Market Overview

The Europe commercial aircraft cabin seating market generated approximately USD ~ million based on a recent historical assessment, supported by fleet renewal programs, rising passenger traffic, and airline investments in cabin modernization to enhance onboard experience. Increasing demand for lightweight seating, regulatory-driven safety upgrades, and retrofit activities across aging fleets have accelerated procurement cycles among carriers seeking operational efficiency and improved fuel performance.

Germany, the United Kingdom, and France dominate regional demand due to strong airline networks, established aerospace manufacturing clusters, and the presence of leading seat suppliers integrated within aircraft production ecosystems. Germany benefits from a large commercial fleet and supplier base, while the United Kingdom advances premium cabin technologies and France supports innovation through aerospace engineering capabilities, collectively reinforcing Europe’s position as a major aviation interiors hub.

Market Segmentation

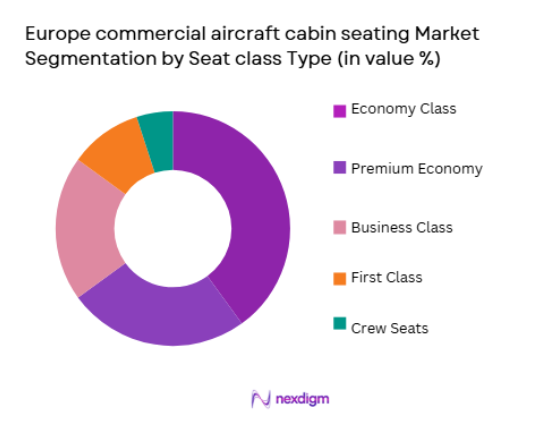

By Seat Class:

Europe commercial aircraft cabin seating market is segmented by seat class into economy class, premium economy class, business class, first class, and crew seats. Recently, economy class has a dominant market share due to large narrow-body aircraft fleets operating short- and medium-haul routes across Europe, where airlines prioritize higher passenger density to maintain route profitability. Low-cost carriers continue expanding operations, reinforcing demand for slimline seats that reduce aircraft weight while maximizing capacity. Additionally, refurbishment programs frequently focus on economy cabins because they impact the highest number of passengers, making return on investment more immediate. Manufacturers are therefore scaling production of lightweight composite seats with modular configurations that simplify maintenance and reconfiguration. Airlines also favor standardized economy seating to streamline certification timelines and reduce procurement complexity, further strengthening its leadership position within the region’s seating ecosystem.

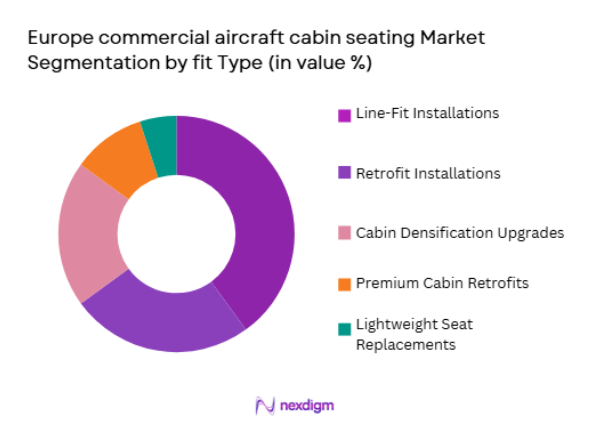

By Fit Type:

Europe commercial aircraft cabin seating market is segmented by fit type into line-fit installations, retrofit installations, cabin densification upgrades, premium cabin retrofits, and lightweight seat replacements. Recently, line-fit installations have a dominant market share due to sustained aircraft production pipelines and airline preference for factory-installed seating that reduces integration risks and operational downtime. Original equipment installations ensure compliance with evolving safety standards while enabling carriers to deploy aircraft faster into revenue service. Aircraft manufacturers increasingly collaborate directly with seat suppliers during production planning, improving supply coordination and lowering lifecycle costs. While retrofits remain significant for aging fleets, line-fit solutions benefit from predictable procurement cycles tied to aircraft deliveries, making them less vulnerable to scheduling disruptions. This alignment with OEM production strategies continues to anchor line-fit installations as the leading procurement pathway across Europe.

