Market Overview

The Europe in-flight entertainment and connectivity market reached approximately USD ~ million based on a recent historical assessment, driven by strong airline focus on passenger comfort, expanding digital cabin capabilities, and growing integration of connectivity-enabled entertainment platforms. Fleet modernization initiatives and investments in wireless streaming technologies continue to accelerate adoption across both full-service and hybrid carriers. Wide-body aircraft deployments on long-haul routes further stimulate demand for advanced onboard entertainment architectures.

Germany, the United Kingdom, and France remain dominant aviation hubs due to extensive airline networks, premium travel demand, and mature aerospace ecosystems that support rapid technology deployment. Strong international traffic volumes encourage carriers to differentiate through high-quality entertainment interfaces and multilingual content offerings. Regional airlines increasingly prioritize digital passenger engagement, reinforcing procurement momentum across major European aviation corridors.

Market Segmentation

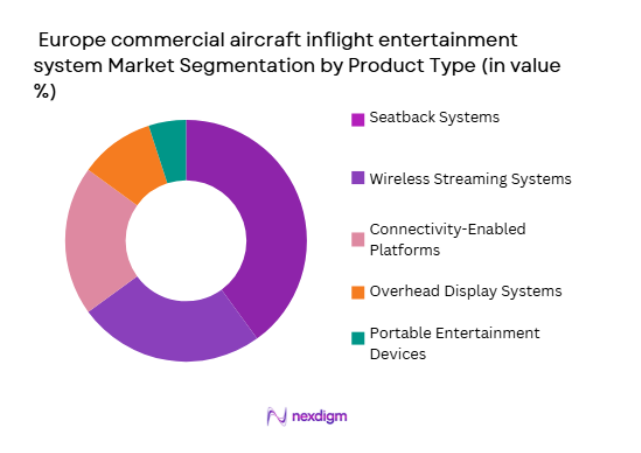

By Product Type:

Europe commercial aircraft in flight entertainment system market is segmented by product type into seatback systems, wireless streaming systems, overhead display systems, portable entertainment devices, and connectivity-enabled platforms. Recently, seatback systems have a dominant market share due to their reliability, integrated user experience, and suitability for long-haul travel where passengers expect uninterrupted entertainment. Airlines favor these systems for premium cabins because they support high-definition content, gaming, and real-time flight data. Established supplier ecosystems and proven certification pathways further strengthen adoption. Additionally, wide-body aircraft deployments across transcontinental routes sustain demand for embedded displays that deliver consistent performance regardless of passenger device availability, reinforcing their leadership position within European fleets.

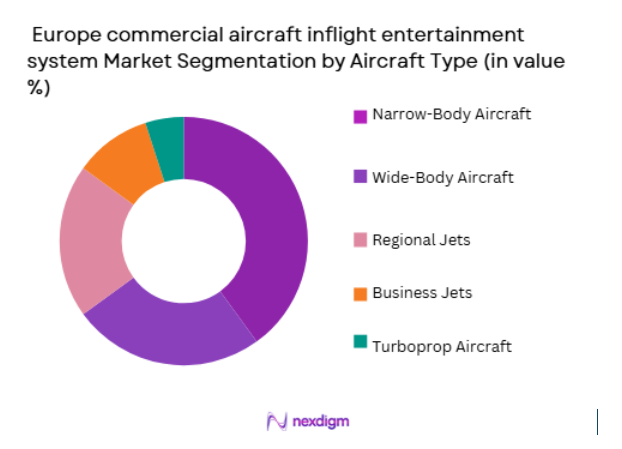

By Aircraft Type:

Europe commercial aircraft in flight entertainment system market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional jets, business jets, and turboprop aircraft. Recently, narrow-body aircraft have a dominant market share due to their extensive deployment across high-frequency intra-European routes where airlines prioritize operational efficiency and passenger engagement. Carriers increasingly equip these aircraft with advanced entertainment and connectivity solutions to remain competitive in short- and medium-haul travel markets. Continuous fleet upgrades by low-cost and hybrid operators further support installations, while technological advances allow compact systems to be deployed without significant weight penalties. The scalability of narrow-body fleets therefore ensures sustained procurement activity across the region.

