with the increasing adoption of smart lighting systems, are expected to shape the market in the coming years. Additionally, as airlines seek to reduce operational costs while enhancing passenger comfort, energy-efficient lighting solutions will continue to gain traction. With the expansion of low-cost carriers and the growing demand for premium passenger experiences, the market is set to witness sustained demand for advanced cabin lighting systems.

Major Players

- Zodiac Aerospace

- Diehl Aerosystems

- Honeywell Aerospace

- Collins Aerospace

- Lufthansa Technik

- Rockwell Collins

- Safran

- Panasonic Avionics

- Thales Group

- Lufthansa Technik

- Goodrich Corporation

- FACC AG

- PPG Aerospace

- Ogle Design

- Luminator Technology Group

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Airlines and airline operators

- Aviation service providers

- Lighting technology developers

- Aerospace R&D companies

- Aircraft maintenance service providers

Research Methodology

Step 1: Identification of Key Variables

Identifying key drivers and barriers influencing the Europe Commercial Aircraft Cabin Lighting market, including technological advancements and regulatory factors.

Step 2: Market Analysis and Construction

Analyzing historical data and current trends to build a robust market model, identifying key growth areas and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Consulting with experts in aviation lighting systems and market stakeholders to validate assumptions and refine the market model.

Step 4: Research Synthesis and Final Output

Synthesize the findings into a comprehensive report, ensuring clarity and actionable insights for market participants.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Passenger Comfort Expectations

Technological Advancements in LED and Smart Lighting

Rising Focus on Energy-efficient and Sustainable Solutions - Market Challenges

High Initial Cost of Advanced Lighting Solutions

Complexity in Integration with Existing Aircraft Systems

Regulatory Compliance and Certification Issues - Market Opportunities

Integration of Smart Lighting for Personalization

Adoption of Sustainable and Eco-friendly Materials

Increasing Demand for Lighting Customization for Brand Identity - Trends

Shift Towards LED and OLED Lighting Technologies

Increasing Use of Dynamic and Color-changing Lighting

Growth in Retrofit and Upgrading Existing Aircraft Lighting - Government regulations

- SWOT analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ambient Lighting

Reading Lights

Emergency Lighting

Mood Lighting

Signage and Indicator Lights - By Platform Type (In Value%)

Narrow-body Aircraft

Wide-body Aircraft

Regional Aircraft

Private Jets

Freighters - By Fitment Type (In Value%)

OEM Systems

Aftermarket Systems

Upgrades & Refurbishments

Modular Systems

Custom-designed Lighting Systems - By EndUser Segment (In Value%)

Airlines

Aircraft Manufacturers

Maintenance, Repair & Overhaul (MRO) Providers

Private Aircraft Operators

Freight Operators - By Procurement Channel (In Value%)

Direct Procurement

Online Procurement Platforms

Third-party Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, EndUser Segment, Fitment Type, Technological Innovation, Sustainability Initiatives, Customization Flexibility, Integration with Cabin Systems, Market Share, Product Quality, Regulatory Compliance, Energy Efficiency, Pricing Strategy, R&D Investment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Diehl Aviation

Zodiac Aerospace

Honeywell Aerospace

Collins Aerospace

Safran

Thales Group

LED Technologies

Panasonic Avionics

Boeing Commercial Airplanes

Airbus Interiors

GKN Aerospace

Lufthansa Technik

FACC AG

STG Aerospace

Luminaire Lighting

- Airlines Demanding High-Quality Lighting for Passenger Comfort

- MRO Providers Upgrading Cabin Lighting for Efficiency

- Aircraft Manufacturers Focused on Innovation and Customization

- Private Operators Seeking Luxurious and Exclusive Lighting Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035