Competitive Landscape

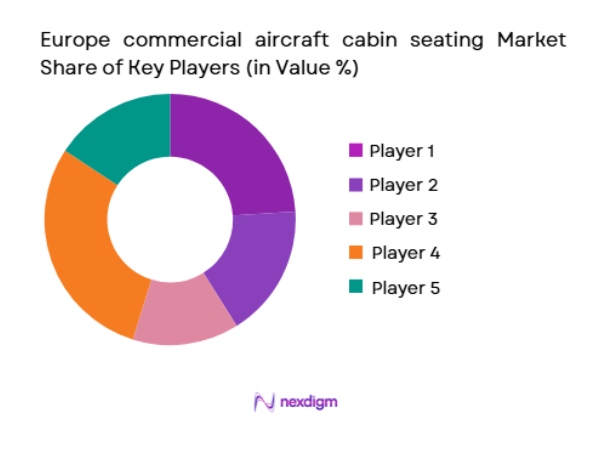

The Europe commercial aircraft cabin seating market exhibits moderate consolidation, with established aerospace suppliers controlling a substantial portion of production through long-term airline and OEM partnerships. Large manufacturers leverage engineering expertise, certification capabilities, and integrated supply chains to maintain competitive advantages, while specialized firms compete through innovation in lightweight materials and premium seating architecture.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Safran Seats | 2018 | France | ~ | ~ | ~ | ~ | ~ |

| Recaro Aircraft Seating | 1972 | Germany | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Thompson Aero Seating | 1997 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Aviointeriors | 1974 | Italy | ~ | ~ | ~ | ~ | ~ |

Europe commercial aircraft cabin seating Market Analysis

Growth Drivers

Increase in Air Travel and Airline Fleet Expansion:

The increase in air travel and the expansion of airline fleets in Europe is a key growth driver in the commercial aircraft cabin seating market. As passenger air traffic continues to rise, airlines are focusing on modernizing their fleets to accommodate the growing number of passengers. New aircraft deliveries and fleet upgrades are driving the demand for advanced cabin seating solutions. With airlines seeking to differentiate themselves by enhancing the passenger experience, particularly in terms of comfort, there is a strong focus on investing in high-quality seating that aligns with both economy and premium classes. The rise of low-cost carriers, which emphasize affordable air travel with efficient cabin designs, is also contributing to the demand for innovative seating solutions. As airlines expand their networks to meet regional and international demand, the requirement for advanced cabin seating technologies grows, driving the market forward.

Demand for Passenger Comfort and Sustainability:

The growing demand for passenger comfort and sustainability is another key growth driver in the market. With passengers increasingly prioritizing comfort, airlines are responding by investing in seats that offer greater comfort, ergonomics, and space, especially in economy class cabins. Furthermore, the increasing regulatory focus on sustainability is pushing airlines to opt for eco-friendly seating solutions that are lightweight and made from sustainable materials. These solutions help reduce fuel consumption and carbon emissions, which aligns with the aviation industry’s broader environmental goals. Airlines are also considering modular seating designs that allow for customization to meet specific needs, enhancing passenger satisfaction. As both environmental and comfort concerns continue to rise, airlines are integrating these considerations into their seat design strategies, which is propelling the market growth.