Competitive Landscape

The Europe commercial aircraft in flight entertainment system market demonstrates moderate consolidation, with global avionics leaders maintaining strong relationships with airlines and aircraft manufacturers. Competitive advantage largely depends on connectivity integration, certification capability, and lifecycle service support, allowing established vendors to sustain long-term contracts while emerging technology firms compete through wireless innovation.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | United States | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | United States | ~ | ~ | ~ | ~ | ~ |

| Viasat Inc. | 1986 | United States | ~ | ~ | ~ | ~ | ~ |

| Lufthansa Systems | 1995 | Germany | ~ | ~ | ~ | ~ | ~ |

Europe commercial aircraft inflight entertainment system Market Analysis

Growth Drivers

Rise in Passenger Demand for Connectivity:

The increasing demand for better in-flight connectivity is a major driver of the Europe Commercial Aircraft In-Flight Entertainment System market. As air travel continues to grow, passengers are seeking more opportunities to stay connected during their flights, particularly for business purposes. Airlines are investing in advanced IFE systems that provide seamless connectivity, allowing passengers to browse the internet, use social media, and stream content while flying. The growing reliance on digital devices has driven the need for high-speed internet access onboard, which airlines are addressing by installing next-generation wireless IFE systems. The trend toward digitalization and remote work is expected to fuel continued growth in demand for in-flight connectivity, further enhancing the adoption of advanced entertainment systems on commercial aircraft. Airlines that offer superior in-flight connectivity and entertainment have a competitive edge, attracting passengers who value seamless experiences during air travel. This demand is expected to rise as more passengers travel and as connectivity technologies continue to improve.

Technological Advancements in IFE Systems:

Technological innovations in IFE systems are also driving the market’s growth. Airlines are increasingly adopting high-definition screens, advanced audio systems, and interactive touch interfaces to provide passengers with a more engaging and immersive entertainment experience. These innovations are helping to differentiate airlines and improve customer satisfaction, driving the demand for more sophisticated IFE solutions. Additionally, the integration of artificial intelligence (AI) in IFE systems allows for personalized content recommendations and enhances passenger engagement during flights. The growing focus on sustainability is also influencing the development of more energy-efficient IFE systems that can reduce the overall environmental impact of in-flight operations. As airlines continue to invest in next-generation technologies, the Europe Commercial Aircraft IFE market is expected to expand rapidly, with a stronger emphasis on passenger-centric features and greater operational efficiencies.

Market Challenges

High Infrastructure and Maintenance Costs:

One of the key challenges facing the Europe Commercial Aircraft In-Flight Entertainment System market is the high cost of infrastructure and maintenance associated with these systems. Installing IFE systems on aircraft requires significant upfront investment, as airlines must purchase and integrate the technology, including screens, connectivity systems, and content servers. The cost of maintaining these systems over time is also substantial, as they require regular updates, technical support, and replacement of aging components. These expenses can be a burden for low-cost carriers or smaller airlines operating on limited budgets. Additionally, the need for seamless integration with existing aircraft systems, along with periodic system upgrades, adds to the overall costs. Despite the demand for advanced IFE systems, the high costs of installation and maintenance may deter some airlines from implementing cutting-edge technologies, limiting the market’s overall growth potential.

Regulatory and Safety Standards Compliance:

The Europe Commercial Aircraft In-Flight Entertainment System market faces significant regulatory challenges, particularly related to safety and compliance with aviation industry standards. Airlines and IFE system providers must adhere to strict safety regulations set by aviation authorities, such as the European Union Aviation Safety Agency (EASA) and the International Civil Aviation Organization (ICAO). These regulations govern the installation, operation, and maintenance of in-flight entertainment systems to ensure passenger safety. As IFE systems become more complex, the risk of non-compliance increases, particularly as new technologies, such as wireless IFE, are integrated into aircraft. Airlines must also ensure that IFE systems do not interfere with aircraft communication and navigation systems, adding another layer of complexity. Meeting these regulatory requirements while maintaining cost efficiency and system performance is a significant challenge for IFE system providers and airlines alike.

Opportunities

Growing Demand for Personalized Passenger Experiences:

One of the significant opportunities in the Europe Commercial Aircraft In-Flight Entertainment System market is the growing demand for personalized passenger experiences. Passengers are increasingly seeking tailored in-flight entertainment options that cater to their individual preferences. Airlines are responding to this demand by incorporating AI-driven systems into their IFE offerings, enabling personalized content recommendations, music playlists, and movies based on passenger behavior and preferences. Additionally, in-flight shopping and interactive services are becoming more integrated into IFE systems, enhancing the overall experience for passengers. By providing customized entertainment options, airlines can differentiate themselves in a competitive market and improve customer loyalty. The opportunity to offer personalized experiences presents significant growth potential for airlines and IFE system providers, driving innovation in content delivery and technology integration.

Integration of Next-Generation Connectivity Solutions:

Another major opportunity lies in the integration of next-generation connectivity solutions into commercial aircraft. With the rise of 5G technology and advancements in satellite-based communications, airlines can offer faster, more reliable in-flight internet services to passengers. This enhanced connectivity allows for better streaming quality, seamless browsing, and real-time communication during flights, which is highly valued by passengers, particularly business travelers. As demand for high-speed internet access increases, airlines are expected to prioritize the installation of advanced connectivity systems to meet passenger expectations. The integration of 5G and other cutting-edge communication technologies into in-flight entertainment systems will further drive the market’s growth by offering enhanced capabilities for both airlines and passengers.