Market Challenges

High Production and Customization Costs:

A significant challenge in the Europe Commercial Aircraft Cabin Seating market is the high cost associated with the production and customization of cabin seating. Manufacturers face rising costs in sourcing high-quality, durable materials that meet both comfort and safety standards. Additionally, the increasing demand for custom-designed seating solutions, which cater to individual airline preferences, adds complexity to the manufacturing process and further drives up costs. While airlines are willing to invest in premium seats for their premium cabins, the financial burden of upgrading or refurbishing the entire fleet of aircraft remains a significant barrier, especially for smaller carriers or those operating on tight profit margins. The cost factor also plays a role in the adoption of more sustainable seating solutions, which, while environmentally friendly, often come with a higher price tag. As a result, finding cost-effective yet high-quality seating solutions remains a critical challenge for manufacturers and airlines alike.

Regulatory and Certification Challenges:

The commercial aircraft cabin seating market faces stringent regulatory and certification requirements that manufacturers must comply with. These regulations are designed to ensure the safety, durability, and comfort of seats and their ability to withstand the harsh conditions of air travel. However, meeting these requirements can be time-consuming and costly, particularly when it comes to new seat designs or innovations in materials. Manufacturers must undergo rigorous testing and certification processes to ensure compliance with safety standards set by aviation authorities, including the European Union Aviation Safety Agency (EASA). Additionally, as the aviation industry moves towards more sustainable practices, manufacturers face the challenge of developing seating solutions that meet both environmental and safety regulations. The complexity and cost of navigating these regulatory and certification hurdles can slow the development and deployment of new cabin seating technologies.

Opportunities

Growth of Premium and Business Class Seating:

One of the key opportunities in the Europe Commercial Aircraft Cabin Seating market lies in the growing demand for premium and business class seating solutions. As the aviation industry continues to recover and grow, there is a shift toward enhancing the passenger experience, particularly for high-paying customers in business and first-class cabins. Airlines are increasingly focused on offering luxurious seating with advanced features such as lie-flat seats, private pods, and personalized services. This growing demand for comfort and exclusivity in premium cabins is prompting airlines to invest in advanced seating technologies that provide a more comfortable and relaxing experience. As business travel continues to rebound, airlines are expected to further upgrade their premium cabins, which will drive demand for high-end seating solutions. The ability to offer a differentiated and comfortable flying experience is becoming a key competitive factor for airlines, making this segment a significant opportunity for seating manufacturers.

Adoption of Sustainable and Eco-friendly Seating Materials:

Another promising opportunity in the market is the adoption of sustainable and eco-friendly seating materials. As the aviation industry faces increasing pressure to reduce its environmental impact, there is a growing demand for lightweight, durable, and recyclable seating solutions. Manufacturers are innovating by using sustainable materials, such as biodegradable plastics, natural fibers, and recycled metals, to design seats that meet both environmental and performance standards. These eco-friendly seats not only help airlines meet sustainability goals but also reduce operational costs by lowering fuel consumption through their lightweight design. As environmental regulations become stricter, the demand for green technologies in cabin seating is expected to increase, providing manufacturers with opportunities to expand their product offerings. Airlines that invest in sustainable seating solutions can enhance their brand image and cater to eco-conscious consumers, creating a significant market opportunity for the adoption of these materials.

Future Outlook

The Europe commercial aircraft cabin seating market is expected to experience steady expansion as airlines prioritize cabin differentiation and operational efficiency. Technological advancements in lightweight materials and modular design will likely reshape product development strategies. Regulatory alignment around sustainability is anticipated to encourage adoption of recyclable seating structures. Continued fleet renewal and retrofit programs should sustain procurement momentum, while premium cabin evolution is projected to influence configuration trends across regional and long-haul operations.

Major Players

- Safran Seats

- Recaro Aircraft Seating

- Collins Aerospace

- Thompson Aero Seating

- Aviointeriors

- Geven S.p.A.