Future Outlook

The Europe commercial aircraft in flight entertainment system market is expected to progress steadily as airlines prioritize digitally enabled passenger experiences. Connectivity innovation and lightweight system architectures will likely shape procurement strategies across both new aircraft and retrofit programs. Regulatory emphasis on cybersecurity and data protection is anticipated to accelerate adoption of secure platforms. Growing passenger reliance on streaming services should further reinforce demand, while collaborative partnerships between airlines and technology providers are projected to support sustained modernization.

Major Players

- Thales Group

- Panasonic Avionics Corporation

- Collins Aerospace

- Safran Passenger Innovations

- Lufthansa Systems

- Viasat Inc.

- Global Eagle Entertainment

- Astronics Corporation

- Burrana

- Kontron AG

- Skyfive AG

- IdeaNova Technologies

- IMM International

- SITAONAIR

- Gogo Inc.

Key Target Audience

- Commercial airlines

- Aircraft leasing companies

- Aerospace OEMs

- Cabin interior integrators

- Government and regulatory bodies

- Investments and venture capitalist firms

- Satellite connectivity providers

- Airline IT solution providers

Research Methodology

Step 1: Identification of Key Variables

Core variables including fleet expansion, connectivity adoption, passenger demand, regulatory frameworks, and supplier innovation were identified to construct the analytical baseline. Macroeconomic aviation indicators were also reviewed to contextualize procurement behavior across European carriers.

Step 2: Market Analysis and Construction

Validated industry datasets and financial disclosures were synthesized to determine market value and segment positioning. Modeling incorporated aircraft deliveries, retrofit cycles, and technology penetration rates to ensure realistic demand estimation.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary insights were cross-verified through consultation with aviation technology specialists and supply-chain experts. Contradictions were resolved through triangulation to enhance reliability and minimize interpretive bias.

Step 4: Research Synthesis and Final Output

Quantitative findings were integrated with qualitative industry developments to produce a cohesive market narrative. The final structure was designed to support strategic planning, investment evaluation, and competitive benchmarking.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising passenger expectations for connected travel experiences

Expansion of long-haul fleets across European airlines

Integration of high-speed satellite connectivity with cabin systems - Market Challenges

High installation and retrofit costs impacting airline budgets

Rapid technology obsolescence requiring continuous upgrades

Complex certification requirements for onboard digital systems - Market Opportunities

Adoption of wireless streaming platforms reducing hardware weight

Personalized content ecosystems enabled by data analytics

Partnerships between airlines and digital content providers - Trends

Migration toward bring-your-own-device entertainment models

Growth in cloud-based content management platforms

Increasing deployment of 4K and immersive display technologies - Government regulations

EASA airworthiness standards governing onboard electronic systems

European cybersecurity regulations applicable to connected aircraft cabins

Passenger data protection requirements under GDPR for digital services - SWOT analysis

Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Seatback In-Flight Entertainment Systems

Wireless Streaming Entertainment Systems

Overhead Display Systems

Portable In-Flight Entertainment Devices

Cloud-Based Content Delivery Systems - By Platform Type (In Value%)

Narrow-Body Aircraft

Wide-Body Aircraft

Regional Jets

Turboprop Aircraft

Long-Haul High-Capacity Aircraft - By Fitment Type (In Value%)

Line-Fit Installations

Retrofit Installations

Hybrid Connectivity Upgrades

Cabin Digitalization Programs

IFE Hardware Replacement - By EndUser Segment (In Value%)

Full-Service Carriers

Low-Cost Carriers

Regional Airlines

Charter Airlines

Aircraft Leasing Companies - By Procurement Channel (In Value%)

Direct OEM Procurement

Supplier Long-Term Agreements

MRO Procurement Programs

Leasing Company Procurement

Third-Party Cabin Integrators

- Market Share Analysis

CrossComparison Parameters (Display Technology, Connectivity Capability, Content Management Platform, Integration Flexibility, Lifecycle Cost) - SWOT Analysis of Key Competitors

Pricing & Procurement Analysis - Key Players

Panasonic Avionics Corporation

Thales Group

Collins Aerospace

Safran Passenger Innovations

Lufthansa Systems

Gogo Business Aviation

Viasat Inc.

Global Eagle Entertainment

Astronics Corporation

Burrana

Kontron AG

Zodiac Inflight Innovations

IdeaNova Technologies

Skyfive AG

IMM International

- Full-service carriers investing in premium entertainment to strengthen brand differentiation

- Low-cost airlines adopting wireless systems to balance cost efficiency with passenger satisfaction

- Leasing companies prioritizing adaptable IFE platforms to maintain aircraft asset value

- Regional airlines implementing lightweight solutions to optimize fuel efficiency

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035