- ZIM Aircraft Seating

- Acro Aircraft Seating

- Expliseat

- STELIA Aerospace

- Diehl Aviation

- Lantal Textiles

- Optimares

- Factorydesign

- FACC AG

Key Target Audience

- Commercial airlines

- Aircraft leasing companies

- Aerospace component manufacturers

- Cabin retrofit service providers

- Government and regulatory bodies

- Investments and venture capitalist firms

- Private equity investors in aerospace

- Aircraft OEMs

Research Methodology

Step 1: Identification of Key Variables

Primary variables including fleet expansion, retrofit demand, passenger traffic patterns, regulatory mandates, and technological innovation were mapped to establish structural market drivers. Secondary indicators such as airline profitability and procurement cycles were evaluated to understand purchasing behavior and capital allocation trends.

Step 2: Market Analysis and Construction

Validated datasets from industry publications, financial disclosures, and aviation databases were synthesized to construct baseline market values. Segment-level modeling incorporated aircraft deliveries, seating density assumptions, and replacement cycles to ensure realistic representation of demand conditions.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were tested through consultations with aerospace analysts and supply-chain specialists to verify assumptions regarding certification timelines, material adoption, and airline investment strategies. Contradictory inputs were reconciled through triangulation to improve analytical reliability.

Step 4: Research Synthesis and Final Output

Quantitative insights were integrated with qualitative industry developments to generate a comprehensive narrative describing competitive dynamics and growth pathways. Final outputs were structured to support strategic decision-making for stakeholders evaluating entry, expansion, or investment opportunities within the Europe commercial aircraft cabin seating market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising aircraft deliveries across European carriers

Increasing demand for lightweight and fuel-efficient seating

Cabin modernization programs focused on passenger comfort - Market Challenges

Stringent aviation certification requirements extending product timelines

High customization costs for premium seating configurations

Supply chain constraints impacting advanced materials availability - Market Opportunities

Expansion of premium economy cabins among European airlines

Integration of smart seating with in-seat connectivity

Growing retrofit demand driven by fleet life-extension strategies - Trends

Adoption of ultra-light composite seat structures

Shift toward modular seating architectures

Enhanced ergonomic designs supporting long-haul travel comfort - Government regulations

EASA certification standards governing aircraft seat safety and crashworthiness

European flammability and material compliance requirements

Cabin safety mandates aligned with EU aviation safety frameworks - SWOT analysis

Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Economy Class Seating Systems

Premium Economy Seating Systems

Business Class Lie-Flat Seating

First Class Suite Seating

Crew Rest and Jump Seats - By Platform Type (In Value%)

Narrow-Body Aircraft Seating

Wide-Body Aircraft Seating

Regional Jet Seating

Turboprop Aircraft Seating

Next-Generation Hybrid Aircraft Seating - By Fitment Type (In Value%)

Line-Fit Installations

Retrofit Installations

Lightweight Seat Upgrades

High-Density Cabin Reconfigurations

Luxury Cabin Refurbishments - By EndUser Segment (In Value%)

Full-Service Network Carriers

Low-Cost Carriers

Regional Airlines

Charter Operators

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct OEM Procurement

Supplier Framework Agreements

MRO-Based Procurement

Leasing Company Sourcing

Third-Party Cabin Integrators

- Market Share Analysis

CrossComparison Parameters (Seat Weight, Certification Timeline, Customization Capability, Passenger Comfort Features, Cost Efficiency) - SWOT Analysis of Key Competitors

Pricing & Procurement Analysis

- Key Players

Recaro Aircraft Seating

Safran Seats

Collins Aerospace

Stelia Aerospace

Geven S.p.A.

ZIM Aircraft Seating

Thompson Aero Seating

Aviointeriors

Acro Aircraft Seating

Expliseat

Optimares

Factorydesign

Diehl Aviation

Lantal Textiles

Aerospace Industrial Development Corporation

- Airlines prioritizing seat density optimization to improve route profitability

- Low-cost carriers emphasizing slimline seating for higher passenger capacity

- Leasing firms seeking standardized seating to support multi-operator compatibility

- Charter operators investing in flexible cabin layouts for diverse travel demand

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035